Are you looking to apply for a position as an insurance agent? Crafting a compelling letter can make all the difference in showcasing your qualifications and enthusiasm for the role. In this article, we'll provide a sample letter template that highlights your skills and demonstrates your passion for helping clients with their insurance needs. So, let's dive in and explore how to write a winning application letter!

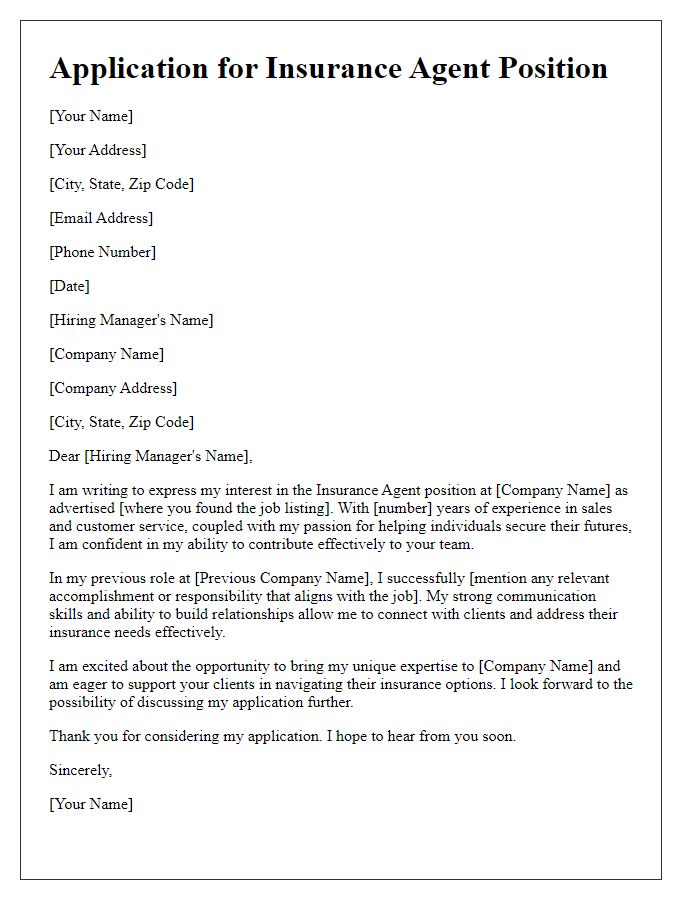

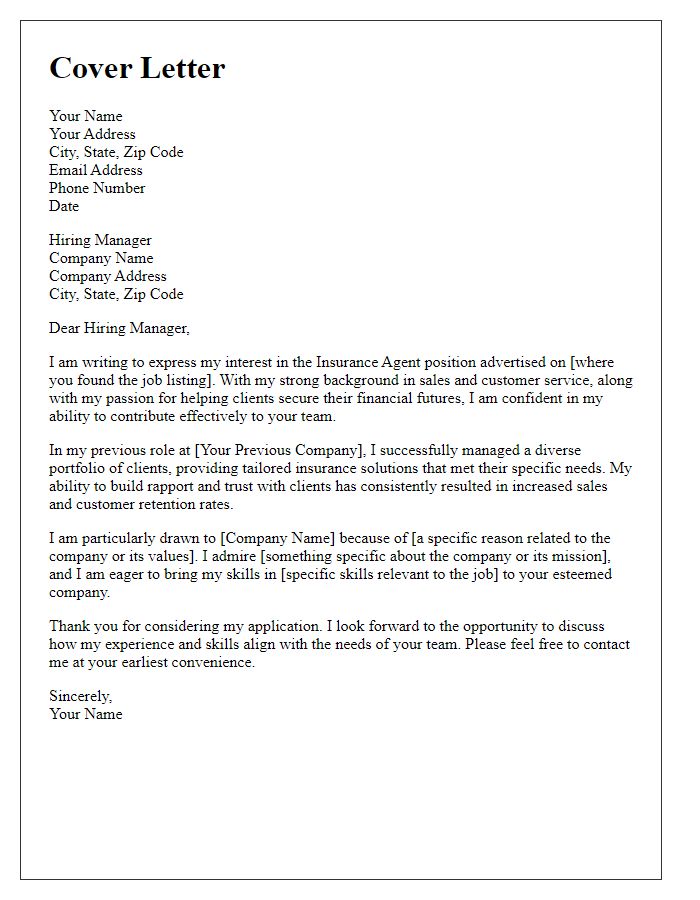

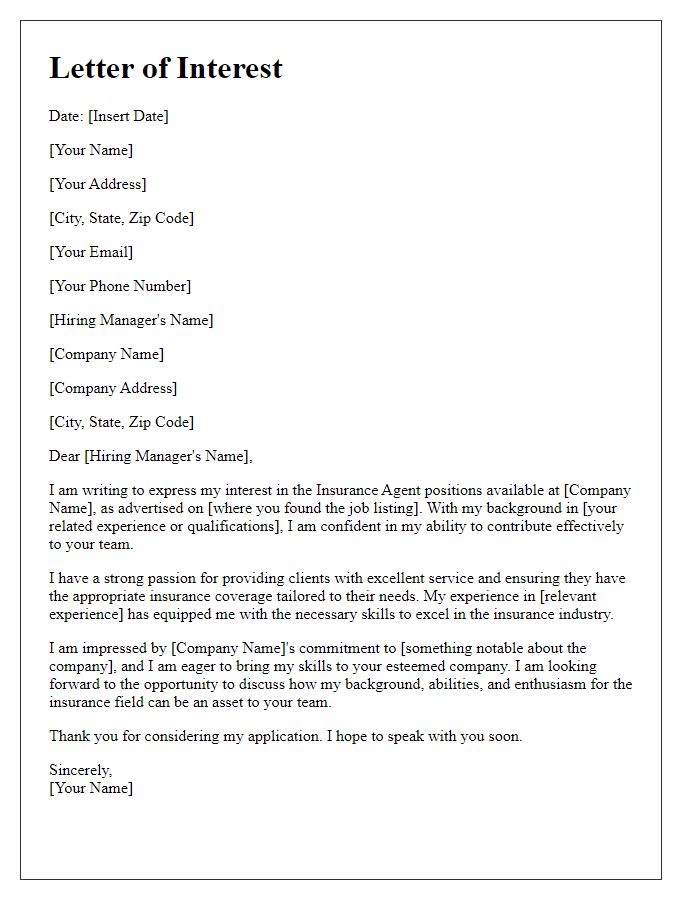

Professional tone and formatting

Insurance agents play a vital role in providing individuals and businesses with necessary coverage against unforeseen risks. With an extensive understanding of policies, claims processes, and industry regulations, agents facilitate informed decisions for clients. Strong communication skills and a customer-centric approach are essential for building trusting relationships in communities, such as Springfield or Miami. Continuous education is crucial, as the insurance landscape evolves with new products and compliance requirements. Successful agents often leverage technology, using CRM systems to manage leads effectively. Networking within local chambers of commerce or industry associations enhances visibility and growth opportunities, ensuring a competitive edge in a challenging marketplace.

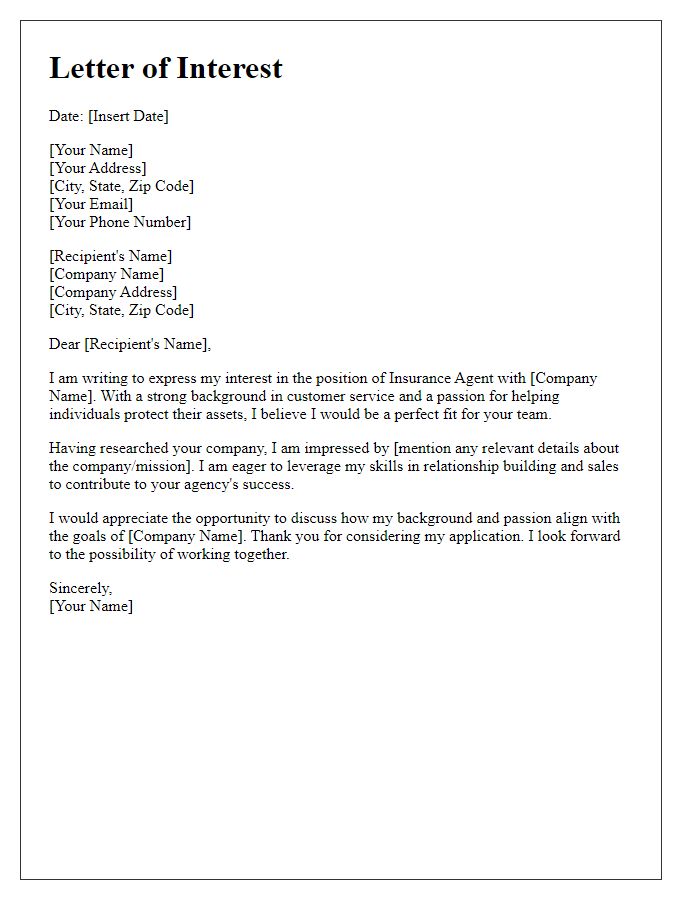

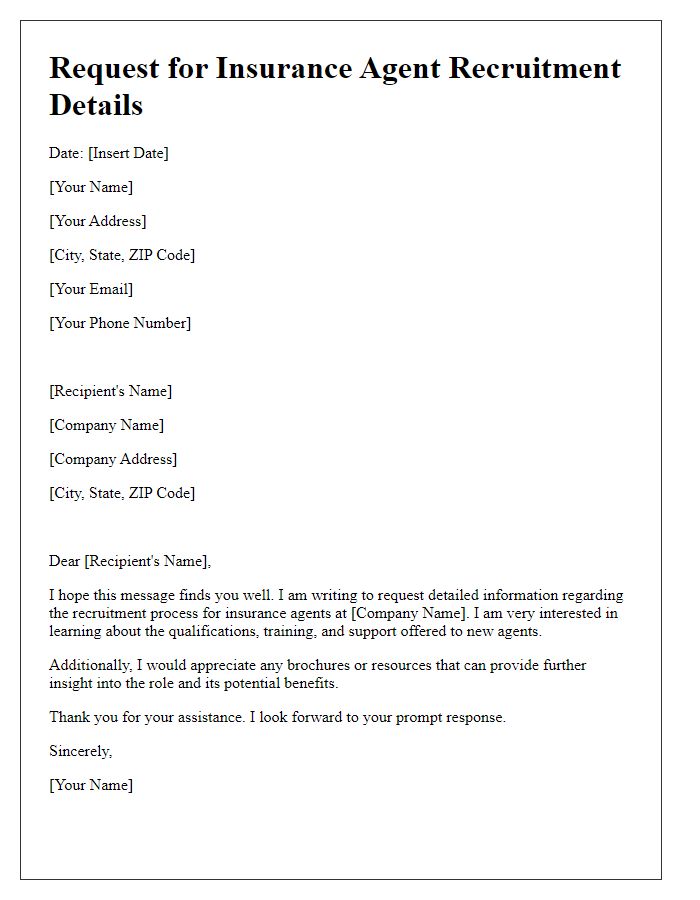

Personalization and recipient details

An insurance agent's application greatly benefits from personalization and tailored recipient details to establish a strong connection. Including the recipient's full name, title, and company or agency name adds a professional touch. Incorporating their specific insurance interests or recent company news creates relevance. Mentioning a mutual connection or referral enhances rapport. Utilizing the recipient's preferred communication method, whether formal or informal, aligns with their expectations. This personalization reflects genuine interest, potentially increasing the chances of a favorable response. Note: Personalization in communications can significantly improve engagement and response rates, especially in competitive industries like insurance.

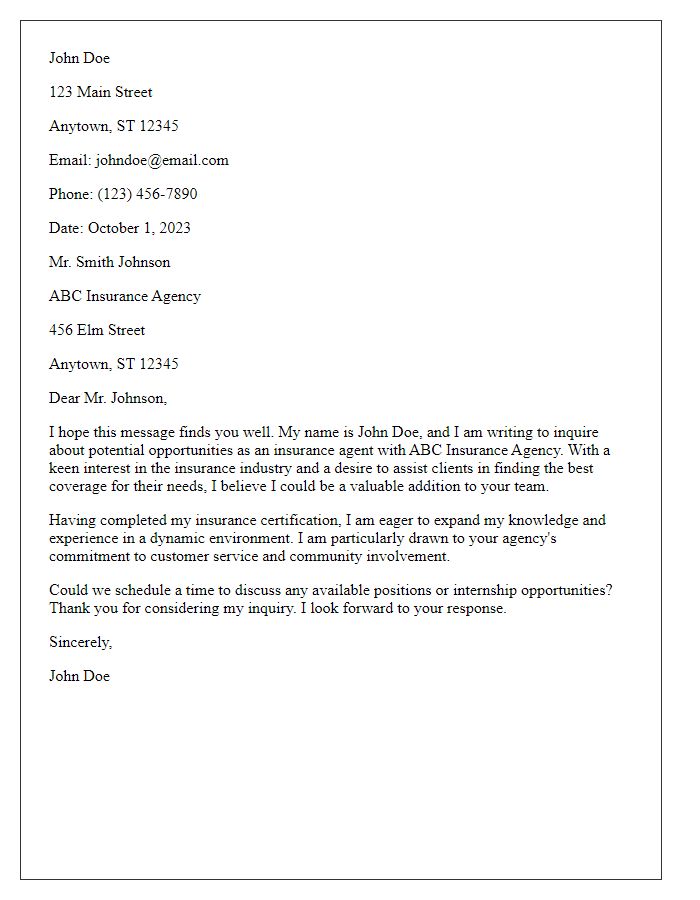

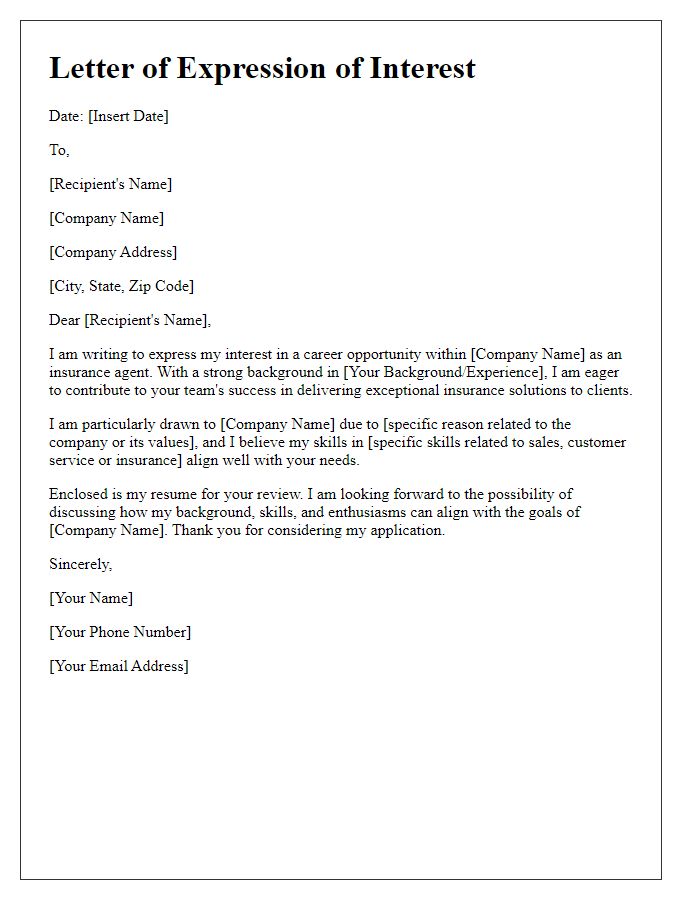

Relevant qualifications and experiences

Aspiring insurance agents should possess relevant qualifications and experiences to excel in the competitive insurance industry. A bachelor's degree in finance, business administration, or a related field provides foundational knowledge of financial concepts (such as risk assessment and policy structuring). Additionally, obtaining certifications such as the Chartered Property Casualty Underwriter (CPCU) or the Life & Health Insurance License (specific to states like California, which has stringent licensing requirements) enhances credibility and expertise. Practical experiences, including internships at established insurance firms, enable agents to gain vital insights into client management and policy sales processes. Furthermore, networking events, such as those organized by the National Association of Insurance Commissioners (NAIC), offer invaluable opportunities to connect with industry professionals and stay updated on regulatory changes.

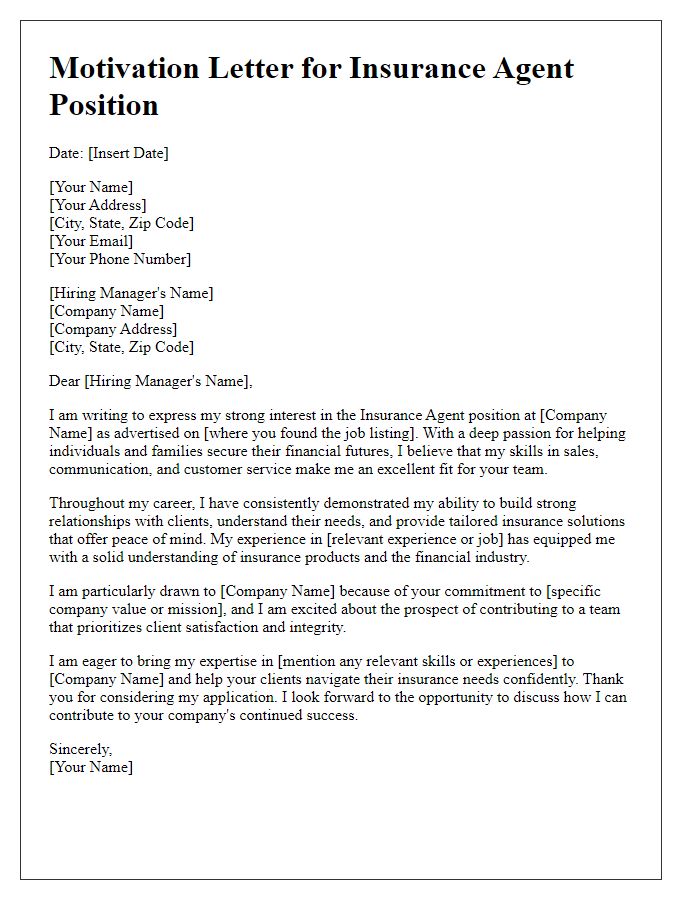

Clear career objectives and alignment with the company

A well-defined career objective can significantly enhance an insurance agent application, showcasing ambition and alignment with the company's goals. Applicants should focus on long-term growth in the insurance sector, aiming for mastery in risk management and customer relationship skills. Demonstrating knowledge of the company's specific services, such as life insurance policies or property and casualty insurance, will indicate a strong understanding of its offerings. Additionally, aligning personal values with the company's mission, such as commitment to customer service excellence and community engagement, can highlight a candidate's suitability and passion for contributing to the organization's success. Engaging with industry trends, such as the increasing use of technology in insurance underwriting, can further illustrate a proactive approach to professional development.

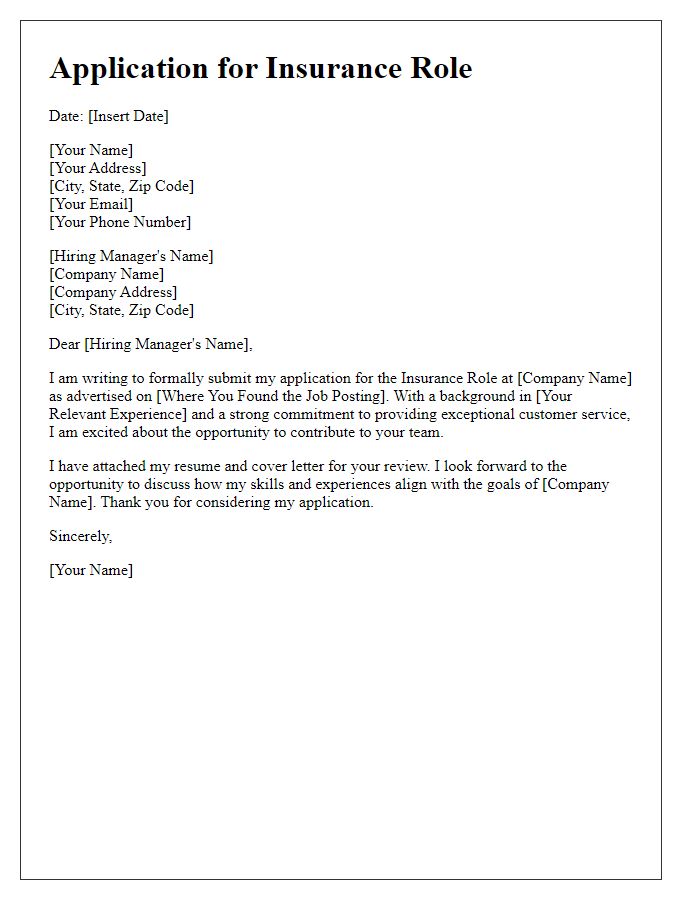

Proper contact information and call-to-action

Insurance agents play a crucial role in helping clients navigate insurance policies and claims. Successful agents maintain proper contact information, ensuring clients can easily reach them for assistance or inquiries. Clear and concise communication is essential, with phone numbers, email addresses, and office locations prominently displayed. A strong call-to-action encourages potential clients to schedule consultations or request policy quotes, fostering proactive engagement. Utilizing customer management software can enhance follow-up efforts, ensuring no inquiries go unanswered. Building strong relationships through effective communication and accessibility leads to increased client satisfaction and loyalty in the insurance industry.

Comments