Navigating an insurance policy coverage dispute can feel overwhelming, but you don't have to tackle it alone. Understanding your rights and the specifics of your coverage is crucial, and having a clear strategy can help you make your case effectively. Whether you're dealing with a denial of claim or an issue regarding the terms of your policy, knowing how to articulate your position can significantly impact the outcome. Ready to learn more about how to approach this situation with confidence?

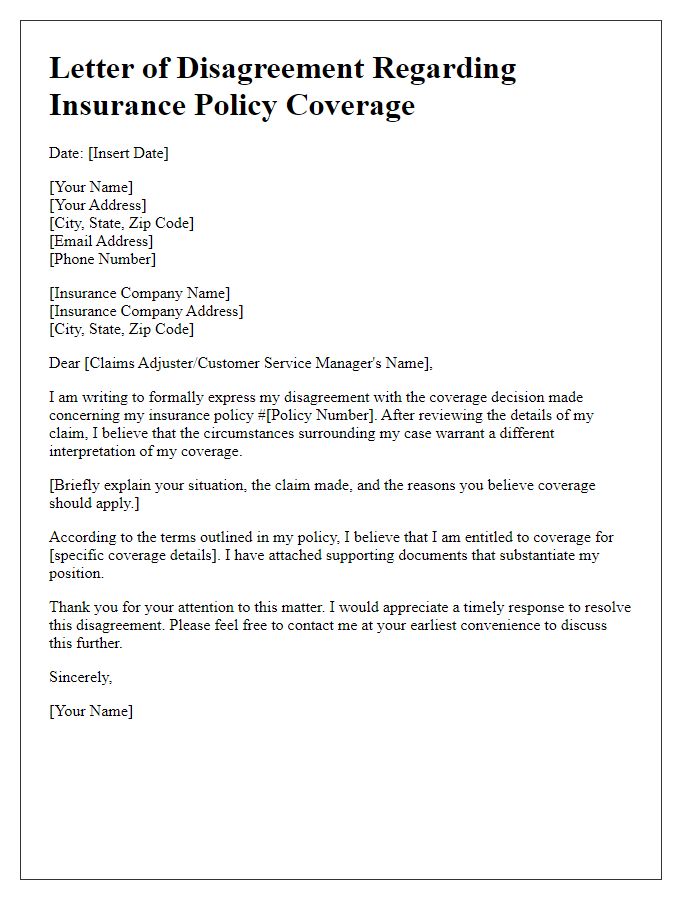

Policy Details and Identification

Insurance policy coverage disputes often arise from misunderstandings regarding the terms of the policy. A primary element in these situations involves the policy details, which include the policy number, effective dates, and coverage limits. Identification of the policyholder (such as name, address, and contact information) is crucial to ensure correct handling of the dispute. Additionally, notes on claims made, dates of incidents, and previously communicated correspondences can provide a comprehensive picture, aiding in resolving disputes efficiently. Key entities such as insurance companies' names and the involved parties' relationships can also affect the dispute outcome significantly.

Specific Coverage Dispute Explanation

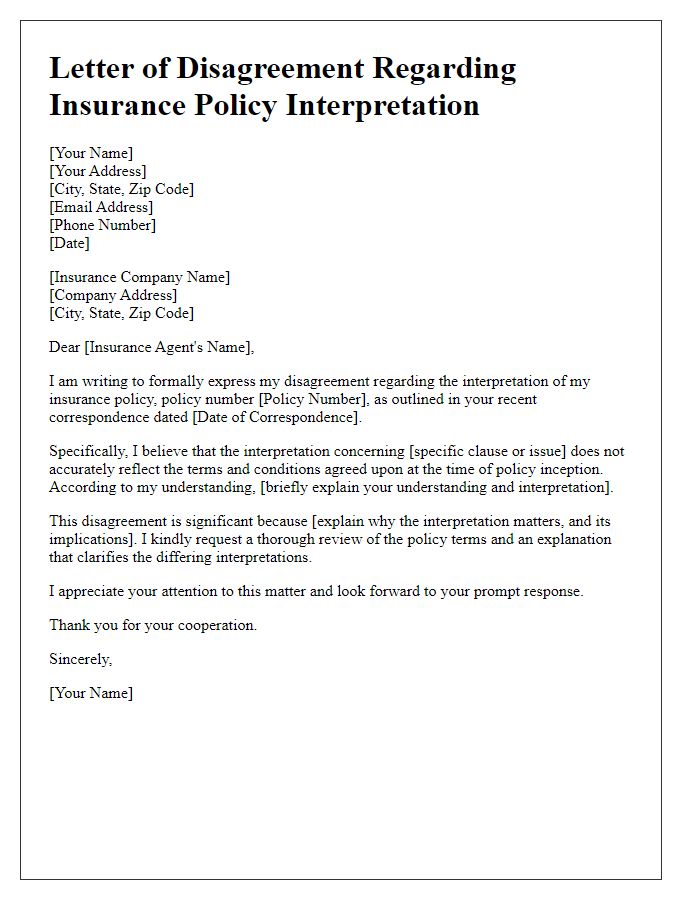

Insurance policy disputes often arise when clients seek clarification on specific coverage aspects. For instance, homeowners might question the extent of protection provided for water damage related to flooding, often influenced by policy language and clauses. In many cases, standard homeowner's insurance policies do not cover flood damage unless a separate flood insurance rider is added, as mandated by the National Flood Insurance Program (NFIP). Clients may find ambiguity in definitions related to "sudden and accidental" incidents versus long-term wear and tear products, prompting disagreements. Properly documenting communications with insurance adjusters can bolster a case, illustrating attempts to resolve misunderstandings about coverage limits, deductibles, and exclusions specific to their incident. When disputes escalate, policyholders may engage legal representation specializing in insurance claims to advocate for fair treatment, leveraging state insurance regulations and precedent cases.

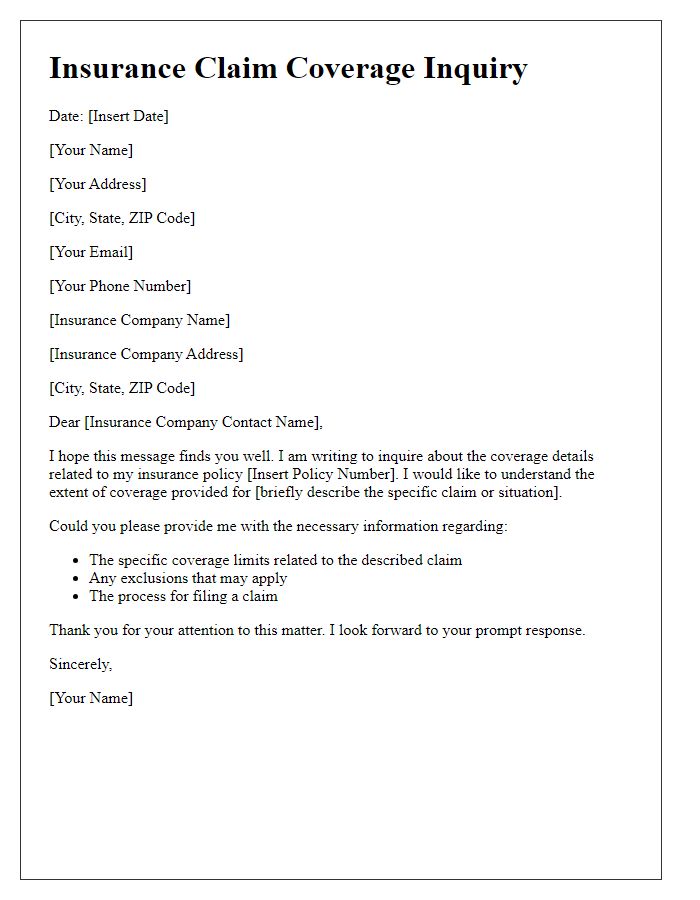

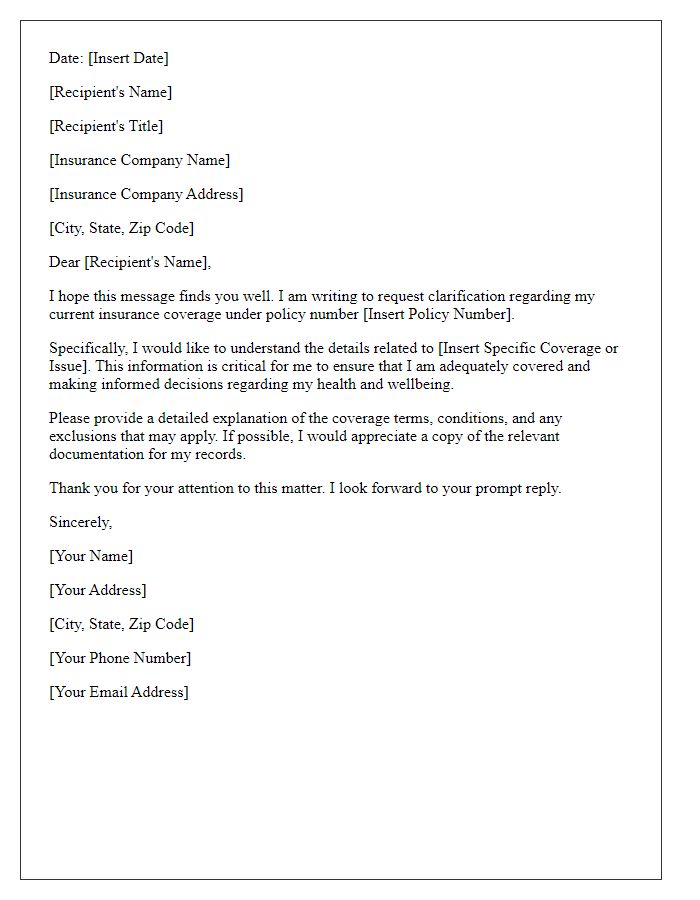

Supporting Evidence and Documentation

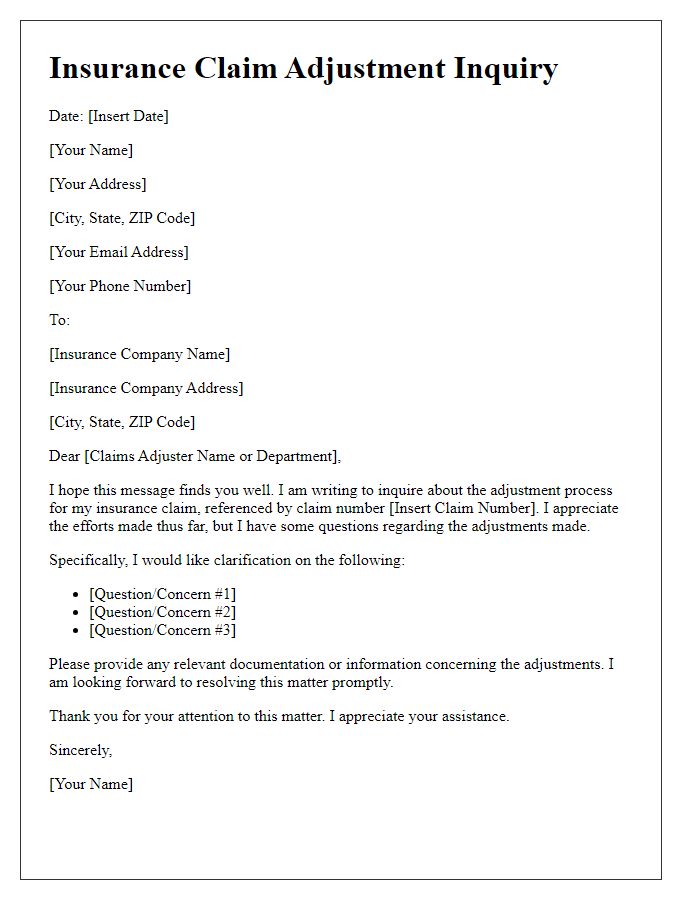

In insurance policy coverage disputes, compiling supporting evidence and documentation is crucial for a successful resolution. Key documents typically include the original insurance policy (detailing coverage terms and conditions), claim submission records (indicating the date of claim and services requested), and communication logs (email correspondence and phone call notes with the insurance company). Photographic evidence (showing damages or incidents) and third-party expert assessments (like repair estimates from licensed contractors) provide tangible proof. Additionally, relevant medical records (for health-related claims) should be collected, along with any previous claim history. Ensuring that all documents are organized chronologically aids in presenting a clear narrative during the dispute process.

Relevant Policy Terms and Conditions

Insurance policy coverage disputes often stem from misunderstandings regarding relevant policy terms and conditions, which outline the specific protections offered within the agreement. Coverage limits typically specify monetary caps on claims, such as $100,000 for property damage or $50,000 for personal liability. Exclusions in policies might include specific events, such as earthquakes in home insurance, affecting claims approval. Important definitions, like "act of God" or "negligence," delineate the responsibilities of both the insurer and insured. Furthermore, the process for filing a claim, including timelines (often within 30 days) and required documentation, is crucial for resolving disputes effectively. Note that reviewing endorsements and amendments is essential, as they may alter original terms significantly. Understanding these elements can lead to clearer communication and resolution during disputes.

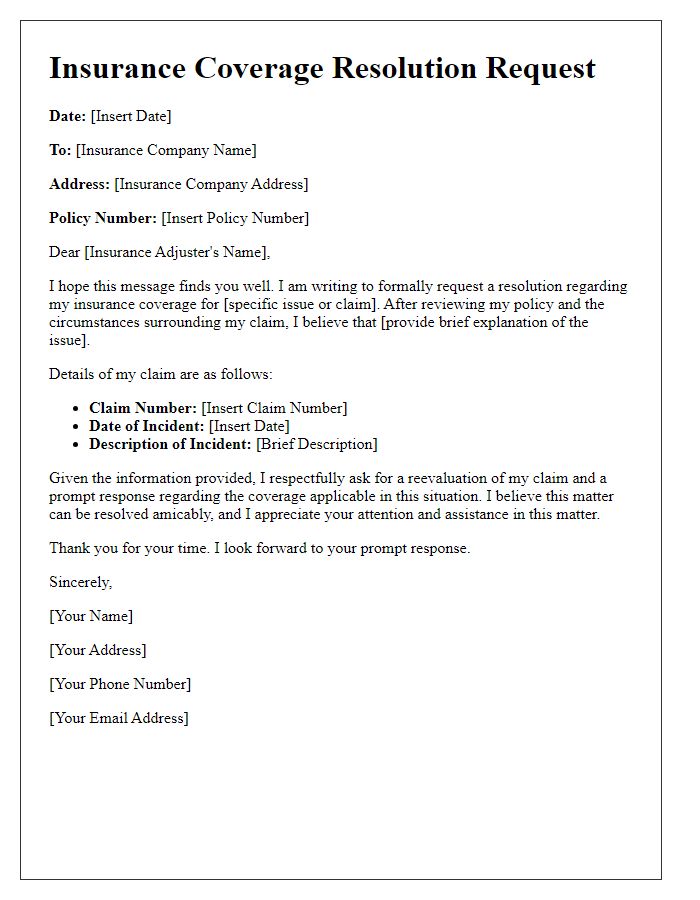

Desired Resolution and Contact Information

In the event of an insurance policy coverage dispute, individuals should clearly outline their desired resolution, which may include a review of the claim amount, reinstatement of coverage, or reimbursement of denied expenses. Essential contact information must be provided, including the name, address, phone number, and email of the policyholder, as well as the insurance company's claims department. A detailed account of the claim (claim number, date of incident) helps streamline communication and facilitate resolution. Documentation such as policy numbers, previous correspondence, and any supporting documents (such as photographs or medical records) should accompany this request to strengthen the position of the policyholder in the dispute process.

Comments