Hey there! If you've ever needed to update your account details, you know how important it is to get that information right. From changing your address to updating your contact number, each detail plays a vital role in keeping your account secure and accessible. In this article, we'll guide you through a simple template for drafting a letter that ensures your amendments are processed smoothly. So, let's dive in and explore how to make your account adjustments hassle-free!

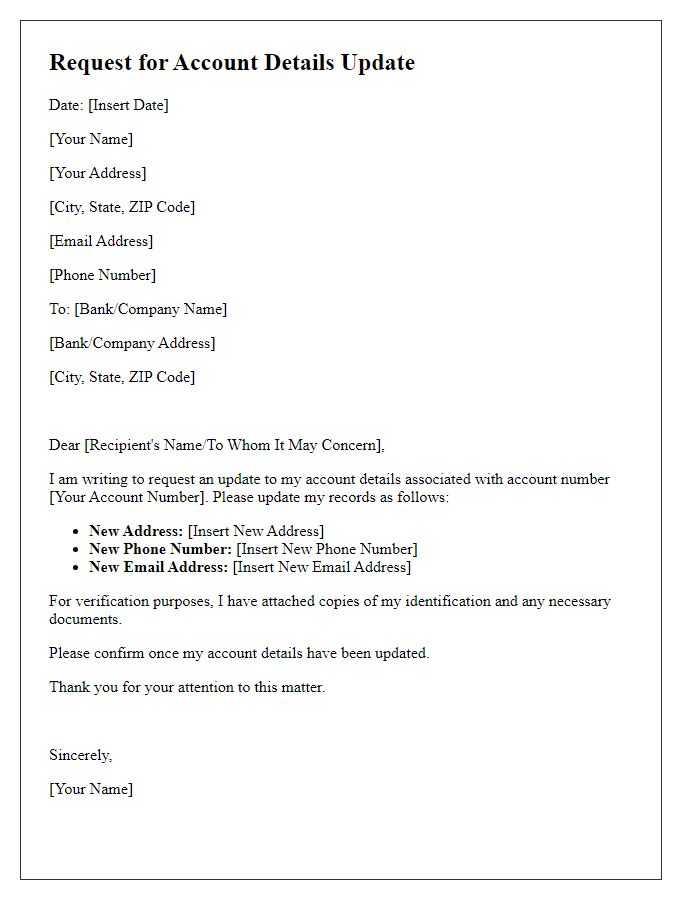

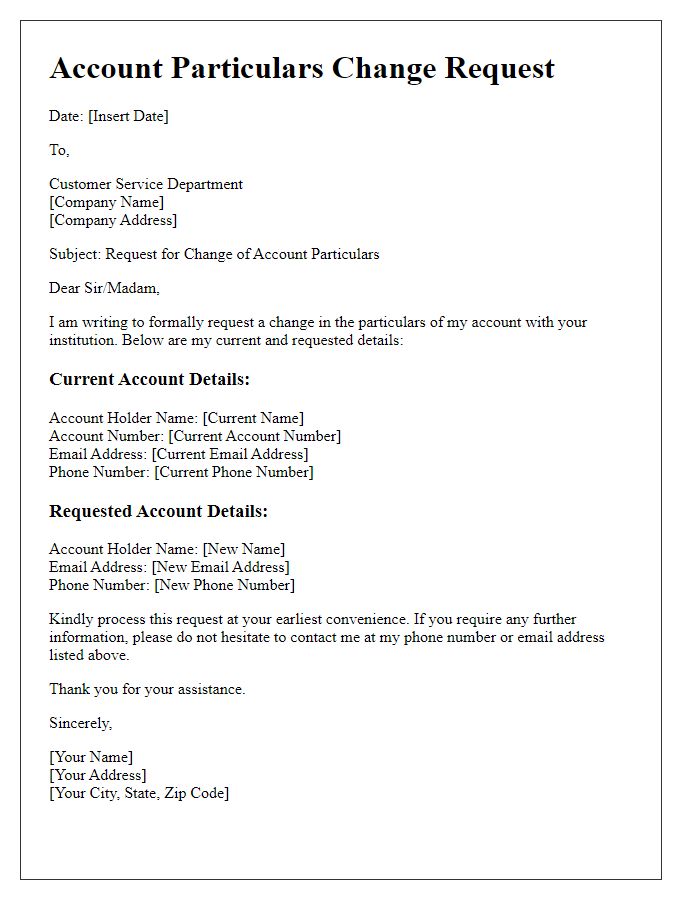

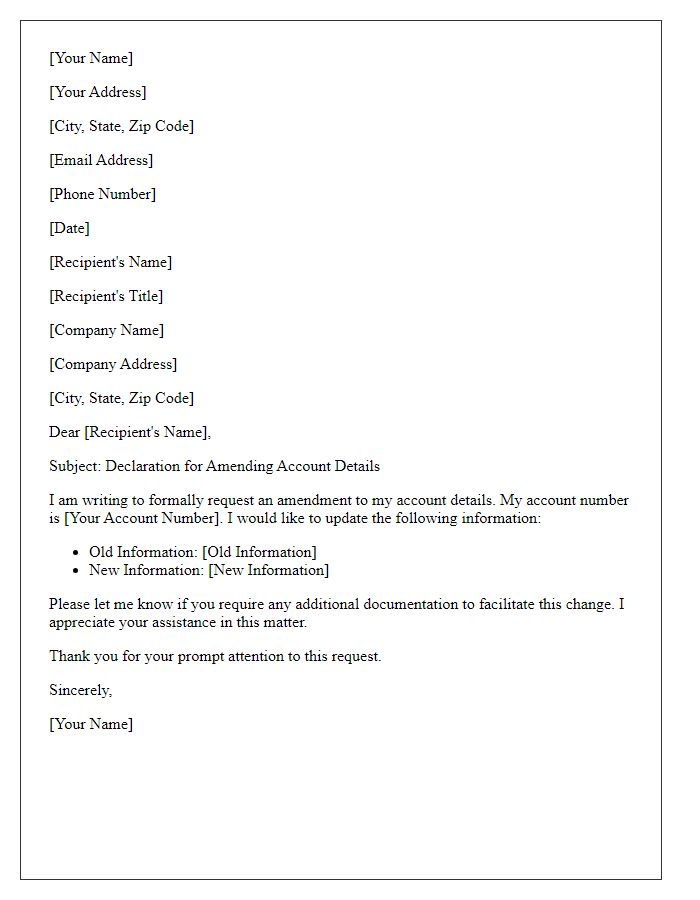

Account Holder's Full Name and Contact Information

Account holder's details, including the full name and contact information, play a crucial role in maintaining secure banking transactions. For example, a complete name (including middle initials) ensures accurate identification during transactions and correspondence. Updated contact information, such as mobile numbers (preferably a primary number reachable 24/7) and email addresses (which should be kept current to prevent disruptions in service), ensures effective communication from the bank regarding account activity. Additionally, including physical addresses (verified to match government-issued IDs) is essential for notifications of any suspicious activity or changes in account status, fostering enhanced security measures for account holder protection.

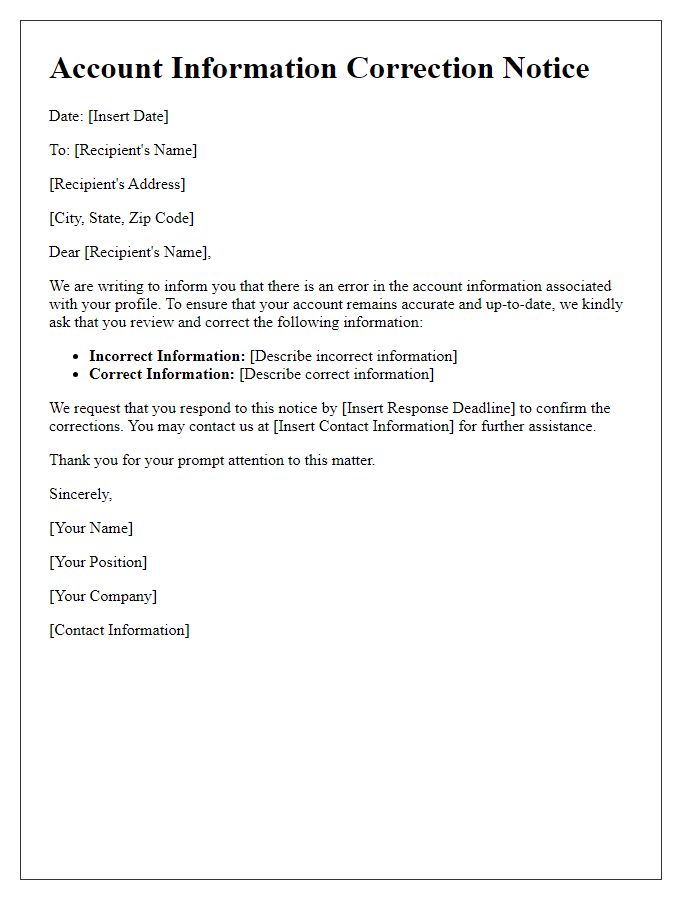

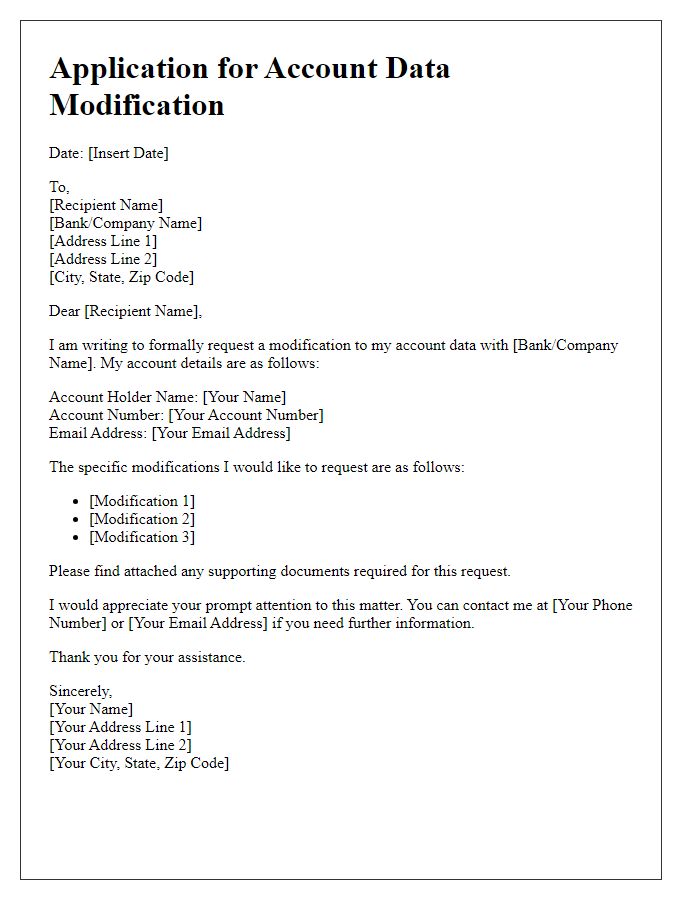

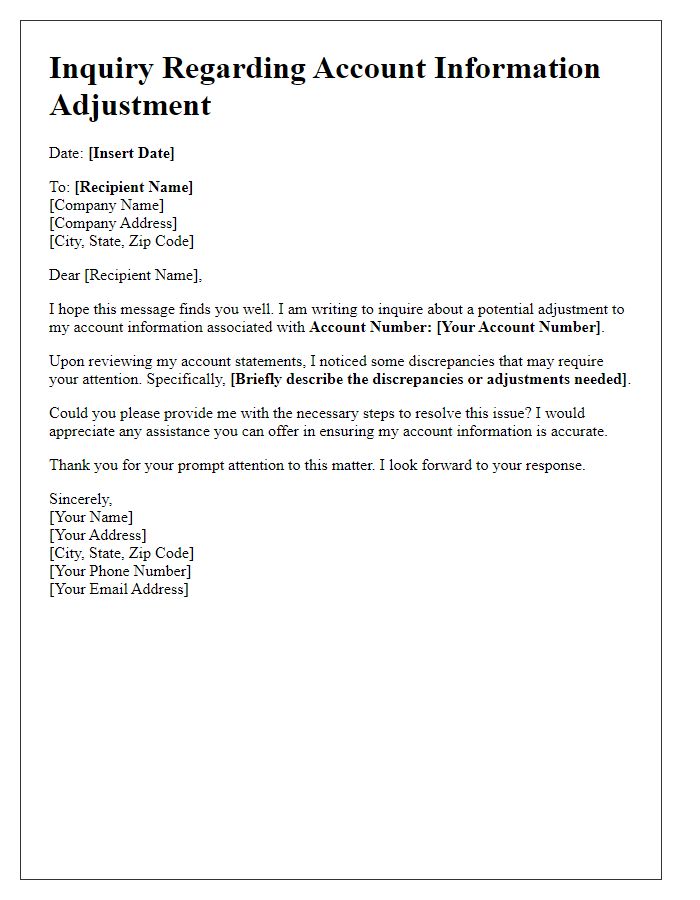

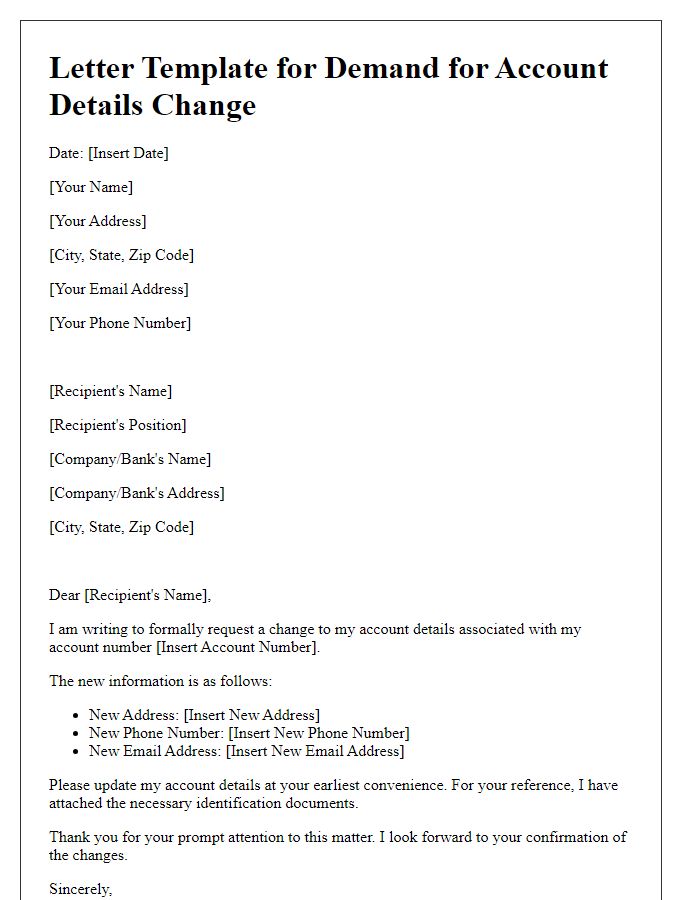

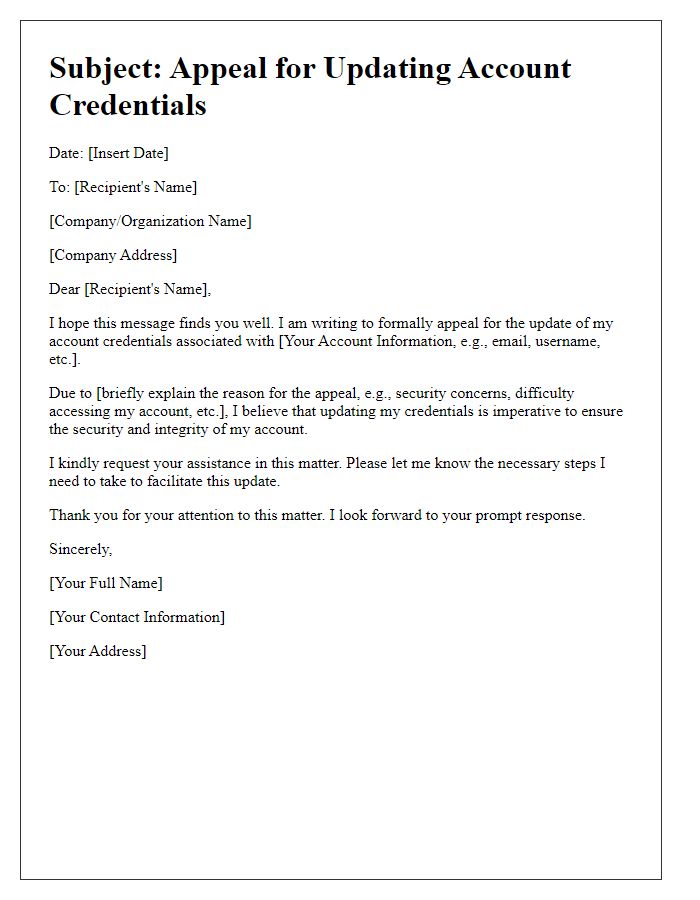

Detailed Description of Amendment Request

An amendment request for account details often involves changes to personal information such as name, address, contact number, or account type. For instance, updating the registered address to 123 Elm Street, Springfield, IL 62704 due to relocation can be crucial for maintaining correct billing and communication. Modifying a contact number from (555) 123-4567 to (555) 987-6543 ensures timely notifications regarding account activity. Additionally, requesting a change in account type from Standard to Premium may enhance service benefits, allowing access to exclusive features available to high-tier users. Each modification request should be clearly stated along with the reason to facilitate accurate processing and confirmation.

Current Account Details

To amend current account details, it is essential to provide accurate information regarding the account holder's identity. Current accounts, commonly held at financial institutions such as banks or credit unions, involve personal information like account numbers, which uniquely identify individual accounts. Address details, including street address and postal code, must also align with official records to avoid discrepancies. Additional identification may include government-issued ID and Social Security Number (SSN) for verification purposes. Banks typically require a signed request submitted via mail or secure online portal to process amendments efficiently. Follow-up communications may occur within a set timeframe, often 3 to 5 business days, depending on the institution's policies.

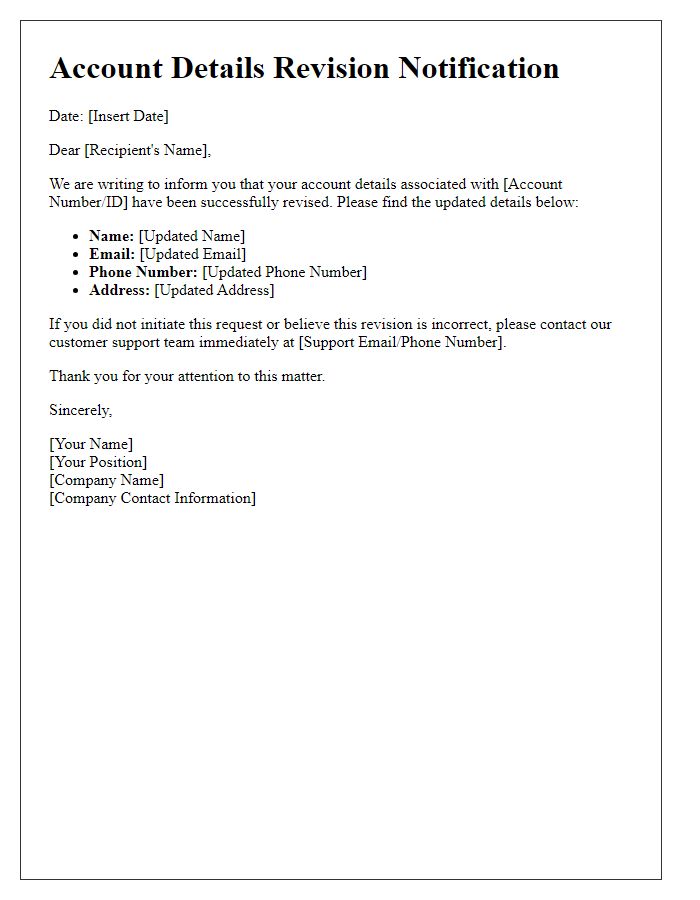

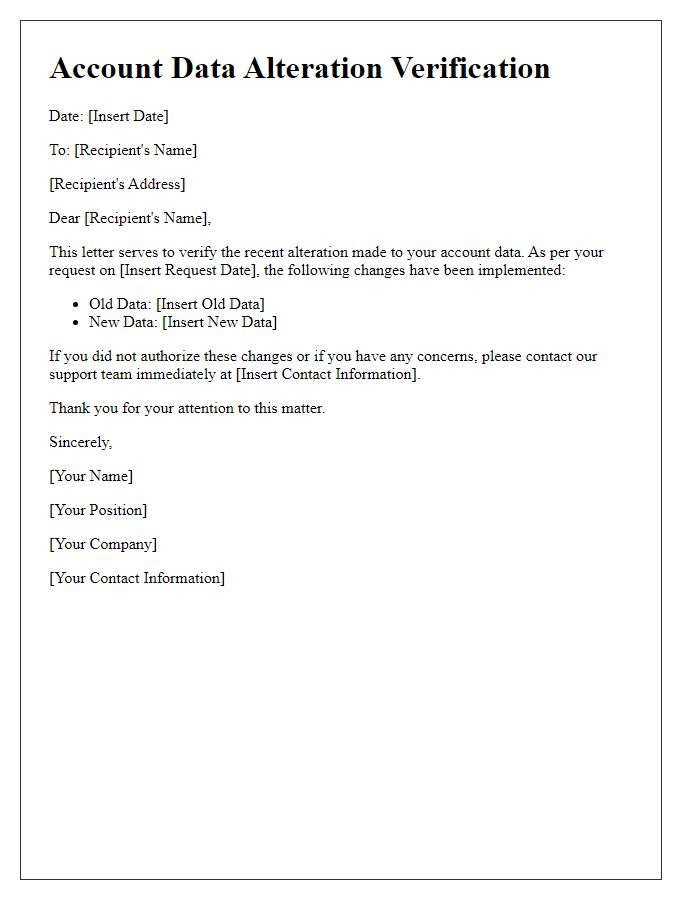

New Account Details

Changing account details requires careful communication. Clear acknowledgment of the previous information and the submission of new data ensures accuracy. Include full name, account number, and updated banking details such as bank name, routing number, and account type. Always secure the request with the date and a formal signature for verification. Such amendments can facilitate seamless transactions, especially for businesses managing payroll, invoices, or automatic payments. Always validate the authenticity of the request to prevent errors or fraudulent activity.

Authorization and Signature of Account Holder

An account holder's signature serves as a critical component in authorizing amendments, ensuring compliance with financial regulations outlined by institutions like banks or credit unions. This signature must align with the one originally provided during account creation. The process typically involves submitting forms with personal identification details, such as a driver's license or passport, and account-specific information, including the account number and the requested changes, ensuring accurate processing. Authorization is essential to prevent unauthorized access or modifications, with a validation period often outlined by the financial institution, frequently lasting several business days.

Comments