Have you ever found yourself in a situation where you've forgotten about an account that once held value? It's not uncommon, and reactivating that dormant account can be a simple yet rewarding task. Whether it's for accessing old memories or reclaiming benefits, breathing life back into an inactive account can open many doors. So, let's dive in and explore how you can easily reactivate your dormant account and enjoy its perks once more!

Personalized Greeting

A dormant account, typically defined as one that has seen no activity for a significant period--often six months or more--can be reactivated through a streamlined process. Individuals may encounter accounts that have become inactive due to various reasons, such as lack of usage or missed communications. To initiate reactivation, users need to provide personal details including full name, account number, and associated email address. The reactivation process may involve verification steps to ensure account security, such as sending a confirmation link or requiring identity verification through security questions. Once the account is reactivated, users gain access to previous balances, transaction history, and features previously utilized, restoring the account's functionality seamlessly.

Account Identification

Reactivation of a dormant account involves several factors. A dormant account, typically inactive for 12 months or longer, requires specific identification details to re-engage. Users often must provide account numbers, email addresses, or user IDs associated with the account. Financial institutions and online platforms may request verification through security questions, personal identification documents, and updated contact information to prevent unauthorized access. Reactivation processes may vary depending on the company's policies, including possible fees or minimum activity requirements post-reactivation. Users should ensure they understand the terms associated with reactivating dormant accounts to avoid future inactivity issues.

Account Status Explanation

Dormant accounts often lead to various concerns regarding security and accessibility. An account becomes dormant after a prolonged period of inactivity, typically lasting over 12 months, impacting banking institutions such as Chase or Bank of America. During this period, account holders may lose access to funds or experience unnecessary fees. Additionally, financial institutions may initiate a process to close such accounts, resulting in the forfeiture of any remaining balance--a process governed by state laws and regulations. Reactivating a dormant account usually requires contacting customer service representatives, providing identity verification information, and potentially submitting a reactivation request in writing. Ensuring the account remains active through regular transactions not only preserves account access but can also maintain account perks, such as interest accumulation or membership rewards.

Reactivation Procedure

Reactivating a dormant account involves a series of specific steps to ensure account security and user authenticity. First, users must verify their identity by providing essential information, such as their full name, account number, and email address associated with the account. Depending on the financial institution or service provider, additional verification methods may include answering security questions or submitting identification documents, such as a driver's license or passport. Once verification is successful, the user will typically receive a confirmation email outlining the reactivation process, including a link or instructions for setting a new password, if necessary. Users should take note of any applicable fees or terms associated with reactivating dormant accounts, which can vary by institution. Finally, maintaining regular activity on the account after reactivation is crucial to prevent future dormancy, ensuring compliance with inactivity policies that may lead to additional fees or account closure.

Contact Information and Support

Dormant account reactivation requests often involve providing specific contact information and support details to ensure a smooth process. Key components include the user's full name as registered, account number linked to the dormant account, email address for correspondence, and a contact phone number for verification purposes. Additionally, support services, which may vary by financial institution, often provide a dedicated hotline or online chat assistance for immediate help. The timeline for reactivation may depend on internal policies, typically ranging from a few hours to several business days. Customers may also need to verify identity through security questions or provide scanned identification documents to comply with regulations and ensure account security.

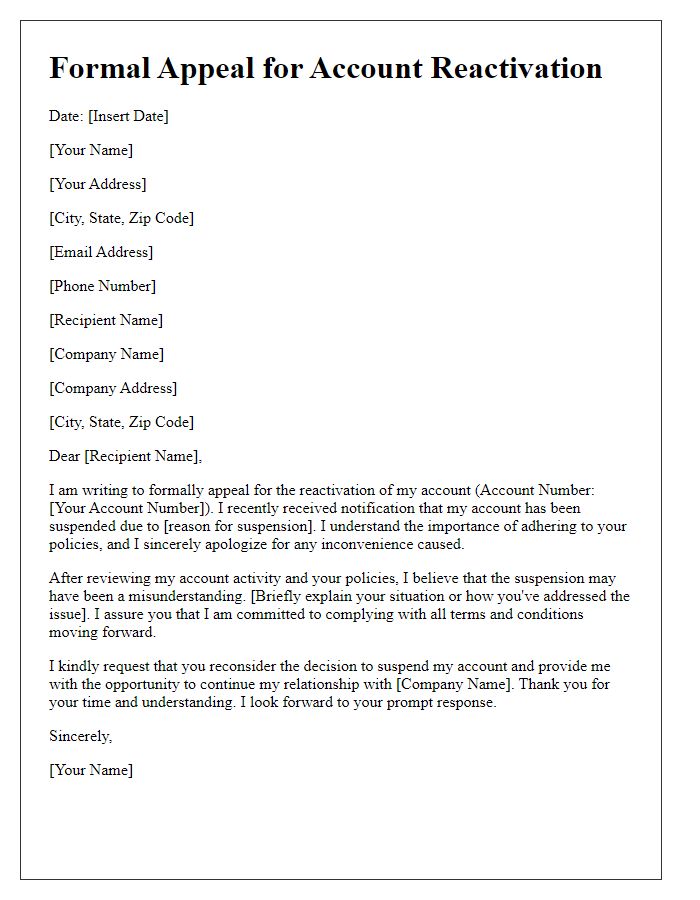

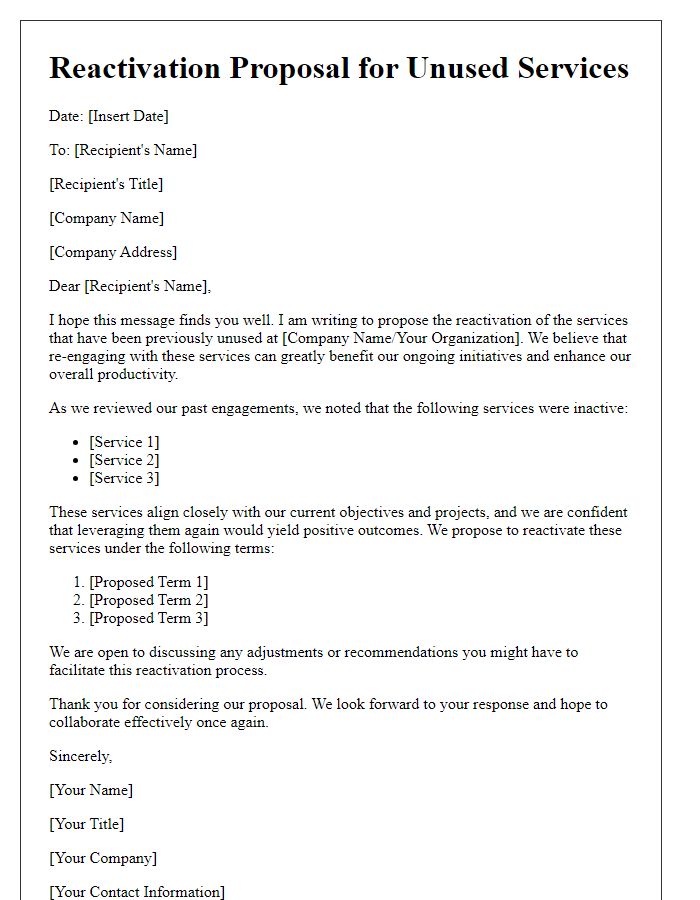

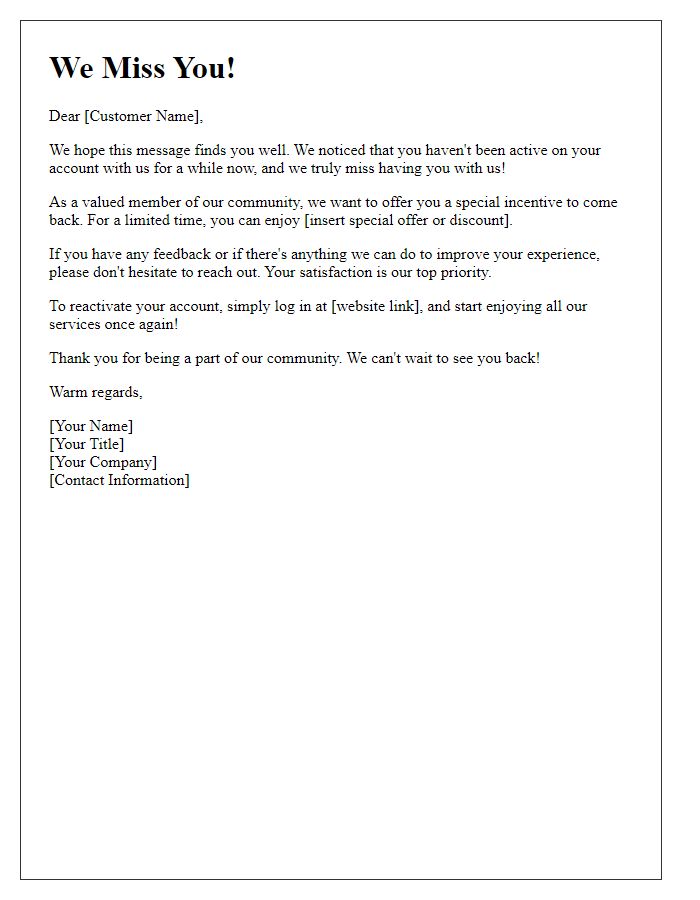

Letter Template For Reactivation Of Dormant Account Samples

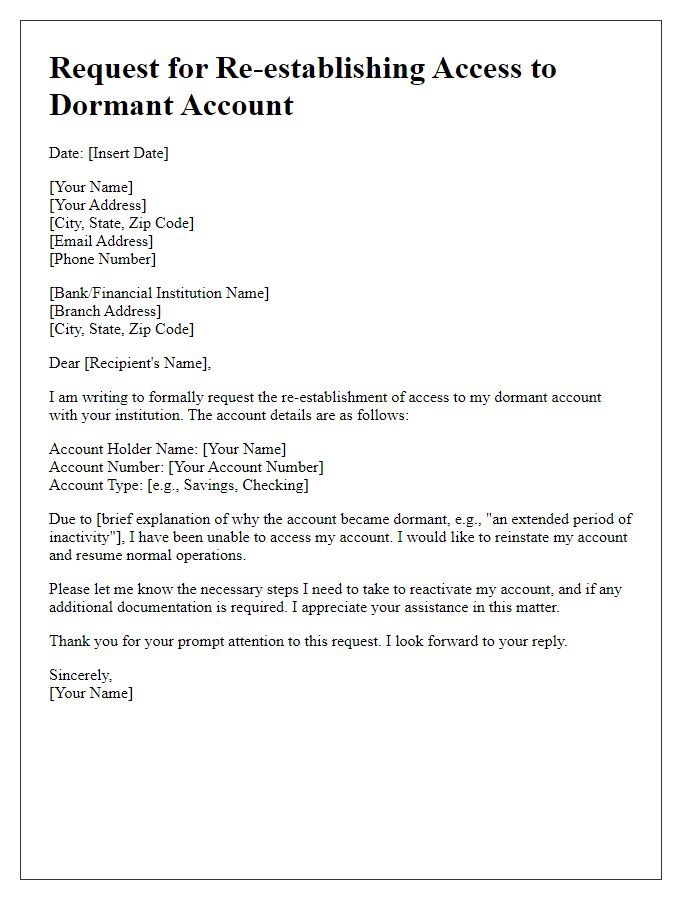

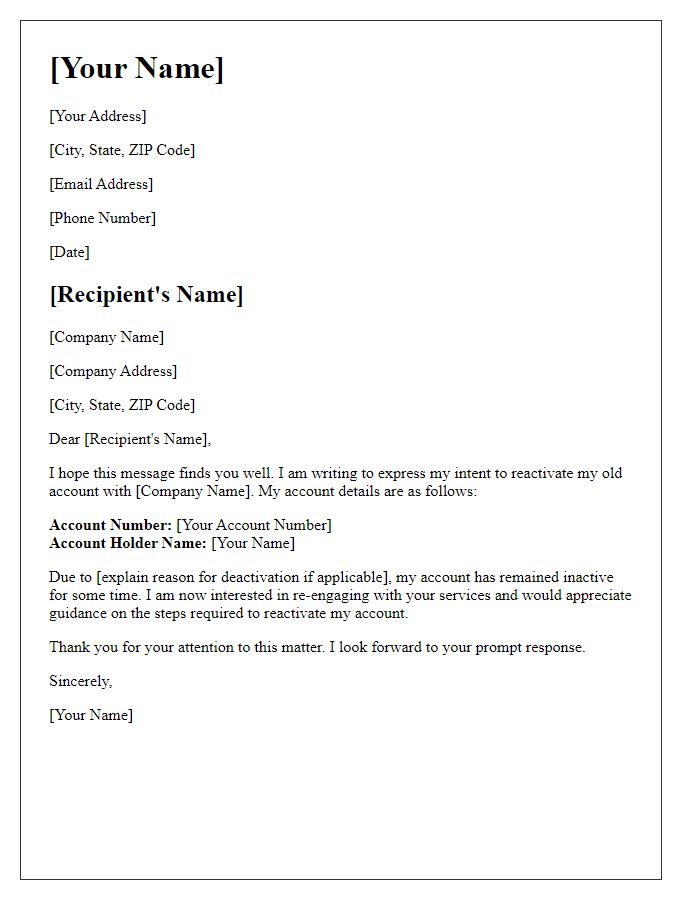

Letter template of request for re-establishing access to dormant account.

Comments