Are you looking for a simple way to provide manual payment instructions? Crafting a clear and concise letter can make all the difference in ensuring a smooth transaction process. In this article, we'll share a handy letter template that outlines essential details while maintaining a friendly, approachable tone. So, let's dive in and explore how to make your payment instructions crystal clear!

Clear Payment Details

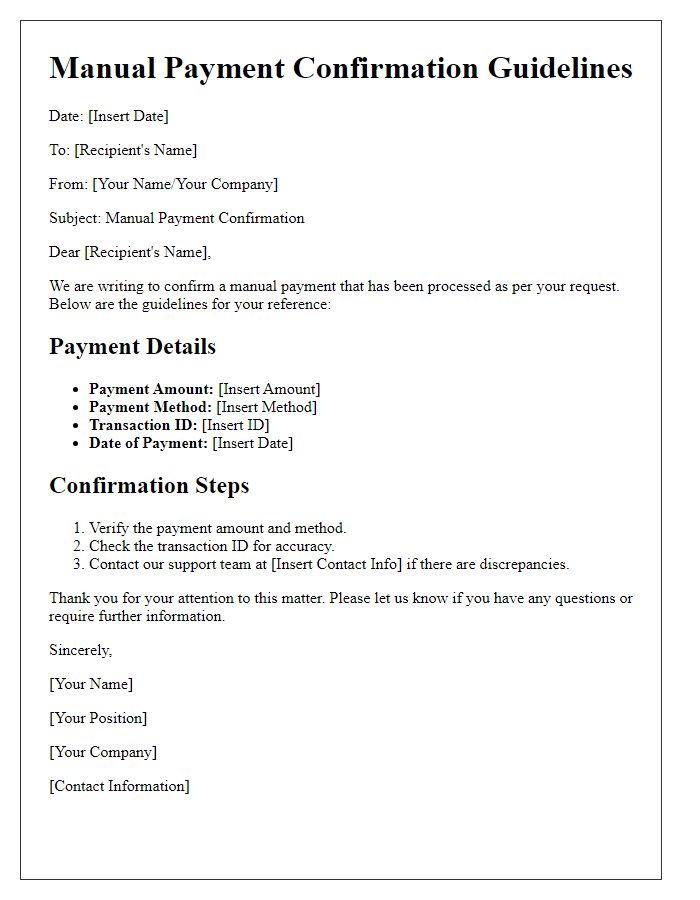

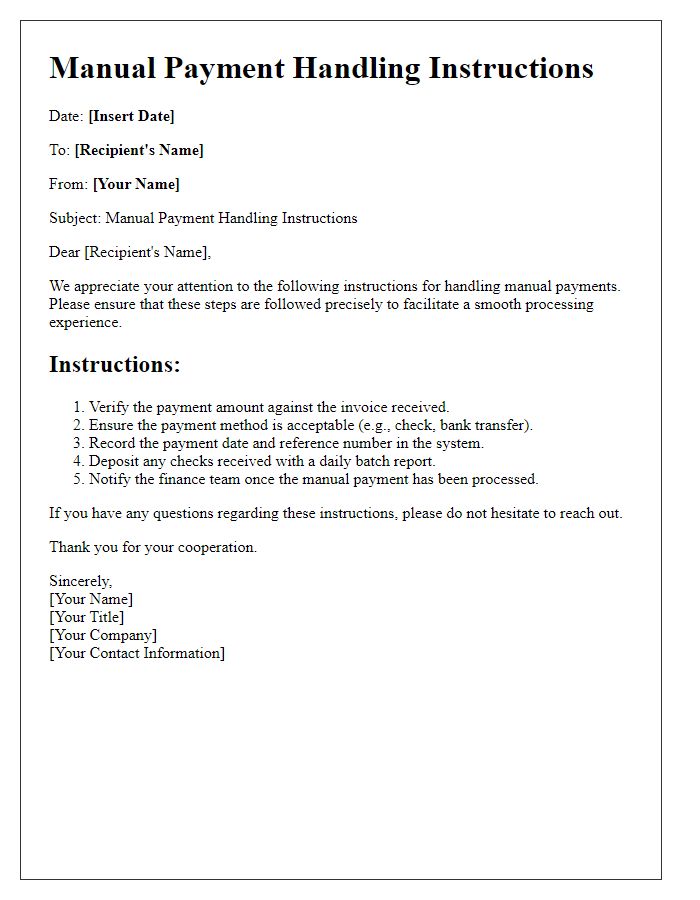

Clear payment details are essential for ensuring successful financial transactions. Specific payment methods, including credit card numbers, PayPal email addresses, or bank account information, must be accurately indicated. Payment due dates should be highlighted, providing clarity on the timeline for payments. Additionally, any invoice numbers or reference codes related to the transaction must be mentioned for easy tracking. Clear instructions on how to initiate the payment process should offer step-by-step guidance, including necessary verification steps. Providing customer support contact information can assist users in addressing any potential issues during the payment process. These detailed components enhance transparency and improve user experience in managing financial obligations.

Billing Information

Billing information is crucial for seamless financial transactions, including invoices, bank transfers, or credit card charges. Accurate details such as the billing address, which includes the street name, city, state, and zip code, ensure the correct processing of payments. Payment methods can vary, with options like ACH transfers (Automated Clearing House), wire transfers, or credit card payments, each having specific requirements. Invoice numbers, often unique to each transaction, facilitate tracking and record-keeping for both the buyer and seller. Ensuring that all of this information is precise avoids delays and potential errors in payment processes, enhancing overall efficiency in business operations.

Due Date

Prompt payment instructions are crucial for maintaining smooth financial operations. Due dates often range from 30 to 90 days (depending on the agreement) and should be clearly specified. For example, invoices dated March 1st with a 30-day term are due for payment by March 31st. To facilitate manual payments, outlined steps include verifying bill details, choosing payment methods (e.g., bank transfer, check, or PayPal), and ensuring confirmation of receipt. It is important to highlight penalties like late fees (usually 1.5% per month) for payments not received by the due date. Providing contact information for billing inquiries promotes transparency and encourages timely settlement of accounts.

Payment Methods Accepted

Manual payment instructions can vary widely depending on the specific context and requirements of businesses. Payment methods accepted often include bank transfers, credit card payments, and online payment services. Bank transfers typically require account numbers and routing information, while credit card payments may need authorization codes. Online services such as PayPal or Stripe request email addresses linked to respective accounts, allowing secure transactions. Different regions may offer specific payment options catering to local preferences, such as mobile payment apps or direct debit arrangements. Clear instructions can enhance the payment experience and reduce processing errors.

Contact Information for Queries

For manual payment instructions related to specified transactions, ensure to provide complete contact information. Include the primary phone number (e.g., +1 (123) 456-7890) for immediate assistance during business hours (9 AM to 5 PM EST). Specify the email address (e.g., support@company.com) for detailed inquiries or follow-up questions regarding payment processes. Mention the physical address (e.g., 123 Business Lane, Cityville, ST 12345) for mailed correspondence, along with the hours of operation. This comprehensive contact framework ensures clients can easily reach out for additional support or clarification on payment procedures.

Comments