Are you ready to tackle the complexities of project financial reconciliation? This essential process not only ensures that your project's expenses align with its budget but also helps to identify any discrepancies that could impact your overall financial health. By carefully analyzing your financial records, you can foster transparency, accountability, and trust among stakeholders. So, let's dive deeper into the best practices and tips for effective project financial reconciliation!

Header with Company Information

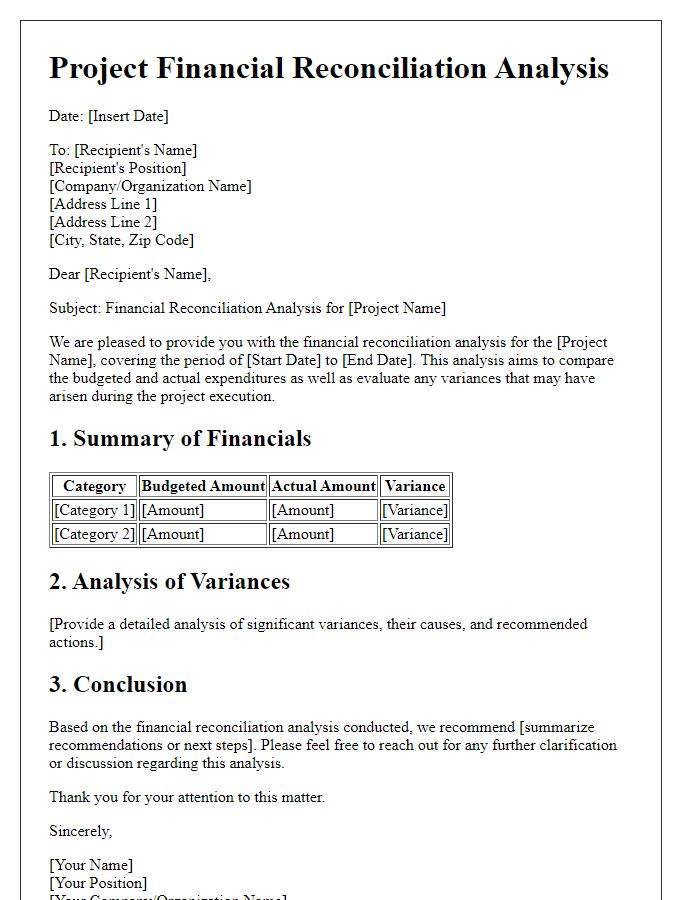

Inaccurate financial records can significantly impact project outcomes, often leading to budget overruns and delayed timelines. For instance, discrepancies in invoicing processes may arise from manual entry errors, especially in high-volume sectors like construction. Implementing a systematic reconciliation process, such as zero-based budgeting, ensures that costs align with project deliverables, facilitating financial clarity. Utilizing software tools like QuickBooks or Sage can streamline data tracking across multiple projects, enhancing transparency. Stakeholders, including project managers and financial analysts, should conduct regular reviews--monthly or quarterly--to mitigate risks associated with financial mismanagement. Business compliance with audit standards, such as those outlined in the Sarbanes-Oxley Act, is essential to uphold integrity in financial reporting for all company initiatives.

Project Details and Reference

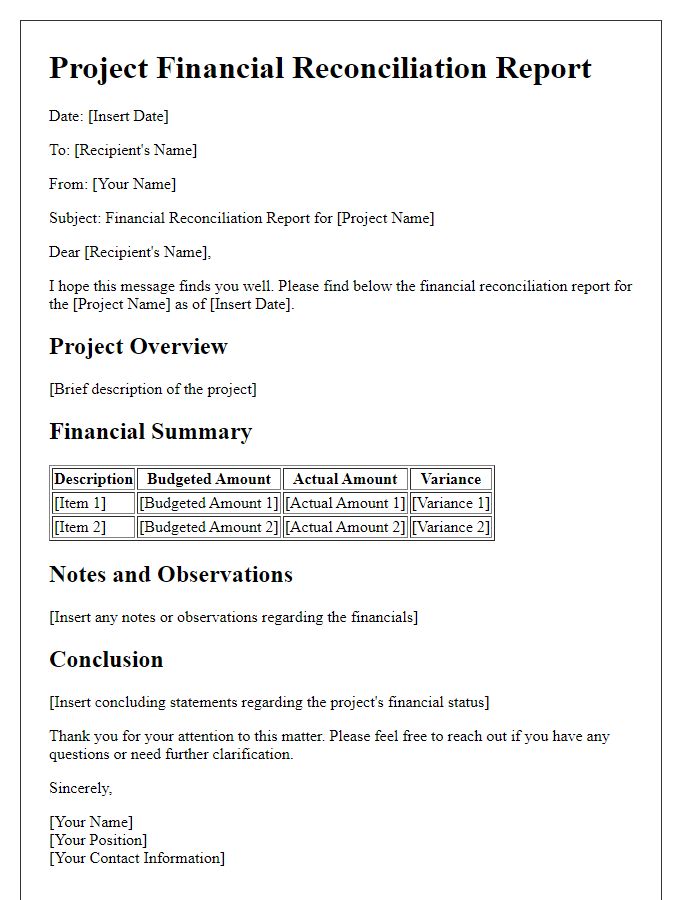

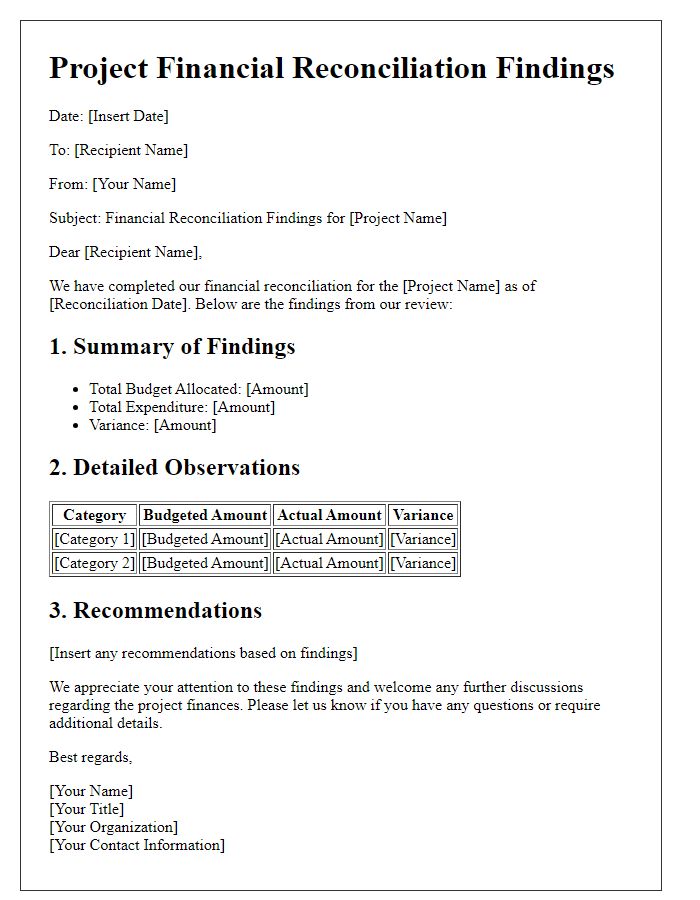

Project financial reconciliation necessitates a comprehensive overview of financial transactions and budget alignment, particularly for large-scale initiatives, such as the Global Clean Water Project, which is budgeted at $2 million. This process involves a meticulous audit of expenses, including direct costs like construction materials and indirect costs like administrative overhead, across various phases of the project. The reconciliation will examine all invoices, receipts, and financial statements during the specified period, ensuring alignment with the predetermined budget outlined in the project proposal submitted to the International Development Agency. Any discrepancies identified will necessitate further investigation, involving discussions with stakeholders located in various regions, including East Africa and Southeast Asia, to verify expenditures and ensure compliance with funding guidelines. Adhering to this rigorous financial tracking enables project managers to adjust future budget forecasts and maintain transparency with funding partners.

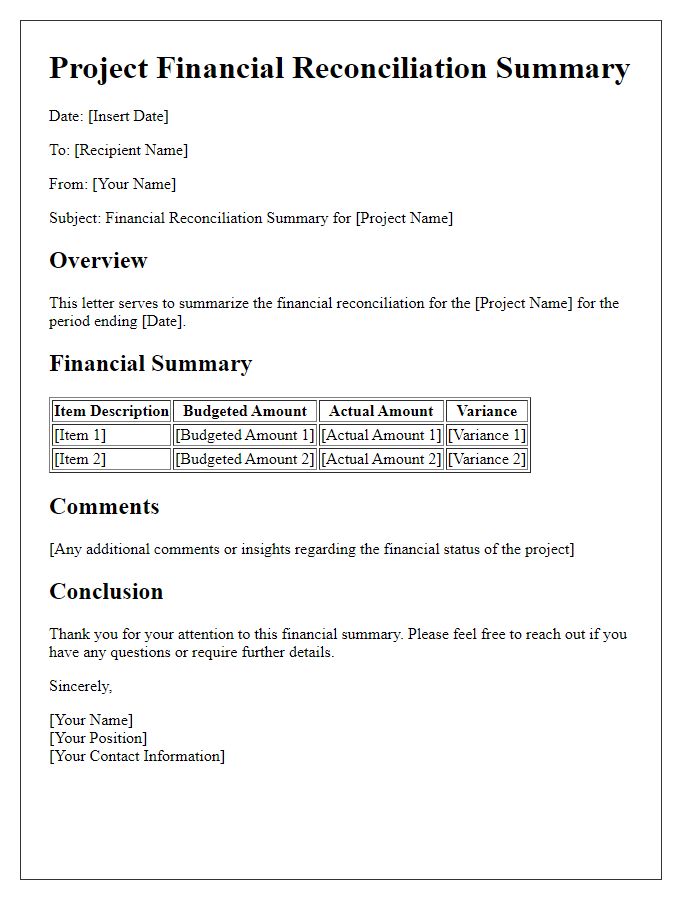

Financial Summary Section

A comprehensive financial reconciliation is essential for any project, especially when assessing the overall financial health and operational efficiency of initiatives within organizations. In project financial summaries, it's crucial to highlight budgeted figures against actual expenditures to identify variances. For instance, a project budget of $500,000 allocated for building renovations in downtown Chicago can be evaluated against incurred costs, detailing categories like materials and labor. Significant discrepancies might indicate areas requiring strategic review or potential future adjustments. Additionally, comprehensive tracking of cash flow is vital; inflows and outflows should be monitored monthly to ensure that financial resources are aligned with project milestones, ultimately aiding in informed decision-making for subsequent fiscal periods.

Itemized Transaction Breakdown

Itemized transaction breakdown provides a detailed view of financial activities related to a specific project, ensuring transparency and accountability. Each transaction records essential elements such as transaction date, vendor name (e.g., XYZ Supplies), purchase description (e.g., office supplies), and amounts (e.g., $250.00 for materials). Tracking expenses against budgetary allocations (originally set at $5,000.00) aids in evaluating financial performance. Inclusion of invoice numbers (e.g., INV-2023-045) streamlines auditing and verification processes. Variances from expected costs, perhaps a 15% increase in material expenses, must be highlighted for further analysis. This detailed breakdown not only supports effective financial management but also facilitates stakeholder communication regarding project status and budget adherence.

Closing and Contact Information

The financial reconciliation process for projects requires meticulous attention to detail and thorough documentation to ensure accuracy. Closing balances must be verified against the initial budget estimates, highlighting variances that arose throughout the project's lifecycle. Contact information, such as project manager details (including name, phone number, and email), should be clearly stated for any follow-up or queries. Comprehensive records of expenditures, income sources, and financial forecasts must be compiled in an accessible format, allowing stakeholders to easily assess the project's overall financial health. Additionally, including relevant financial statements, such as profit and loss statements or balance sheets, enhances transparency and aids in future project planning.

Comments