Are you looking for a way to ensure that your payment information is accurate and secure? Verifying payment details not only protects your transactions but also gives you peace of mind in today's fast-paced digital world. In this article, we'll explore quick and effective methods to confirm your payment details, helping you avoid potential mishaps. So, let's dive in and discover how you can safeguard your financial information!

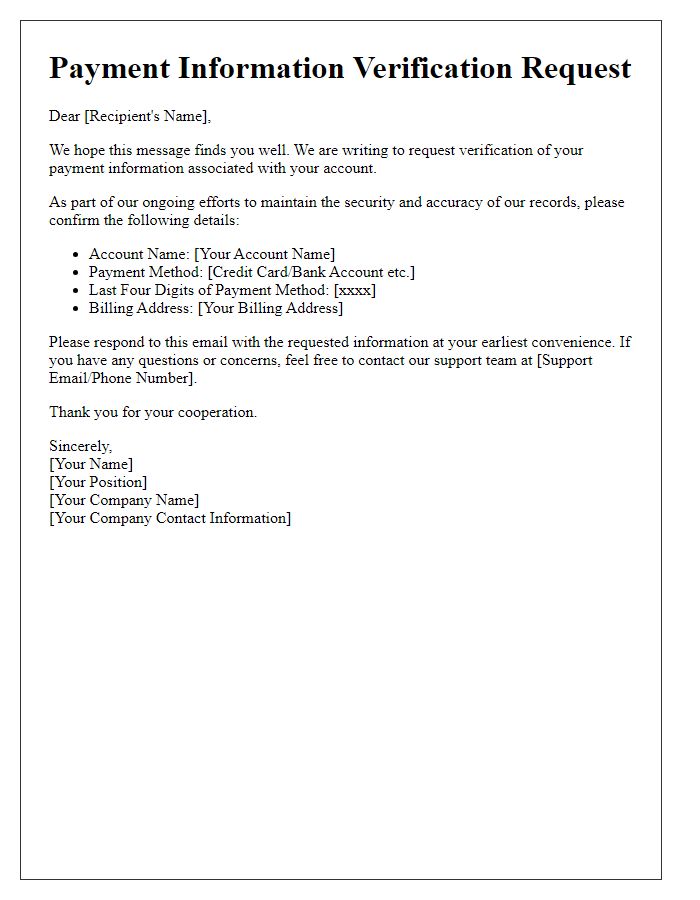

Recipient's contact information

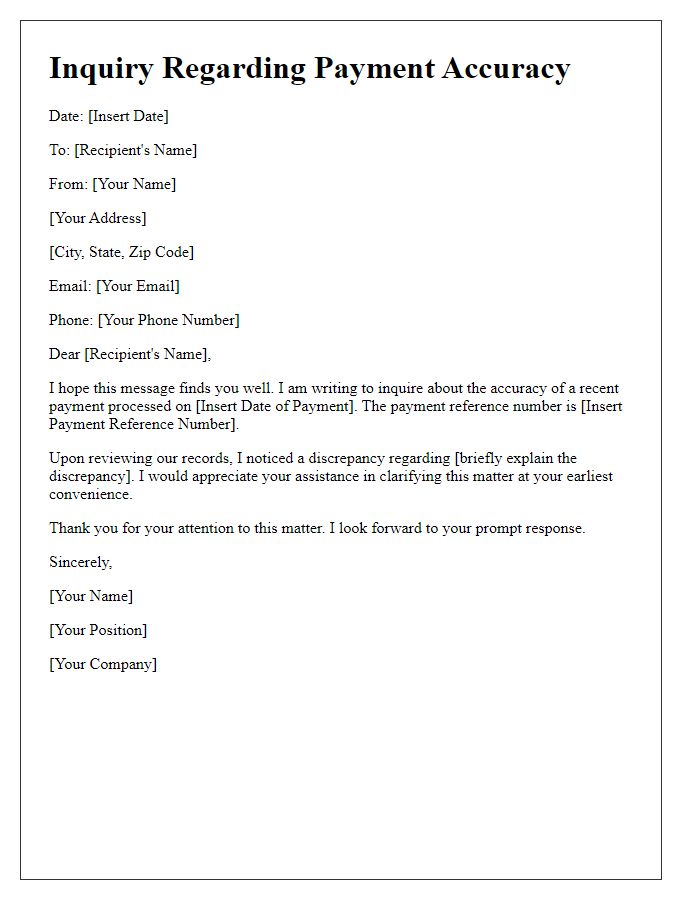

Payment verification is essential for ensuring the accuracy of financial transactions and maintaining security. Customer accounts, particularly in e-commerce platforms like PayPal or Stripe, require precise information such as credit card numbers (typically 16 digits), expiration dates (month/year format), and CVV codes (three-digit security number) to process payments efficiently. Verification often includes matching the billing address, which could impact fraud prevention. This process safeguards both consumers and businesses from potential financial losses, enabling seamless transactions in locations like Amazon or eBay. Regular audits of payment information can help companies comply with regulations set forth by entities like the Payment Card Industry Data Security Standard (PCI DSS).

Clear subject line

Verification of Payment Information Required for Account Security In today's digital landscape, verifying payment information is essential for safeguarding accounts and preventing unauthorized transactions. Payment methods, such as credit cards (Visa, MasterCard, American Express) or digital wallets (PayPal, Apple Pay), require confirmation of billing addresses and name details to ensure accuracy. This verification process typically includes the use of secure communication protocols (like HTTPS) to protect sensitive information. Failure to verify payment data can lead to transaction declines, potentially disrupting access to services or products, especially in online marketplaces like Amazon or eBay. Regularly updating and confirming payment information enhances overall account security, minimizing financial risks and unauthorized access.

Salutation and polite greeting

Verifying payment information is essential for maintaining security and accuracy within financial transactions. Payment details, such as credit card numbers (up to 16 digits), expiration dates (typically month/year format), and security codes (3 or 4 digits), must be cross-checked to prevent fraud and unauthorized access. Organizations often employ encryption protocols, like AES (Advanced Encryption Standard), to protect sensitive information during transmission. In addition, regular audits, often performed quarterly, ensure that data protection policies comply with regulations such as PCI-DSS (Payment Card Industry Data Security Standard). Secure verification processes protect both the user and the entity involved in the transaction, fostering trust in e-commerce environments.

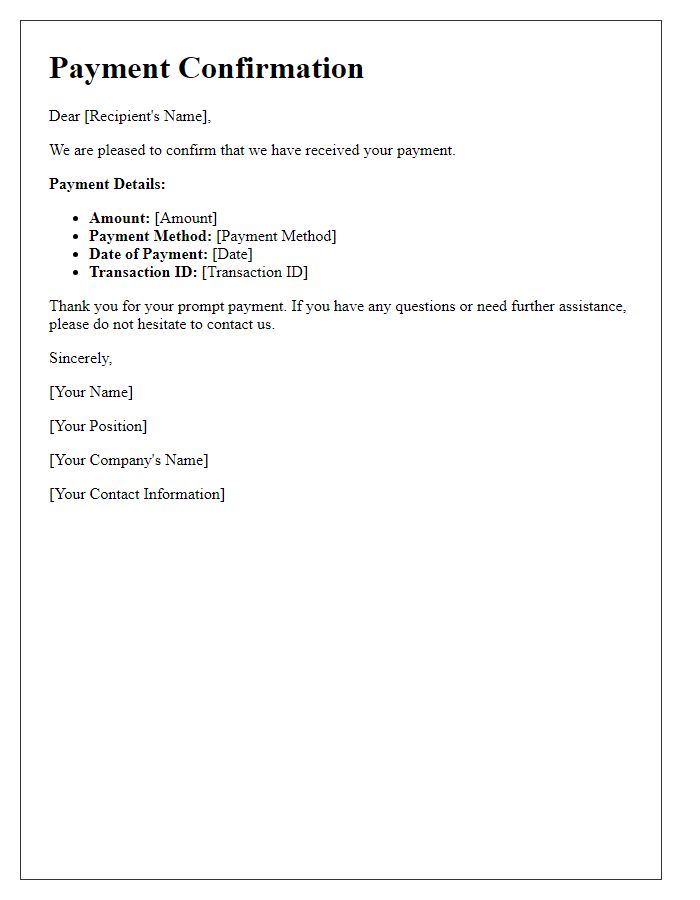

Detailed payment information

Verifying payment information is crucial for businesses to ensure financial transactions are secure and accurate. Payment methods such as credit cards (Visa, MasterCard, American Express) typically require details including card number, expiration date (usually MM/YY format), CVV (3-digit or 4-digit security code), and billing address. Bank transfers necessitate account numbers, routing numbers, and the name of the financial institution. E-commerce platforms may require user verification through two-factor authentication, ensuring that the person using the account is authorized. Compromises in payment security can lead to significant losses, thus underscoring the importance of meticulous record-keeping and periodic audits in protecting sensitive financial information.

Request for confirmation or verification

Payment verification processes are crucial for maintaining security in financial transactions, particularly for large sums such as $10,000 or more. Banks, like JPMorgan Chase, often require additional verification steps to ensure that the funds are legitimate and authorized. Typically, this involves confirming identity through methods like two-factor authentication, which may include sending a code to registered mobile numbers. Documentation such as government-issued identification or utility bills may also be necessary to establish proof of address for compliance with Know Your Customer (KYC) regulations. This meticulous approach protects both consumers and institutions in the increasingly complex digital payment landscape.

Comments