Are you tired of managing accounts that you no longer use? Closing inactive accounts can simplify your life and enhance your financial security. In this article, we'll walk you through a straightforward letter template specifically designed for closing those dormant accounts with ease. So, grab a cup of coffee, sit back, and let's dive into the details!

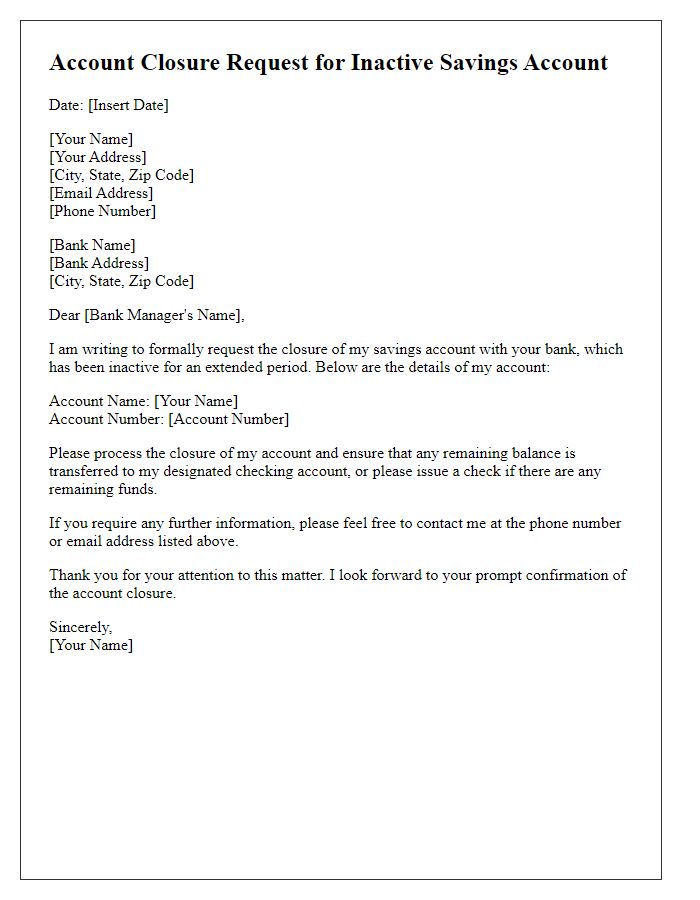

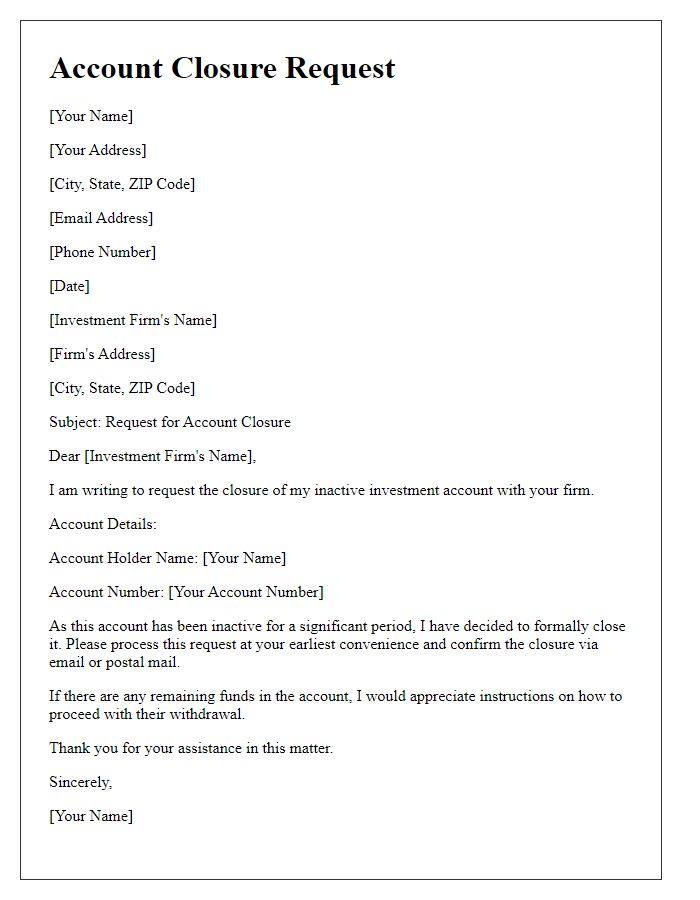

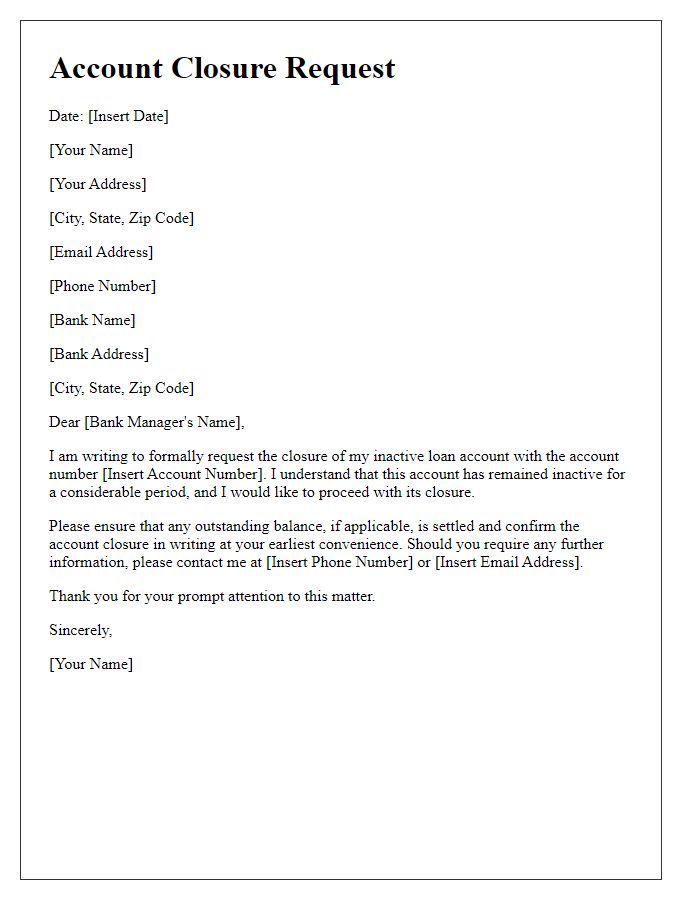

Account Holder Information

Lorem Ipsum Bank, established in 1990, is contacting customers regarding account closure. Inactive accounts held by individuals, such as John Smith with account number 123456789, will be closed if no activity occurs within 12 consecutive months. As of October 2023, a recent review indicated that the average inactive account incurs maintenance fees of $10 monthly. Customers must address any outstanding balances before closure to avoid financial penalties. All customers are encouraged to verify their account activity status via the online banking portal or by contacting customer service at 1-800-555-0199 during business hours (Monday to Friday, 9 AM to 5 PM Eastern Standard Time).

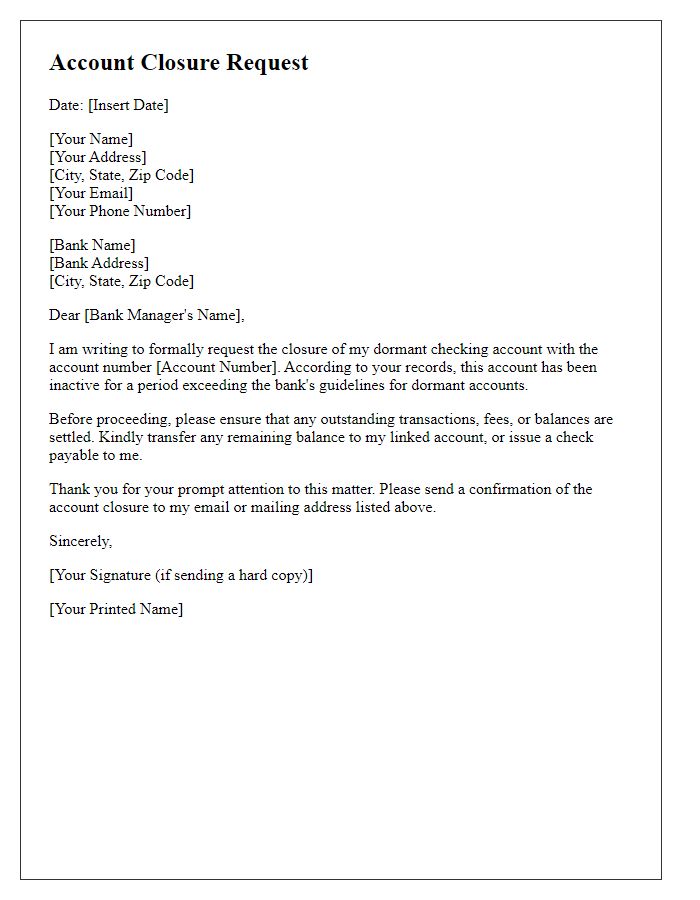

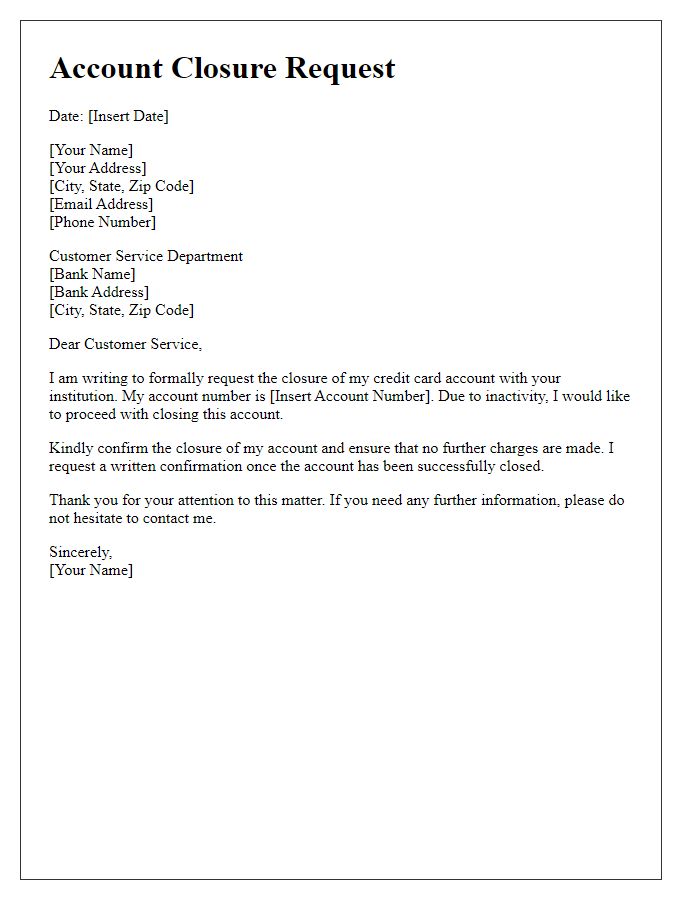

Account Activity Summary

Inactive accounts can lead to security risks and lost opportunities for financial optimization. According to recent statistics, approximately 25% of bank accounts remain dormant for over a year. This includes platforms like Bank of America and Chase, where periodic inactivity can incur fees. Financial institutions often initiate a review process for such accounts, potentially leading to account closure after extended inactivity, defined as 12 months or longer. Notification usually involves an account activity summary, detailing any past transactions or balance statuses, ensuring that account holders are informed before final decisions are enacted. Closing inactive accounts can streamline financial management and enhance overall security.

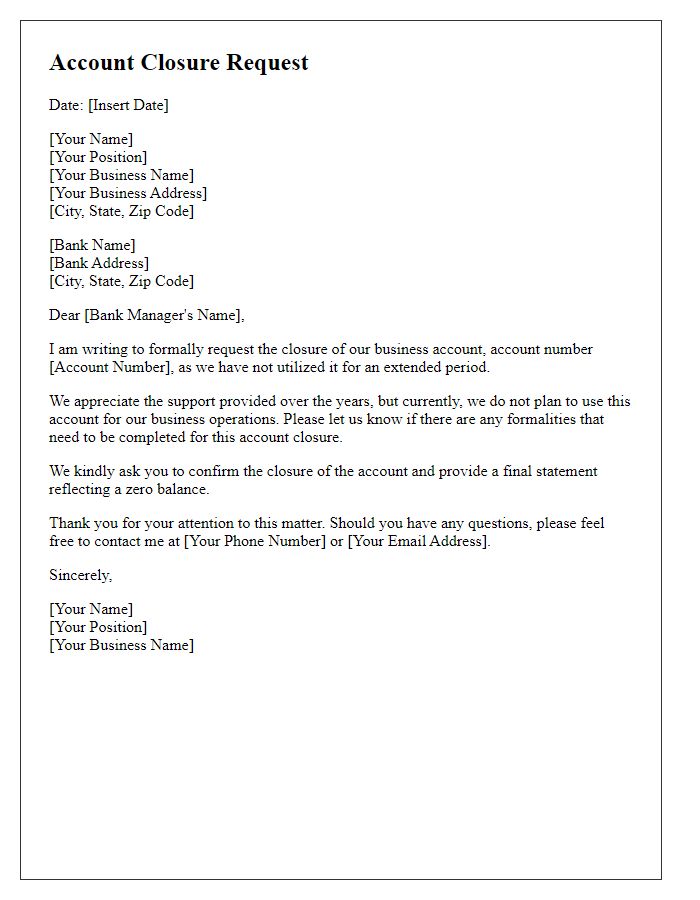

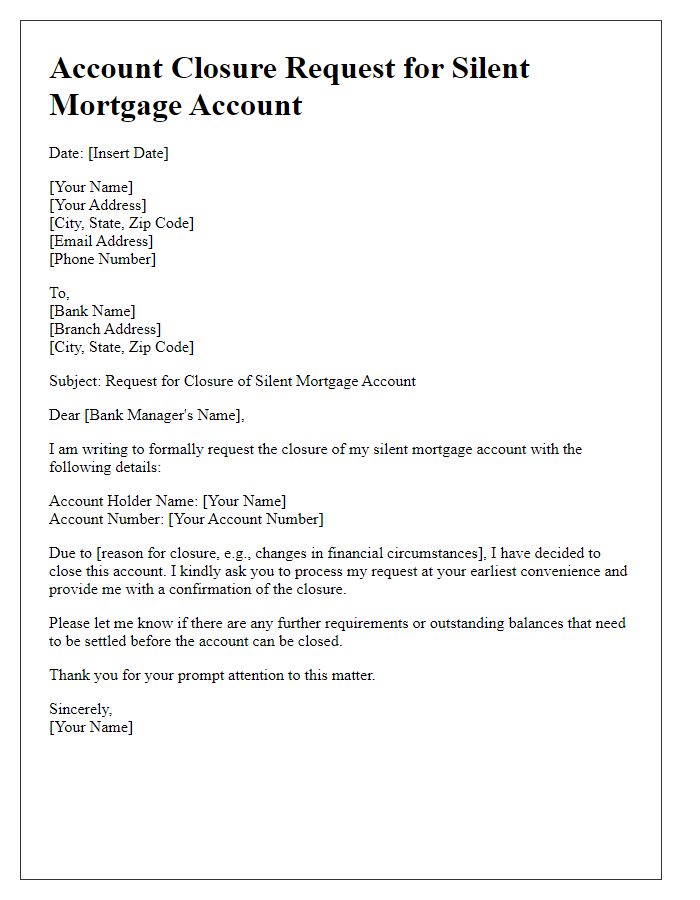

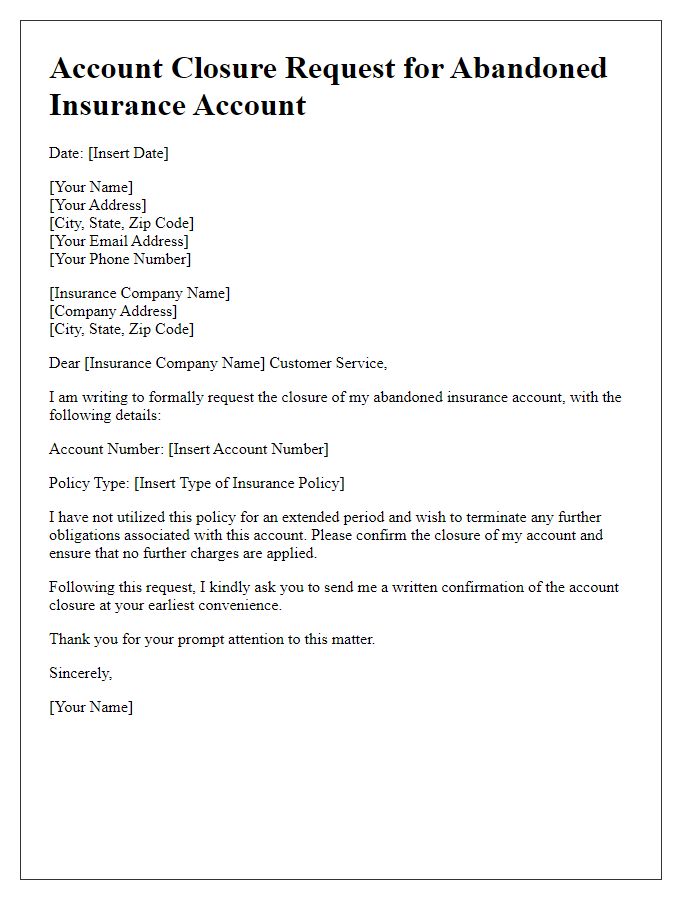

Reason for Closure

Closing inactive accounts prevents security risks and maintains accurate records. Accounts inactive for over 12 months, especially financial or service accounts, can expose users to identity theft or unauthorized access. Reducing the number of dormant accounts (especially those with personal information) minimizes potential data breaches and simplifies account management processes. Specific platforms, like social media or banking, often have policies for automatic closure after periods of inactivity, ensuring compliance with regulations. Users are typically notified via email regarding such closures, allowing for the possibility of reactivation before final termination.

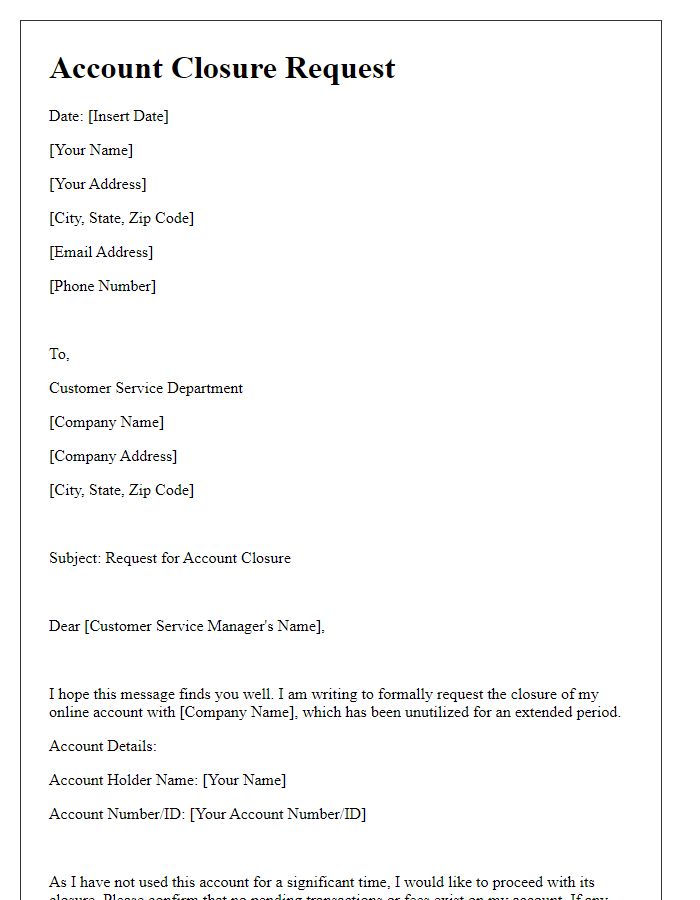

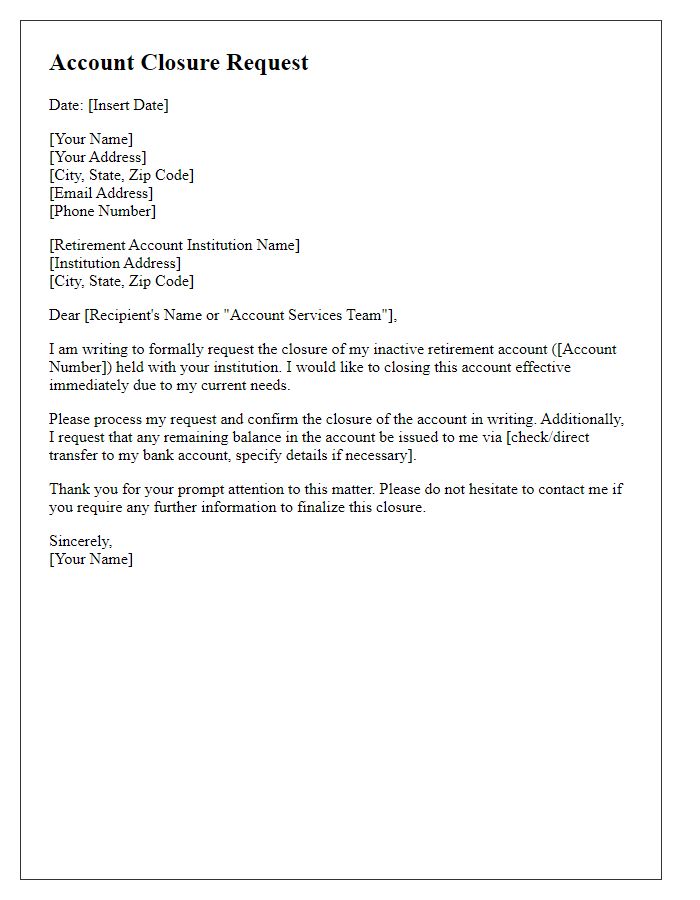

Final Statement and Balance

Closing inactive accounts involves careful consideration of remaining balances and any unresolved transactions. A final statement provides a comprehensive overview of the account's history, showcasing transactions over the last 12 months, and highlighting any pending fees or charges accrued. Additionally, if the balance is positive, the final statement indicates the amount to be refunded, detailing the method of reimbursement, such as check or direct deposit. It addresses any outstanding charges that may affect the final balance, including service fees typically assessed after six months of inactivity. All these factors contribute to a smooth closure process for the account holder, ensuring clarity and transparency in the final transactions associated with their financial records.

Reinstatement Process or Contact Information

Inactive accounts, defined as accounts lacking any user activity for a period exceeding 12 months, may face closure procedures by various institutions such as banks or online services. The reinstatement process typically requires users to verify their identity through security questions or a confirmation email sent to the registered address. Contact information, including customer support phone numbers or email addresses, is crucial for users seeking assistance or clarification regarding the closure process. Institutions often emphasize the importance of updating personal details to prevent unauthorized account closures and ensure the security of sensitive information.

Comments