Are you looking for a straightforward yet professional way to notify your clients about closing their accounts? It's essential to communicate this sensitive information clearly while maintaining a positive relationship. In this article, we'll explore a versatile letter template that ensures transparency and respect for your clients' needs. So, let's dive in and discover how to craft the perfect closing client account notification!

Client Information and Account Details

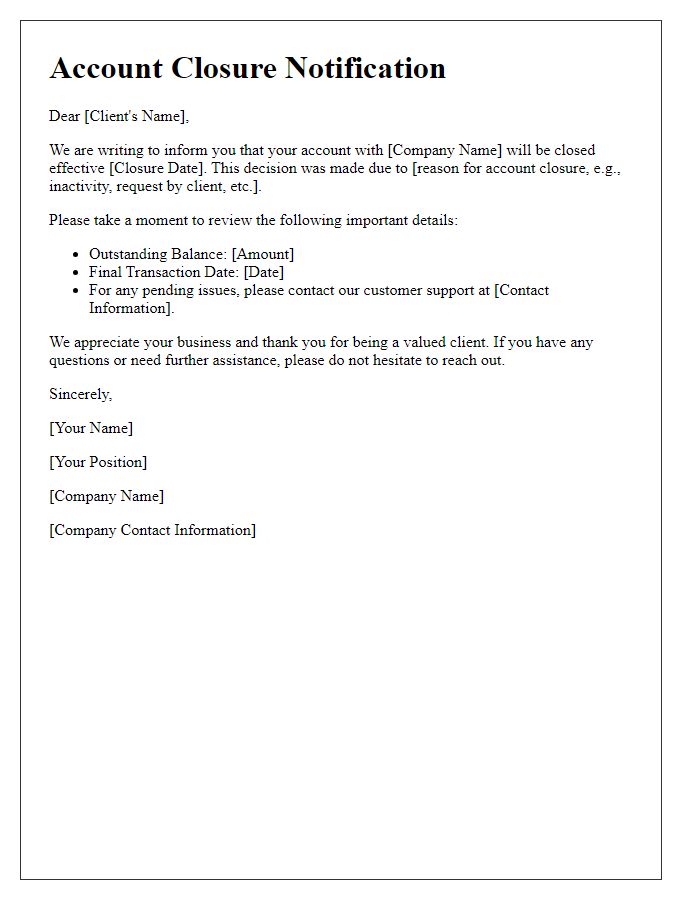

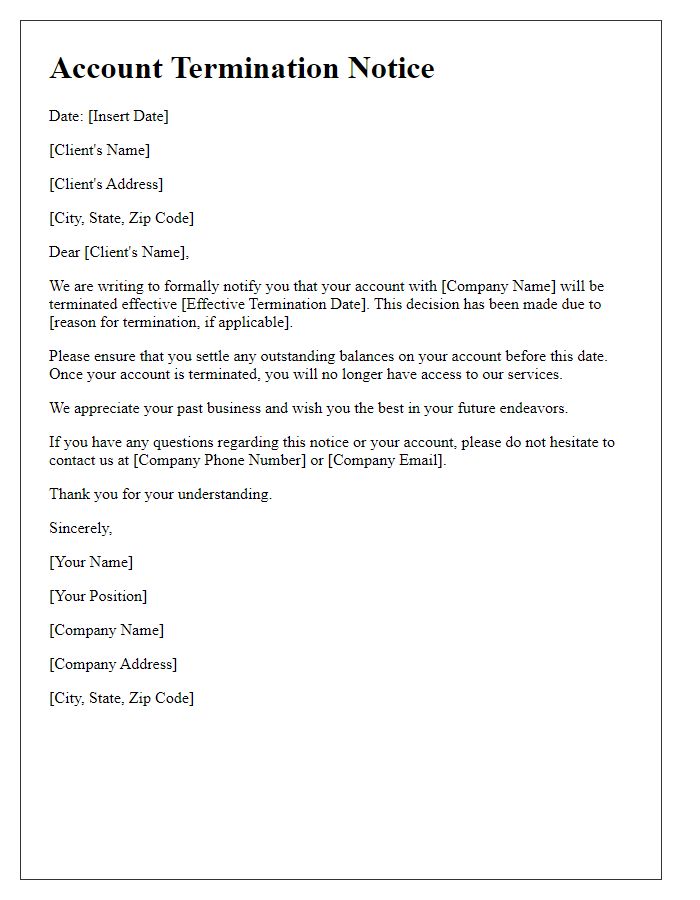

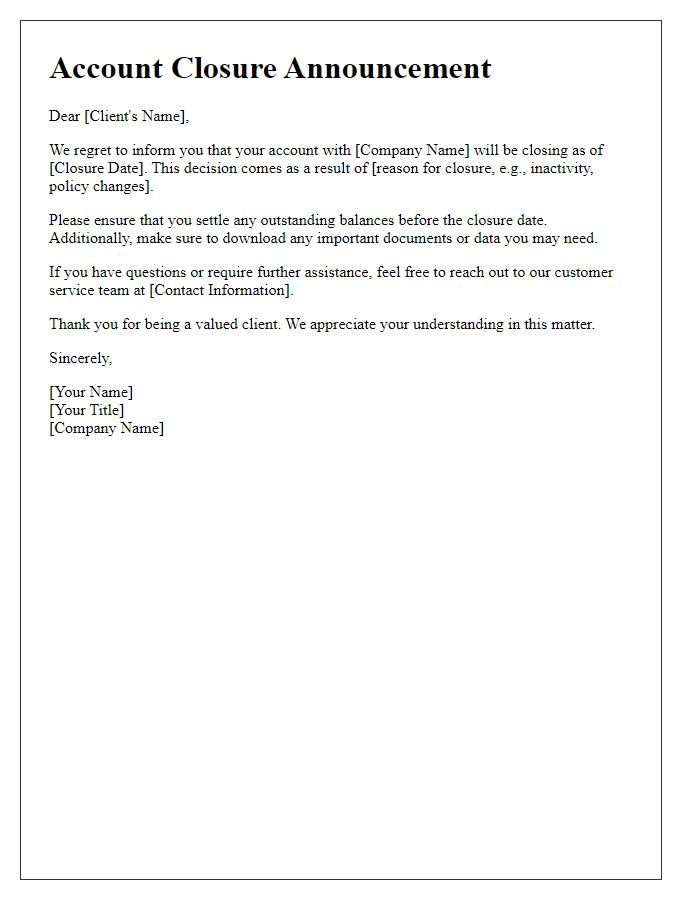

Closing client accounts often involves important client information and specific account details. This includes identifying the client's full name, account number, and account balance, along with any recent transactions relevant to the account closure. Proper notification requires clarity on the final steps, such as the date of closure and any potential refunds or outstanding fees. It is crucial to ensure that the client understands the implications of closing their account, including access to final statements and the procedure for retrieving any remaining funds. Providing alternative options for future banking needs or services may also be beneficial to facilitate a smooth transition.

Reason for Account Closure

A formal notification regarding the closure of a client account requires a thoughtful approach to convey the necessary details with clarity. This communication may include reasons such as inactivity over a specified period (e.g., 12 months), or a decision made by the client to discontinue services. This type of correspondence could also involve discussions related to compliance issues (e.g., failure to provide requested documentation) or changes in company policy affecting account maintenance fees. Accounts linked to certain types of services, like savings accounts with minimum balance requirements, often face closure due to failure to meet those prerequisites. Ensuring that the client understands the specific circumstances leading to this decision is essential for maintaining goodwill and facilitating any required final transactions.

Effective Date of Closure

Closing a client account can be a significant decision impacting both the institution and the client. A formal notification should clearly indicate the effective date of closure. This date serves as the final day of account activity, transactions, and any potential fees or penalties that may apply. Timely communication is essential, ideally providing clients with at least a 30-day notice before the effective date. This allows clients to withdraw funds, complete necessary transactions, and understand any implications of the account closure. Including relevant contact information for client inquiries further enhances clarity during this transition.

Final Account Balance and Settlement Instructions

A closing client account notification involves informing the client about the final account balance and providing settlement instructions. Clients must be made aware of their final balance, which includes any pending transactions, fees, or penalties before account closure. Ensure clarity in listing the total amount, typically presented in the currency of the account, such as US Dollars or Euros. Outline settlement instructions meticulously, detailing the method of withdrawal, whether via direct bank transfer, check issuance, or electronic payment platforms like PayPal. Mention any deadlines for processing these requests, which may vary based on the institution's policies, typically ranging from 7 to 14 business days. Emphasize the importance of reviewing all statements prior to closure to confirm accuracy, ensuring transparency and trust throughout the closure process.

Contact Information for Further Assistance

Closing a client account can lead to confusion or concern, necessitating clear communication. Clients should be provided with an easy-to-access contact information section that includes a dedicated support hotline, email address, or service desk link. Having these resources readily available ensures clients can seek assistance for questions or issues regarding their account closure. It's essential for businesses to maintain a supportive relationship, allowing clients to feel valued and informed even during the transition away from the service. Ensuring that customer service representatives are trained to handle account closure inquiries can enhance client experience and increase satisfaction despite the account termination.

Comments