Are you considering a venture capital acquisition but unsure where to start? It's an exciting journey that can propel your business to new heights, but navigating the initial inquiry can feel daunting. In this article, we'll break down essential elements of a venture capital acquisition letter that can make a lasting impression on potential investors. So, if you're ready to turn your ambitions into reality, read on for expert tips and a handy template to guide you!

Clear Value Proposition

The venture capital landscape thrives on clear value propositions that attract potential investors. A compelling value proposition succinctly communicates the unique advantages of a startup, such as innovative technology, disruptive business models, or scalable solutions. For example, in the rapidly evolving renewable energy sector, a company might highlight its proprietary solar panel technology that increases energy efficiency by 30% compared to traditional models. Investors, like those from firms such as Sequoia Capital or Andreessen Horowitz, often seek measurable metrics that demonstrate market potential and revenue projections, such as target revenue growth rates of 200% annually. Furthermore, understanding the competitive landscape and articulating a strong market position within a specific geographic area, such as Silicon Valley, can significantly enhance the appeal of the value proposition. Investors prioritize thorough market analysis, showing trends and consumer behaviors that align with the startup's objectives, fostering confidence in the business's growth trajectory.

Market Opportunity Analysis

Market opportunity analysis involves assessing various factors that influence the potential success of a venture. Key elements include the target market size, identifying industry trends, and understanding competitive landscapes. Analyzing market segments, such as demographics and consumer behavior, reveals the preferences of specific groups, informing strategic decisions. Additionally, examining economic indicators, such as GDP growth rates and consumer spending patterns, provides insights into the market's health. Finally, trends in technology and innovation often create new opportunities for growth, making it essential to stay informed about advancements that could impact the venture's success.

Financial Projections

In a venture capital acquisition inquiry, financial projections play a crucial role in demonstrating the potential viability of a startup or business. Financial projections typically span 3 to 5 years, detailing expected revenue growth, profit margins, and cash flow. Investors focus on key metrics such as Annual Recurring Revenue (ARR), which measures predictable and recurring revenue components. Market analysis, including Total Addressable Market (TAM) estimates, helps assess scalability for the business model. In addition, sensitivity analysis provides insights into how changes in market conditions could affect financial performance. A well-structured forecast encompasses various expenses like operational, marketing, and administrative costs, important for understanding the path to profitability. Accurately anticipated milestones, such as reaching breakeven points and key performance indicators (KPIs), are essential to build investor confidence.

Experienced Management Team

The experienced management team at XYZ Ventures, a firm established in 2010 in Silicon Valley, comprises industry veterans with over 50 years of combined experience in technology startups and venture capital. Key team members include Jane Doe, former COO of a Fortune 500 tech company, who has successfully led multiple high-growth initiatives, and John Smith, a seasoned investor with a track record of funding over 30 startup companies, generating an average ROI of 25%. The team leverages deep industry knowledge and strategic insights to identify disruptive technologies and high-potential markets, fostering innovation and driving sustainable growth in portfolio companies. Their proven leadership and operational expertise position XYZ Ventures as a valuable partner for emerging businesses seeking capital and guidance in a rapidly evolving market landscape.

Potential Return on Investment

The potential return on investment (ROI) in the venture capital sector is influenced by various factors, including market trends, industry growth, and company performance. A promising startup in the technology sector, for instance, may yield significant returns if it captures a substantial market share, potentially leading to multiples of 3x to 10x on initial capital over a five to seven-year horizon. Key industries such as artificial intelligence (AI) and renewable energy have shown a recent uptick in investment activity, with venture capital funding reaching over $300 billion globally in 2021 alone. Investing in these high-growth areas can provide venture capitalists with lucrative exit options, including initial public offerings (IPOs) or acquisitions by well-established corporations. Due diligence on potential portfolio companies, including their business model, competitive landscape, and financial projections, is crucial for maximizing ROI. Furthermore, understanding regional market dynamics, such as those in Silicon Valley or emerging markets in Southeast Asia, can enhance strategic investment decisions and ultimately lead to higher returns.

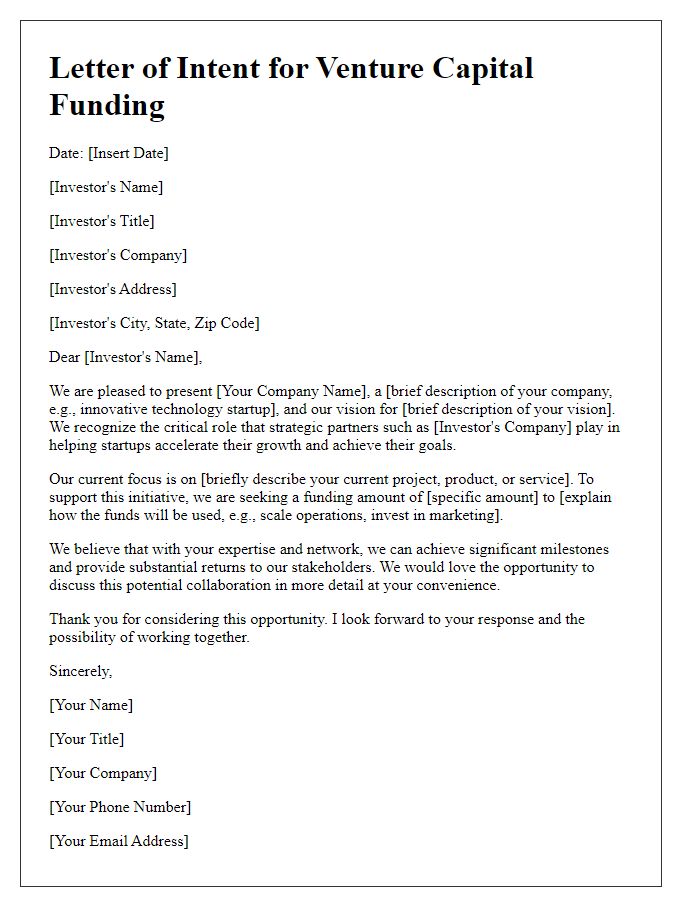

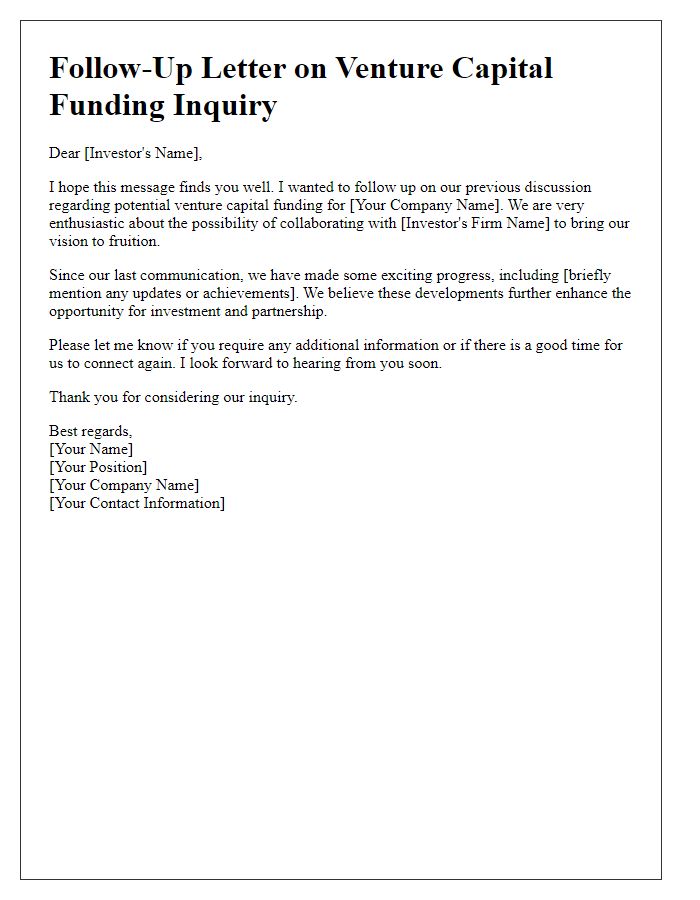

Letter Template For Venture Capital Acquisition Inquiry Samples

Letter template of engagement for venture capital acquisition collaboration

Letter template of expression of interest in venture capital acquisition

Comments