Have you ever wondered how to craft the perfect letter for charitable contribution receipts? It's a simple yet essential task that can make a significant impact on your donors' experience. A well-structured receipt not only serves as proof of their generous contributions but also reinforces the bond between your organization and its supporters. Dive into our article to discover tips and templates that can elevate your communication with donors!

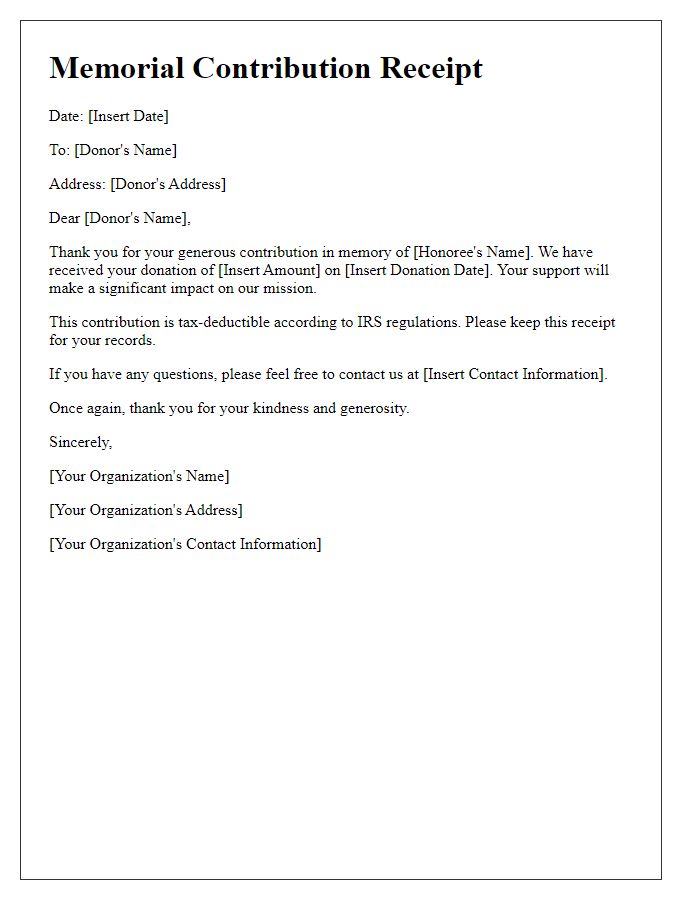

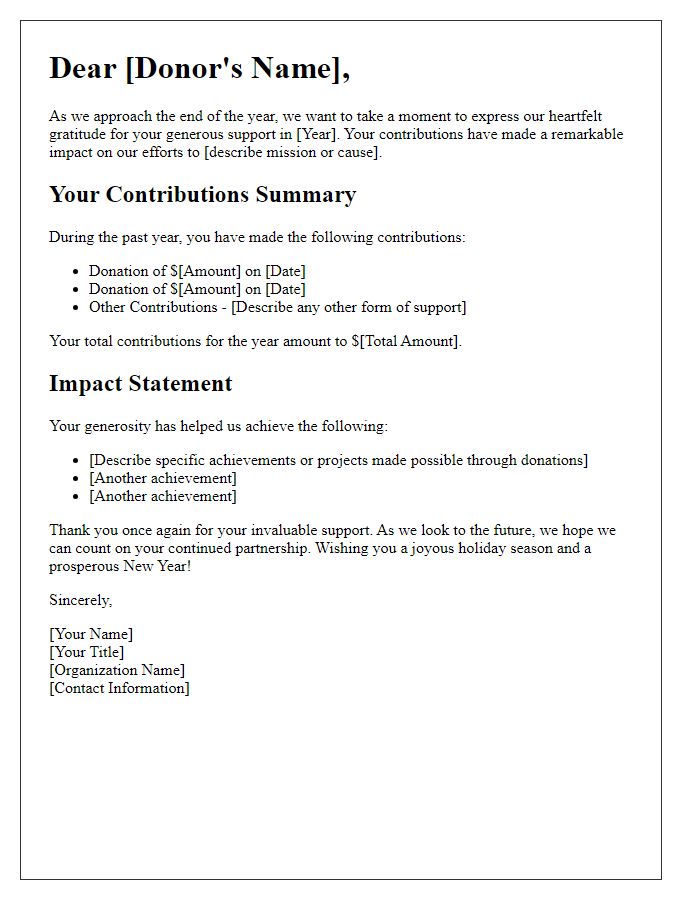

Donor's Name and Address

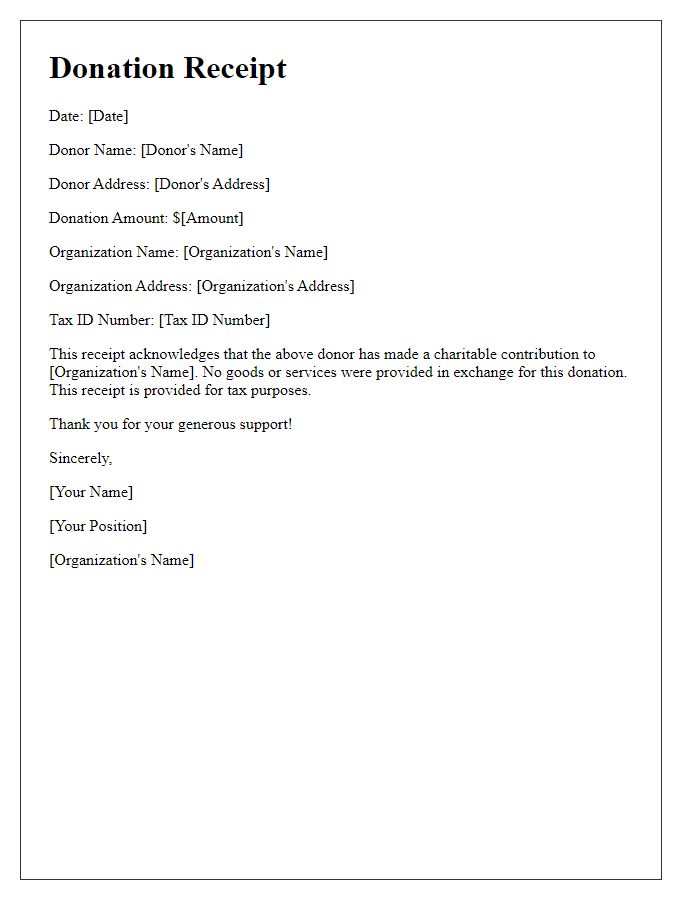

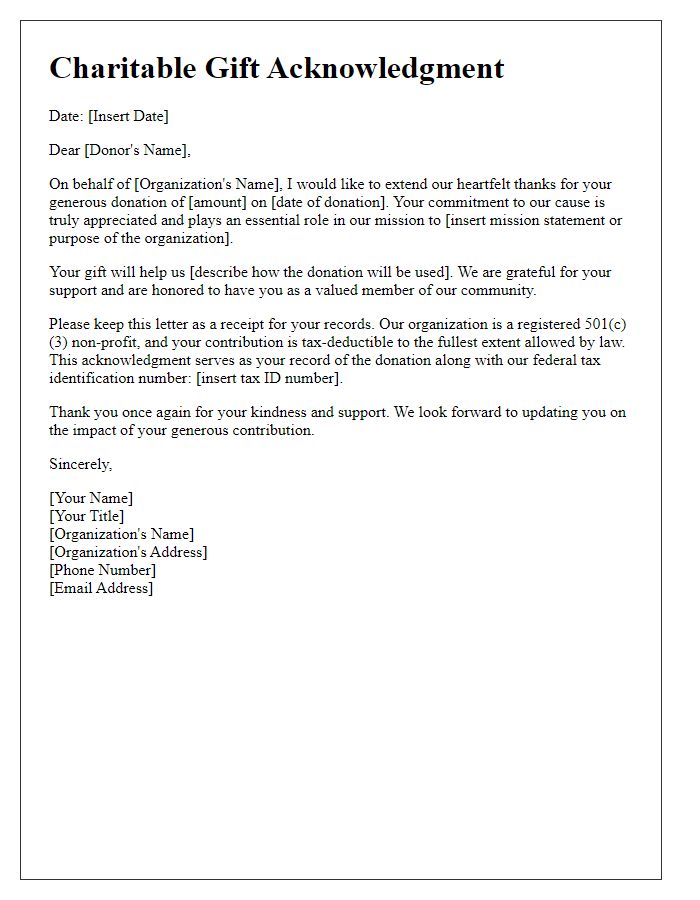

In the realm of charitable contributions, accurate documentation plays a crucial role in enabling donors to claim deductions on their taxes while providing organizations with a record of donations for accountability. Each receipt should detail the donor's name, ideally including the full legal name, and their complete address, encompassing street address, city, state, and zip code to validate the donor's identity and location. Nonprofit organizations often utilize specific formats to ensure compliance with IRS regulations, such as including the date of donation, the amount donated, and a statement confirming that no goods or services were received in exchange for the contribution, thus ensuring the full deductible nature of the gift. This careful attention to detail not only fosters transparency but also nurtures trust between donors and the organizations they choose to support.

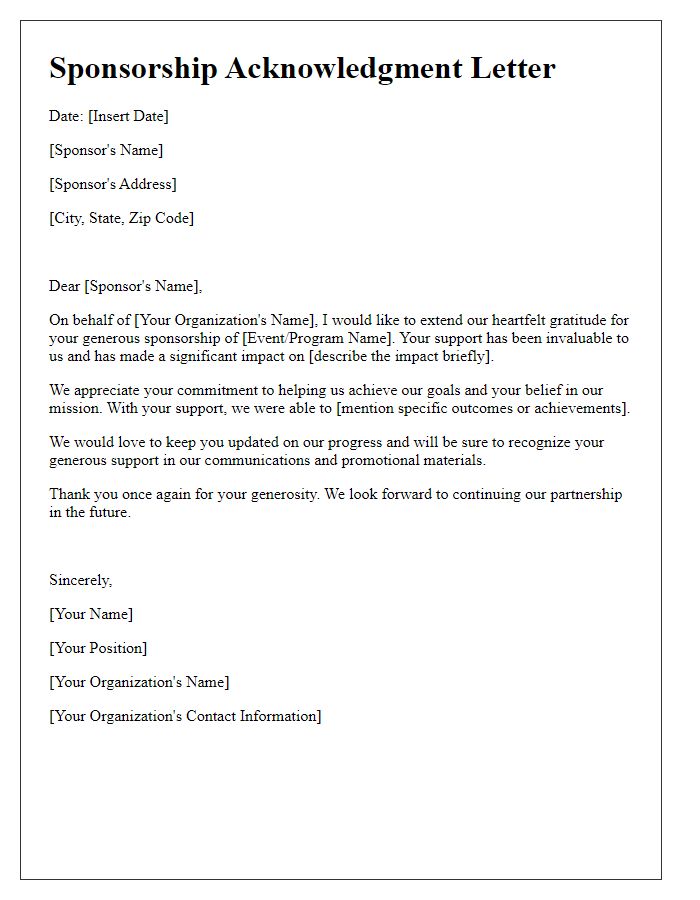

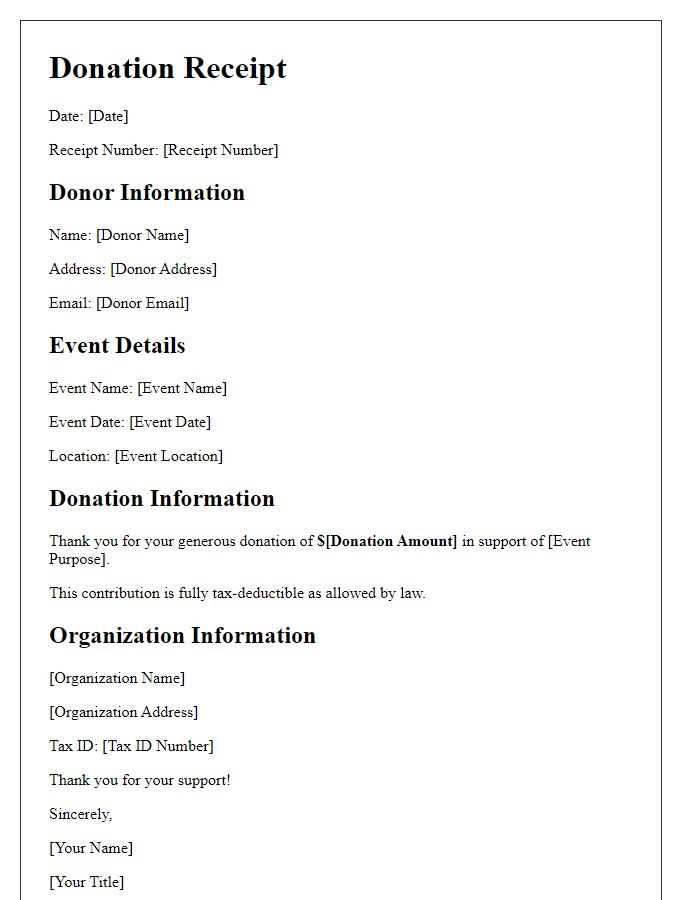

Charity's Name and Tax ID

Charity organizations often issue contribution receipts to acknowledge donations for tax purposes. Essential details include the charity's name--specific to registered entities (e.g., "Helping Hands Foundation")--and the tax identification number (Tax ID), a unique identifier assigned by the IRS, typically consisting of nine digits (e.g., 12-3456789). Including the date of donation, description of the contribution (e.g., monetary amount, itemized goods), and any relevant terms, such as whether goods or services were provided in exchange for the donation, is crucial for compliance with IRS regulations. Receipts serve as documentation for donors when filing tax returns, ensuring proper deductions for charitable contributions.

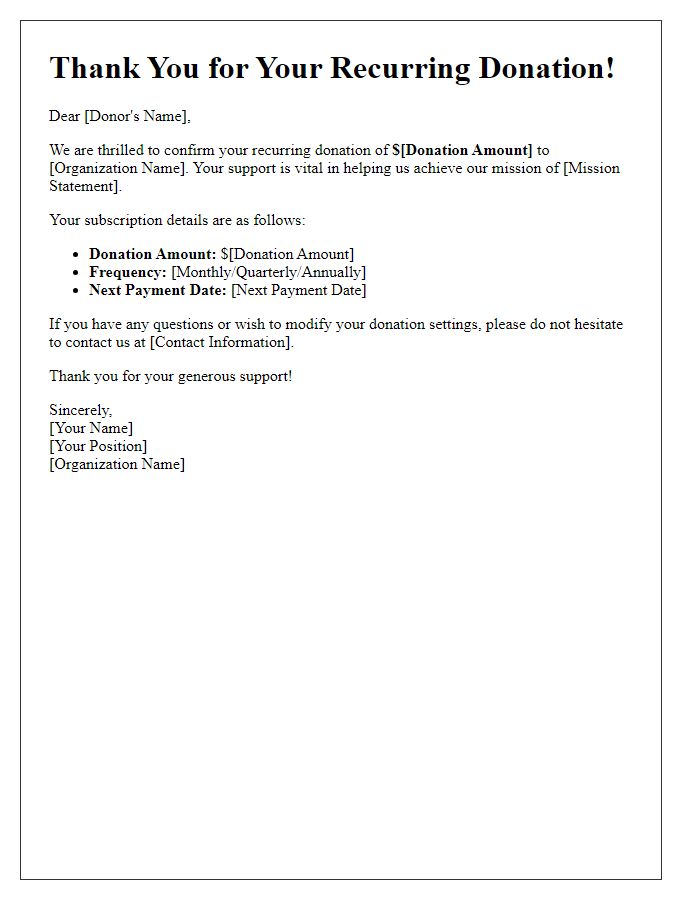

Description of Donation

A charitable contribution receipt must clearly state the specifics of the donation. For instance, an individual may donate $100 to the American Red Cross, identified by its registered charity number 53-0227892, aimed at supporting disaster relief programs. The receipt should include the date of the donation, which in this case could be November 1, 2023. Additional details such as the donation method, for example, a credit card transaction, should also be documented. Furthermore, it may mention that no goods or services were exchanged for this donation, ensuring the donor understands the full tax-deductible nature of their contribution.

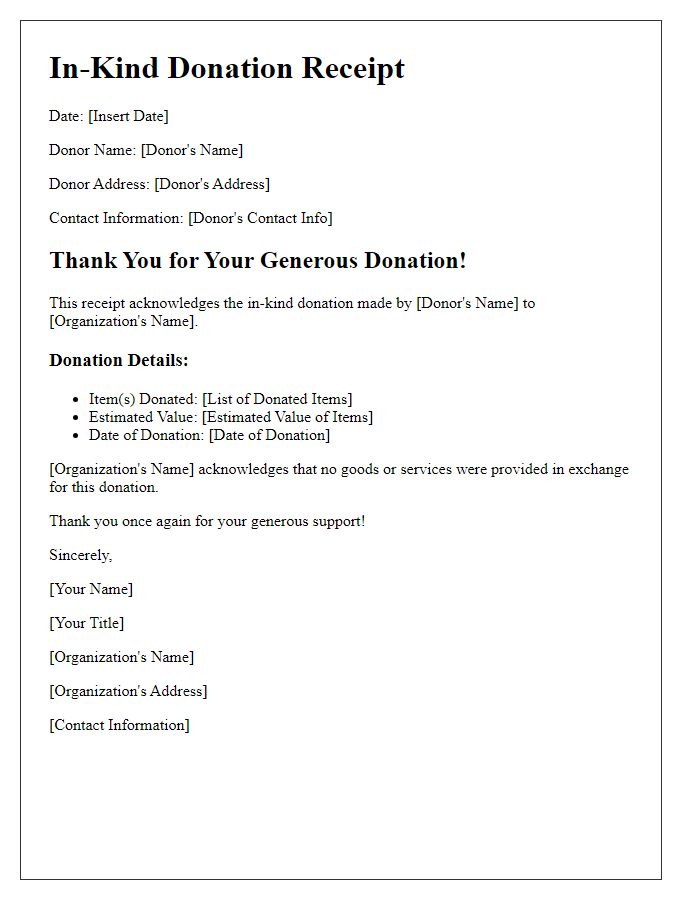

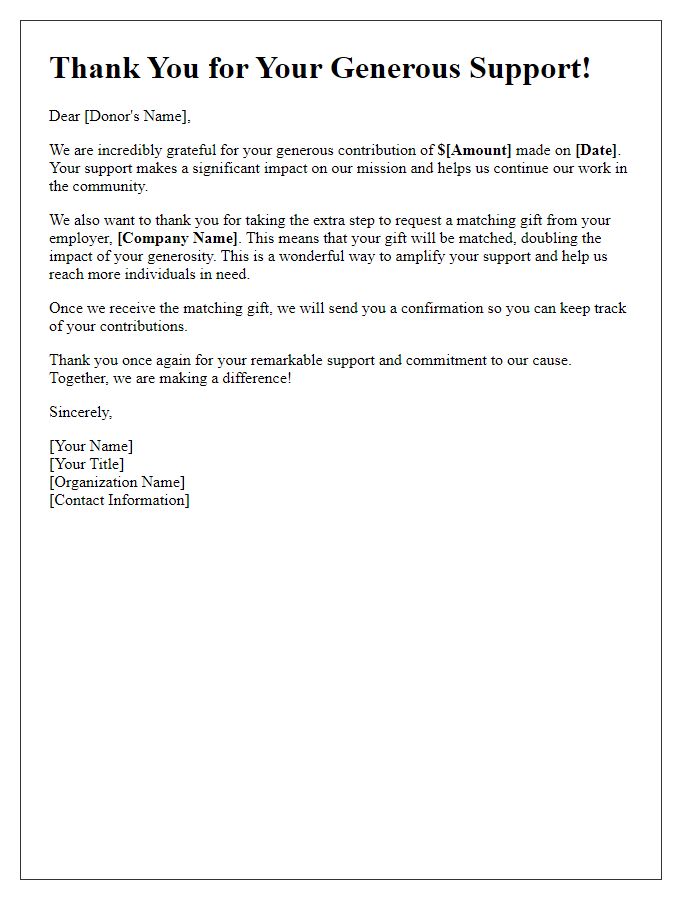

Statement of Value for Non-cash Gifts

Charitable organizations often provide donors with a Statement of Value for non-cash gifts, such as items donated to a nonprofit entity (e.g., clothing, electronics, vehicles). This receipt typically includes the name of the charity, its registered address, and tax identification number for IRS verification purposes. It also details the date of the donation, a brief description of the donated items, and their estimated fair market value, calculated based on appraisals or comparable sales. According to IRS guidelines, if the total value of the non-cash contributions exceeds $500, additional forms, such as Form 8283, may need to be submitted along with the donor's tax return. This process not only affirms the donor's goodwill but also ensures compliance with federal regulations regarding charitable deductions.

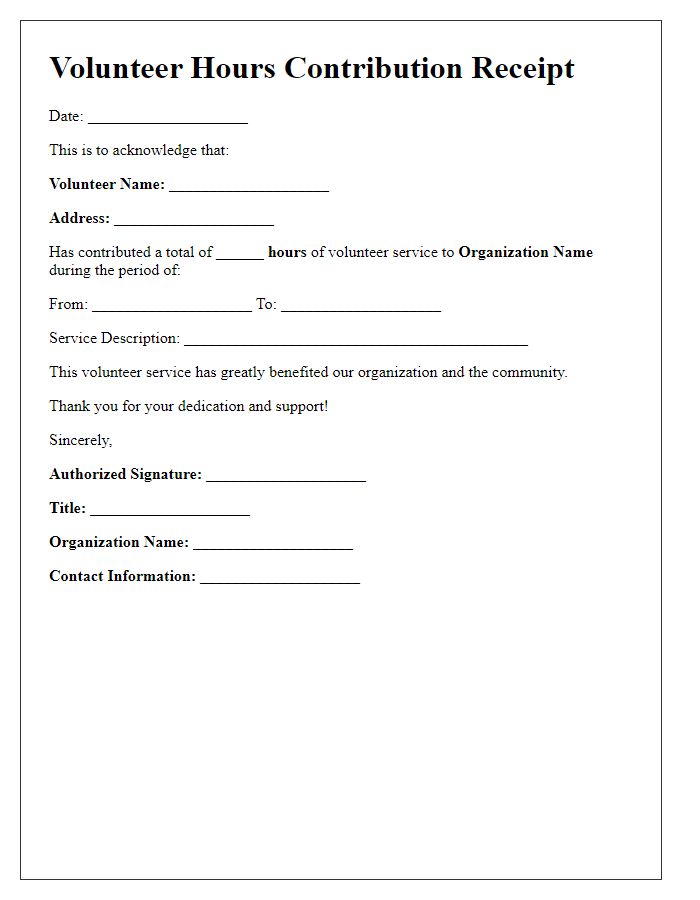

Date and Acknowledgment of Receipt

Acknowledgment of charitable contributions plays a critical role in tax deduction processes. Nonprofit organizations, such as registered 501(c)(3) entities in the United States, provide receipts to donors for contributions, including cash or goods. The date, usually at the time of donation, is essential for record-keeping and annual tax filings. The receipt typically details the donor's name, address, and the organization's information--including the tax identification number--to ensure compliance with IRS regulations. A statement affirming that no goods or services were exchanged for the donation can further solidify the record's validity for tax deductions. Proper documentation aids transparency and accountability within the charitable sector.

Comments