Are you feeling frustrated with an unexpected charge on your account? You're not alone, and it's completely understandable to want clarity on the matter. In this article, we'll explore how to effectively draft a complaint letter to address any overcharges and ensure your voice is heard. So, let's dive in and discover how to resolve your billing issue together!

Clear and concise subject line

Overcharged Account Complaint: Request for Resolution and Refund

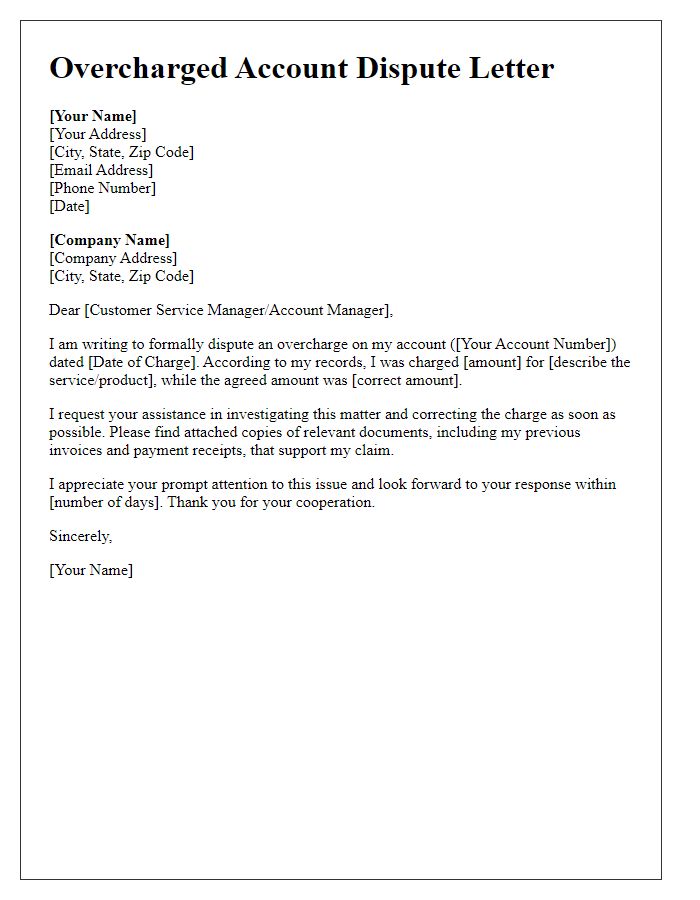

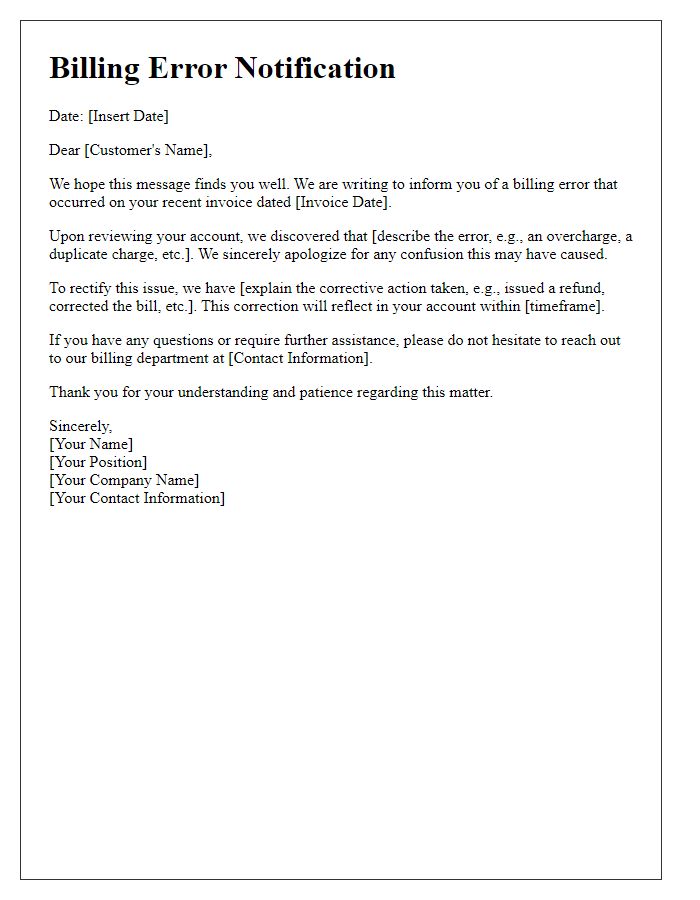

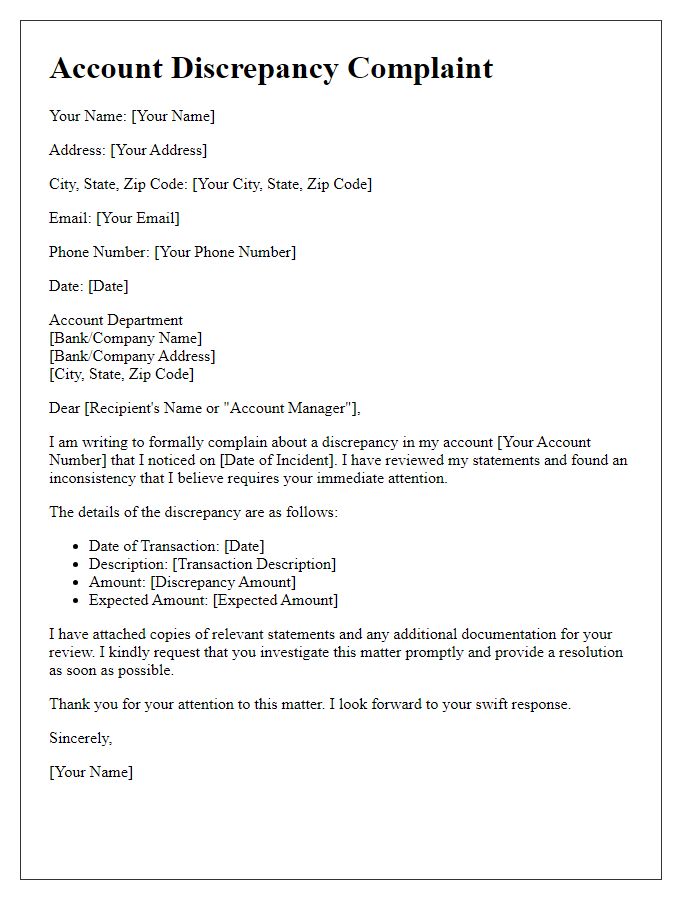

Account details and personal identification

An overcharged account discrepancy can lead to significant financial strain for individuals. High account overages often stem from billing errors or misunderstandings regarding service usage. Personal identification details, such as a driver's license number or Social Security number, can help verify account ownership and facilitate the investigation process. Account numbers serve as a unique identifier for the specific client account in question, enabling customer service representatives to promptly retrieve relevant information. Providing documentation, such as recent invoices or statements, enhances clarity and supports the claim while addressing billing inaccuracies. Prompt resolution is crucial for maintaining customer trust and satisfaction in financial services.

Description of the overcharge issue

The recent billing statement from XYZ Utility Company indicates an overcharge of $125 on my account (Account Number: 123456789). This discrepancy occurred in September 2023, which is unusual compared to my previous monthly charges averaging around $75. The billing history shows a consistent usage pattern with no significant changes in consumption. Upon reviewing this month's detailed charges, I noticed additional fees labeled as "service adjustment" and "estimated usage," which were not present in prior statements. The sudden increase and lack of clear explanation have raised concerns about the accuracy of meter readings at the service address: 123 Main St, Hometown, USA. I request a thorough review and correction of this billing error to ensure fair and accurate charges moving forward.

Request for specific corrective action

Overcharged accounts can lead to significant financial distress for individuals, particularly when the discrepancy amounts to substantial figures like $150 or more. A review of recent billing statements reveals errors that require immediate attention. Each billing cycle should reflect accurate charges based on agreed-upon rates. Customers may notice repeated erroneous charges for services not rendered, which can further exacerbate trust issues with the service provider like XYZ Utility Company. Such overcharges not only impact personal budgets but can also trigger fees from financial institutions due to insufficient funds or unexpected withdrawals. Prompt corrective action is essential, including a thorough investigation of billing practices and a timely refund process, to restore customer confidence and uphold transparency.

Contact information for follow-up

An overcharged account can lead to significant financial stress and customer frustration. Review statements from financial institutions like banks or credit card companies for discrepancies exceeding 10% of expected charges. In industries such as telecommunications or utilities, ensure the billing period aligns with provided services. Contact information, including customer service numbers and email addresses, is essential for effective resolution, often found in service agreements or company websites. Document each interaction for follow-up purposes, noting dates, representatives' names, and reference numbers related to your complaint, to facilitate a thorough investigation by the company.

Comments