Hey there! If you've ever found yourself in the awkward position of needing to remind someone about a late payment, you're not alone. It can be a tricky conversation to navigate, but having a solid letter template can make the process smootherâand keep your professional relationship intact. In this article, we'll explore effective ways to communicate your reminder tactfully and respectfully, ensuring you get paid without creating unnecessary tension. So, let's dive in and discover the best practices for crafting that perfect late payment reminder!

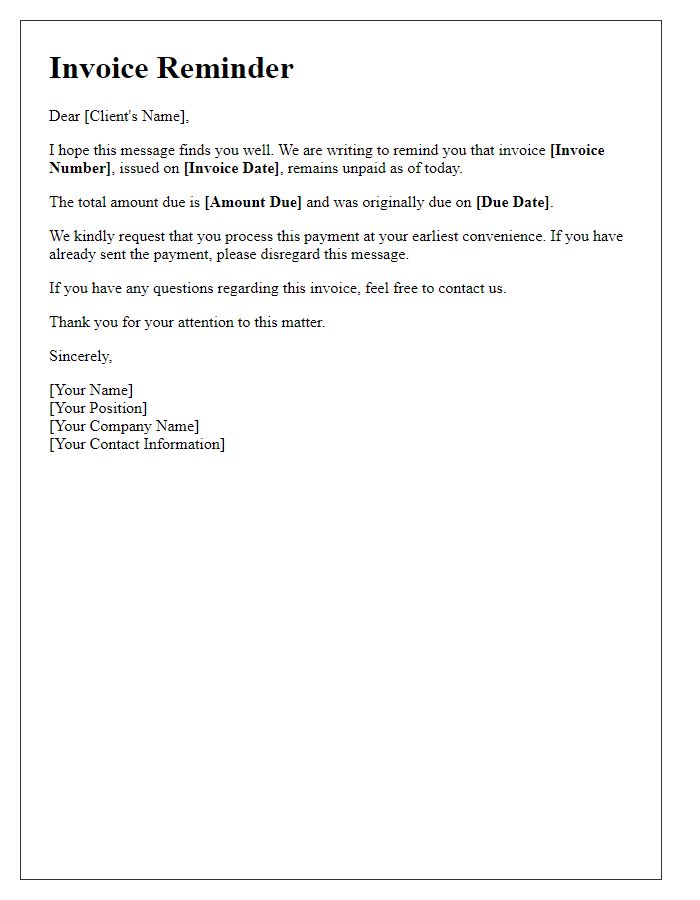

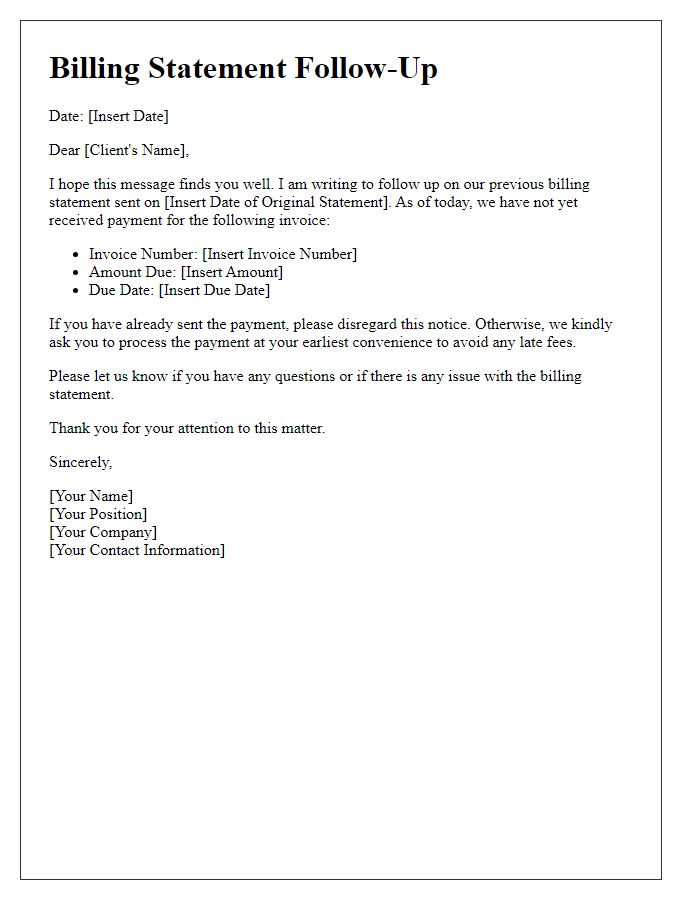

Clear subject line

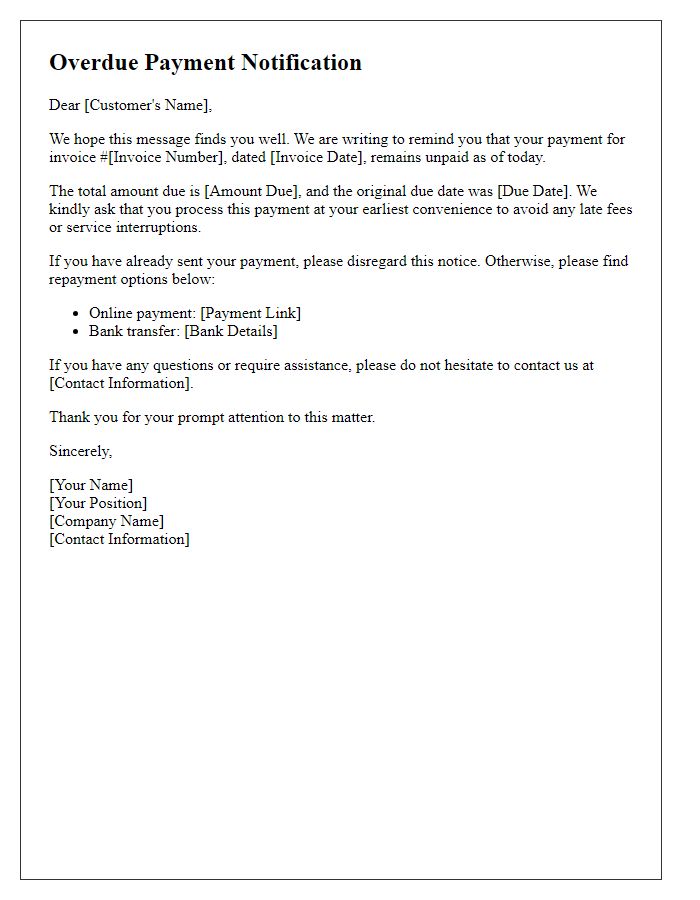

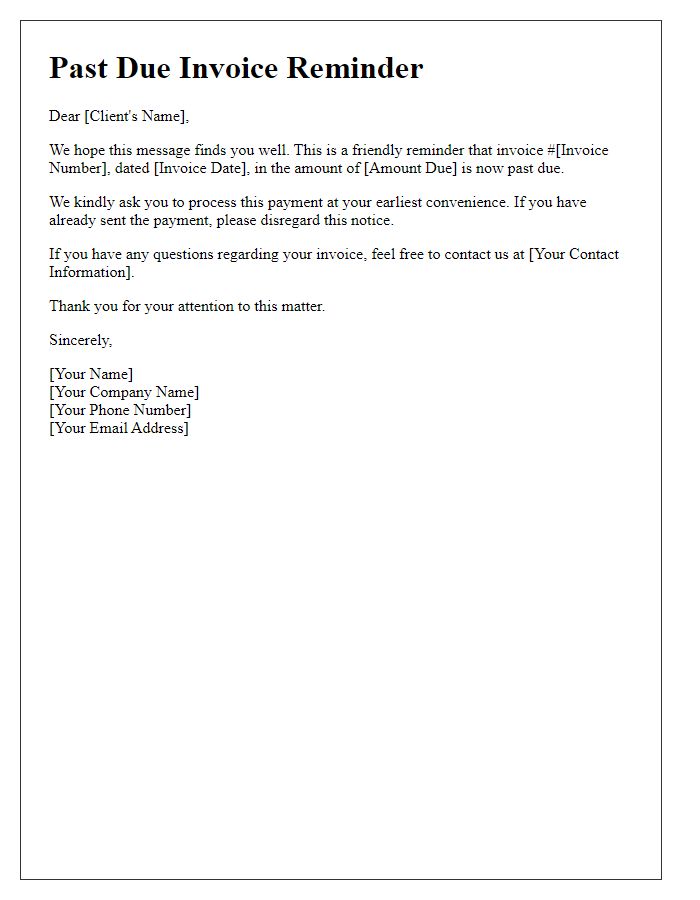

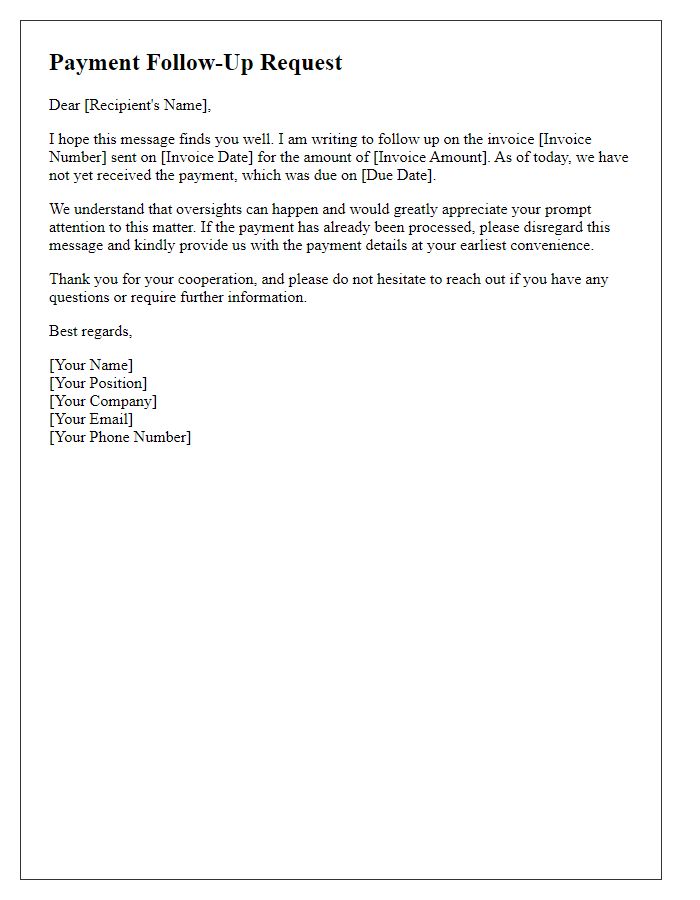

Late payment reminders are essential for maintaining a healthy cash flow in businesses. A subject line like "Friendly Reminder: Invoice #1234 Due" can effectively prompt recipients to take action. Clear communication regarding outstanding amounts, payment due dates, and accepted payment methods can help increase the likelihood of timely payment. Including specific details such as the invoice date (e.g., October 5, 2023), total amount due ($500), and any late fees that may accrue after a certain date (e.g., a 5% fee after October 20, 2023) provides the necessary context. Businesses can enhance engagement by offering additional assistance or clarification on the payment process, ensuring a respectful yet firm tone throughout the reminder.

Polite language

Timely payment of invoices ensures smooth business operations, avoiding potential disruption in services. Outstanding payments can disrupt cash flow, particularly for small businesses reliant on regular income, such as freelancers or service providers. For instance, a payment overdue by 30 days might affect the ability to procure essential supplies or pay employee wages. Regular follow-up communications encourage clients to prioritize outstanding invoices, fostering a respectful business relationship. Effective reminders often include essential details such as the original due date, invoice number, and a clear call to action to facilitate prompt payment.

Amount owed and due date

Outstanding invoices can disrupt cash flow for businesses and create tension in vendor-client relationships. A common scenario involves amount owed, for instance, $500, which was due on September 15, 2023. In such cases, late payment reminders play a crucial role in maintaining financial stability. These reminders typically emphasize the importance of prompt payment to avoid late fees, which can be a percentage of the total amount owed. Clear communication regarding the outstanding balance and the urgency of settling the debt can foster accountability and ensure timely resolution.

Payment methods

Late payment reminders are crucial for maintaining cash flow in businesses. Companies often follow structured approaches such as emails, invoices, or phone calls to communicate with clients. Payment methods include bank transfers, credit cards, and online payment platforms like PayPal or Stripe. Timely reminders (usually within 30 days of the due date) emphasize the importance of fulfilling financial obligations. The company's credit terms, such as net 30 or net 60, help set customer expectations. Firms may apply late fees or interest charges after a certain period to discourage delayed payments. Effective communication regarding late payments ensures healthy financial relationships and supports sustainable business practices.

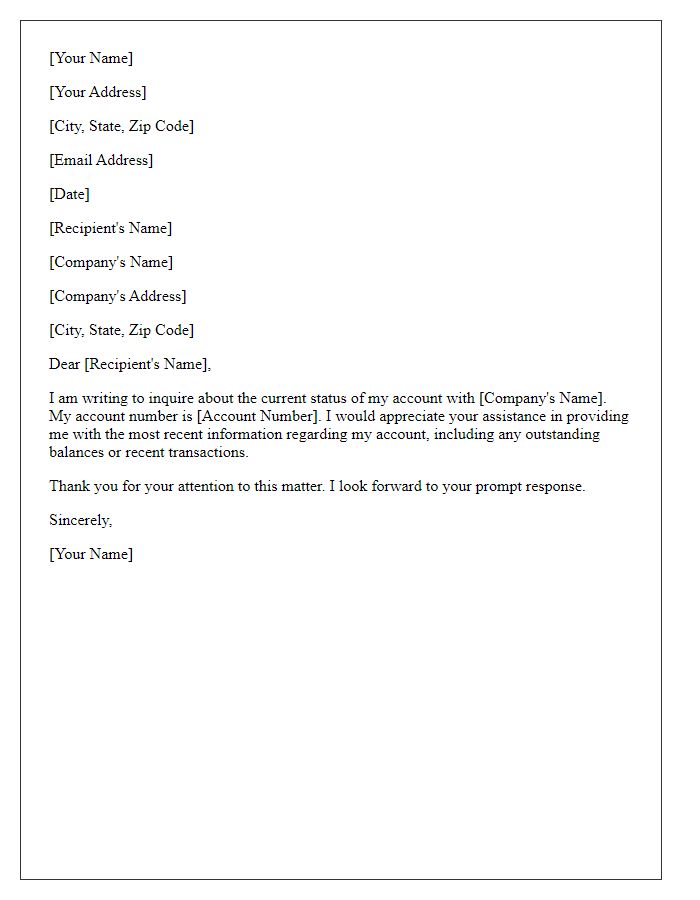

Contact information

Late payment reminders serve as crucial communications for maintaining business cash flow. Businesses like retail companies (e.g., Walmart) and service providers (e.g., telecommunications firms like Verizon) often rely on effective late payment reminders. These reminders typically include details such as invoice numbers, due dates, and outstanding amounts. Contact information for the accounts department or billing office (including email addresses and phone numbers) should be clear to facilitate prompt responses. Including late fees or interest charges as per agreements can further emphasize the urgency and seriousness of the reminder. Clear, professional language helps maintain relationships while ensuring reminders are taken seriously.

Comments