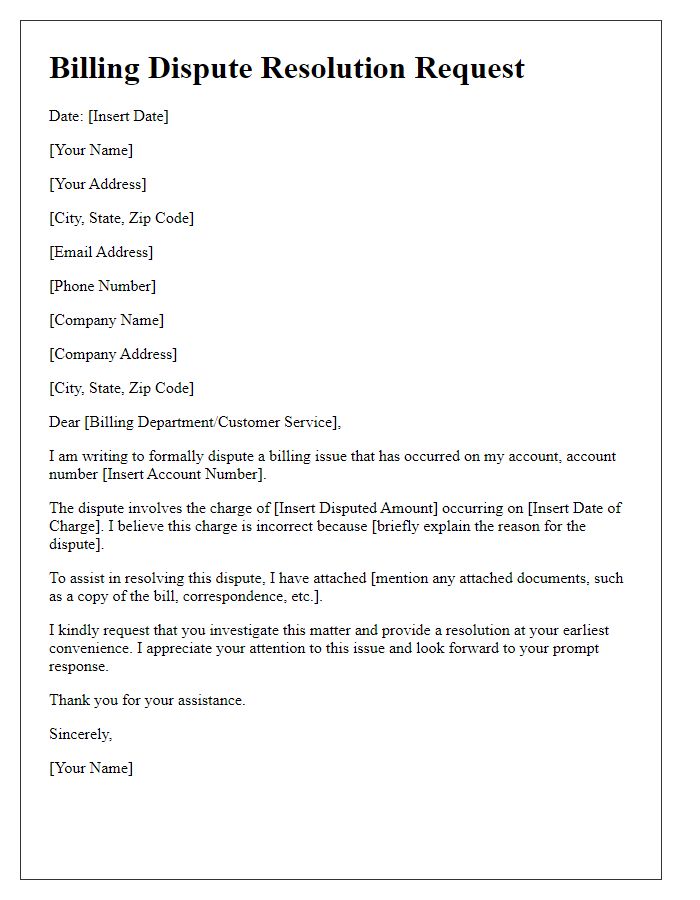

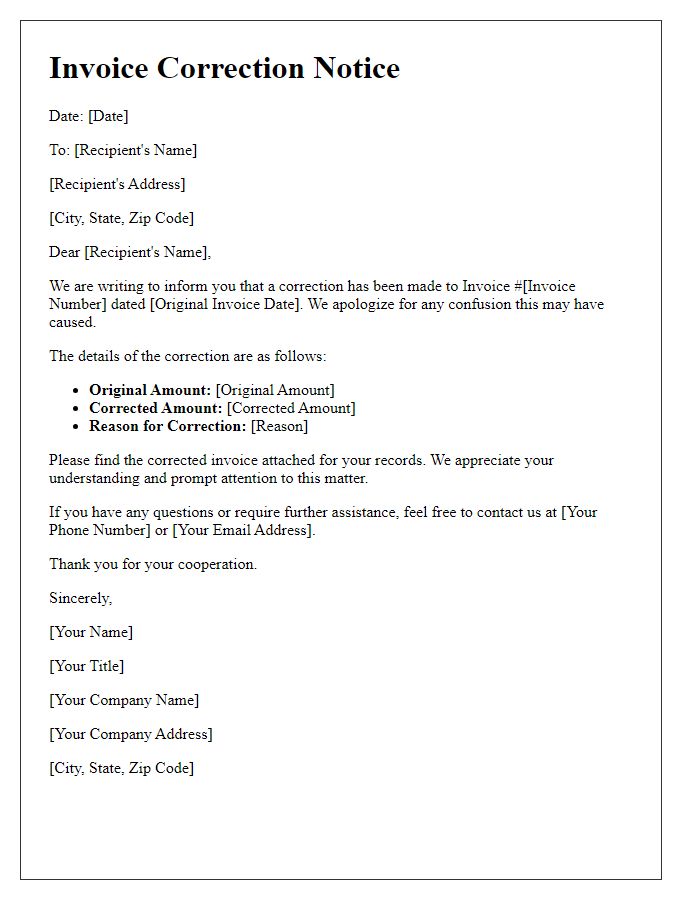

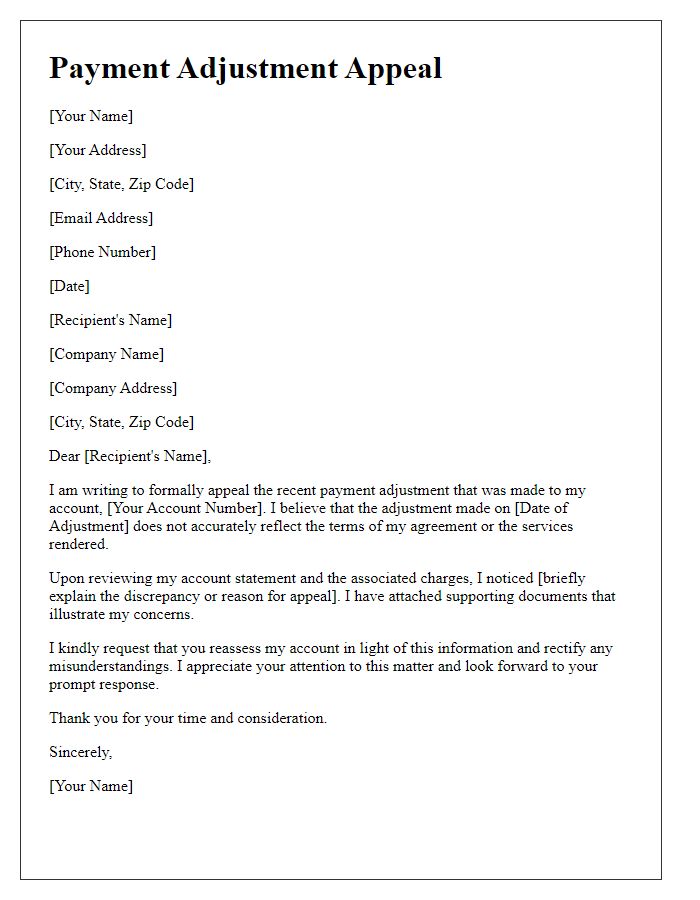

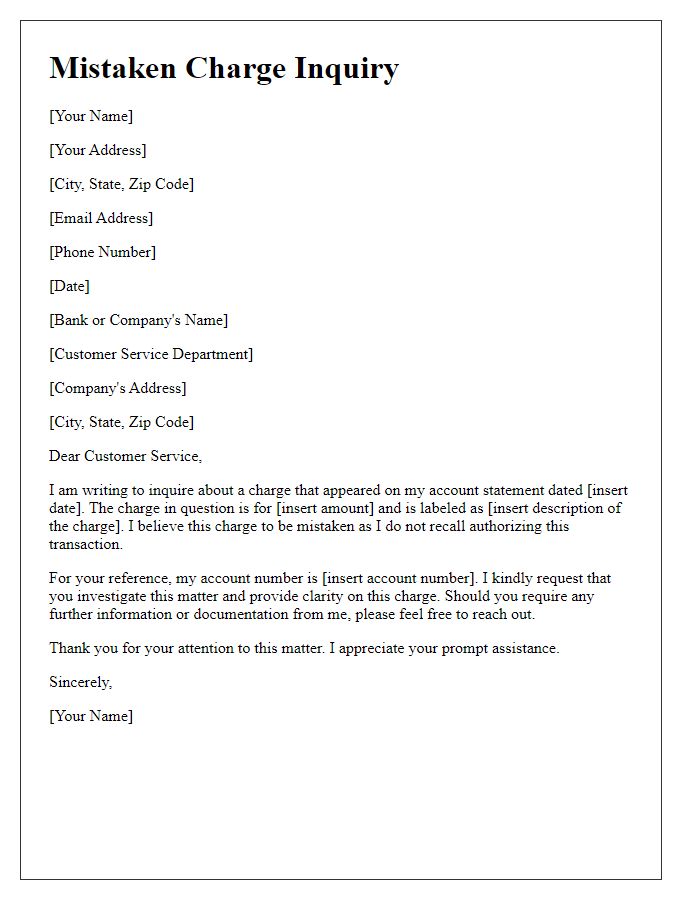

Are you feeling frustrated about a billing error that's disrupted your peace of mind? You're not alone; many people encounter the same issue at one point or another. Addressing these discrepancies doesn't have to be daunting, especially if you have the right tools at your disposal. Join me as we explore a simple letter template for correcting billing errors effectivelyâread on to learn how to resolve your concerns smoothly!

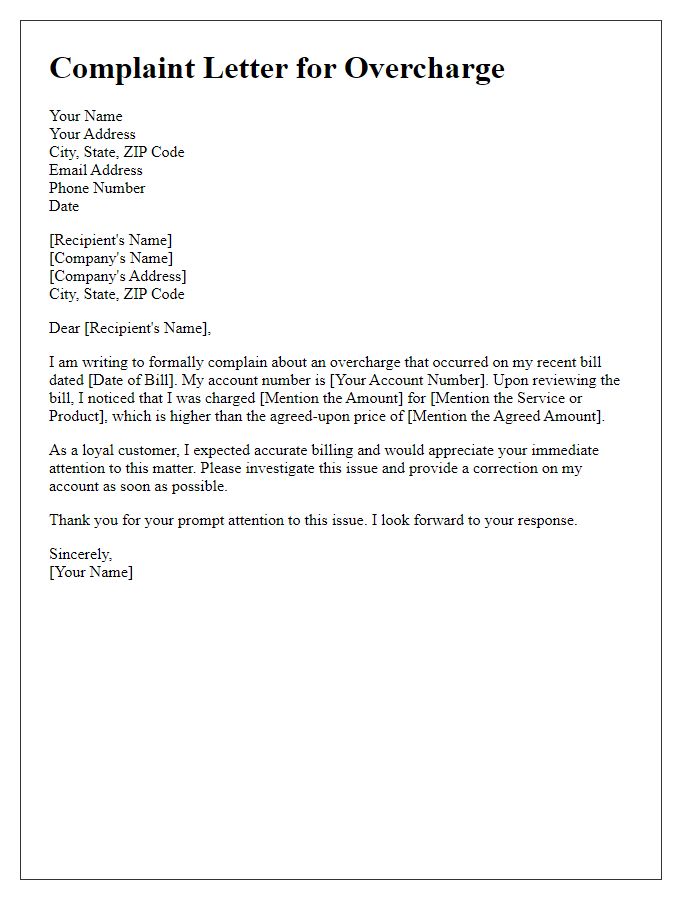

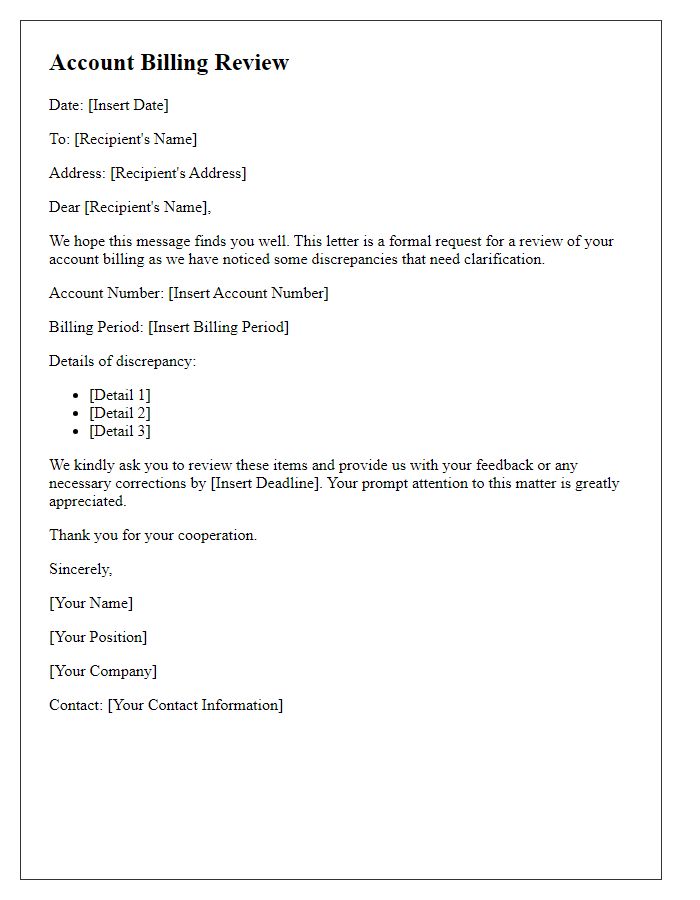

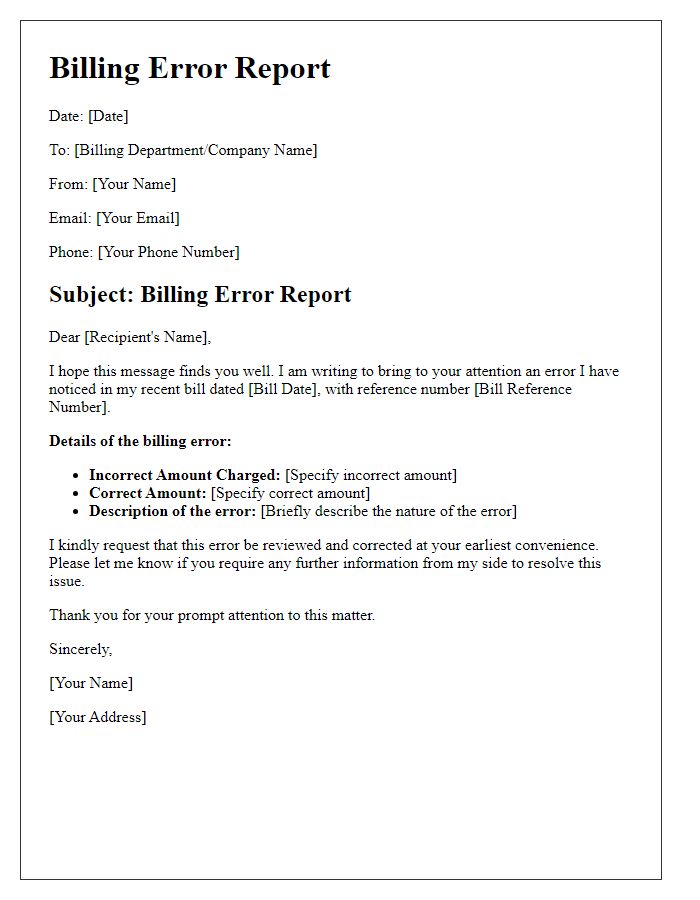

Clear Identification of Error

Identifying billing discrepancies requires careful examination of invoiced amounts, payment records, and associated dates. A typical billing error may manifest as an overcharge, where the total due exceeds the agreed-upon amount specified in the contract, such as a service fee of $250 instead of the billed $300. Comparing line items on invoices against previous bills provides clarity, revealing miscalculations or duplicate charges for services rendered, like an extra month of service not utilized. Documentation, including payment confirmations and correspondence, alongside clear identification of service dates, assists in pinpointing errors accurately and expedites resolution with the billing department or service provider.

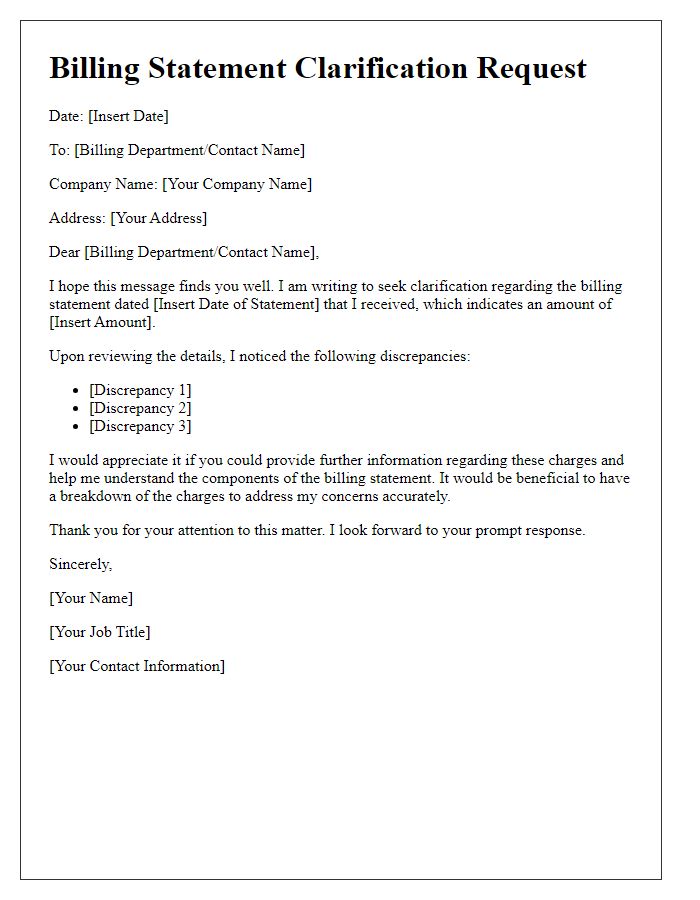

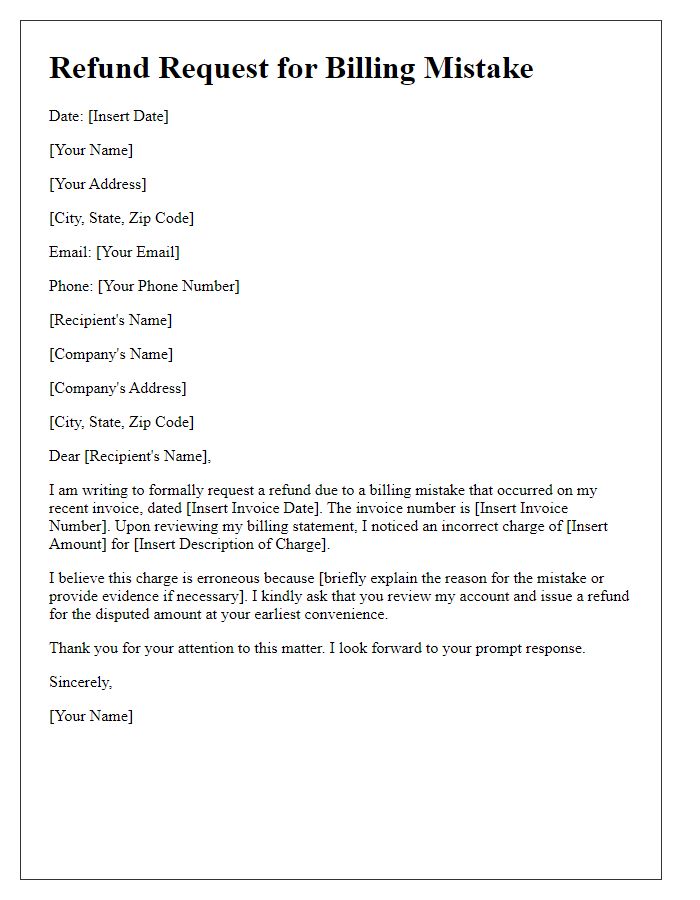

Detailed Explanation of Discrepancy

Billing discrepancies often arise due to inaccurate data entries in financial statements or invoices. For instance, a customer may notice an overcharge of $50 on their latest bill from a utility company. The bill dated September 2023 indicates charges for 1500 kilowatt-hours (kWh) of electricity usage, while the actual recorded usage from the smart meter is only 1200 kWh. This 300 kWh difference, if charged at a rate of $0.10 per kWh, results in an erroneous charge of $30. Additionally, fees applied for late payment due to this error can further inflate the total owed. It is essential to rectify such discrepancies immediately to maintain customer trust and satisfaction. Accurate billing impacts the relationship between the service provider and customer, safeguarding against potential disputes and loss of business. Addressing these concerns promptly ensures adherence to regulations, such as the Fair Credit Billing Act, which protects consumer rights during billing errors.

Specific Billing Details Reference

Billing discrepancies can occur easily, affecting financial accuracy for both service providers and customers. For example, incorrect charges (such as over $150) may appear on monthly statements, leading to potential disputes. Timely resolution becomes critical, typically within 30 days of notification. Affected accounts, often identified by unique reference numbers (for example, #123456), should be promptly investigated by the billing department to ensure proper adjustment. Accurate billing records not only support customer satisfaction but also maintain healthy business relationships, preventing long-term financial issues. Proper documentation, including detailed itemized statements, is essential for effective communication during the correction process.

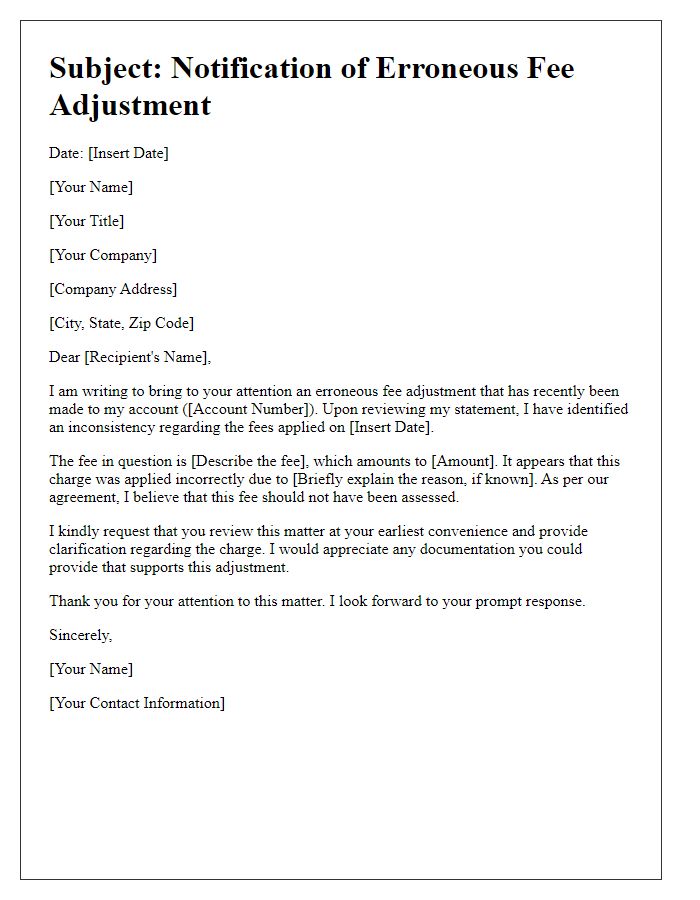

Desired Resolution or Adjustment

Billing errors can create significant frustrations for consumers, leading to inquiries regarding discrepancies on monthly statements. Common issues include discrepancies in service charges, unexpected fees, or incorrect billing amounts. For example, a utility bill might show an overcharge of $50 due to a miscalculation of usage, or a credit card statement might reflect an erroneous double charge for a single purchase. Many consumers seek prompt correction to restore trust in billing accuracy, often requesting a revised statement or a refund for the overcharged amount. Effective resolution involves timely communication from customer service representatives and a clear explanation of the corrective measures taken to resolve any identified errors.

Contact Information for Follow-up

In instances of billing error correction, it is crucial to include clear and accurate contact information for effective follow-up. Provide a full name of the account holder, such as John Smith, alongside a distinct phone number, like (123) 456-7890, ideally a mobile number for quick responses. Include an email address, for example, johnsmith@email.com, to facilitate written communication. The physical address should also be listed, ensuring clarity in correspondence, such as 123 Elm Street, Springfield, IL, ZIP code 62701. Ensuring this detailed contact information will expedite the resolution process of billing discrepancies with service providers or financial institutions.

Comments