Are you eagerly awaiting the confirmation of your tax refund? We understand how important it is to keep track of your finances, especially during tax season. In this article, we'll explore the essential components of a confirmation letter for tax refund acceptance, ensuring you have everything you need to stay informed. So, let's dive in and discover how to create the perfect template for your confirmation letter!

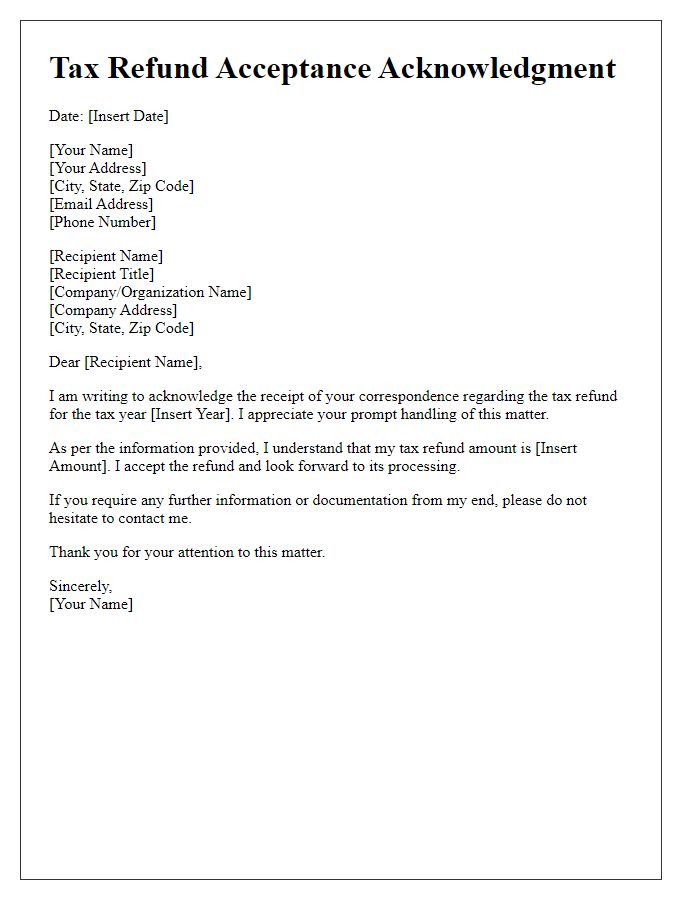

Personal Information

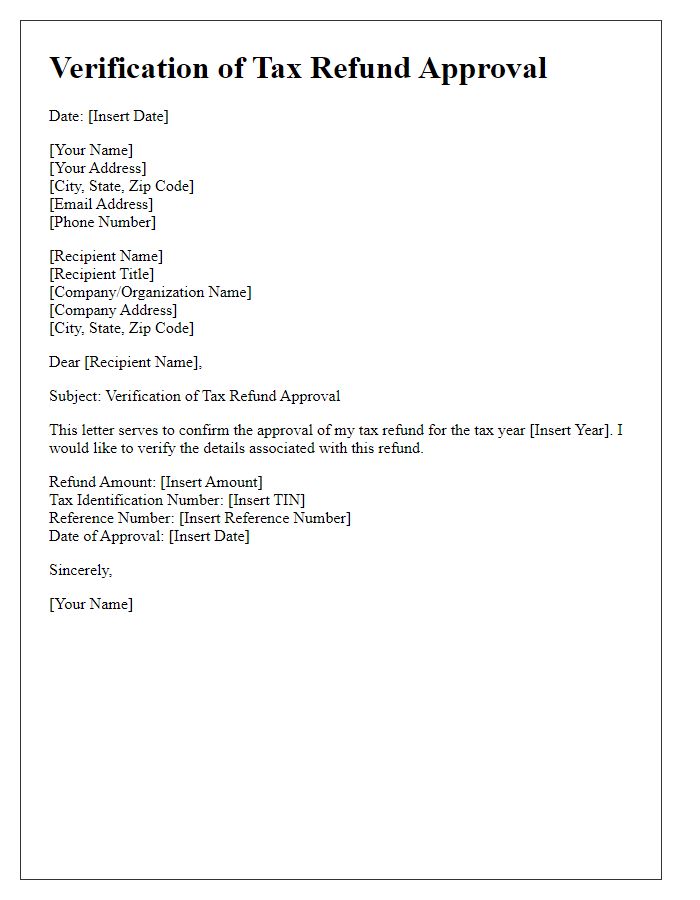

Confirmation of tax refund acceptance provides crucial details for taxpayers. This document typically includes personal information such as name, address, and taxpayer identification number (TIN) for accurate identification. Tax year reference ensures clarity regarding the specific tax period being addressed. Refund amount indicates the total sum eligible for reimbursement, often tied to various deductions or credits claimed on the tax return. Acceptance date signifies when the tax authority, such as the Internal Revenue Service (IRS) in the United States, officially verified the refund. Additionally, tracking information may be provided, allowing taxpayers to monitor the status of the refund process through official channels.

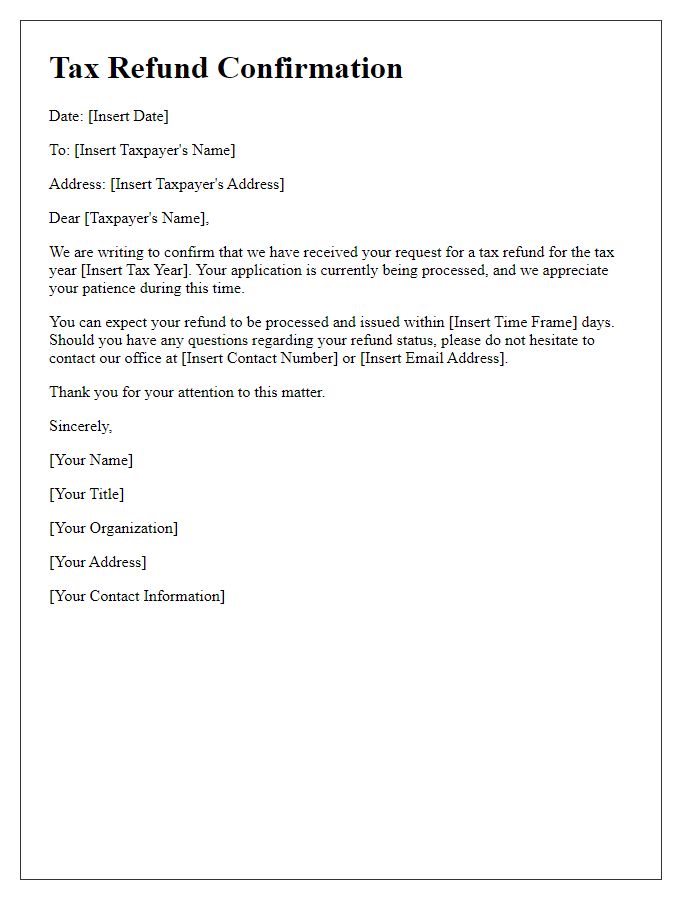

Taxpayer Identification

Taxpayer Identification Numbers (TIN) serve as unique identifiers for individuals and entities in the United States tax system. The Internal Revenue Service (IRS) processes requests for tax refunds based on information associated with this number. Refund acceptance can occur through various methods, including direct deposit, which is often faster than traditional paper checks. Upon submission, taxpayers may receive electronic confirmation within 24 hours, while paper submissions can take several weeks. Additionally, the IRS Refund Status tool allows individuals to track their refund, providing updates as it progresses through the system. Timely communication from the IRS ensures that taxpayers remain informed about their refund status, which is crucial for financial planning and budget management.

Tax Assessment Details

Tax assessment details, including refund acceptance, play a crucial role in personal finance management. A tax refund, often processed by government agencies such as the Internal Revenue Service (IRS) in the United States, can significantly impact an individual's financial strategy. For instance, the average tax refund in recent years has been around $2,800, a substantial sum that can assist in various expenses such as paying off debt, funding savings accounts, or investing in retirement plans. Furthermore, timely processing of tax refunds typically occurs within 21 days from the filing date, providing quick access to funds. Maintaining accurate tax assessment details, including forms such as the 1040 and W-2, is essential for ensuring smooth communication with tax authorities and avoiding potential delays.

Refund Amount Confirmation

The confirmation of tax refund acceptance relates to the successful processing of a tax refund claim submitted by an individual or business entity. The refund amount, often calculated based on tax overpayments or eligible deductions, is critical for financial planning. For example, the IRS (Internal Revenue Service) in the United States typically issues refunds processed within 21 days; the refund amount can vary greatly, ranging from $1 to several thousand dollars depending on the taxpayer's income and deductions. Taxpayers should receive a notice indicating the accepted refund amount, ideally by mail or through digital platforms, which details the submission date, the processing timeframe, and any pertinent information about the refund method, such as direct deposit or a mailed check. Timely confirmation allows recipients to manage their finances effectively, ensuring compliance and awareness of potential tax obligation adjustments.

Contact Information and Queries

Tax refund acceptance confirmations are crucial communication in the financial sector, underscoring the importance of accurate documentation and clear communication. Tax agencies like the Internal Revenue Service (IRS) in the United States handle millions of refunds annually, amounting to billions of dollars. Recipients typically range from individual taxpayers to large corporations, with varying refund amounts dependent on income thresholds and deductions. Confirmation letters outline essential details, such as taxpayer identification numbers, refund amounts, and expected timelines for deposit, ensuring transparency. Queries regarding the refund status can be directed to dedicated phone lines or online portals, enabling taxpayers to address concerns promptly and enhancing customer service.

Comments