Are you looking to make a strong impression in your application for a financial analyst position? Crafting a compelling letter can set you apart from the competition by showcasing your skills and experiences effectively. In this article, we'll provide you with a versatile letter template that highlights your analytical abilities, attention to detail, and teamwork. So, if you're ready to elevate your job application, keep reading to discover how you can present yourself as the ideal candidate!

Tailored Job Title and Company Name

The financial analyst role at Bank of America, a global leader in financial services, presents an exciting opportunity to utilize analytical skills in assessing financial statements, forecasting trends, and evaluating investment risks. The position focuses on data analysis, requiring proficiency in tools such as Excel, SQL, and financial modeling software. Analysts are tasked with providing actionable insights based on extensive market research and financial metrics, influencing key business decisions and strategy formulation. Collaboration with cross-functional teams ensures a comprehensive approach to financial performance evaluations while aligning with regulatory standards and best practices within the financial sector.

Highlighted Relevant Experience

Experience in financial modeling encompasses the development of detailed forecasts and projections, often utilizing Excel spreadsheets with complex formulas and macros. Specific roles at Fortune 500 companies, such as Goldman Sachs or JPMorgan Chase, often emphasize creating models that estimate future cash flows, enabling precise investment strategies. Responsibilities include analyzing historical data trends, such as revenue growth rates and operating expenses, which contribute to informed financial decision-making. Additionally, participation in quarterly earnings reports necessitates collaboration with cross-functional teams to present key findings using data visualization tools like Tableau or Power BI, ensuring clarity in communicating performance metrics to stakeholders. Experience with ERP systems, like SAP or Oracle, streamlines financial reporting processes and enhances overall efficiency, indicating a strong understanding of financial systems integration.

Technical and Analytical Skills

A financial analyst position requires strong technical and analytical skills, essential for processing vast amounts of data and making informed decisions. Proficiency in financial modeling, using software like Microsoft Excel, allows for the creation of detailed forecasts and evaluations based on historical performance metrics. Familiarity with statistical analysis tools such as R or Python enables in-depth examination of financial trends and their implications on market behavior. Knowledge of financial databases, including Bloomberg Terminal or FactSet, is crucial for accessing real-time market data and conducting comprehensive industry research. Understanding financial statements, specialized accounting practices, and key performance indicators (KPIs) aids in assessing companies' financial health and investment potential in the evolving economic landscape.

Demonstrated Success and Achievements

Demonstrated success in financial analysis involves numerous quantifiable achievements that reflect a strong ability to interpret financial data and provide strategic insights. For instance, during a previous role at Global Finance Corp (2018-2021), improved budget forecasting accuracy by 20% through the implementation of advanced statistical modeling techniques. Successfully identified cost-saving opportunities, resulting in annual savings of $150,000 across operational budgets. Developed detailed financial reports that contributed to a 15% increase in quarterly profits by providing actionable insights to senior management. Played a pivotal role in the financial planning and analysis (FP&A) team, driving successful completion of over 30 cross-functional projects, enhancing profitability and optimizing resource allocation. Recognized as Employee of the Year in 2020 for outstanding contributions to strategic financial initiatives.

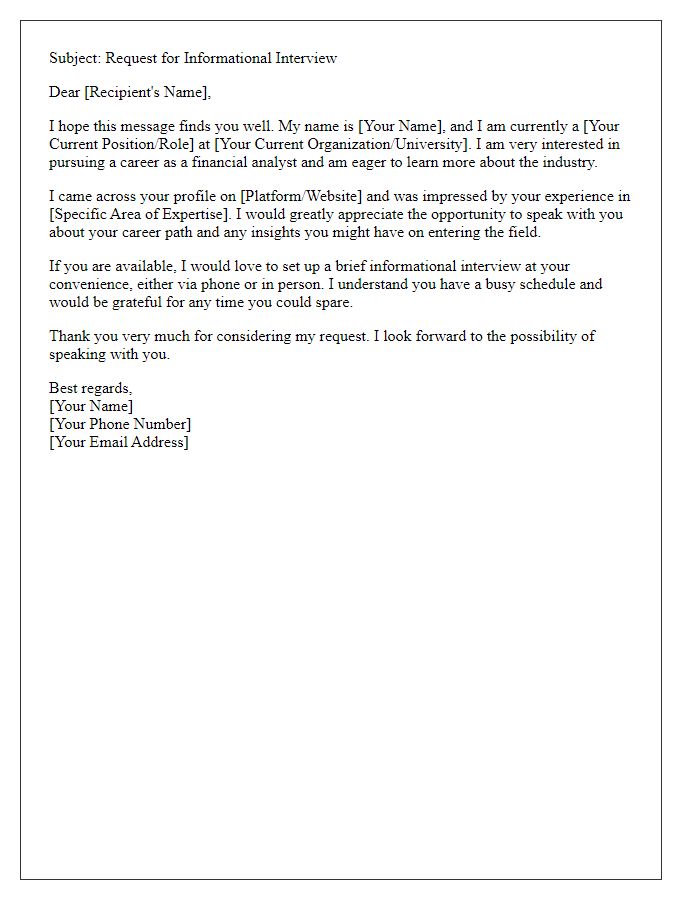

Call to Action for Interview

Crafting compelling financial reports requires mastery of data interpretation and an understanding of financial principles, such as Generally Accepted Accounting Principles (GAAP). An astute financial analyst proficient in tools like Excel and financial modeling can provide insights using key performance indicators (KPIs) that drive strategic decision-making. In-depth experience with financial forecasting and budgeting processes, often employed in Fortune 500 companies, highlights the analyst's ability to predict future revenue trends and control operational costs. Additionally, familiarity with regulatory frameworks, including the Sarbanes-Oxley Act, ensures compliance and reinforces integrity in financial reporting, making the financial analyst an invaluable asset to any organization.

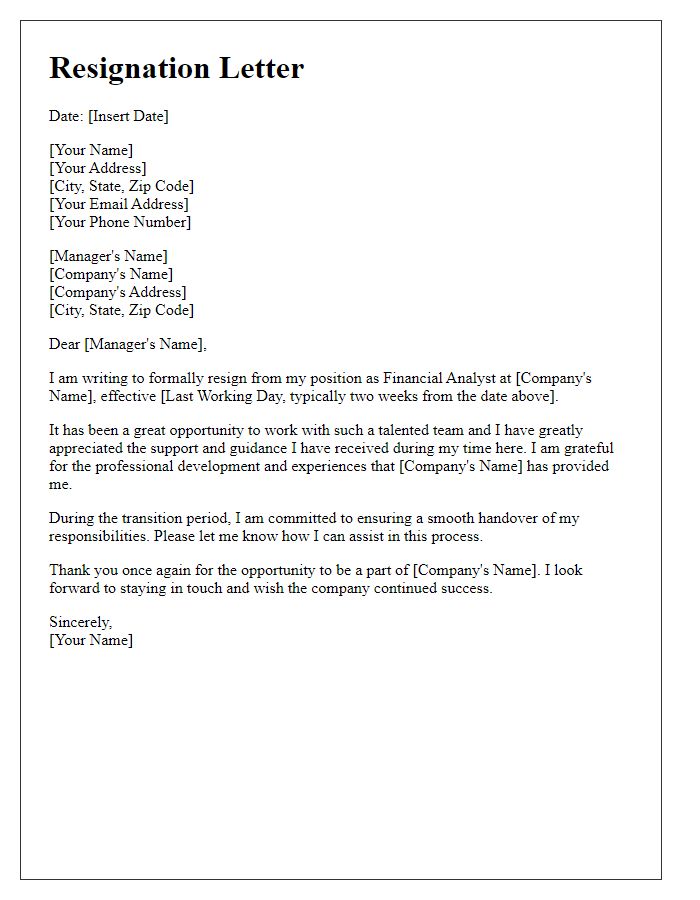

Letter Template For Financial Analyst Positions Samples

Letter template of introduction for financial analyst job opportunities.

Comments