Hey there! We all know how easy it is to forget a payment due date amidst our busy schedules. That's why a friendly reminder can go a long way in keeping everything on track. Whether it's a bill, a subscription, or a loan, staying updated on payment timelines helps us maintain good financial health. Ready to learn how to craft the perfect payment due date reminder letter? Read on!

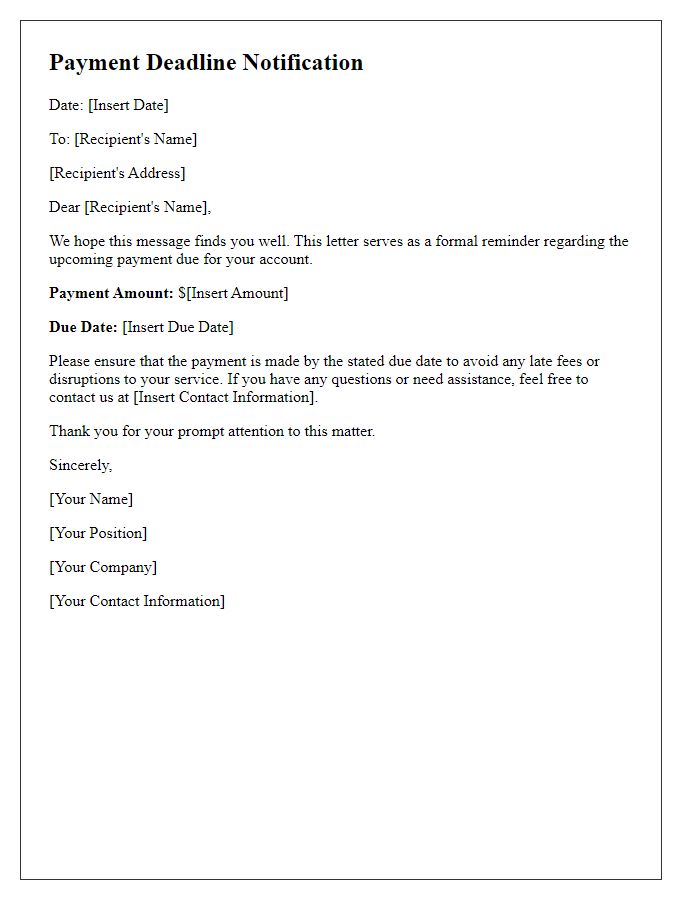

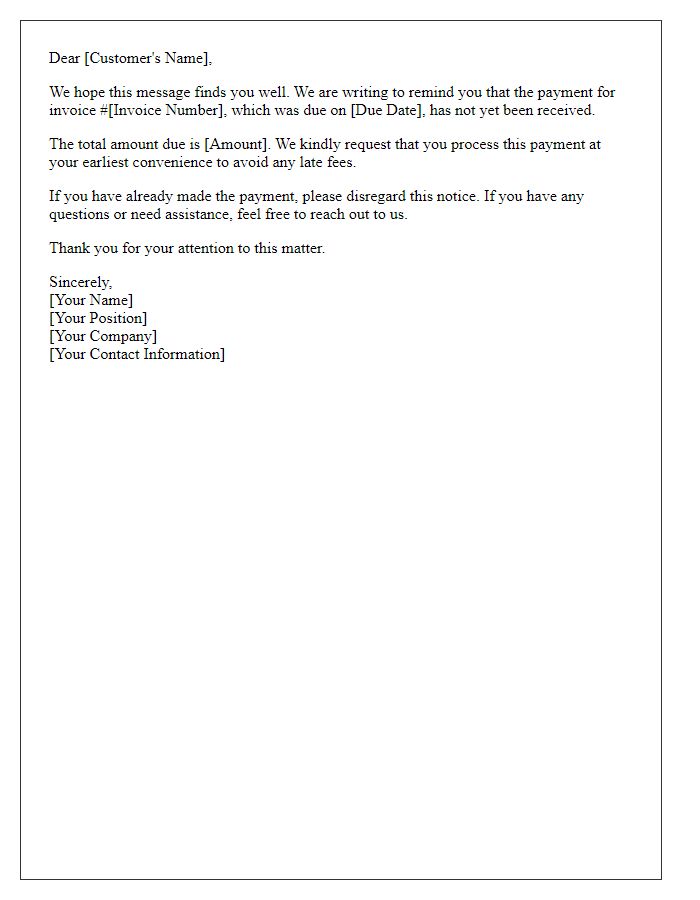

Clear subject line

A payment due date reminder serves to notify individuals or organizations about outstanding payments. Timely reminders are crucial in managing accounts and maintaining cash flow. A clear and concise subject line, such as "Payment Due Reminder: Invoice #12345," captures attention immediately. Including specific details, like the due date (e.g., October 15, 2023) and the amount due ($250), enhances urgency. It is beneficial to mention the payment method options, such as bank transfer, credit card, or online payment portal. Additionally, expressing appreciation for prompt payments fosters a positive relationship and encourages adherence to payment terms.

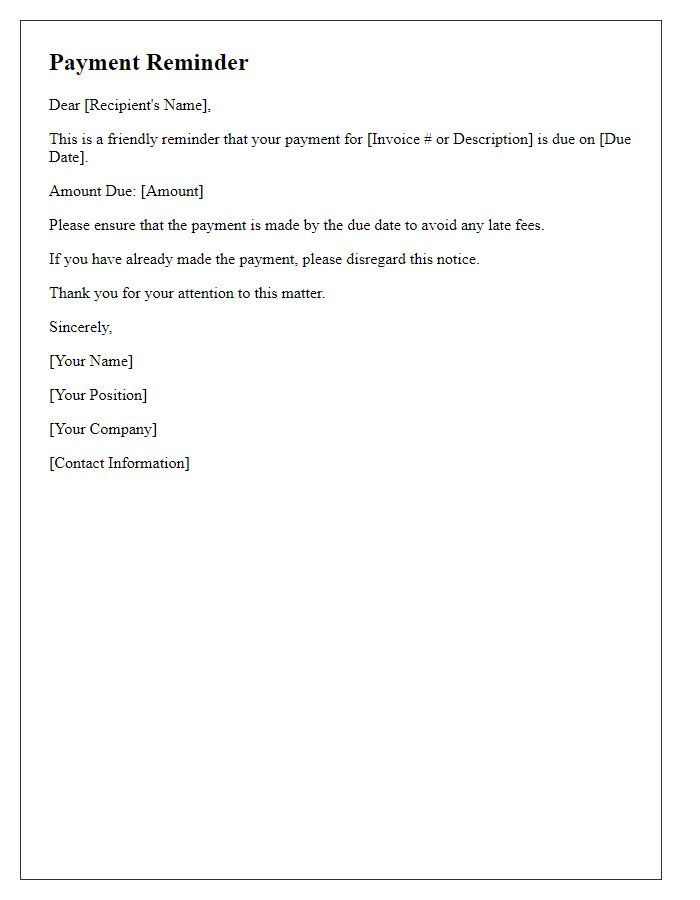

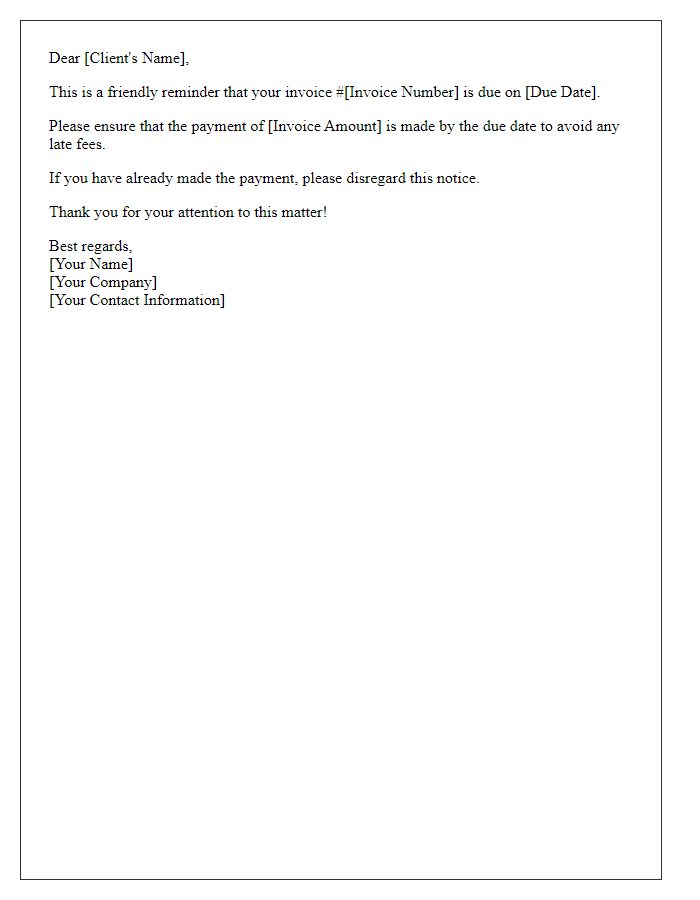

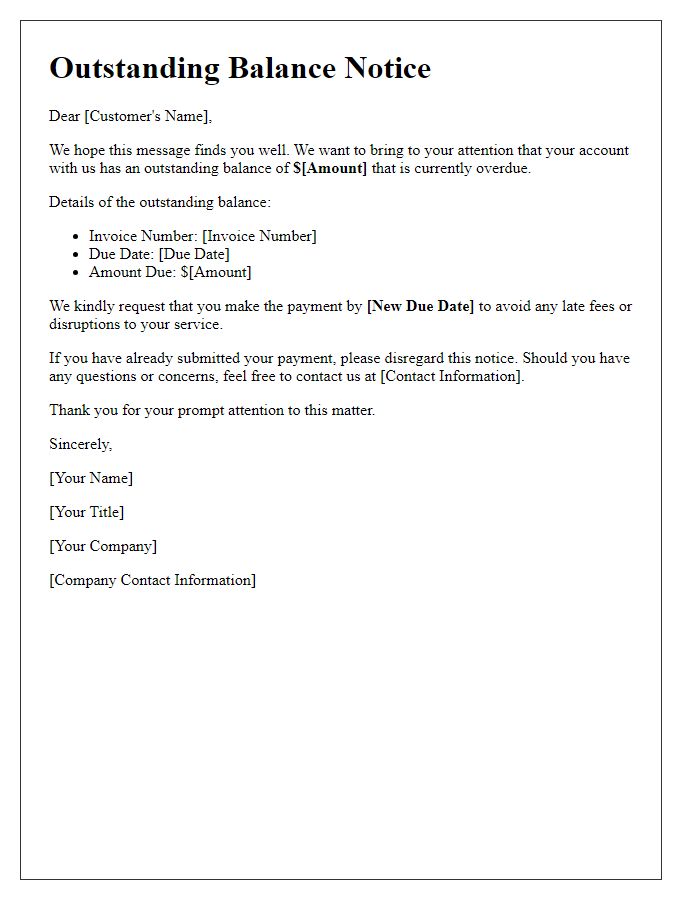

Friendly tone

A payment due date reminder serves to assist individuals in managing their financial obligations effectively. Many organizations send reminders at least a week before the due date, typically communicated through email or text messages. Payment terms often specify a 30-day timeframe for settling invoices, contributing to cash flow management. Friendly reminders ensure a positive relationship with clients or customers, fostering trust and encouraging timely payments, which is crucial for maintaining business operations. Such reminders may highlight specific payment methods accepted, including credit cards, bank transfers, and online payment platforms, making the process more convenient for recipients while minimizing the risk of late fees or service interruptions.

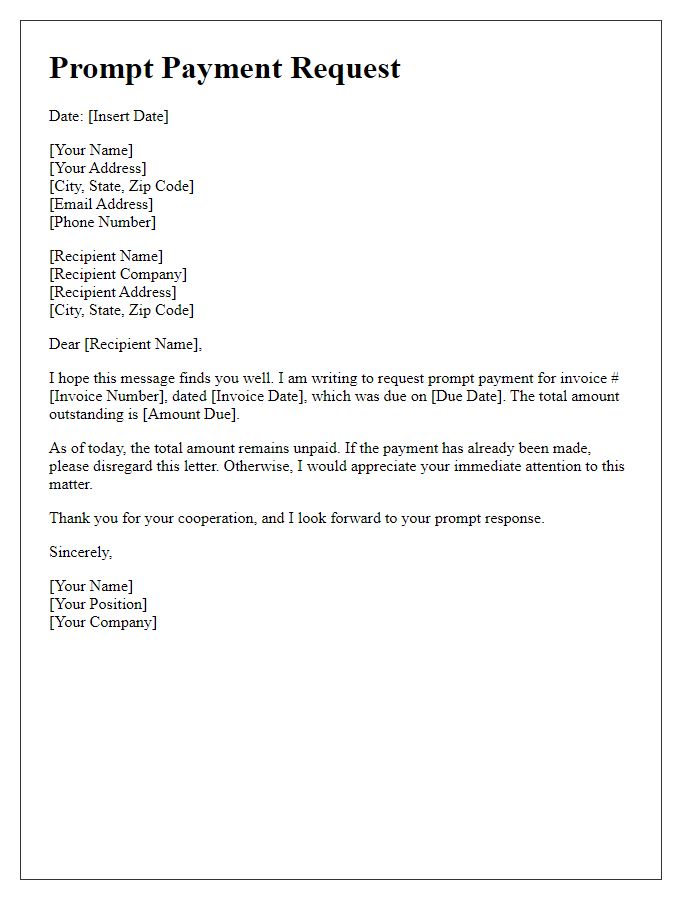

Payment details

A payment due date reminder can help ensure timely transactions, such as utility bills or credit card payments. Clear information regarding the payment amount, due date (e.g., 15th of each month), and accepted payment methods (such as online banking or checks) is crucial. Properly formatted invoices that include unique account numbers and reference details facilitate easier identification and processing. Additionally, specifying any late fees or penalties (for instance, fees accruing after a seven-day grace period) enhances the urgency for prompt payment. Effective communication of these details can significantly reduce the chance of missed payments.

Consequences of late payment

Late payment of invoices can result in significant financial penalties for businesses. Typically, this may include late fees, often calculated as a percentage of the unpaid amount, which can vary between 1% to 5% per month. Additionally, prolonged delays may lead to a deterioration of trust between vendor and client, affecting future negotiations and potentially resulting in disrupted services or halted shipments. Credit scores could also suffer; particularly regarding businesses relying on trade credit or loans for operations. Legal actions for debt recovery may ensue, leading to costly court fees and additional administrative burdens. Maintaining timely payment not only avoids these repercussions but also fosters a positive business relationship.

Contact information

Payment due dates can significantly impact the cash flow of businesses, with delays leading to financial strain. Businesses often establish clear payment terms, stating expectations for clients regarding settlement dates, typically set between 15 and 30 days post-invoice. Contact information for billing departments is crucial to facilitate prompt communication, allowing clients to easily address queries or issues. Effective reminder strategies include automated emails or direct phone calls, ensuring clients are aware of impending deadlines. Maintaining a professional tone in communications often encourages timely payments and strengthens relationships.

Comments