Are you gearing up for a compliance audit and feeling a bit overwhelmed? Preparing for such an important review can be daunting, but with the right approach, it can also be an opportunity for growth and improvement. In this article, we'll share a simple letter template designed to guide you through the compliance audit preparation process, ensuring you're well-equipped for success. So, let's dive in and make your audit preparation as seamless as possibleâread on for more insights!

Regulatory requirements

Compliance audits require thorough preparation to ensure adherence to regulatory requirements, such as those outlined by the Sarbanes-Oxley Act in the United States or the General Data Protection Regulation (GDPR) in the European Union. Organizations must gather documentation, including financial statements, internal controls, and data privacy policies, to demonstrate compliance with these legal frameworks. Key entities involved may include compliance officers, external auditors, and regulatory bodies (like the Securities and Exchange Commission). Additionally, timelines (such as quarterly or annual audit schedules) must be established, ensuring readiness for on-site evaluations and interviews. Proper training for employees on compliance protocols is essential to minimize risks associated with non-compliance, which could lead to substantial penalties or reputational damage.

Audit scope and objectives

The compliance audit scope encompasses all operational processes and regulatory requirements within the organization, specifically focusing on financial reporting standards (such as IFRS - International Financial Reporting Standards) and industry-specific regulations (including GDPR - General Data Protection Regulation for data protection compliance). Key objectives of the audit include identifying potential areas of non-compliance, evaluating the effectiveness of internal controls in mitigating risks, and ensuring adherence to legal mandates such as the Sarbanes-Oxley Act for financial transparency. Additionally, the audit aims to assess employee training programs related to compliance and measure the overall awareness of regulatory obligations among staff members at the headquarters in New York City.

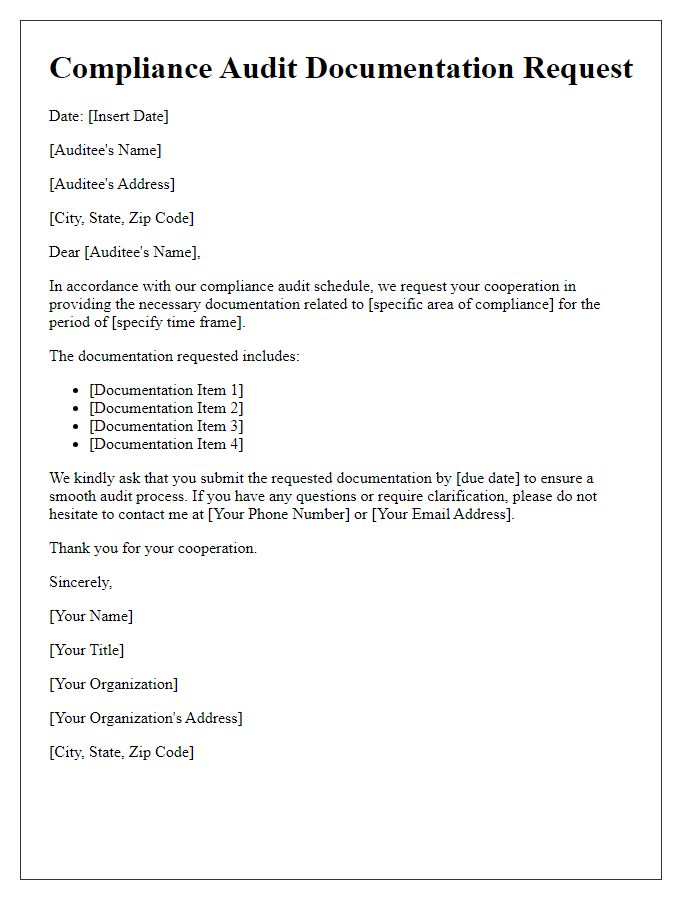

Documentation and records

The preparation for a compliance audit requires meticulous attention to documentation and records, particularly concerning regulatory requirements and company policies. Essential documents include financial statements, which must adhere to Generally Accepted Accounting Principles (GAAP), contracts outlining client and vendor agreements, and training records showcasing employee compliance with safety standards mandated by the Occupational Safety and Health Administration (OSHA). Internal audit reports, generated quarterly by the compliance officer, provide insight into adherence to policies and procedures. By maintaining organized records in a centralized digital repository, accessible to authorized personnel, companies can streamline the audit process, ensuring that all necessary information is readily available for review by external auditors. Regular audits of document integrity must also be performed to mitigate the risk of discrepancies that could lead to regulatory penalties or damage the organization's reputation.

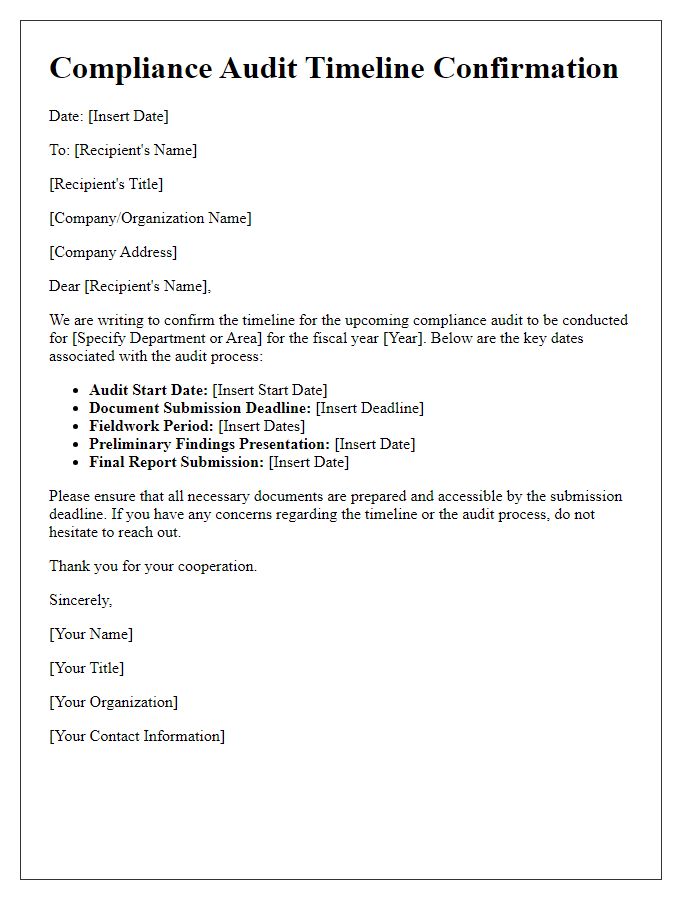

Timeline and deadlines

Preparing for a compliance audit involves a detailed timeline and specific deadlines to ensure all relevant documentation and protocols are thoroughly reviewed. Typically, the audit preparation timeline spans several weeks, starting approximately six weeks prior to the audit. The initial phase focuses on identifying key compliance areas, such as financial regulations, occupational safety standards, or data protection laws, including GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act) compliance. By the four-week mark, teams should conduct a comprehensive internal review, addressing deficiencies identified in previous audits or risk assessments. Two weeks before the audit, finalize documentation such as policy manuals, procedural guidelines, and training records. A week in advance, prepare a walkthrough of operations, ensuring that all staff are briefed and aware of their roles during the audit process. Lastly, make arrangements for auditor accommodations and an agenda for the audit day, ideally one business day before the actual audit, to facilitate a smooth transition and response to auditor inquiries.

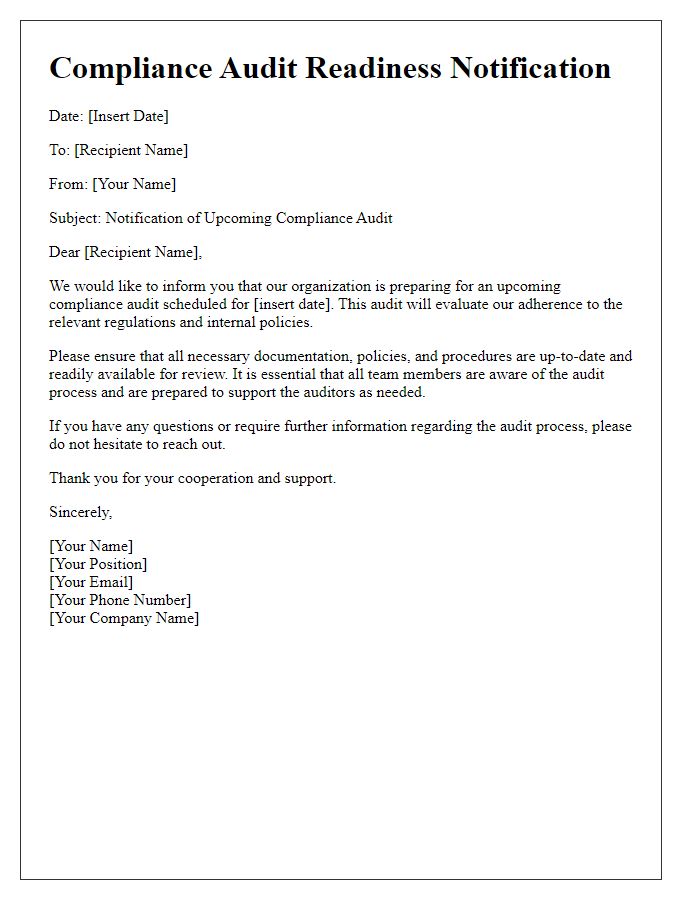

Contact information and support

During the compliance audit preparation phase, ensuring accurate contact information is crucial for seamless communication and support. Key stakeholders include the Compliance Officer, typically stationed at the headquarters in New York City, reachable at (555) 123-4567, and the Legal Counsel, based in the corporate office in San Francisco, who can be contacted via email at legal@company.com. Support teams, such as IT and HR, play vital roles; the IT support team, located in the head office, is available at (555) 987-6543. Additionally, maintaining a dedicated email alias, compliance.support@company.com, allows for organized inquiries and feedback during the audit process. This structured contact framework facilitates efficient coordination among all parties involved as they prepare for the audit.

Comments