Are you ready to take control of your financial future? In today's fast-paced world, having a solid financial plan is more important than ever. Whether you're saving for retirement, planning for your children's education, or simply looking to manage your expenses better, seeking professional guidance can make all the difference. Let's explore the essential steps to crafting a personalized financial plan that suits your unique needsâread on to discover how our consultations can empower you!

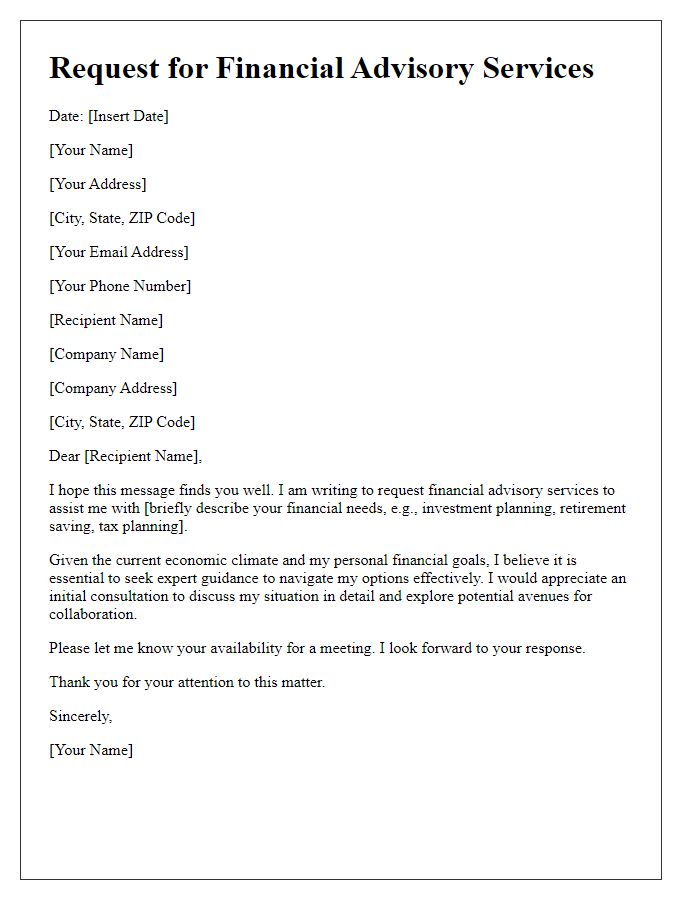

Clear Objective and Services Offered

During financial planning consultations, establishing a clear objective is essential to streamline the process and ensure effective communication. Goals may range from retirement planning, such as saving for retirement accounts like a 401(k), to debt management, focusing on strategies to reduce liabilities like student loans or credit card debt. Services offered in these consultations typically include personalized budgeting advice, investment strategies involving stocks and bonds, tax planning to optimize liabilities, and estate planning to safeguard assets for future generations. Utilizing tools such as risk assessment questionnaires can help tailor these services to individual client needs. Financial metrics, including net worth evaluations and cash flow analysis, further refine the consultation's focus, leading to actionable steps toward achieving financial stability and growth.

Personalized Client Information

Personalized financial planning consultations involve gathering comprehensive client information, tailored to individual financial goals and circumstances. Relevant data encompasses income details such as salary (monthly or annually), investment portfolios including stocks (e.g., S&P 500 index funds) or bonds, and savings accounts across various banks (e.g., Chase, Bank of America). Personal expenses should include fixed costs like mortgage payments on property (e.g., a home in Los Angeles) and variable expenses like groceries and entertainment. Key life events, such as retirement plans (target age around 65), children's education (college savings for a grade school child), or potential inheritances, also play a crucial role in shaping personalized strategies. Understanding liability factors, such as outstanding debts (credit card or student loans), contributes to a holistic overview. Regular assessments and adjustments based on market changes (like interest rates from the Federal Reserve) ensure the financial plan remains aligned with client objectives and needs.

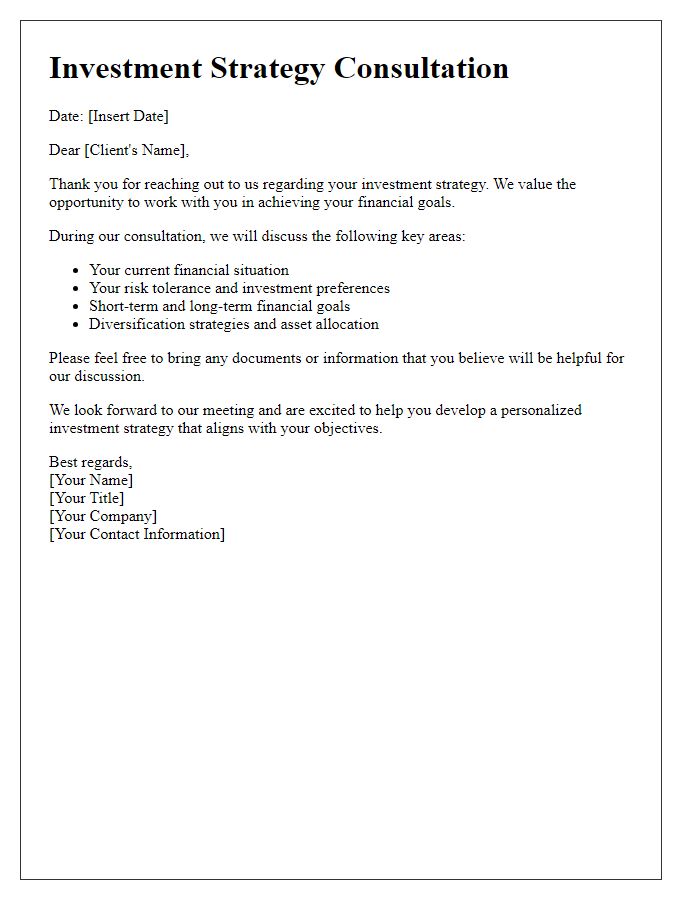

Appointment Scheduling and Availability

Financial planning consultations require careful appointment scheduling to ensure availability for clients seeking to manage their investments and retirement plans. Professionals typically offer flexible hours, including weekdays from 9 AM to 5 PM and selected weekend slots, depending on the firm's policy. Clients often seek guidance on asset allocation, risk management, and tax strategies, with each meeting usually lasting between 60 to 90 minutes. Utilizing online scheduling tools allows clients to view real-time availability, ensuring they choose a convenient slot aligned with their financial planning needs. Regular reminders via email or text can enhance attendance rates, ensuring clients maximize their sessions with financial advisors.

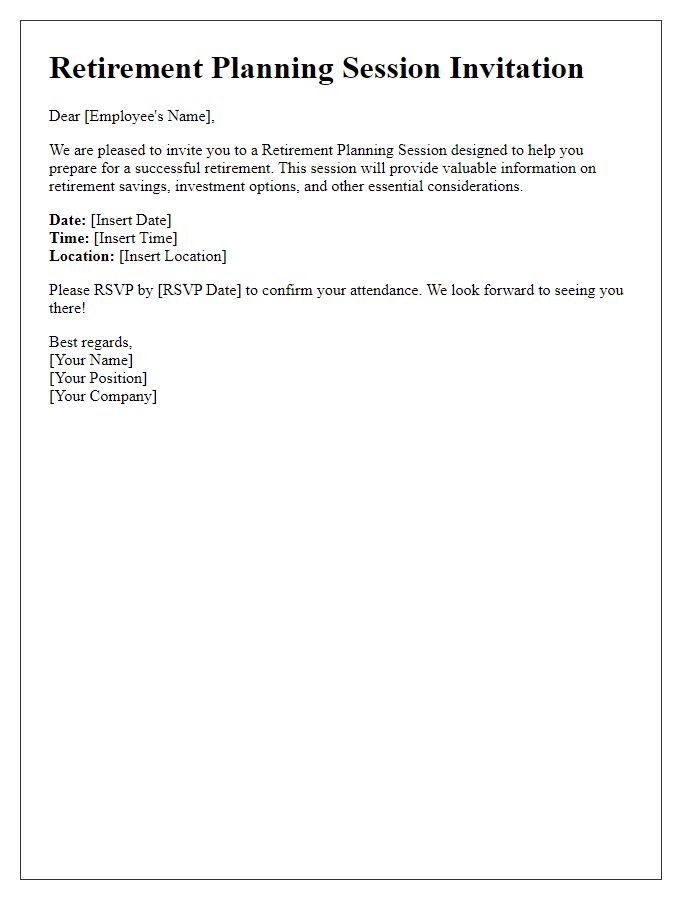

Confidentiality and Privacy Assurance

Confidentiality and privacy are paramount in financial planning consultations. Clients entrust financial advisors with sensitive information, such as income details, investment portfolios, and personal goals. Financial institutions must adhere to regulations like the Gramm-Leach-Bliley Act (GLBA), which mandates protecting clients' private data. Advisors utilize secure technologies (encryption, secure servers) to safeguard information from unauthorized access. Moreover, client interactions often occur in private settings (offices, virtual meetings), ensuring discussions remain confidential. Regular training on privacy policies and ethical standards strengthens the commitment to confidentiality. Creating a culture of trust fosters long-term client relationships essential in the financial advising industry.

Contact Information and Follow-up Steps

Financial planning consultations require clear communication and organized follow-up steps to ensure clients receive the best service. Contact information should include the financial advisor's name, office address in a regional financial hub (like New York City, known for its financial district), phone number, and professional email. Follow-up steps may involve scheduling an in-person meeting or virtual consultation via secure platforms, sending out pre-meeting questionnaires for needs assessment, and providing a detailed agenda to establish concrete financial goals. Emphasis on response times (within 48 hours) ensures clients feel valued and keeps the consultation process efficient. Documenting these interactions fosters transparency and helps build long-term relationships.

Comments