Have you ever found yourself in a situation where a transaction on your account just doesn't add up? It can be frustrating to navigate the process of disputing a transaction that seems unfair or incorrect. In this article, we'll guide you through the steps to effectively compose a dispute transaction notification letter. Keep reading to discover essential tips and a handy template that can help you resolve your financial concerns swiftly!

Clear Subject Line

A clear subject line is essential for ensuring the recipient understands the purpose of an email immediately. For example, "Dispute Notification for Transaction ID #123456 - Urgent Attention Required" effectively highlights the issue at hand. Including the transaction ID allows for easy reference to specific incidents, ensuring efficient communication. The use of the word "Urgent" stresses the importance of prompt action, which can expedite resolution. Keeping the subject concise while informative is critical, as it encourages timely responses and aids organization within email threads.

Detailed Transaction Information

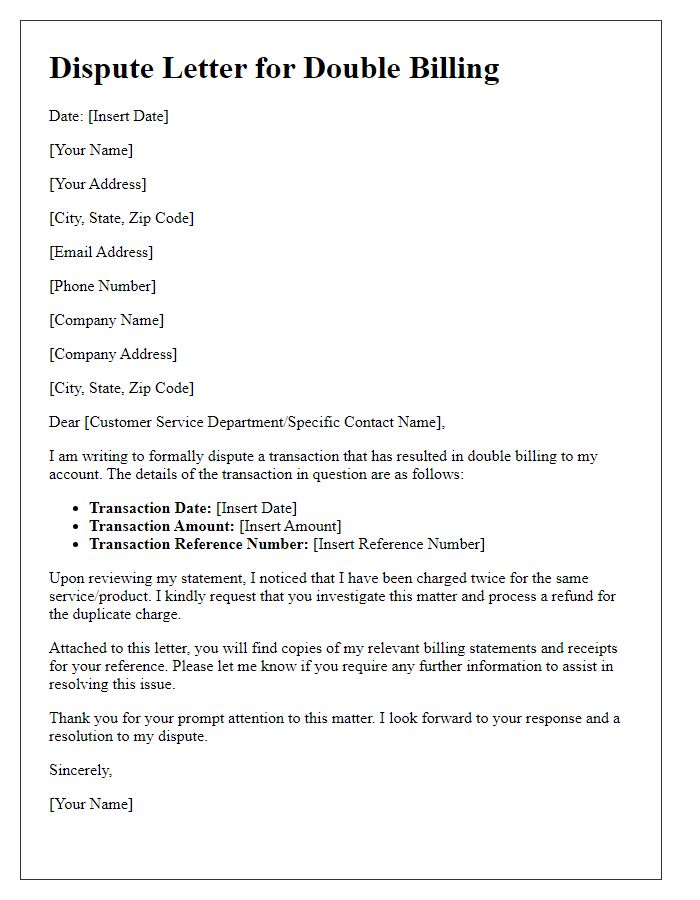

Disputes over transactions can significantly impact user experience in banking and e-commerce. For instance, a financial service provider may receive a notification regarding an unauthorized transaction on a customer's credit card. Transaction details include the date, amount (such as $150.00), merchant name (like Online Retailer Inc.), and transaction ID (e.g., 123456789). Customers often report these issues via customer support channels, leading to investigations that involve transaction audits. Resolution processes may take several days, affecting consumer trust. Implementing robust fraud detection systems is essential for minimizing these disputes and safeguarding customer information.

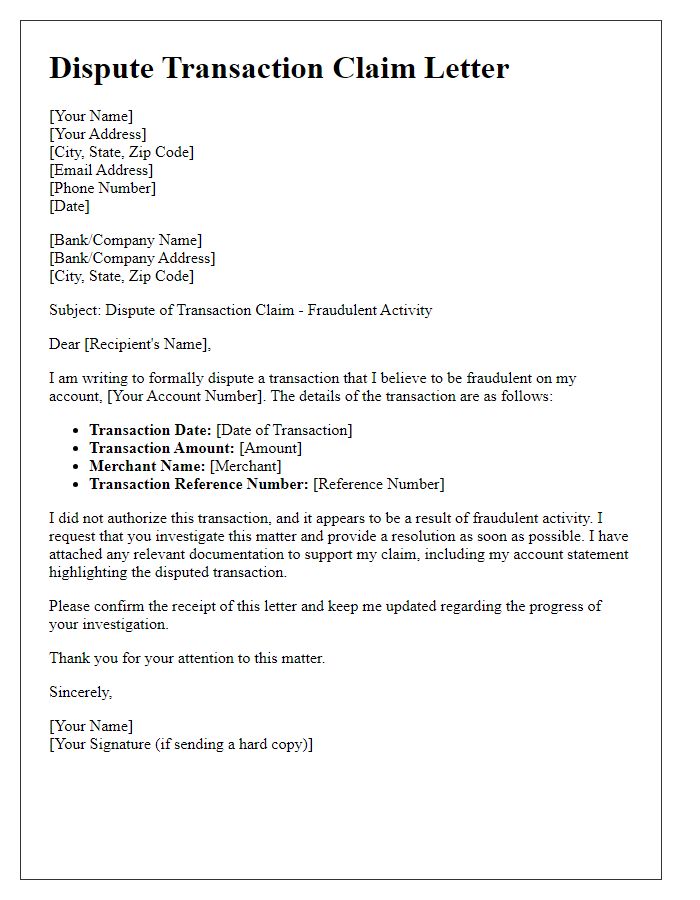

Explicit Description of Dispute

A transaction dispute notification typically involves detailing the specific transaction in question, including the date of the transaction, name of the merchant or service provider, amount charged, and the reason for the dispute. For instance, a user might report a charge of $49.99 from "Global Gadgets Inc." dated October 5, 2023, citing non-receipt of item purchased, which further complicates the verification process. Essential supporting documents, like purchase receipts or communication records with the vendor, can be referenced to reinforce the claim. Timely reporting of such disputes, ideally within 60 days from the transaction date, is crucial to ensure appropriate investigation and resolution by the financial institution involved.

Attached Supporting Documents

Dispute transaction notifications require clarity and concise presentation of evidence. A well-structured notification includes relevant details such as transaction date, transaction amount (e.g., $150.00), merchant name (e.g., Amazon.com), and specific reasons for the dispute. Supporting documents attached should include receipt copies, screenshots of transaction history, and communication records with the merchant. Highlighting discrepancies, such as unauthorized charges or incorrect billing, ensures the dispute is emphasized effectively. Clear labeling of each document helps in easy reference, facilitating a smoother resolution with financial institutions or payment processors.

Contact Information for Follow-up

Dispute transaction notifications require clear communication and detailed contact information for effective follow-up. The notification should include critical details such as the transaction date, amount (for example, $150.00), and the transaction ID (e.g., #ABC1234) for reference. Important contact information should encompass the dispute contact name (e.g., Jane Doe), phone number (such as (555) 123-4567), and email address (jane.doe@example.com) ensuring prompt resolution. A timeframe for response (like 7 to 10 business days) is also essential to manage expectations. Providing this information ensures a streamlined process for resolving disputes efficiently.

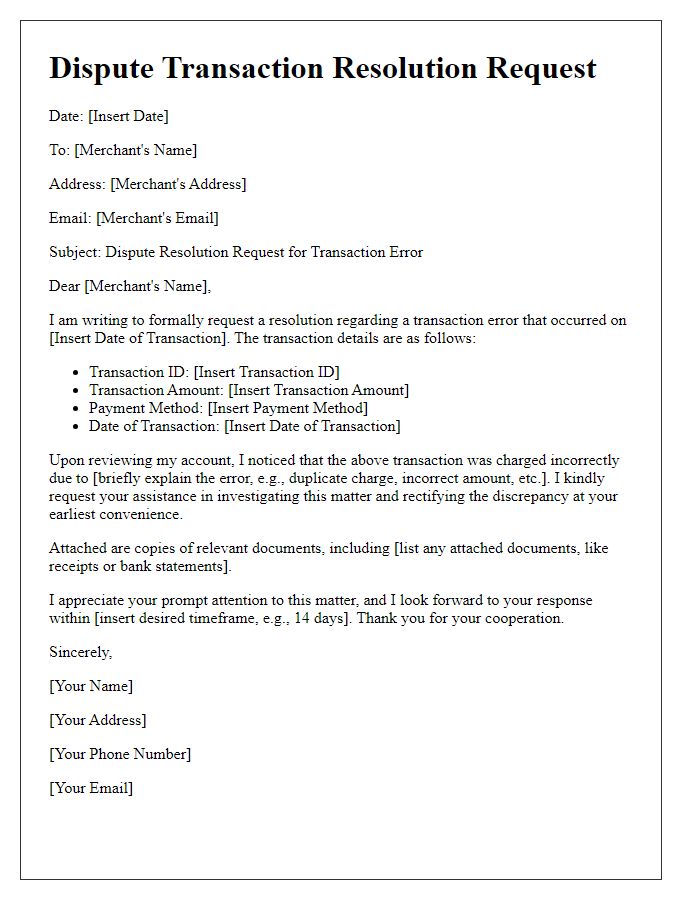

Letter Template For Dispute Transaction Notification Samples

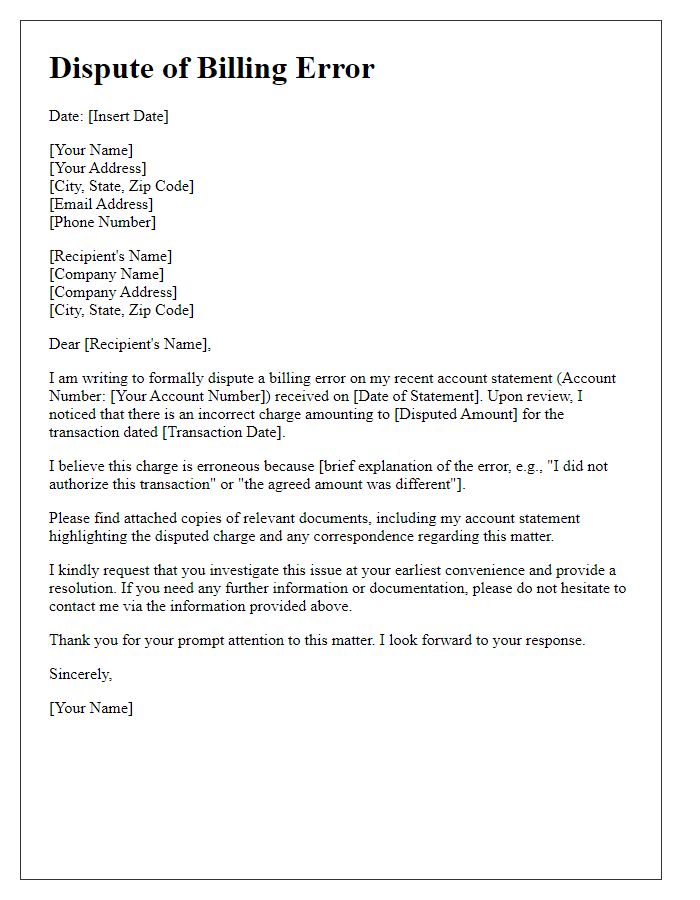

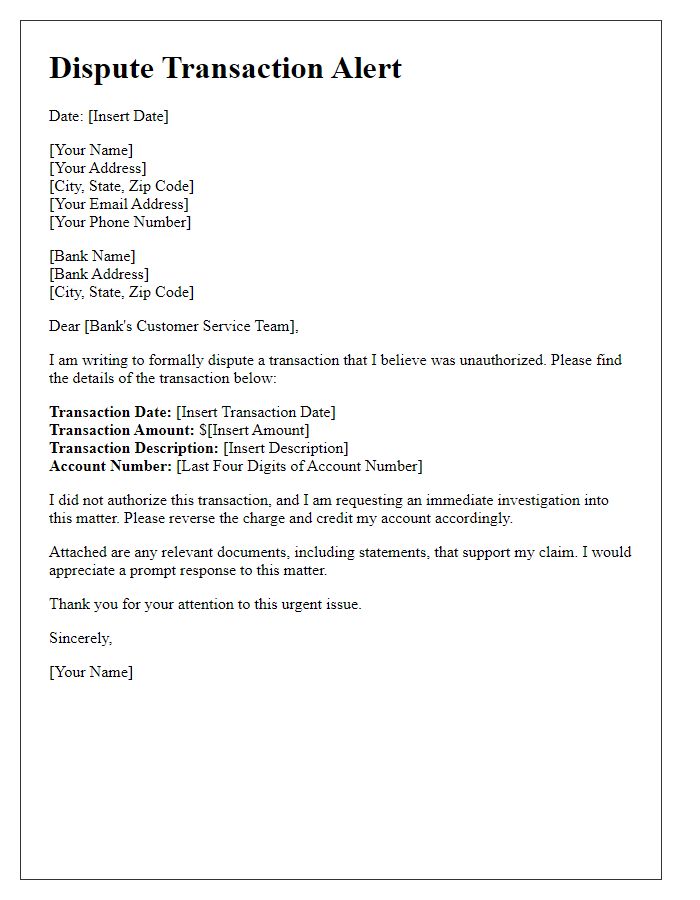

Letter template of dispute transaction communication regarding billing errors

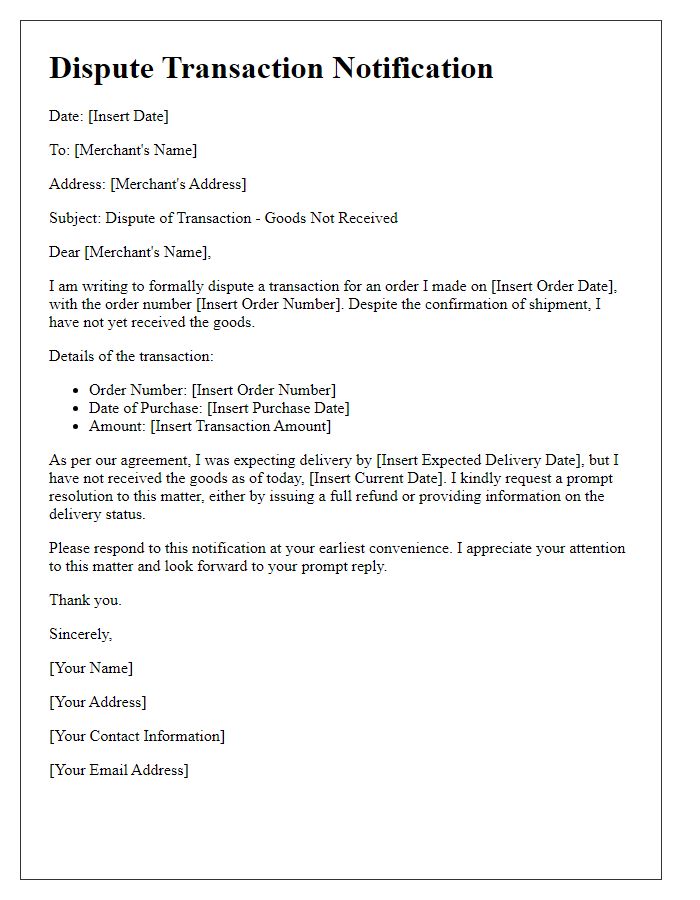

Letter template of dispute transaction notification for goods not received

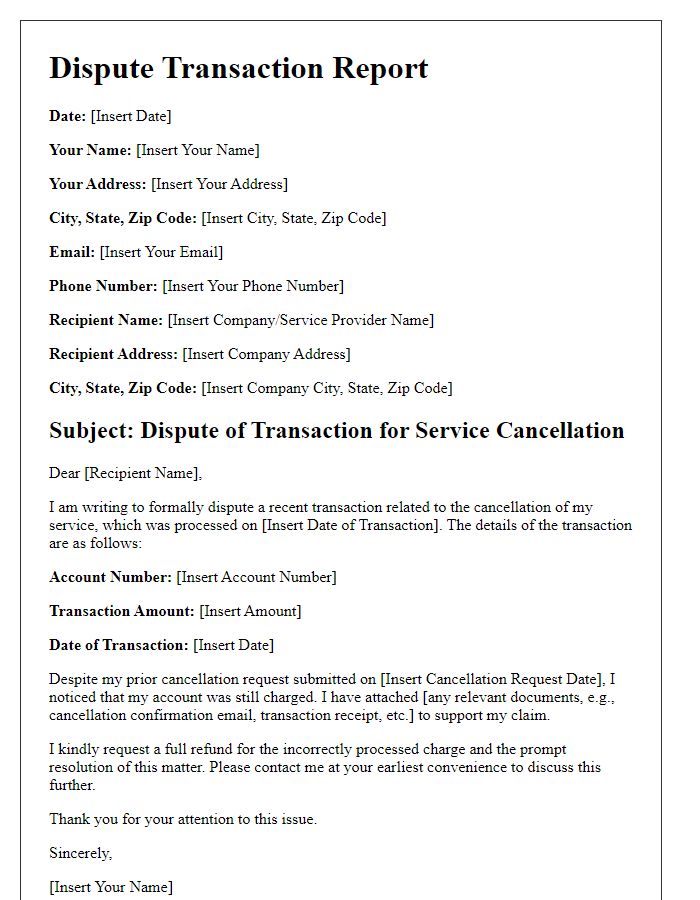

Letter template of dispute transaction report for service cancellation issues

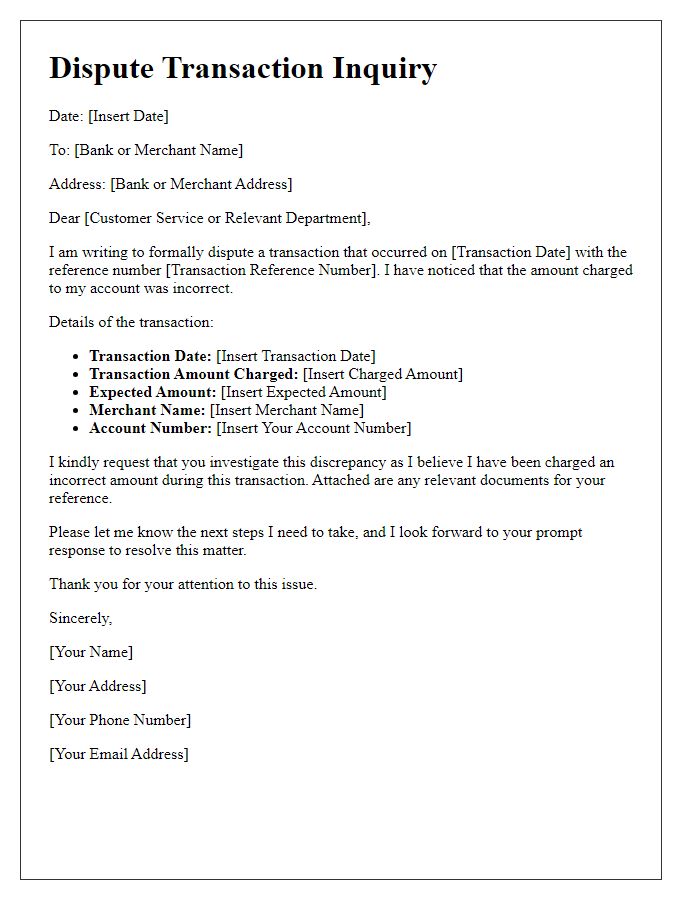

Letter template of dispute transaction inquiry for incorrect transaction amount

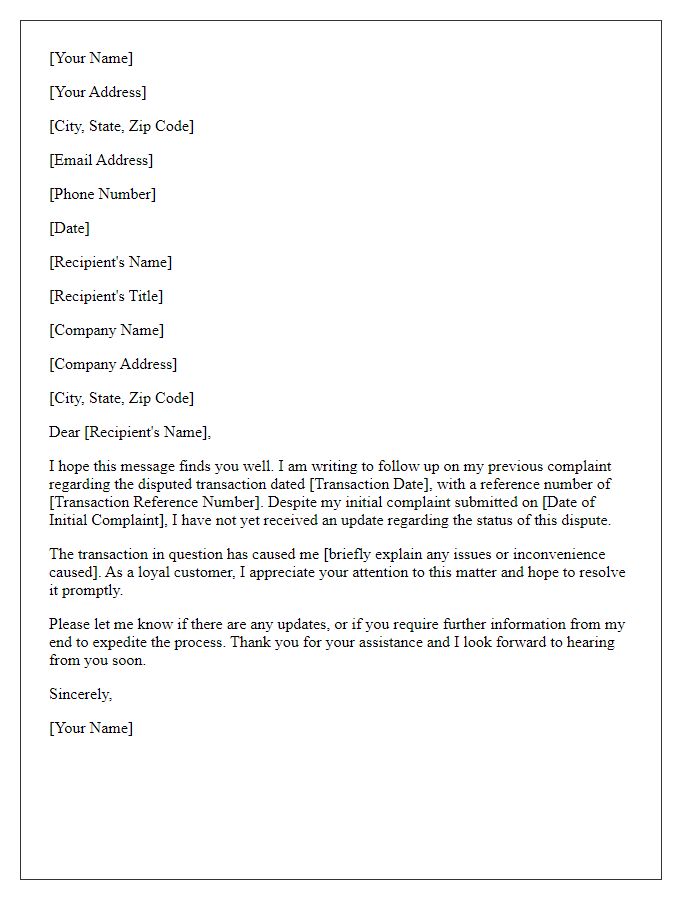

Letter template of dispute transaction follow-up after initial complaint

Comments