Are you looking to dive into your financial history and understand your credit landscape better? Understanding your credit data can provide valuable insights into your financial health, making it easier to make informed decisions. In this article, we'll guide you through the process of drafting an effective letter to obtain your historical credit data. So, grab a cup of coffee and let's explore how you can take this important step towards financial clarity!

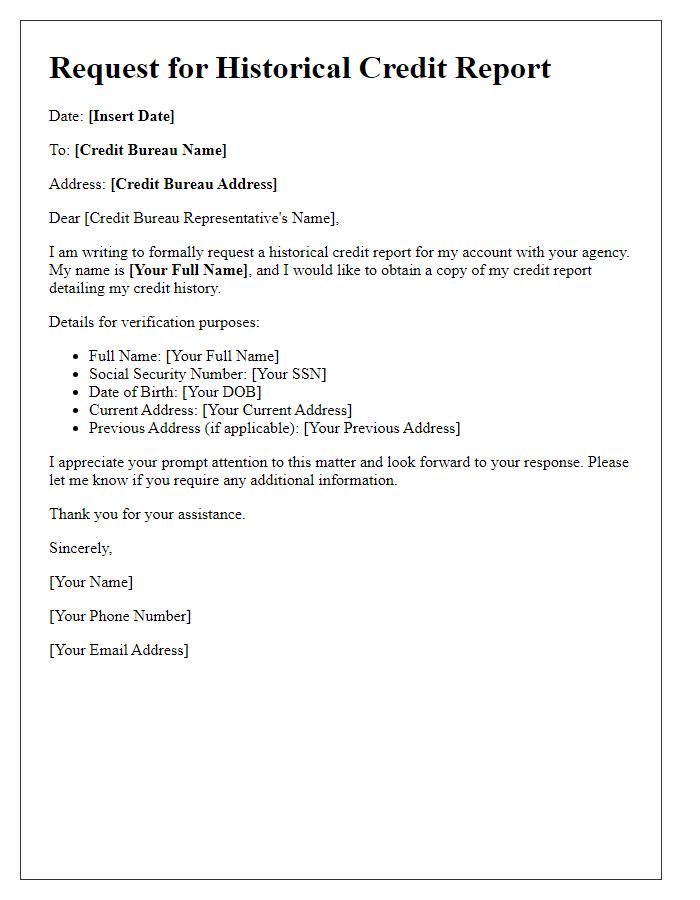

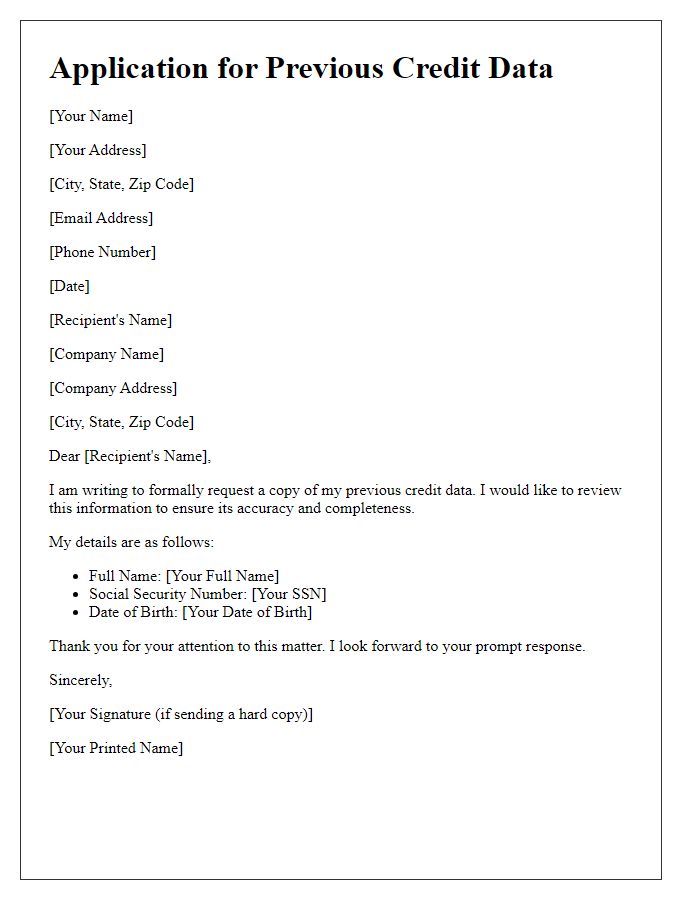

Personal Identification Information

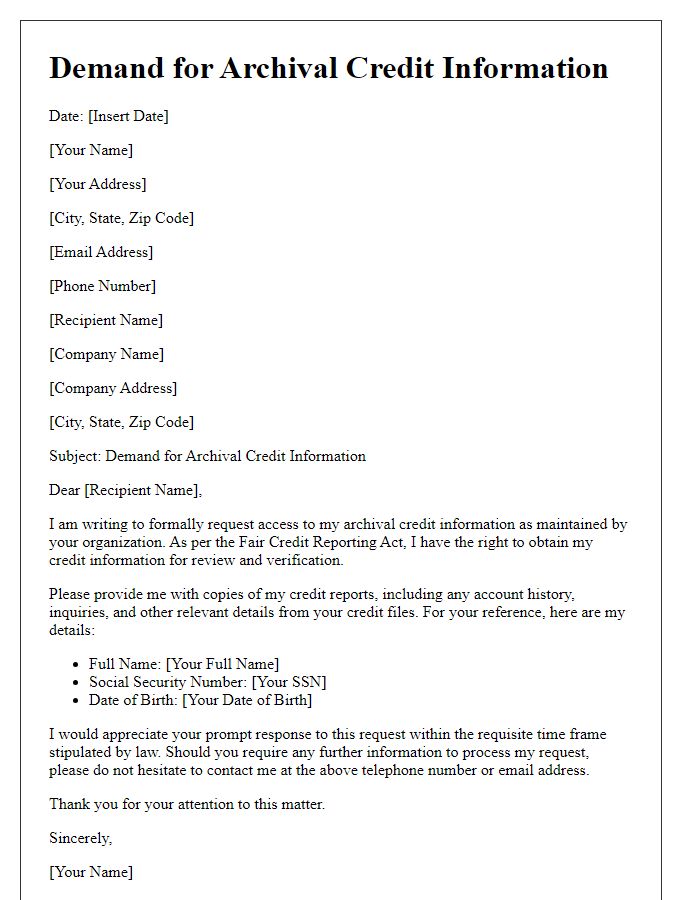

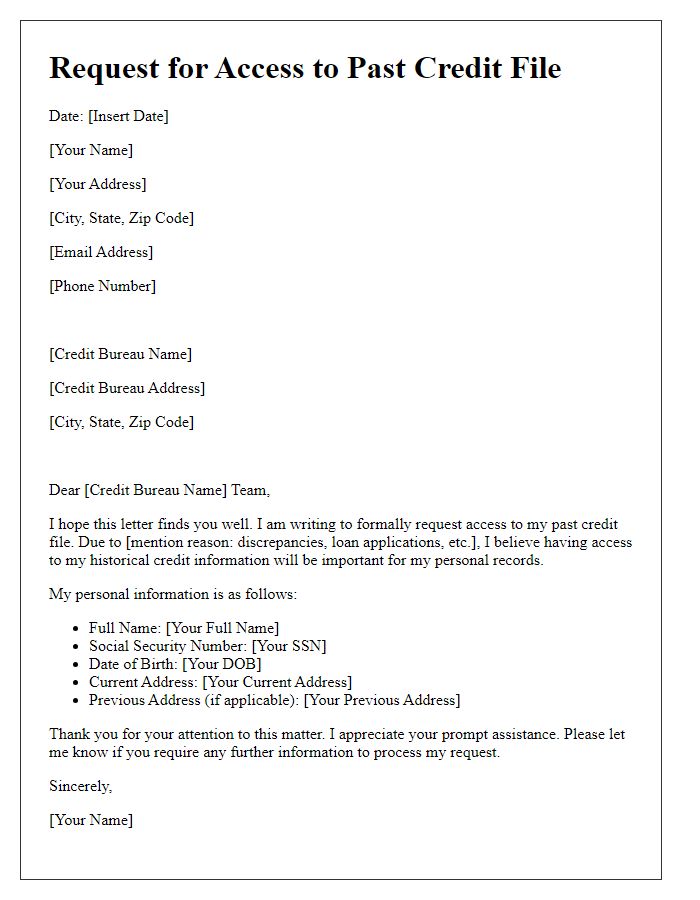

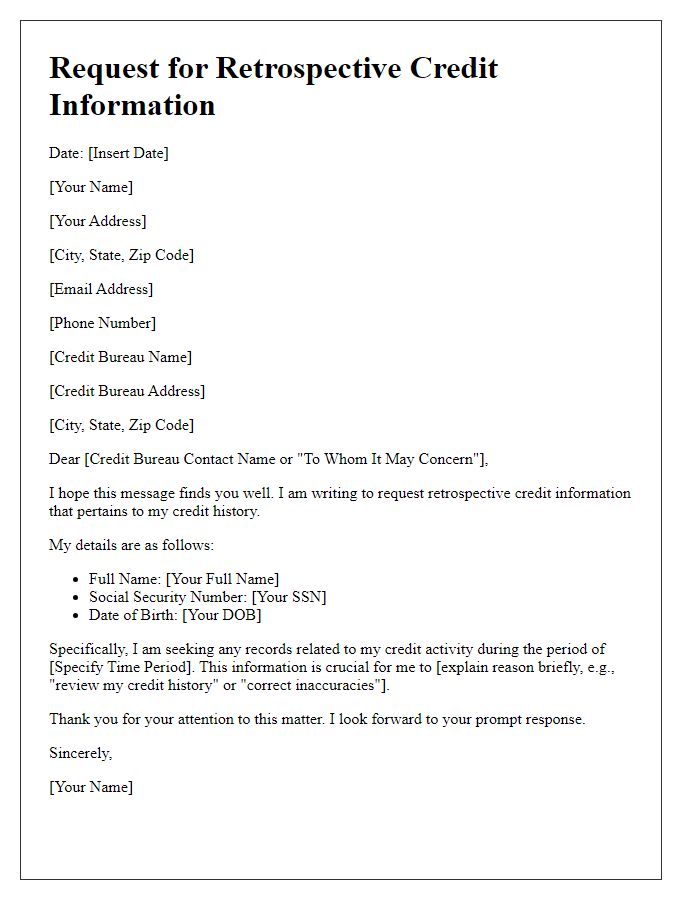

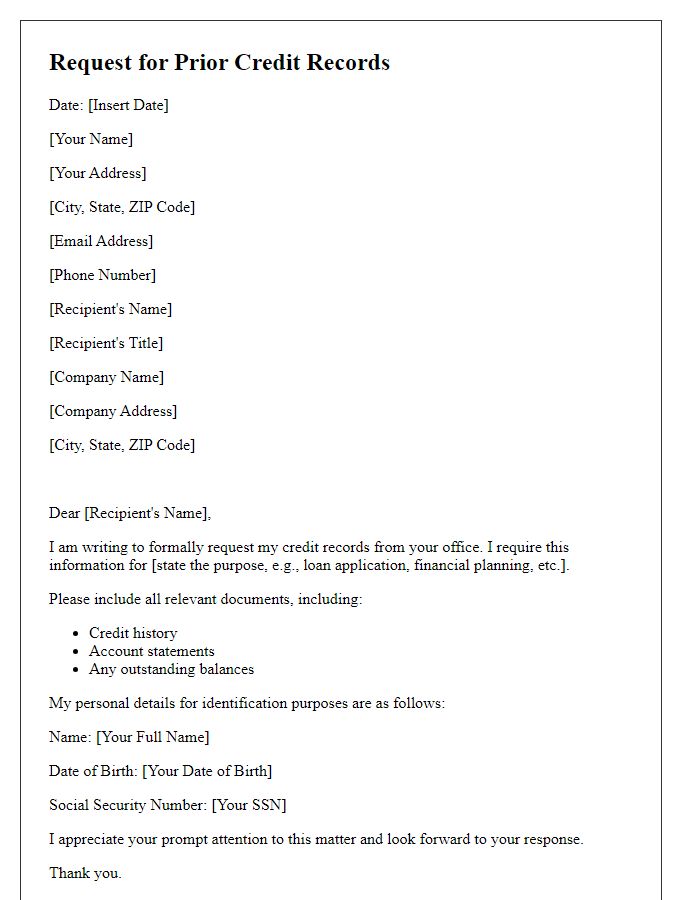

Obtaining historical credit data requires clear personal identification information to verify identity. Key details include full name (as listed on credit reports), date of birth (to confirm age and identity), social security number (a unique identifier for credit records in the United States), and current address (ensuring records are sent to the correct location). Additional notes may involve prior addresses for the last five years (to track credit history accurately), and any previous names (maiden name or aliases) that may appear on historical records. Providing accurate and comprehensive personal identification supports efficient processing of requests for historical credit data from agencies such as Experian, TransUnion, and Equifax.

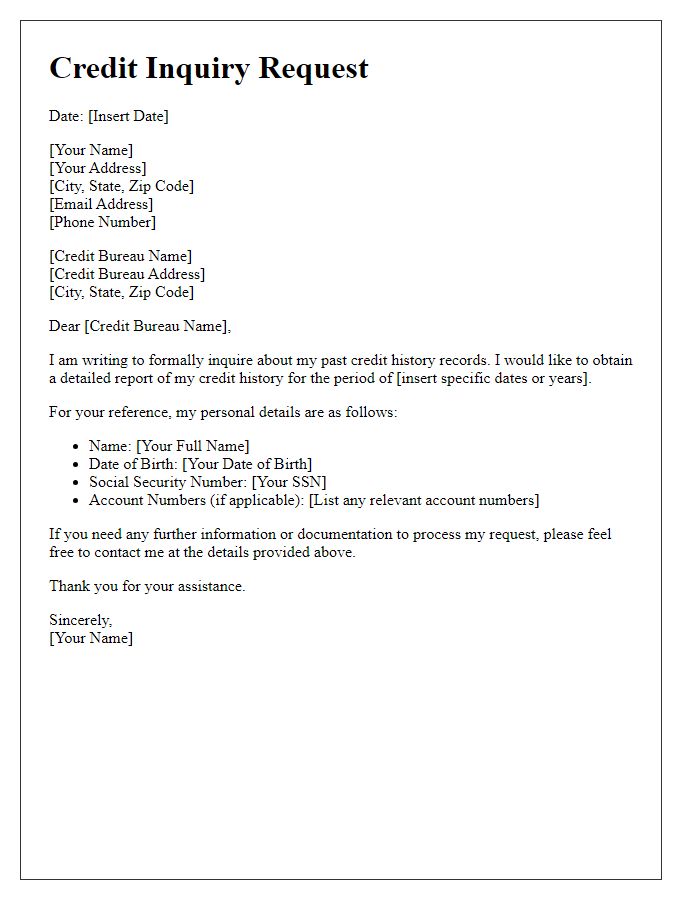

Specific Account Details

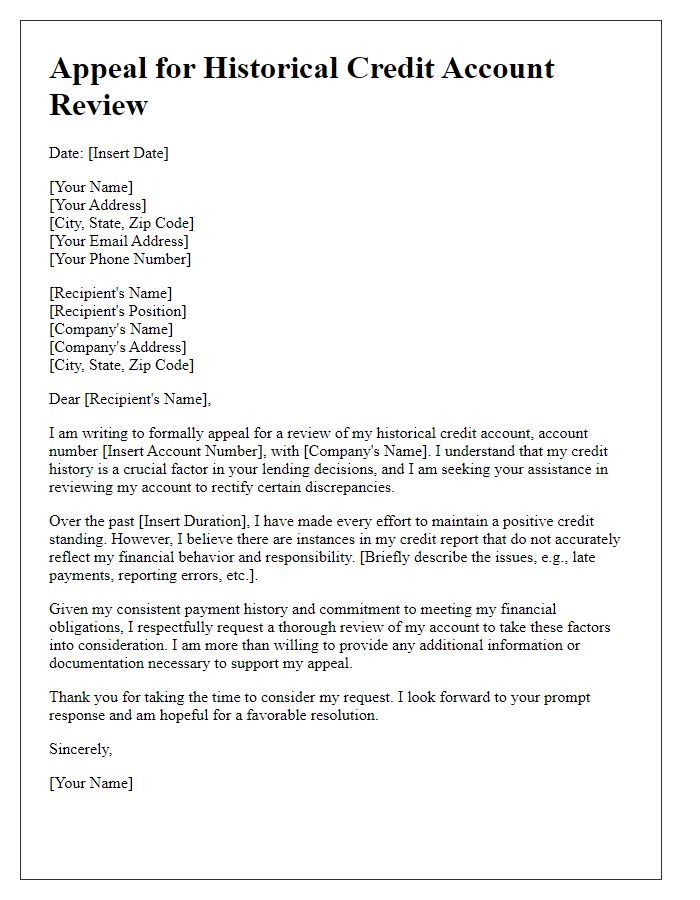

Obtaining historical credit data is essential for financial assessments, particularly for specific accounts such as mortgage loans, auto loans, and credit cards. Financial institutions, including banks like JPMorgan Chase and Wells Fargo, maintain records that detail account activity over various time frames, often extending back several years. Accurate historical data encompasses information such as payment history, outstanding balances, and credit limits, which can influence credit scores. Consumers typically request this data through formal channels, like credit bureaus (Experian, Equifax, TransUnion), which are required by law to provide complete credit histories upon request. Thorough documentation and specific account identifiers, such as account numbers and dates of account opening, enhance the retrieval process and ensure accuracy in the information provided.

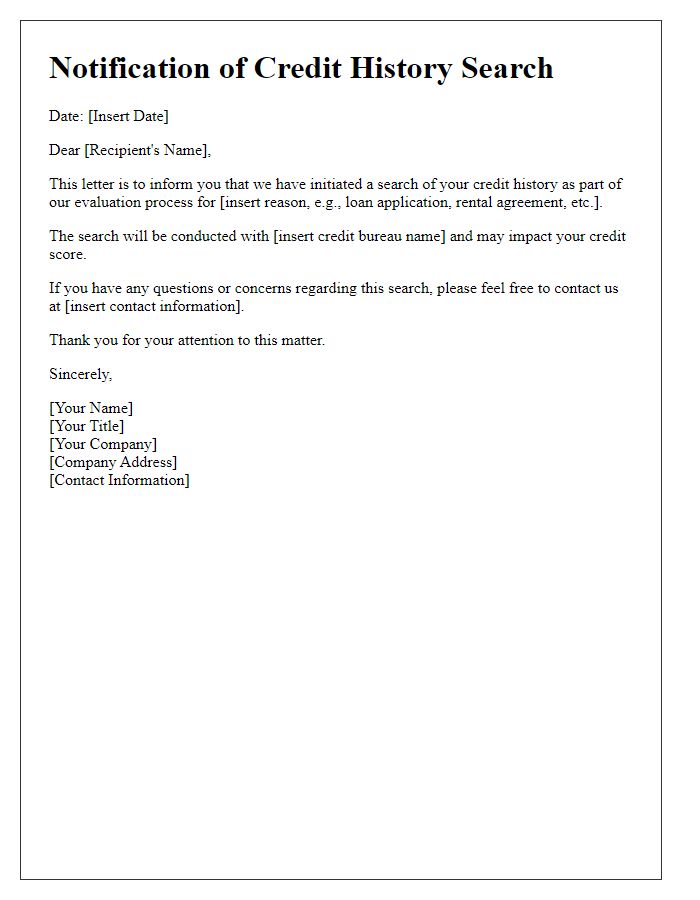

Consent and Authorization Statement

A consent and authorization statement for obtaining historical credit data serves as a formal agreement between the consumer and the credit reporting agency. This statement typically includes details about the consumer's legal name, social security number, and date of birth, ensuring precise identification. Furthermore, it outlines the specific purpose for requesting the historical credit data, such as applying for a mortgage with a bank like Wells Fargo or seeking a car loan with Toyota Financial Services. The statement also emphasizes the consumer's right to review the data requested, ensuring compliance with the Fair Credit Reporting Act (FCRA). Signature lines for both the consumer and the representative of the credit agency may also be included to validate the authorization. Protecting sensitive information is crucial, hence appropriate handling and storage protocols must be followed.

Clear Purpose of Request

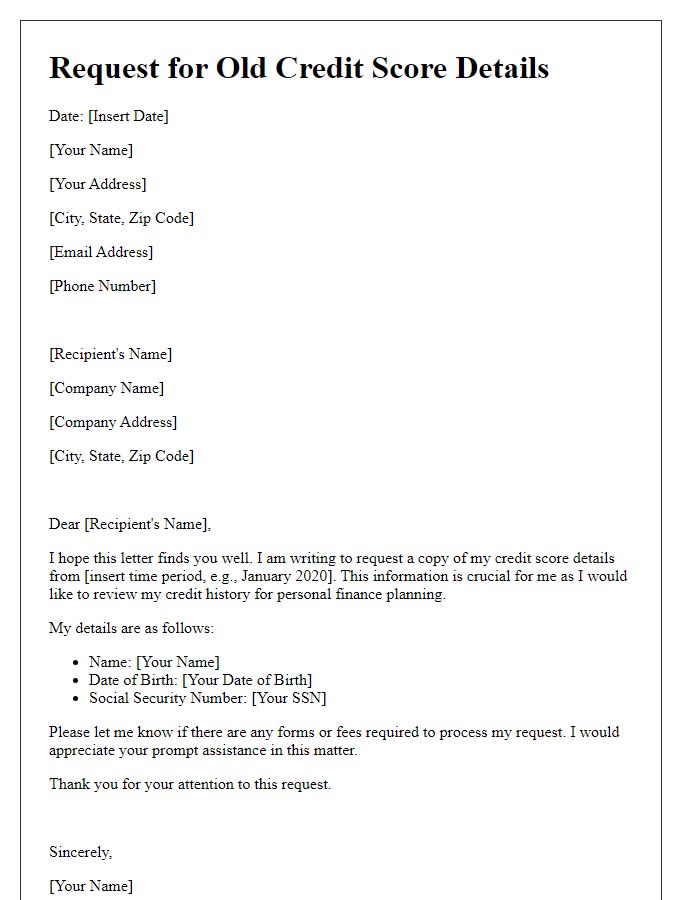

A formal request for historical credit data plays a crucial role in financial analysis and risk assessment. Organizations and individuals often seek this information to review credit history, evaluate creditworthiness for loans, or understand financial behavior over time. Such data can include payment history, credit utilization, and outstanding debts, typically encompassing several years, sometimes back to 2000 or earlier. Entities involved in this process may include banks, credit bureaus, and financial institutions. Clear identification of the requesting party, such as a company or individual, along with the purpose of acquiring this data, enhances transparency. Accurate details regarding the specific timeframe, typically ranging from 2 to 10 years, add context to the request. Additionally, compliance with legal regulations, such as the Fair Credit Reporting Act (FCRA) in the United States, ensures that the process adheres to guidelines regarding consumer privacy and data use.

Contact Information for Response

Obtaining historical credit data is essential for analyzing financial trends and evaluating past credit behaviors. A typical request may involve submitting a formal letter to credit bureaus, such as Experian, Equifax, or TransUnion. The letter should include specific details such as full name, previous addresses (for the past 5 years), Social Security number, and date of birth, ensuring identity verification and compliance with the Fair Credit Reporting Act (FCRA). Additionally, it is crucial to provide a clear purpose for the data, for instance, conducting a personal audit or applying for a loan with an institution like Bank of America or Wells Fargo. Contact information, including a phone number and email address, should be prominently featured to facilitate timely responses from the credit agencies.

Comments