Are you embarking on a construction project that needs funding approval? Securing the right financial backing can often feel like navigating a maze, but it doesn't have to be daunting. In this article, we'll explore practical steps and helpful templates to guide you through the process, ensuring you present your project in the best light possible. So, if you're ready to learn how to craft a compelling letter that captures the attention of potential investors, keep reading!

Project Overview and Objectives

The proposed construction project aims to develop a state-of-the-art community center in downtown Springfield, enhancing local social infrastructure. This facility will cover approximately 15,000 square feet, offering multipurpose rooms, a gymnasium, and leisure areas, serving a population of over 50,000 residents. The primary objectives include promoting community engagement, providing educational programs, and hosting cultural events. The project budget is estimated at $3 million, with funding sought through state grants, local government contributions, and private donations. Anticipated completion date is June 2025, ensuring timely delivery for summer programs and activities. The project aligns with Springfield's urban development plan, fostering economic growth and improving quality of life.

Detailed Budget and Financial Analysis

A comprehensive financial analysis is crucial for securing funding approval for construction projects, like the upcoming residential development in downtown Austin, Texas. The detailed budget breakdown outlines major expenses, including materials (such as steel and concrete), labor costs (estimated at $1.5 million for skilled workers), and equipment rental fees (approximately $250,000 for cranes and bulldozers). Additionally, project management overhead (set at 10% of total costs), permits and inspection fees (around $50,000), and contingency funds (15% reserved for unforeseen expenses) are meticulously calculated. The total projected budget stands at $5 million, reinforcing the necessity of a well-structured financial plan to persuade potential investors for funding approval. Timeframes for the construction phases, funding milestones, and return on investment estimations further solidify the viability of the project.

Risk Assessment and Mitigation Strategies

Construction project funding requires a thorough risk assessment to identify potential hazards, ensuring safety and financial viability. Key risks include project delays, cost overruns, and environmental compliance issues. The mitigation strategies involve regular project reviews, cost monitoring techniques, and adherence to regulations set by bodies like the Environmental Protection Agency. Additionally, implementing safety protocols, such as OSHA standards, and employing skilled labor can minimize operational risks. Contingency funds of 10-15% of the total budget may be allocated to address unforeseen circumstances. Collaboration with insurance providers, like the Builders Risk Insurance policy, enhances coverage against property damage and liability issues. Each of these measures contributes to a robust framework that supports the funding approval process by demonstrating comprehensive risk management.

Compliance with Regulatory Standards

Compliance with regulatory standards is a critical aspect of construction project funding approval. Each project must conform to local, state, and federal regulations, such as the International Building Code (IBC) and Environmental Protection Agency (EPA) guidelines. For instance, a recent project in San Francisco, California, required adherence to stringent seismic safety standards due to the city's geographical vulnerability to earthquakes. In addition, funding authorities often demand evidence of compliance with zoning laws, which determine land use and building heights, as seen in the case of Chicago's Loop area where mixed-use developments must meet specific zoning requirements. Documentation demonstrating compliance, such as environmental assessments and safety inspections, must be submitted to secure financing, ensuring that projects not only meet regulatory obligations but also maintain the safety and welfare of the community.

Sustainability and Environmental Impact Evaluation

Sustainability and environmental impact evaluations play a crucial role in construction project funding approvals, ensuring compliance with regulations and community standards. These evaluations assess potential effects on surrounding ecosystems, flora, and fauna, as well as long-term sustainability practices. In 2023, the U.S. Green Building Council emphasized the importance of LEED certification, incorporating metrics related to energy efficiency, waste reduction, and water conservation. Evaluators consider the project's carbon footprint, with projects ideally aiming to reduce greenhouse gas emissions by 30% or more compared to traditional construction methods. Additionally, stakeholders analyze local biodiversity, ensuring minimal disruption to habitats, particularly in environmentally sensitive areas like wetlands and endangered species habitats. The evaluation process involves community consultations, detailed reporting, and adherence to guidelines set forth by entities such as the Environmental Protection Agency (EPA) to guarantee a balance between development and ecological preservation.

Letter Template For Construction Project Funding Approval Samples

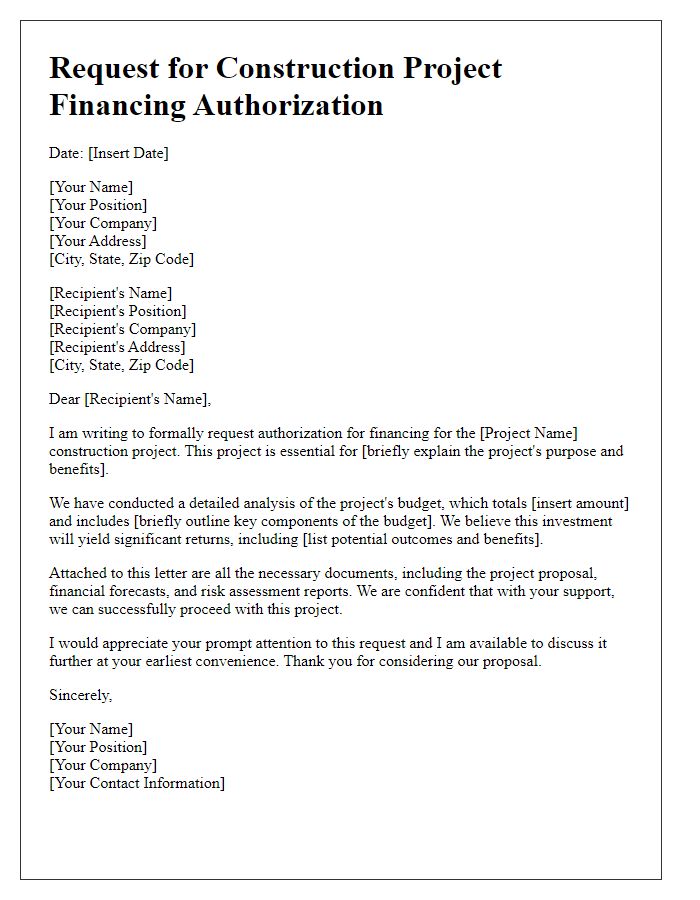

Letter template of request for construction project financing authorization

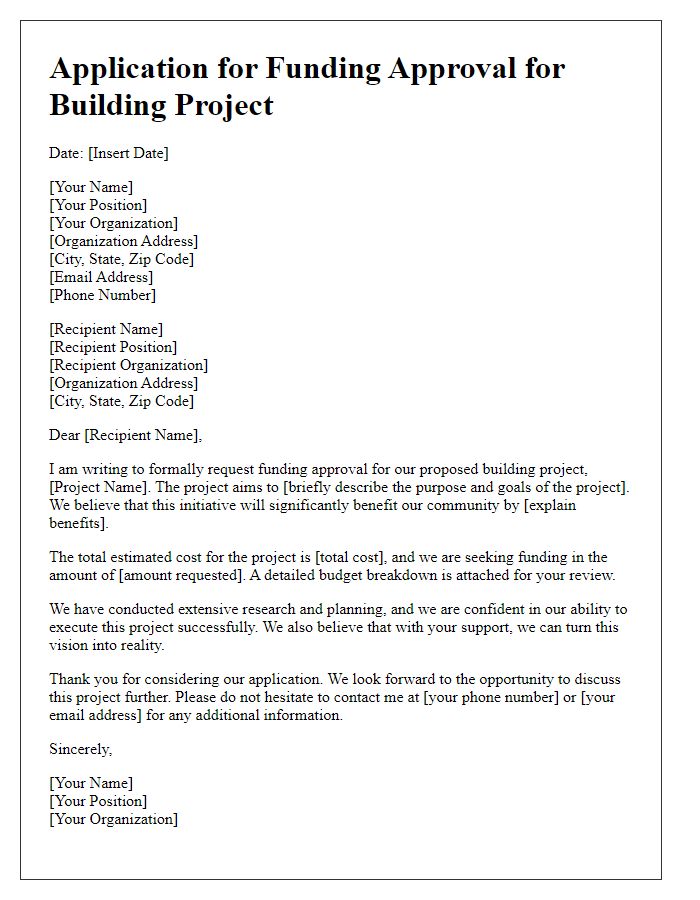

Letter template of application for funding approval for building project

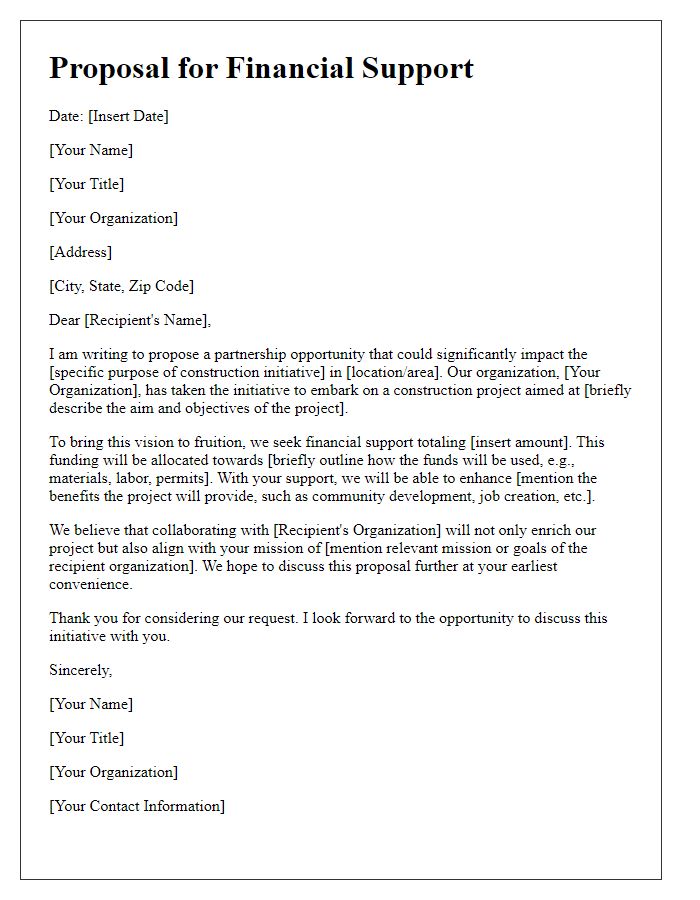

Letter template of proposal for financial support for construction initiative

Letter template of inquiry for investment approval in development project

Letter template of formal request for budget allocation for construction work

Letter template of solicitation for sponsorship in infrastructure project

Letter template of petition for capital funding for construction endeavor

Letter template of demand for project funding endorsement for building work

Letter template of notification for approval request regarding construction financing

Comments