Are you feeling overwhelmed by unexpected fees due to late payments? You're not alone! Many people find themselves in similar situations, and there's a way to navigate it gracefully. If you're curious about how to request a late payment fee waiver, keep reading for helpful tips and a sample letter to help you craft your own request effectively.

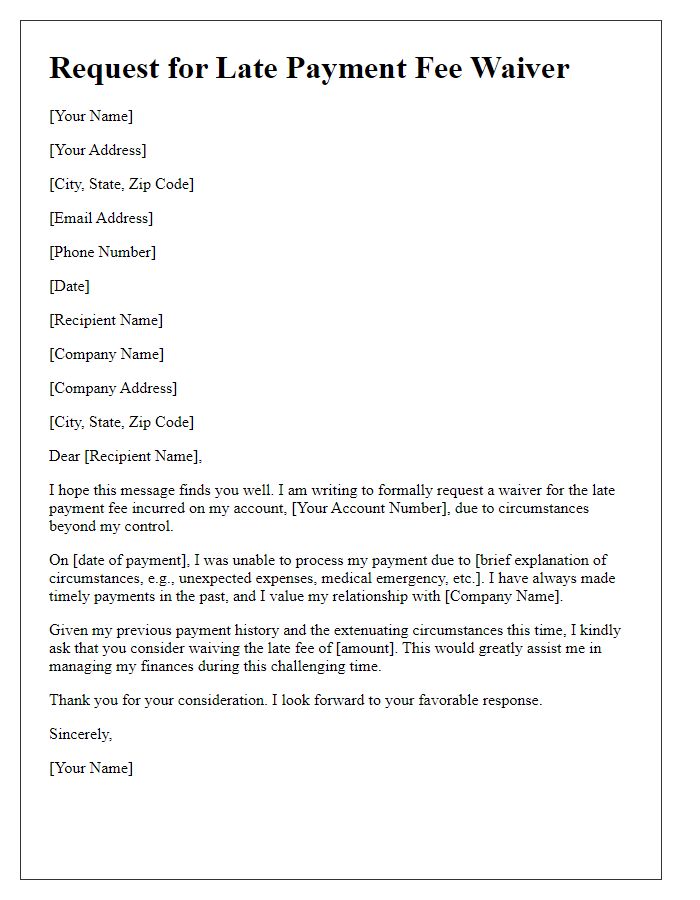

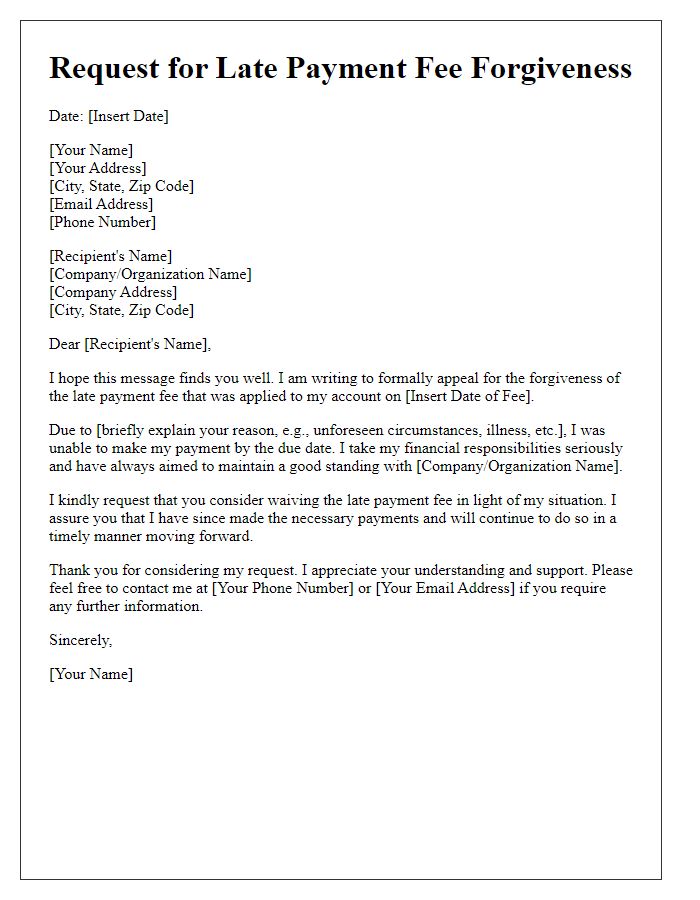

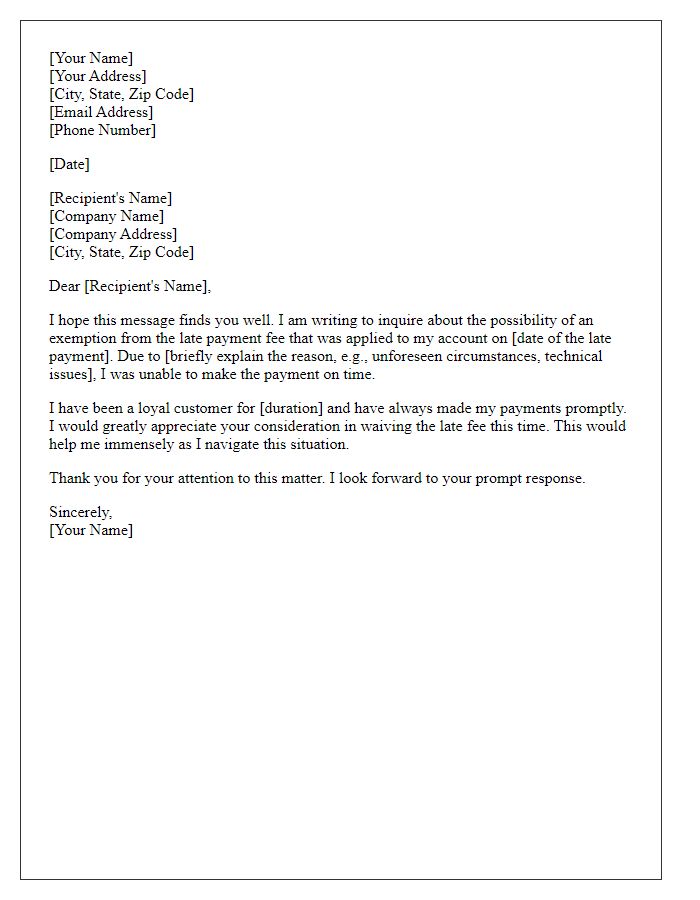

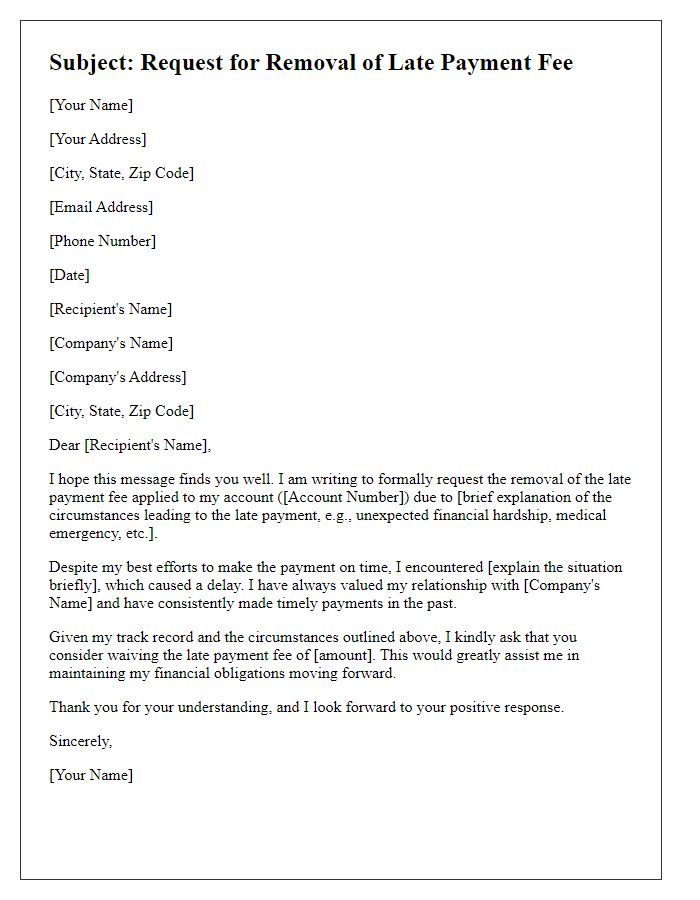

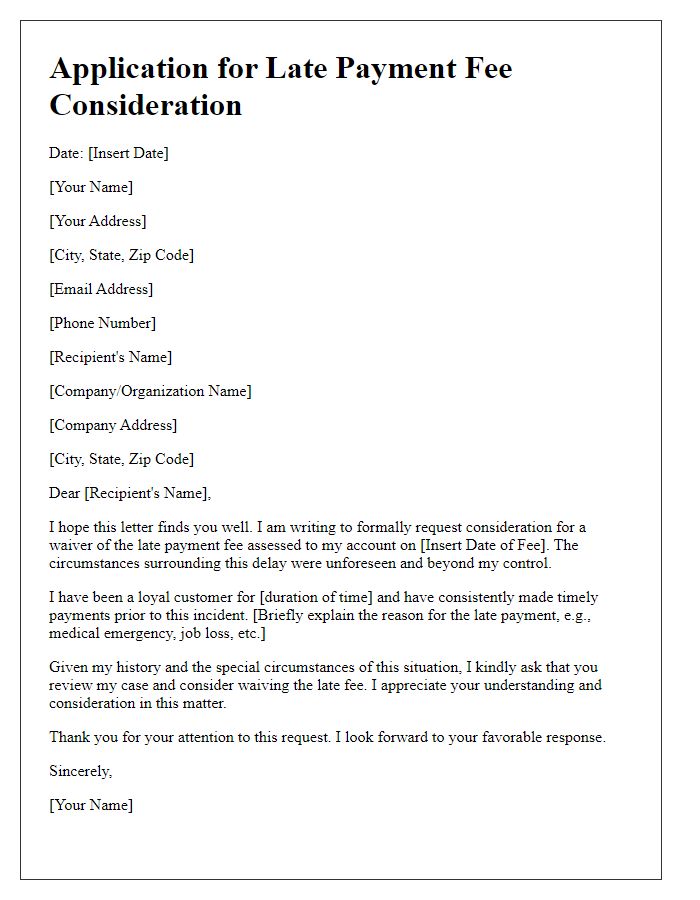

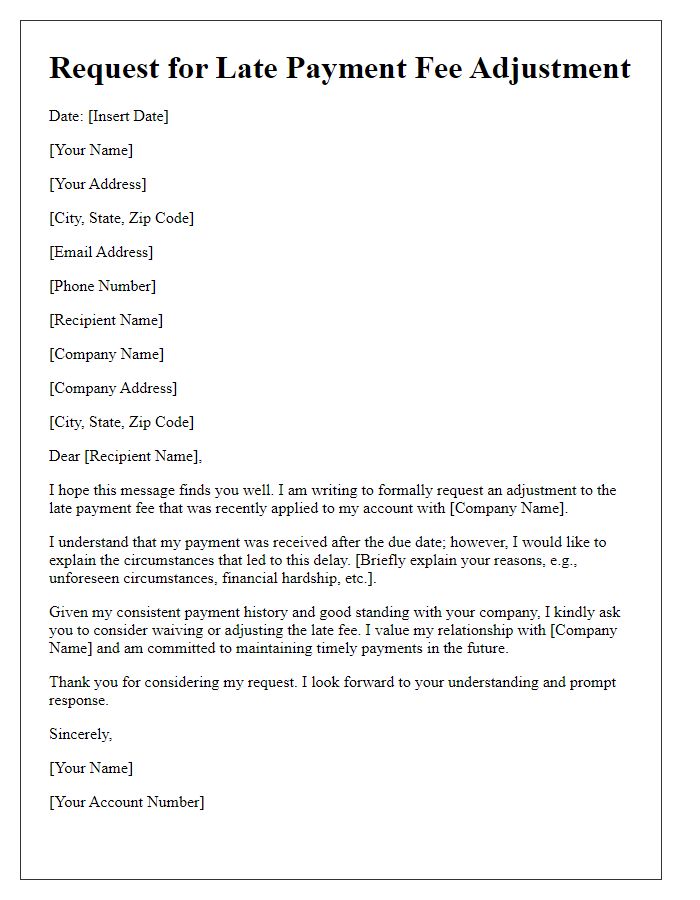

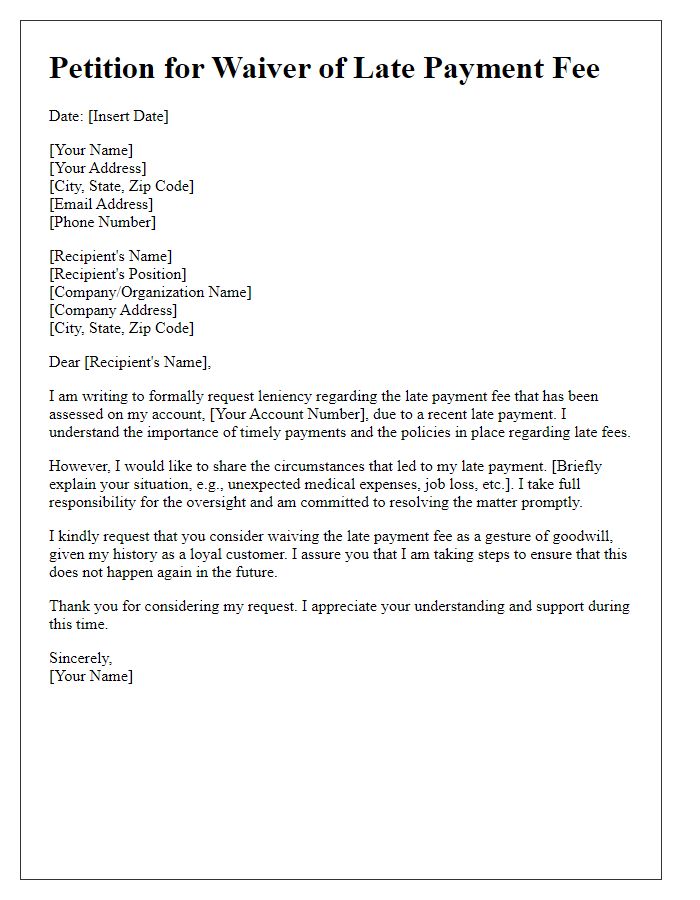

Polite opening and acknowledgment of relationship

Understanding the financial strains individuals may face during unexpected events, businesses often grant compassion to loyal customers in times of need. A strong rapport built over years can facilitate discussions regarding policies, previous payments, and account history, potentially leading to favorable considerations. Clients should carefully craft requests, highlighting timely payments and previous interactions, to form a solid foundation for waiving late fees. Encouraging an open dialogue regarding unique circumstances might enhance the relationship and foster goodwill between both parties, ensuring continued customer satisfaction.

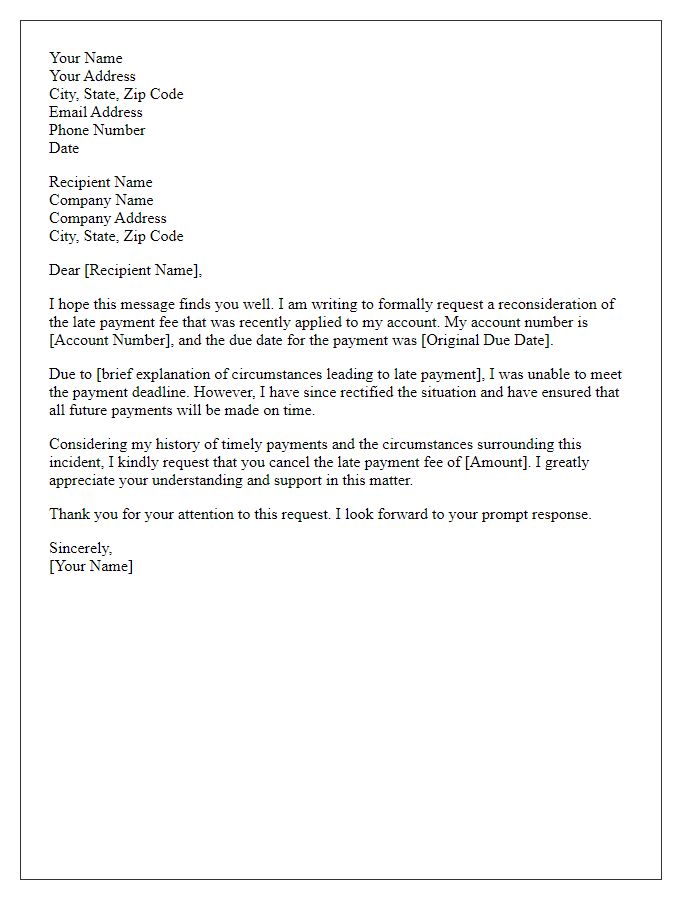

Explanation of delayed payment circumstances

Delays in payment often stem from unforeseen circumstances, such as medical emergencies or job loss impacting financial stability. For example, a sudden hospital visit could lead to substantial medical bills, diverting funds originally allocated for bills. Similarly, losing a job, as reported by the U.S. Bureau of Labor Statistics (with an unemployment rate fluctuating around 5% in 2023), can create unexpected cash flow issues. Such situations can disrupt regular financial obligations, resulting in late payments. Documenting these events can provide context for seeking leniency in late fees, emphasizing the intent to maintain timely payments moving forward.

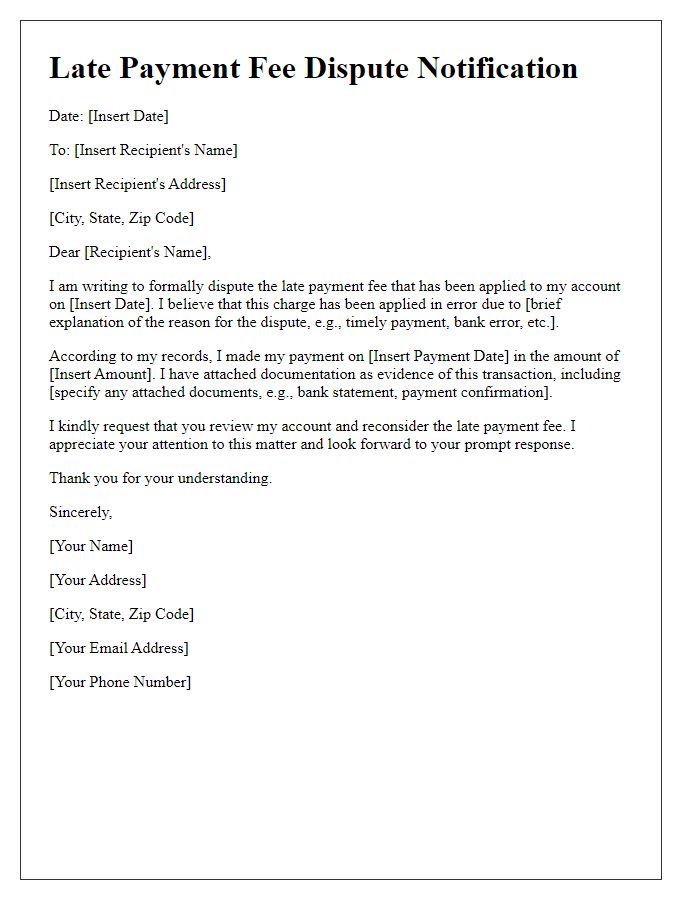

Request for waiver of late payment fees

Submitting a request for a late payment fee waiver demonstrates financial responsibility and open communication with creditors. Timely payments typically prevent additional fees; however, unexpected circumstances like medical emergencies or job loss may hinder this. The financial institution, such as a credit card company or utility provider, often considers a customer's payment history and relationship when evaluating waiver requests. Clear documentation outlining the reasons for the late payment, along with any supporting documents, enhances the chances of approval for waiving fees, usually assessed in the range of $25 to $50, varying by organization and account type.

Assurance of prompt future payments

A late payment fee waiver request emphasizes understanding of financial obligations while providing reassurance of commitment toward timely payments in the future. Such requests should highlight instances of previous on-time payments, maintaining positive relationships with service providers or creditors. Detailing personal or business circumstances that contributed to the late payment could further enhance credibility. Including specific dates and amounts related to obligations under discussion strengthens the case for consideration. Demonstrating awareness of the fee structure and expressing genuine intent to avoid future lapses can foster goodwill and potential leniency in fee assessments.

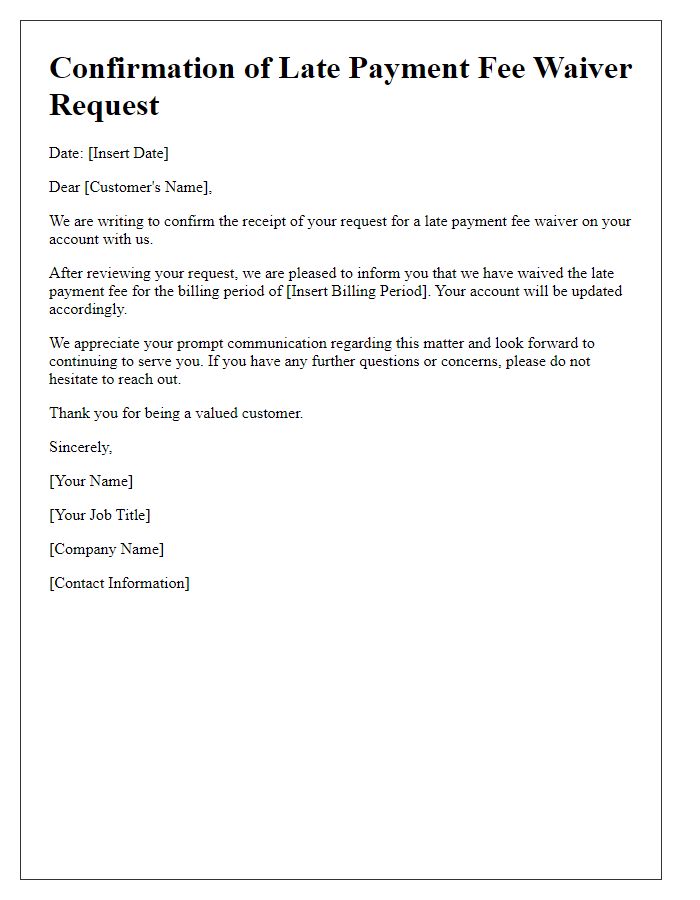

Contact information for follow-up communication

A late payment fee waiver request may involve specific contact information for effective follow-up communication. Including details such as an email address, phone number, and preferred contact method ensures clear correspondence. The relevant customer account number should also be provided to facilitate quick identification. It is crucial to note the specific billing period in question, along with any associated invoice numbers, to provide context and streamline the resolution process. Clarity in communication can foster a more favorable response regarding the waiver request from the concerned financial entity.

Comments