Have you ever found yourself scratching your head over a billing discrepancy? It can be frustrating to navigate the complexities of account statements, especially when you know something isn't right. Addressing such issues doesn't have to be daunting, and with the right approach, you can swiftly resolve any billing errors. If you're looking for a helpful way to communicate your concerns, stick around as we dive into effective letter templates for correcting those pesky mistakes!

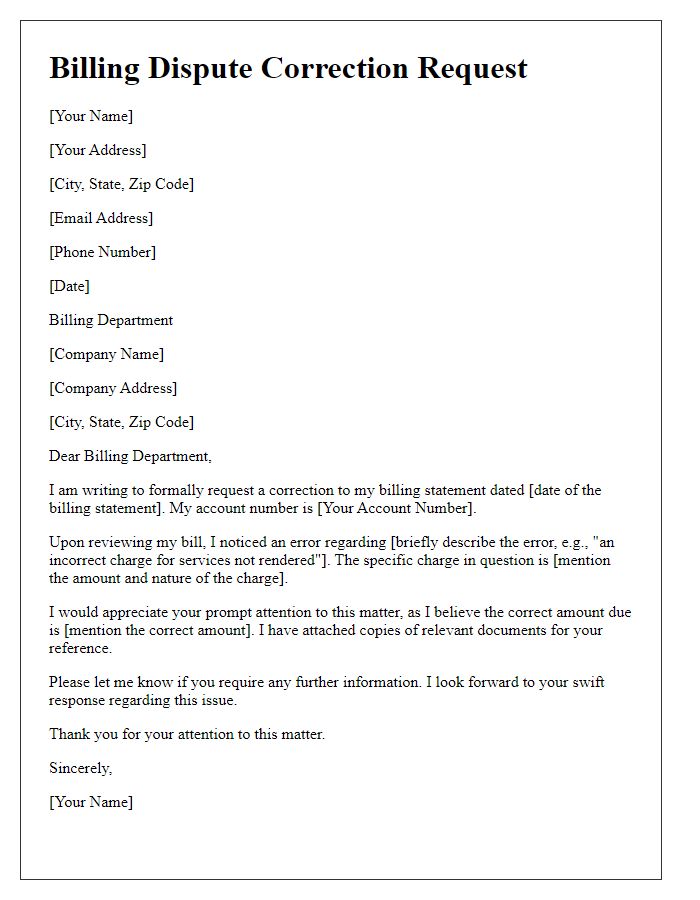

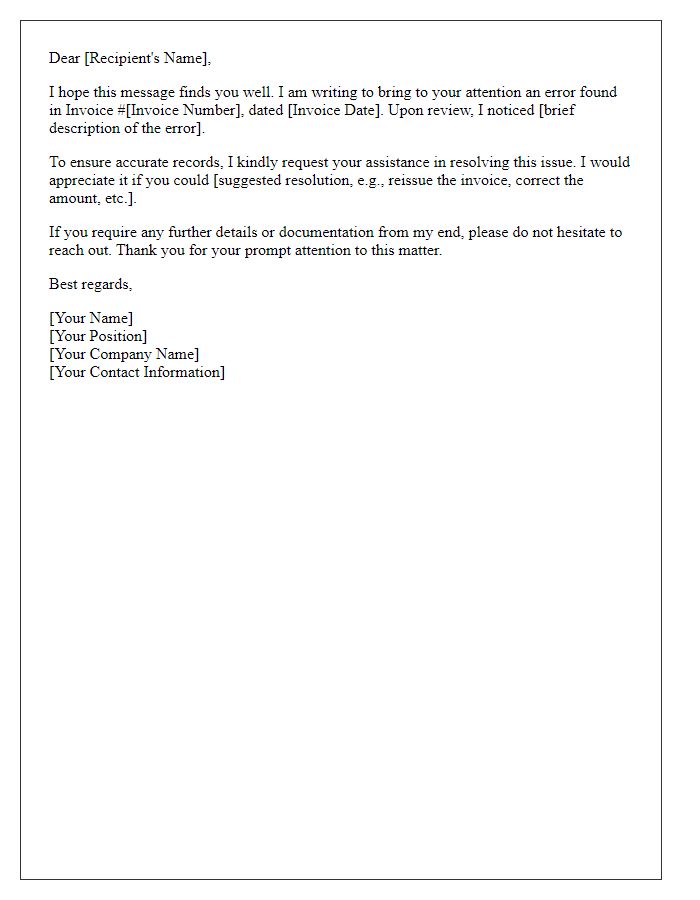

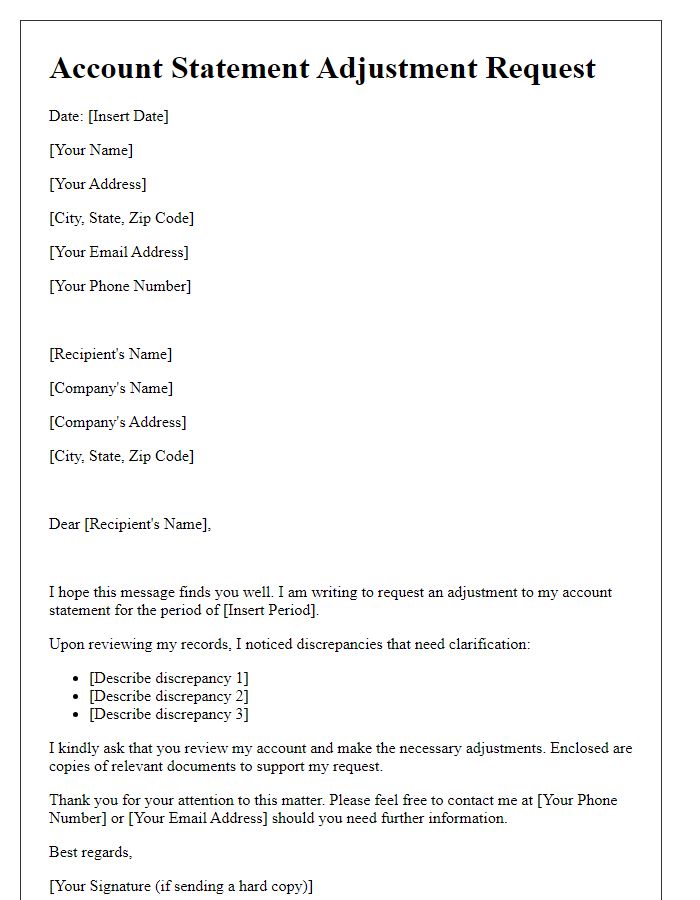

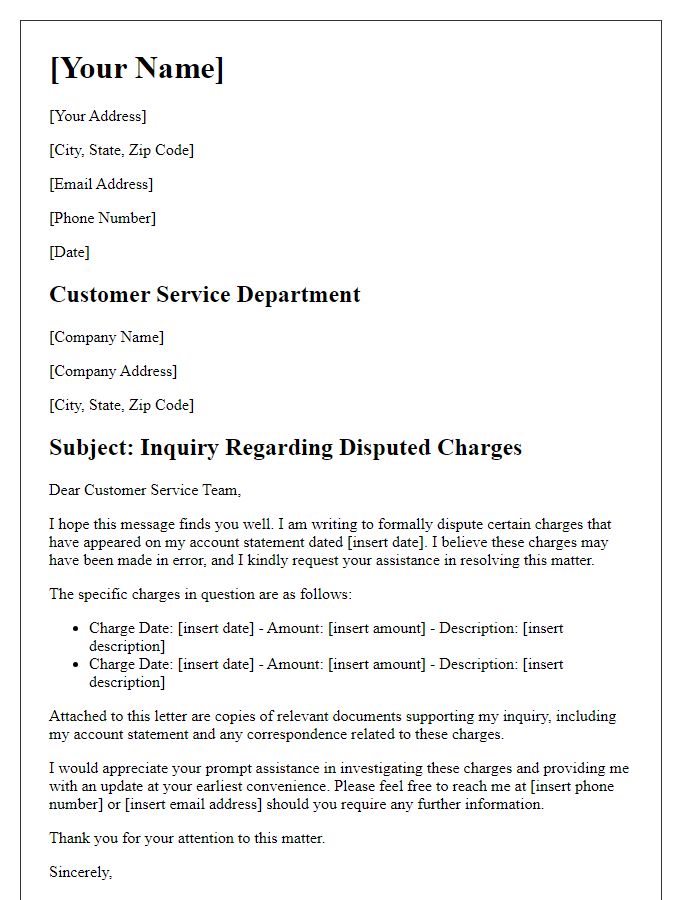

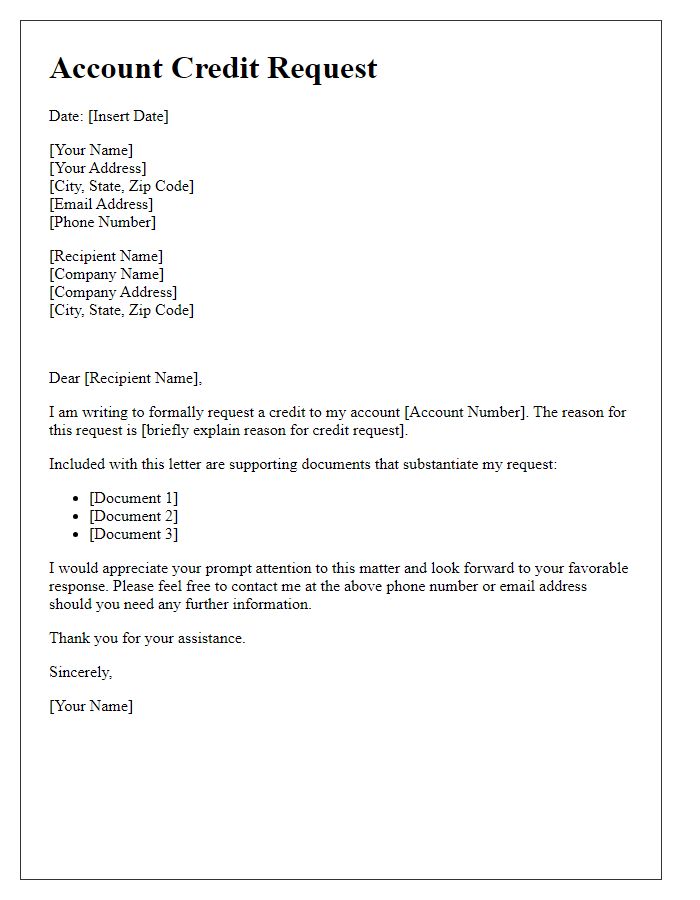

Accurate account details.

Accurate account details are vital for seamless billing processes and financial transactions. Any discrepancies in account information, such as incorrect email addresses or mismatched account numbers, can lead to errors in invoicing and payment processing. For instance, billing errors can result in delayed payments or unnecessary late fees, affecting customer satisfaction and trust. Regular audits of account information, especially during significant events like quarterly fiscal reports or annual budget reviews, are essential to ensure accuracy. Addressing these billing inaccuracies promptly can enhance the overall efficiency of financial management in businesses and prevent potential legal issues related to billing disputes.

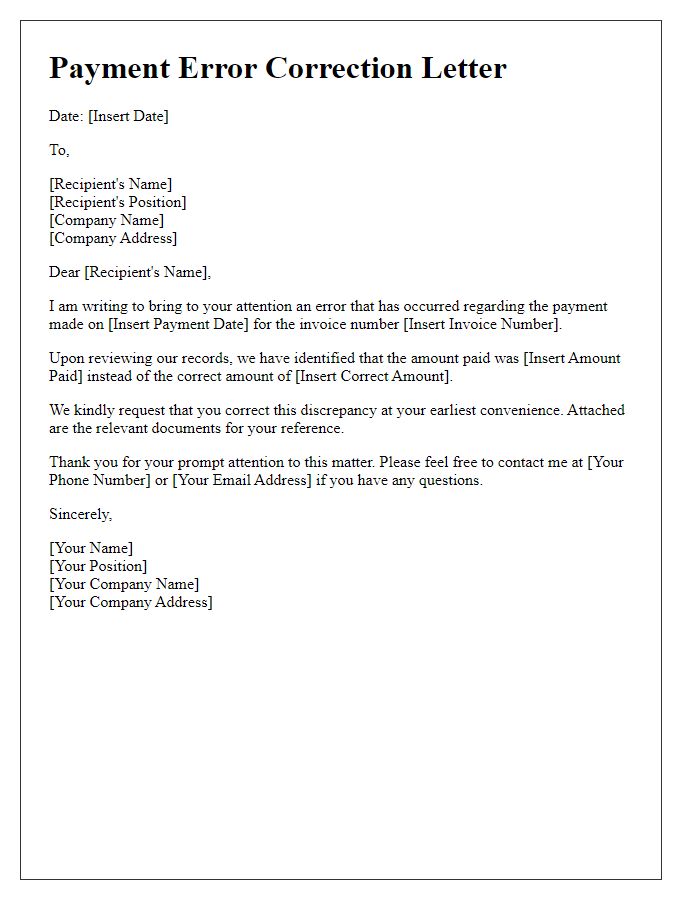

Clear error description.

Billing discrepancies can arise from various sources such as incorrect billing amounts, duplicated charges, or misapplied payments. For instance, an account holder might notice an overcharge of $50 on their monthly statement from a service provider, potentially due to a miscalculation during automated billing cycles. In another case, if there are two identical charges for a single service rendered on a specific date, this could lead to confusion and frustration. Timely resolution of these errors, especially within the billing cycle, is crucial for maintaining accurate financial records and ensuring customer satisfaction. Clear documentation, including account numbers and specific transaction dates, plays a vital role in facilitating effective communication with billing departments.

Corrected billing amount.

A corrected billing amount is essential to ensure accurate account management and customer satisfaction. Common billing errors can arise from various sources, including incorrect charges, duplicate entries, or misapplied payments. For instance, if a customer's account with a utility company had a previously billed amount of $150, and after review, it is determined that only $100 was owed, the corrected billing amount would reflect this change. A prompt notification regarding the specific adjustments to the billing statement is crucial to maintain transparency and trust between the service provider and the customer. Ensuring that the customer receives a clear breakdown of the original charges, corrections made, and the new total fosters good communication and helps prevent future discrepancies.

Contact information.

Billing errors can significantly impact account accuracy and overall customer satisfaction. It's vital to provide clear contact information for prompt resolution. The contact information should include the name of the billing department representative, direct telephone number (such as 1-800-555-0199), and email address (for instance, billing@serviceprovider.com). Additionally, a physical mailing address (e.g., 1234 Billing Lane, Suite 400, Cityville, ST, 12345) may be necessary for formal correspondence. Customers should note the importance of referencing account numbers (like ACCT1234567) and specific billing periods (such as January 2023 to March 2023) when reporting discrepancies, ensuring efficient processing of the correction request.

Supporting documentation.

Billing errors may arise due to discrepancies in transactions or incorrect account information. It is vital to gather supporting documentation, such as invoices, statements, or receipts, to substantiate claims regarding billing inaccuracies. Documentation may include transaction records showing charges, payment confirmations indicating previously settled amounts, or contracts outlining agreed-upon fees. Clear identification of the account number associated with the billing error helps facilitate prompt resolution. Additionally, a detailed description of the specific discrepancy, including dates and amounts involved, assists in clarifying the issue for billing departments. Timely submission of these documents is essential for swift correction of the account statement.

Comments