Have you ever found yourself puzzled over a mysterious duplicate charge on your account? It's a situation many of us dread, and understanding how to address it effectively can save both time and money. In this article, we'll explore a simple yet thorough template for crafting a letter to initiate your duplicate charges investigation. So, grab a cup of coffee and join me as we dive deeper into the steps you can take to resolve your payment concerns!

Date of transaction and duplicate charge details

A thorough investigation into duplicate charges reveals specific transaction details that require immediate attention. On September 15, 2023, a charge of $150.00 was recorded on the account ending in 1234 at the merchant name 'Tech Gadgets Inc.', located in San Francisco, California. A subsequent, identical charge of $150.00 appeared on the account on September 16, 2023, during the same billing cycle, indicating a possible error in processing. The disparity in transaction dates within a 24-hour window raises concerns about the merchant's transaction handling procedures and necessitates further examination of account activity for potential resolution.

Customer account information

Customer account information should include a unique identification number (such as an account number) for efficient retrieval and analysis. Relevant personal details consist of the customer's full name, contact information (phone number and email address), and billing address to ensure accurate identification. Transaction details necessitate data including the date of the duplicate charge, the amount levied, and the method of payment (credit card, debit card, or bank transfer). Documenting previous communication records regarding the issue enhances transparency. Additionally, including any reference numbers associated with previous transactions and communications can aid in streamlining the investigation process.

Description of issue and initial findings

Duplicate charges often create significant issues for consumers and businesses alike. During the investigation, it was noted that multiple transactions were recorded for the same item, leading to bills appearing higher than expected. For instance, a purchase made on April 15, 2023, in New York City at a popular retail store resulted in a $49.99 charge appearing twice on the customer's bank statement. Initial findings indicate a glitch in the point-of-sale system during high-traffic times, with potential implications for transaction processing software that could affect similar cases across multiple locations. Further examination of transaction logs and customer feedback is required to assess the full scope of the issue.

Documentation of communication with involved parties

An investigation into duplicate charges on billing statements often requires meticulous documentation of communication with all involved parties. The billing department meticulously reviews transaction records, focusing on specific invoice numbers and payment dates related to the duplicate charges (e.g., recorded on November 15, 2023). Communication with the client, such as emails sent on October 25, 2023, and follow-up calls to the customer service team, provides a comprehensive understanding of the issue. Additionally, correspondence with the financial institution involved (e.g., Bank of America) and their transaction confirmation can reveal discrepancies in charges. Documenting each interaction is crucial in establishing a clear timeline and facilitating resolution of the duplicate charge cases while ensuring accountability among all stakeholders.

Recommended actions and resolution steps

Duplicate charges can significantly impact customer trust and financial records for businesses. A thorough investigation should begin with a detailed review of transaction records, preferably through a secure database management system. Identify the transaction IDs, dates, amounts, and customer accounts involved. Engaging with payment processing platforms like PayPal or Stripe may provide insights into discrepancies. After identifying duplicates, propose actions such as issuing refunds or credits within a stipulated time frame, generally 5-10 business days to rectify the charges. Implementing enhanced transaction monitoring tools can prevent future occurrences. Regular auditing (quarterly or bi-annually) is essential to maintain financial integrity and customer satisfaction. Clear communication with affected customers, detailing the resolution process, is crucial during this investigation.

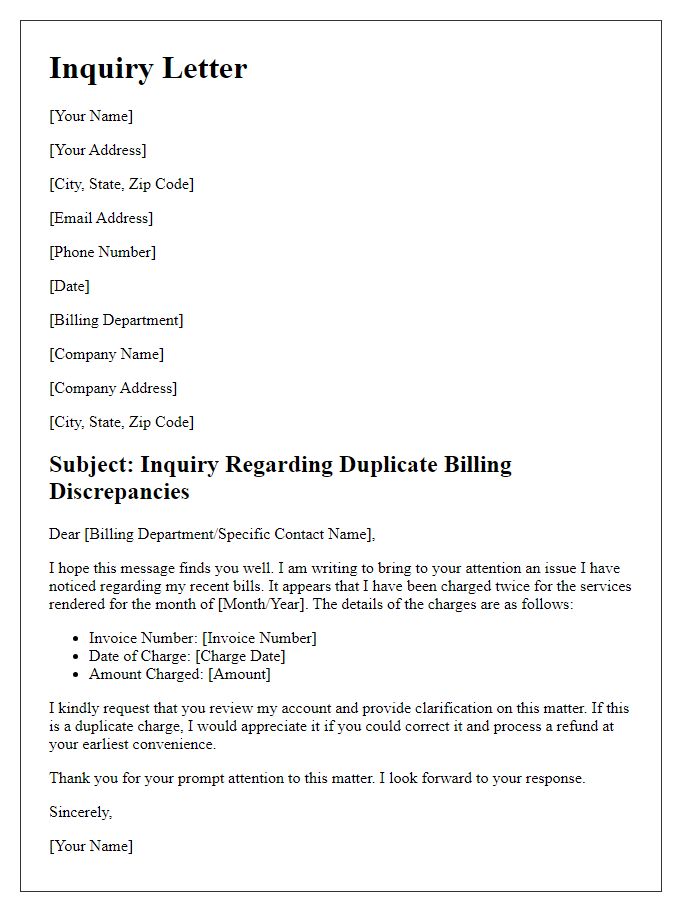

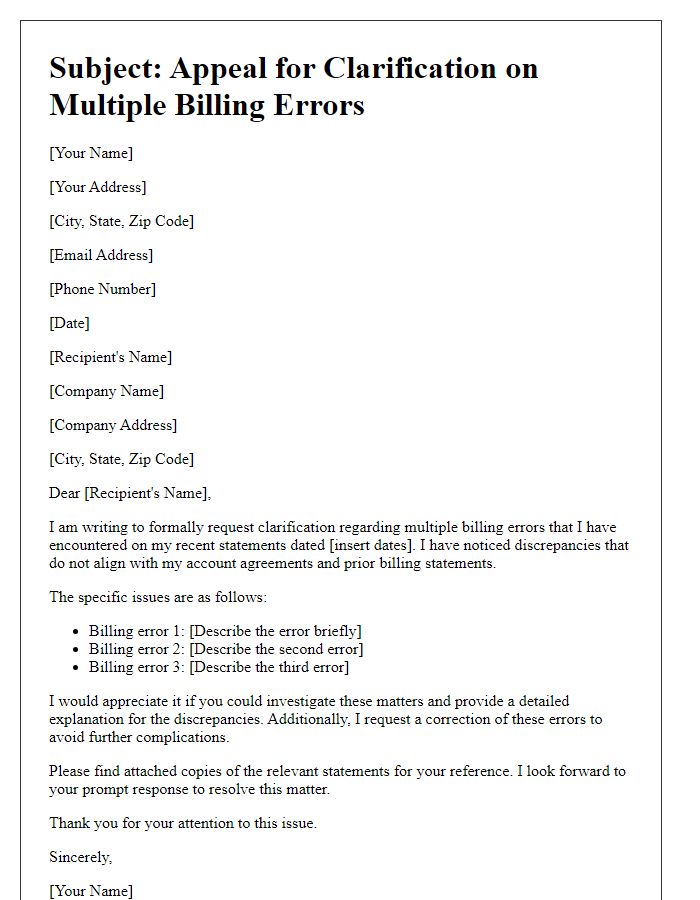

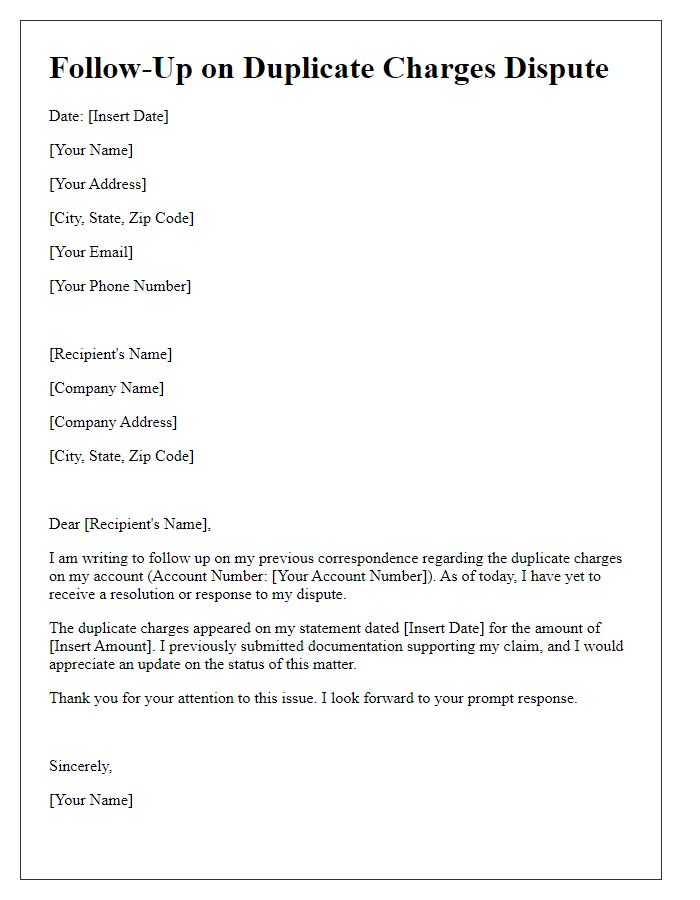

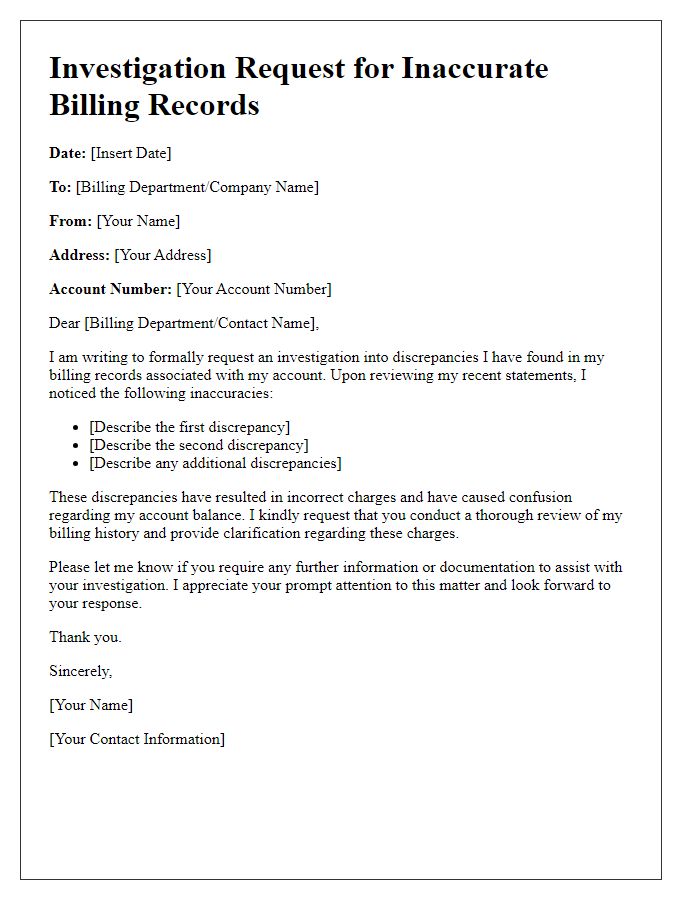

Letter Template For Duplicate Charges Investigation Report Samples

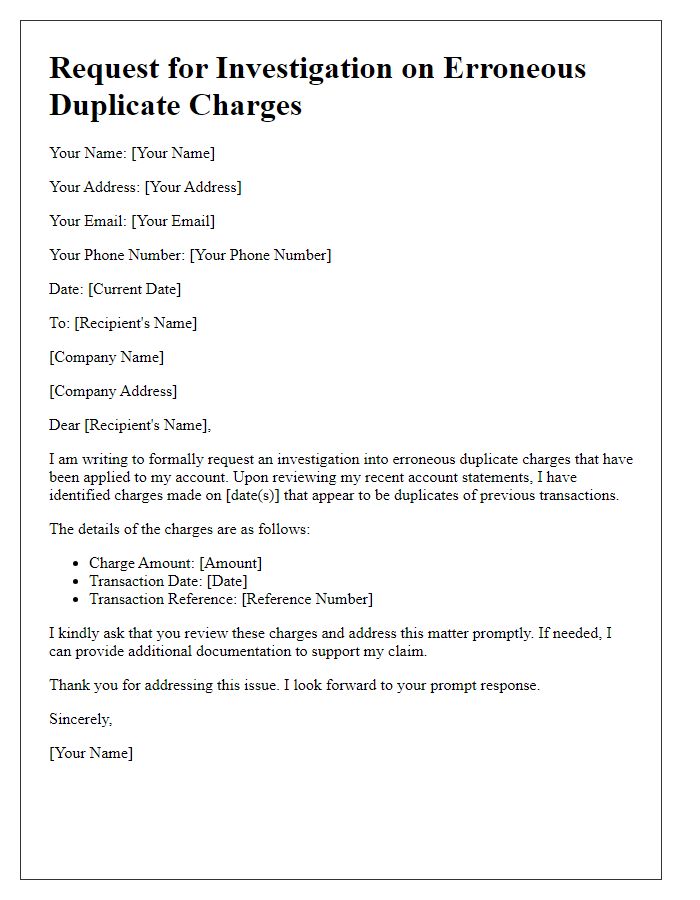

Letter template of request for investigation on erroneous duplicate charges.

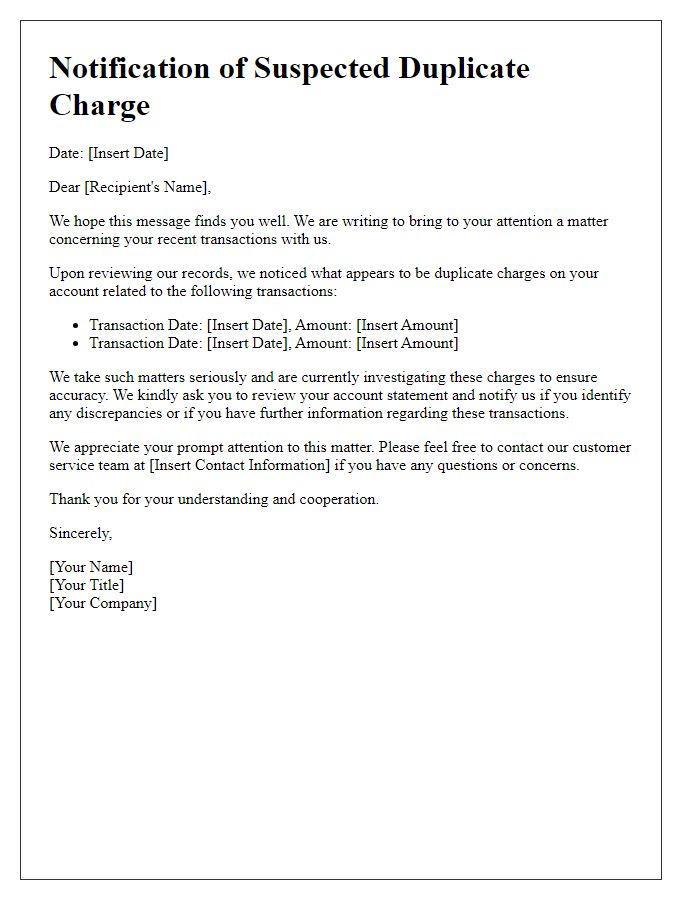

Letter template of notification about suspected duplicate charge issues.

Comments