Have you ever experienced a frustrating error with your financial service provider? It can be incredibly disheartening to see discrepancies in your accounts or incorrect charges applied. In today's article, we'll explore how to effectively communicate your concerns and resolve such issues. So, if you're dealing with a financial service error and want to know the best way to address it, keep reading!

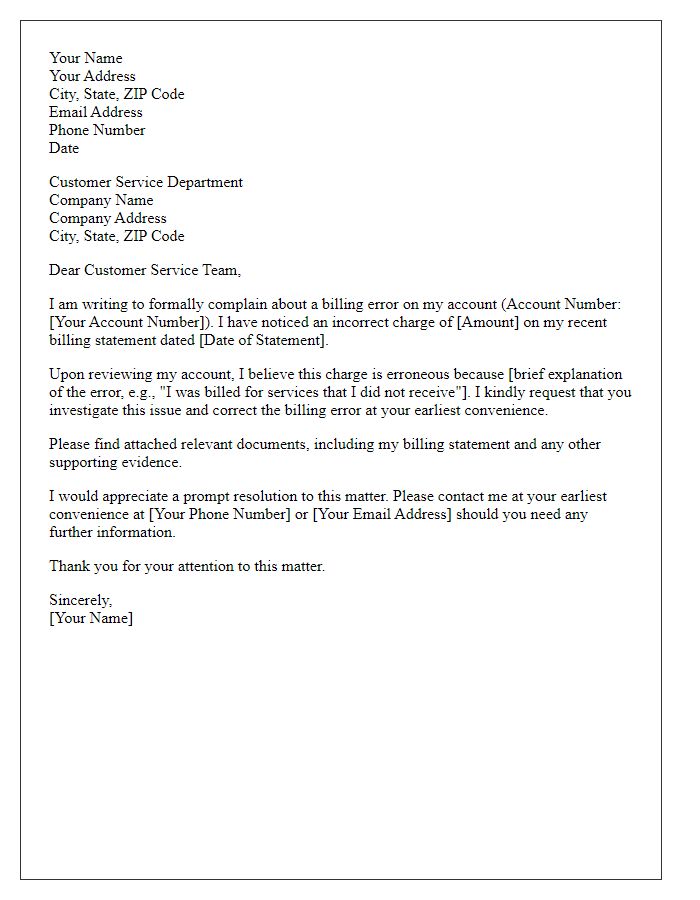

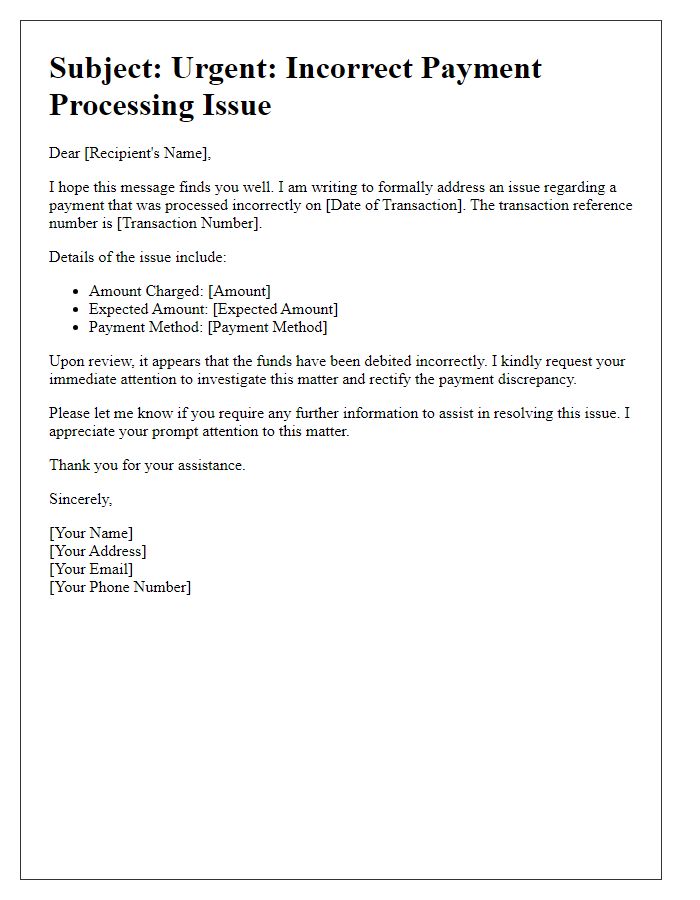

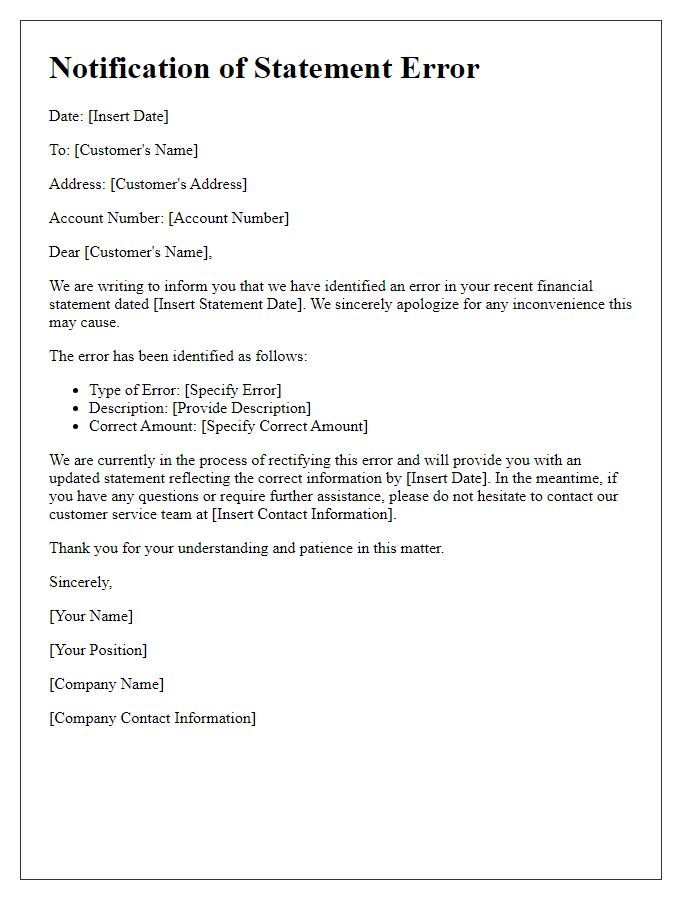

Clear Error Description

An inaccurate transaction can significantly disrupt personal finances, especially when dealing with financial services such as credit cards and bank accounts. Discrepancies like unauthorized charges, incorrect billing amounts, or failure to reflect deposits can lead to confusion and express financial hardship. A billing error typically involves mishandled charges that do not match receipts or agreements, often resulting from system glitches or clerical mistakes. In 2022, the Consumer Financial Protection Bureau reported a surge in error complaints, with incidents affecting thousands of customers across major banks. These issues necessitate timely resolution to restore the integrity of financial records and ensure customer trust in future transactions.

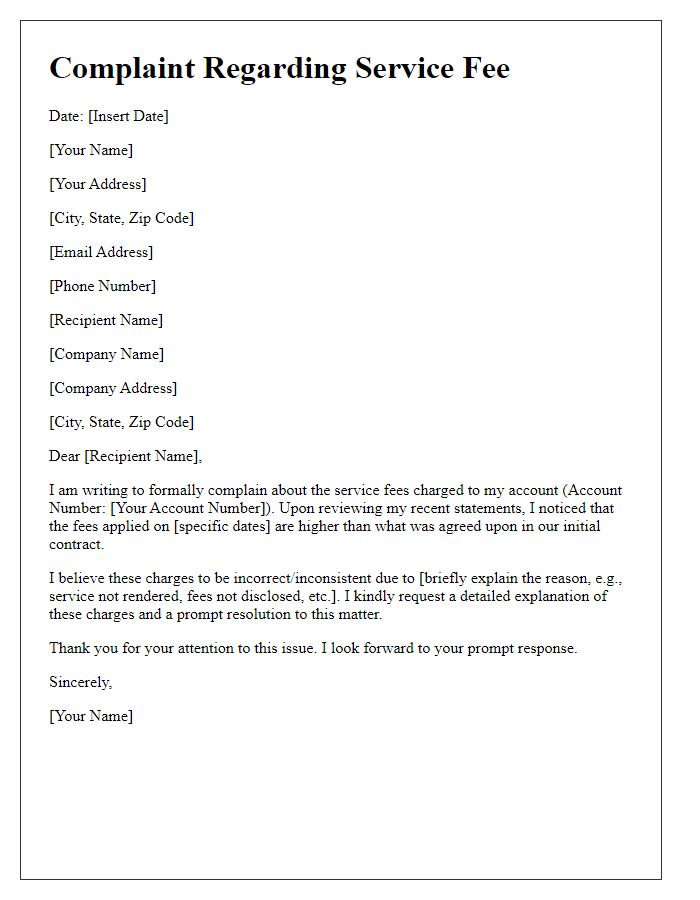

Account Details

Errors in financial service accounts can lead to significant issues for customers. When discrepancies arise in account details such as transaction history, account numbers, or balance figures, customers often face confusion regarding their financial status. For instance, a missing deposit of $1,200 can disrupt budgeting and spending plans, causing unintended overdrafts. In some cases, incorrect account numbers may result in funds being sent to the wrong recipient, leading to frustration and delays in retrieving those funds. Addressing these errors swiftly is crucial for maintaining trust and ensuring customer satisfaction in financial institutions.

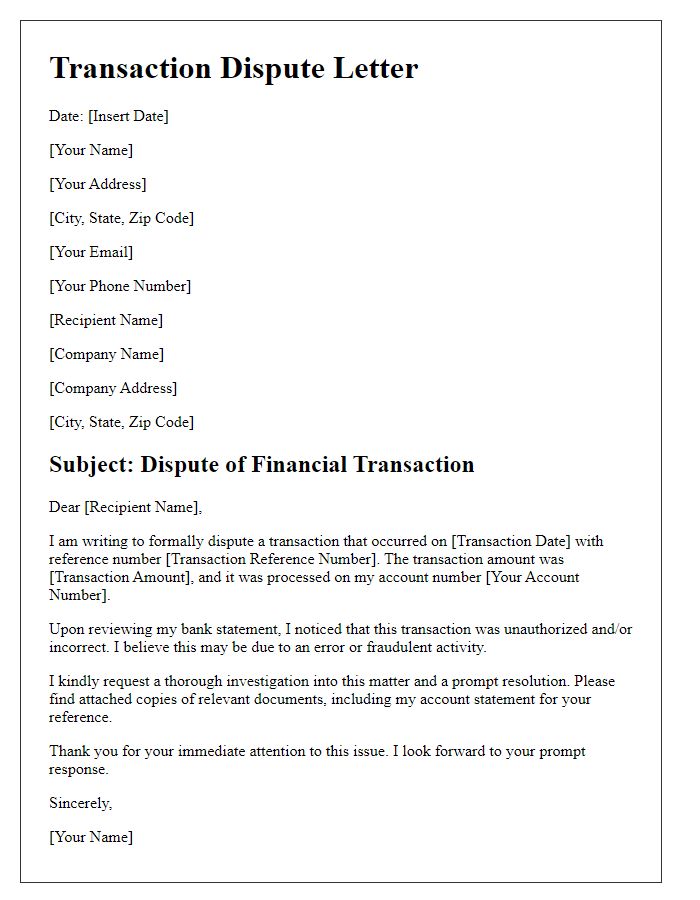

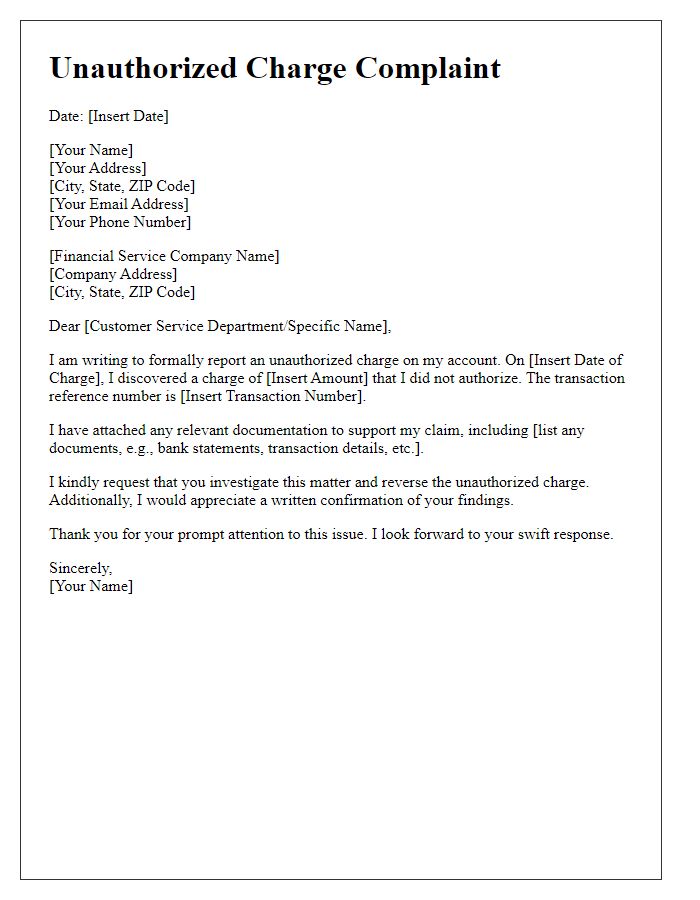

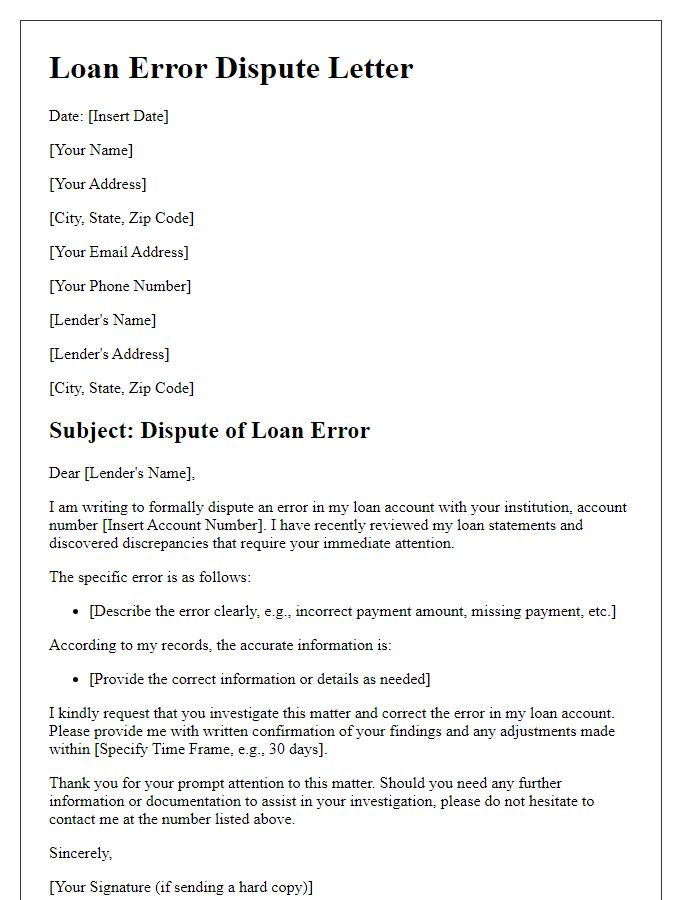

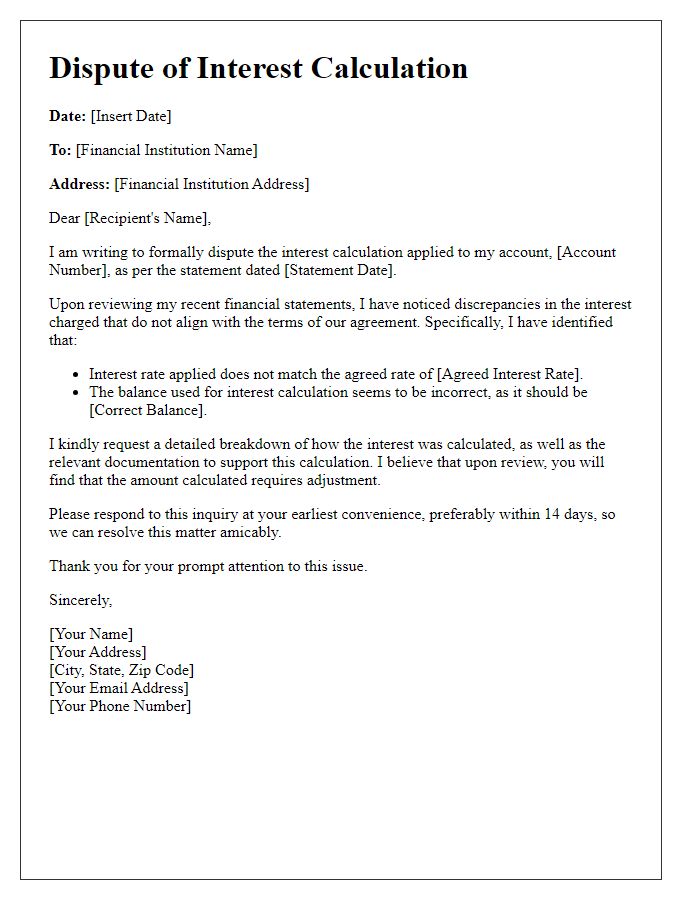

Supporting Documentation

Errors in financial services can have significant impacts on personal and business finances. A financial institution's mistake in billing, such as incorrect charges on credit cards or erroneous account fees, often leads to financial strain for customers. Supporting documentation, such as bank statements, transaction receipts, and account statements, plays a crucial role in substantiating these claims. Additionally, communication records, including emails and call logs (dates and times), provide evidence of prior attempts to resolve the issue. The details of the transaction, including the date, amount, and nature of the error, must be clearly outlined to facilitate proper investigation by the financial service provider. Prompt resolution is essential to maintain trust and ensure the continued operation of financial accounts.

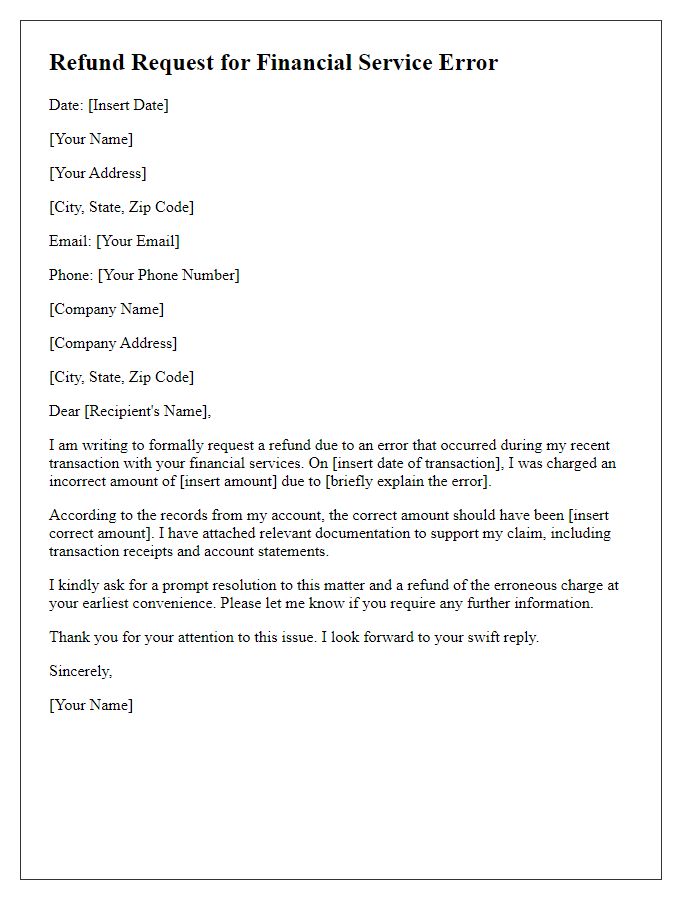

Expected Resolution

A financial service error can significantly impact personal finances and emotional well-being. Clients may experience discrepancies in account balances or transaction issues, particularly in banking institutions such as JPMorgan Chase or Bank of America. In 2021 alone, reports indicated that approximately 15% of customers encountered billing inaccuracies or unauthorized charges. Rapid resolution is vital, often within 30 days, to ensure trust and satisfaction. Suggested resolutions include reimbursement of funds, rectification of account statements, and detailed explanations of the discrepancies. Maintaining accurate financial records is essential for consumers, ensuring they can confidently manage their budgets and future investments.

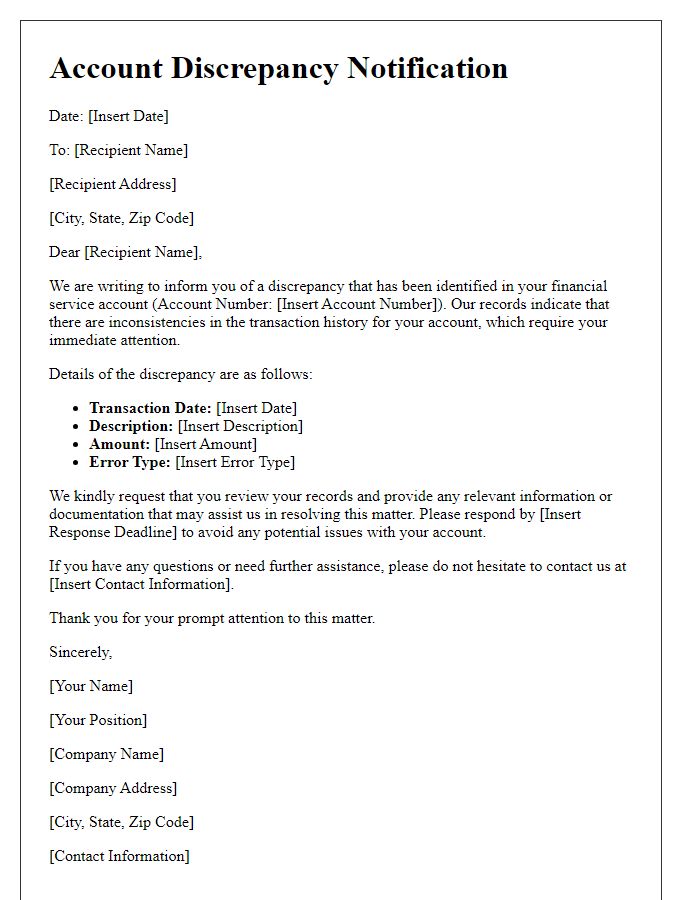

Contact Information

Financial service errors can lead to significant inconveniences for clients relying on accurate account management. Common errors may include incorrect billing amounts, unauthorized transactions, or erroneous interest calculations. Key financial institutions such as banks, credit unions, or investment firms often require detailed information for resolution. Critical contact information includes account numbers (unique identifiers for customer accounts), transaction dates (specific days when errors occurred), and the names of customer service representatives interacted with. Clients must also provide personal information, such as full names, addresses, and phone numbers, to verify identity and expedite the complaint process. Timely reporting of these errors is essential to minimize financial disruption and maintain accurate reporting with credit bureaus.

Comments