Hey there! If you've ever found yourself staring at a bill that includes an unexpected service charge, you're definitely not alone. Many of us have experienced the frustration of unauthorized fees sneaking their way onto our statements, leaving us questioning the integrity of the service provider. In this article, we'll discuss how to effectively address these charges and assert your rights as a consumer. So stick around, as we dive into tips and templates that will help you craft the perfect complaint letter!

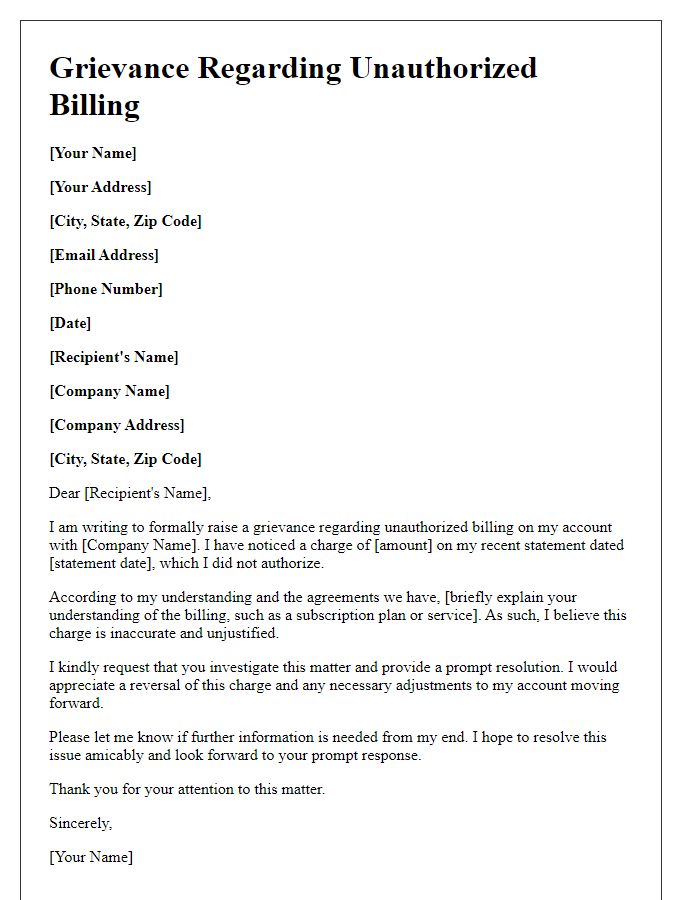

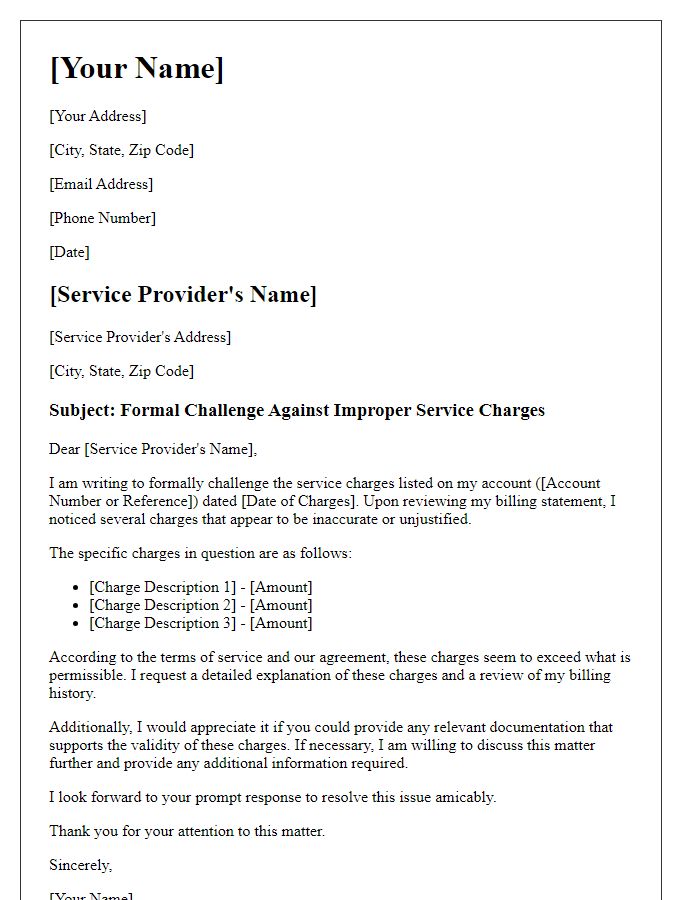

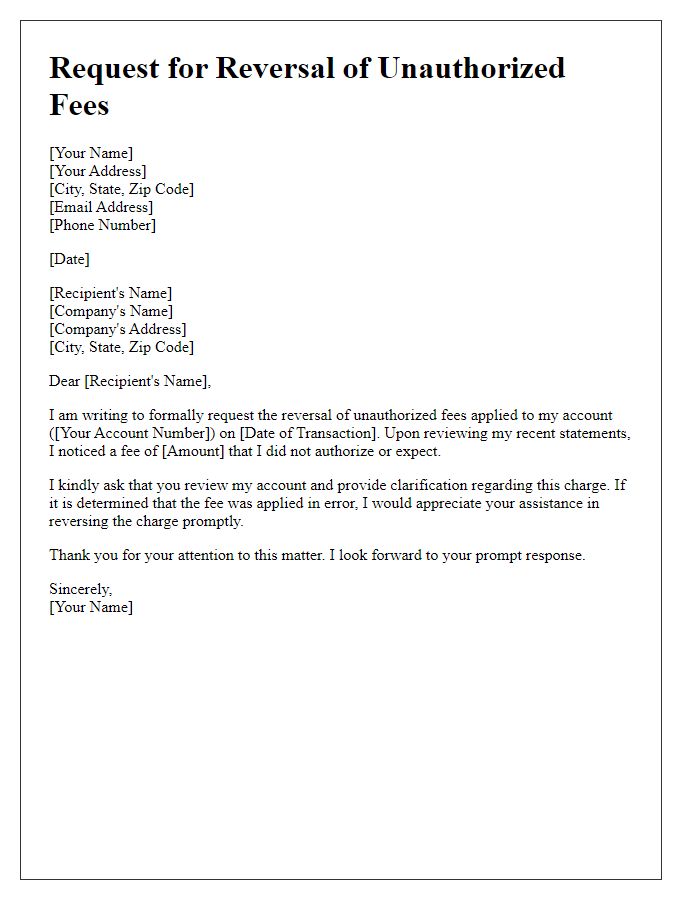

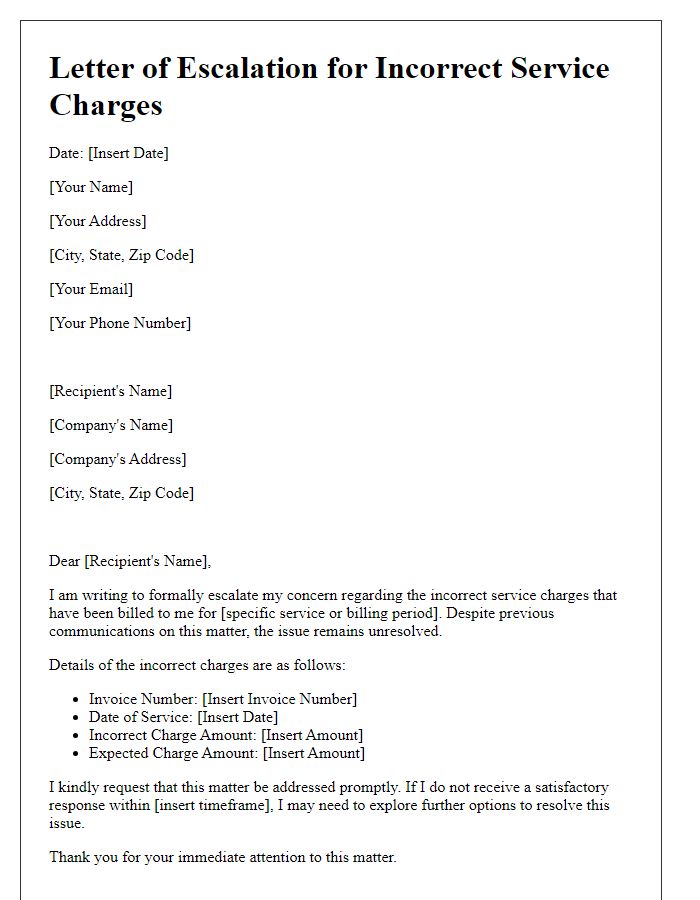

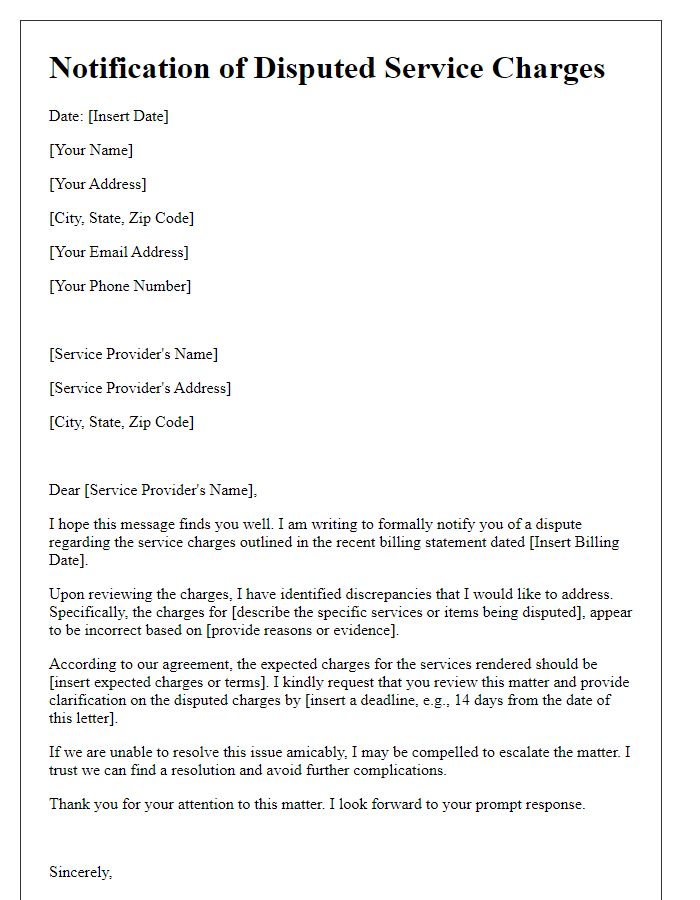

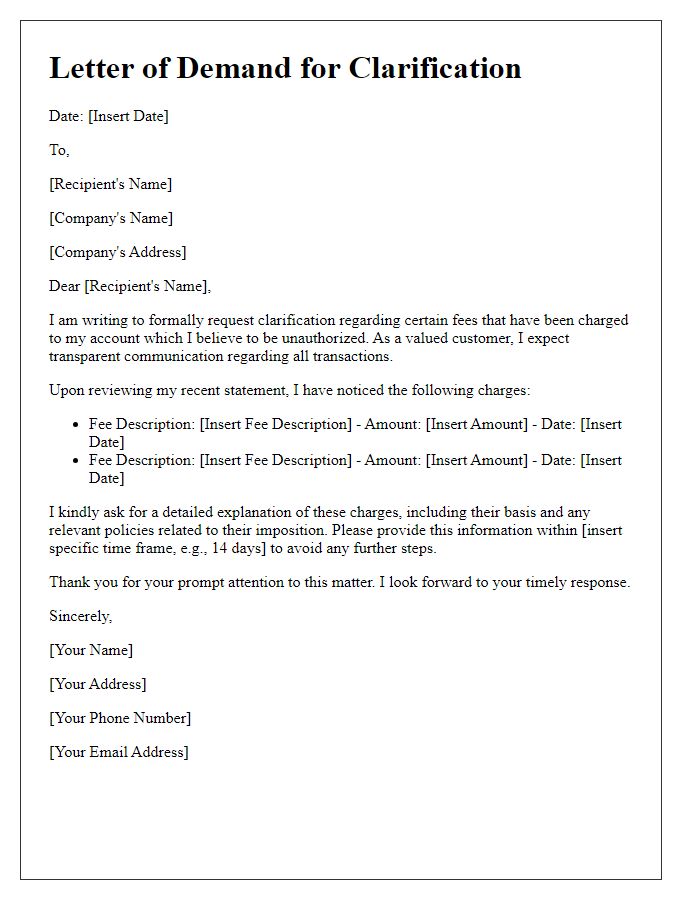

Clear Subject Line

Unauthorized service charges can create financial stress for individuals and businesses alike. Instances of such charges often appear on billing statements, causing confusion and frustration. For example, a subscription service might mistakenly bill you $29.99 monthly when only a one-time payment was intended. The service provider's customer service department, often located overseas, may have long wait times (averaging 20 minutes during peak hours) and may require extensive proof of prior agreements. Additionally, consumers frequently overlook terms and conditions, leading to misinterpretations of agreed-upon services or fees. Financial institutions report a significant rise in complaints regarding unexpected charges, making it imperative to address these discrepancies promptly.

Detailed Description of Charge

Unauthorized service charges can arise unexpectedly, leading to customer frustration and confusion. For instance, a recent charge of $75 for a "premium support package" appeared on a consumer's monthly internet bill from XYZ Internet Services without prior notification. The package, which includes additional technical support and exclusive online resources, was not requested or agreed upon by the consumer. This lack of transparency not only leads to financial discrepancies for customers but also raises questions about the company's billing practices. In accordance with consumer protection laws, it is essential for service providers to maintain clear communication regarding fees to prevent misunderstandings and ensure customer trust.

Account Information

Unauthorized service charges can create significant financial burdens for consumers. for instance, unexpected fees might appear on monthly statements from financial institutions like banks or credit card companies. These charges, sometimes exceeding $100, may stem from service providers processing transactions incorrectly or failing to adhere to agreed contractual obligations. Consumers should retain copies of account statements and invoices, documenting dates and amounts of the disputed charges, to bolster their case during the complaint process. Additionally, contacting customer service representatives promptly can initiate dispute resolution efforts, aiming for reimbursement or charge reversal.

Request for Resolution

Unauthorized service charges can create significant financial strain on customers, especially when charged without prior consent or notification. In many cases, these charges ($50-$200 range) appear on monthly billing statements from service providers, including telecommunications companies and utility providers. Customers often find themselves confused and frustrated upon reviewing their statements, leading to disputes. Resolving these issues typically involves contacting customer service representatives, which may require navigating complex automated systems. Regulatory bodies, such as the Federal Trade Commission (FTC), provide guidelines that protect consumers against unfair billing practices, emphasizing the importance of clear communication and consent for any charges incurred. By formally addressing the unauthorized charge, individuals can seek reimbursement, clarification, and an assurance that such practices will not be repeated.

Contact Information

Unauthorized service charges can lead to customer frustration and financial discrepancies. Consumers often encounter unexpected fees, sometimes exceeding $50, which can be applied to various services such as telecommunications or utilities. These charges may not be clearly outlined in contract agreements, leaving customers confused and dissatisfied. Reports indicate that companies often fail to provide itemized billing, making it difficult to identify specific services linked to fees. Addressing this issue may involve contacting customer service departments or regulatory agencies, like the Federal Trade Commission (FTC), which oversees unfair business practices. Keeping detailed records of all communications can be crucial in resolving disputes related to unauthorized charges.

Comments