Change can be daunting, especially when it involves something as important as your bank account details. However, understanding the process of confirming a change to your account number can make it a lot smoother. In this article, we will walk you through a simple letter template that you can use to notify your financial institution about your new account number. So, let's dive in and explore how you can easily communicate this important update!

Subject Line Clarity

Subject lines in emails are crucial for conveying the purpose of the message clearly and efficiently. A well-crafted subject line can significantly increase the likelihood of engagement and prompt action from the recipient. For instance, phrases like "Confirmation of Account Number Change" or "Updated Account Number Notification" directly inform the recipient about the email's content. Additionally, including the date or relevant account details (like the last four digits of the account number) can enhance specificity, helping the recipient to quickly identify the email's context. Clear subject lines reduce misunderstandings, promoting effective communication and ensuring important information is not overlooked in busy inboxes.

Recipient Information

A confirmation of an account number change is an important notification for clients, ensuring the security of financial details. The message typically includes recipient information such as full name, address, and possibly an account number associated with the previous account to maintain clarity. Additionally, date of the change, along with the new account number, should be clearly stated. This communication helps prevent confusion and provides reassurance about the account's integrity. In cases involving banks like Chase or services like PayPal, it may also detail any necessary steps for verification to safeguard against fraud.

Clear Confirmation Statement

Account number changes can significantly affect access to banking services. A clear confirmation statement is essential for customers to understand the update fully. This statement should include the new account number and the effective date (typically within 1-5 business days) to avoid potential confusion. Customers may require this documentation for future reference or transactions. Additionally, it is prudent to ensure that contact information remains up-to-date, including customer service phone numbers or email addresses. Bank systems should prioritize security measures throughout this process to protect sensitive information from unauthorized access.

Updated Account Number

Updating an account number requires notifying customers regarding changes for accuracy and security. The updated account number serves as a unique identifier for transactions and account management. Changes often occur due to bank mergers or updates in banking software. The notification should assure customers about the security of their information while emphasizing the importance of using the new account number for future transactions. Failure to use the updated account number may result in transaction failures or delays, causing potential inconvenience. Ensuring prompt communication about such changes is essential for maintaining customer trust and operational efficiency.

Contact Information for Assistance

In the process of managing financial accounts, the confirmation of an account number change is essential for maintaining accurate records. Customers are advised to verify updates via official communications from their bank, ensuring the integrity of personal data. For any inquiries or concerns regarding the alteration, the designated Customer Service department, reachable at 1-800-123-4567, is available Monday through Friday from 9 AM to 5 PM EST. Additionally, secure online access through the bank's website can provide real-time information regarding account status. Safeguarding personal information during this process is paramount, requiring customers to use only verified sources for communication.

Letter Template For Confirmation Of Account Number Change Samples

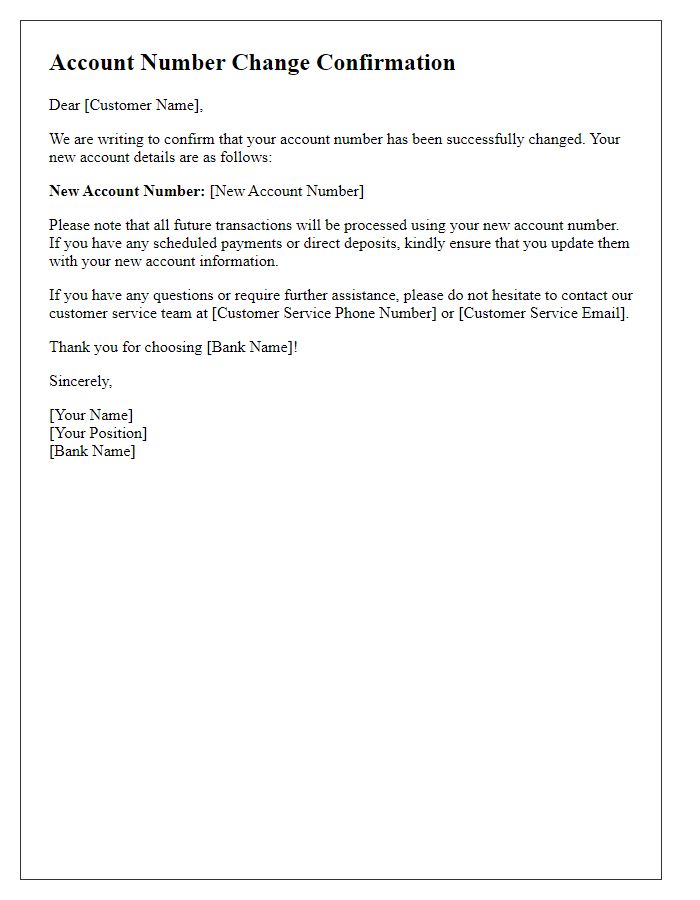

Letter template of account number change confirmation for banking services.

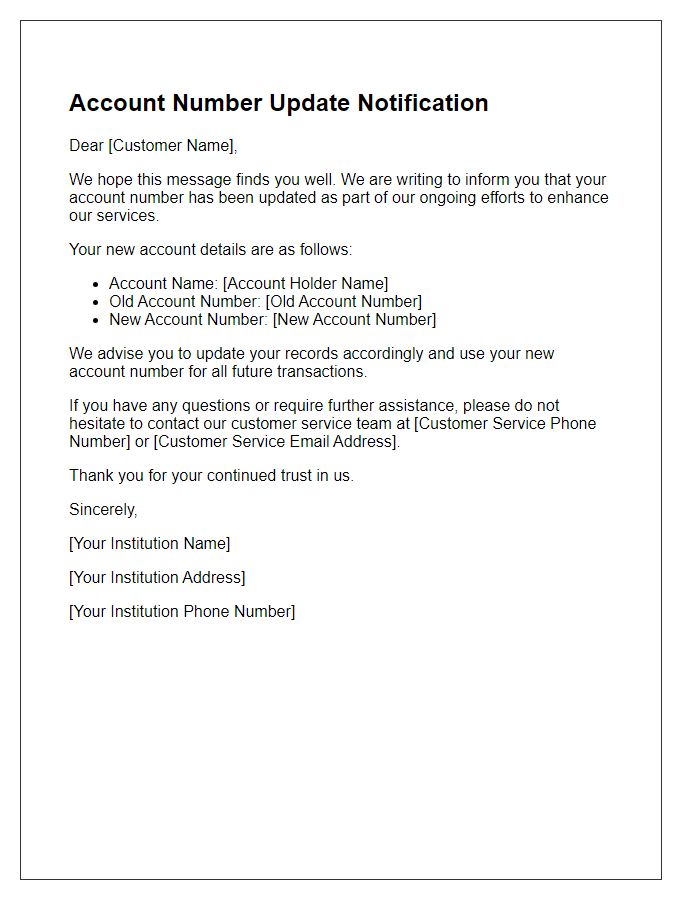

Letter template of updated account number notification for financial institutions.

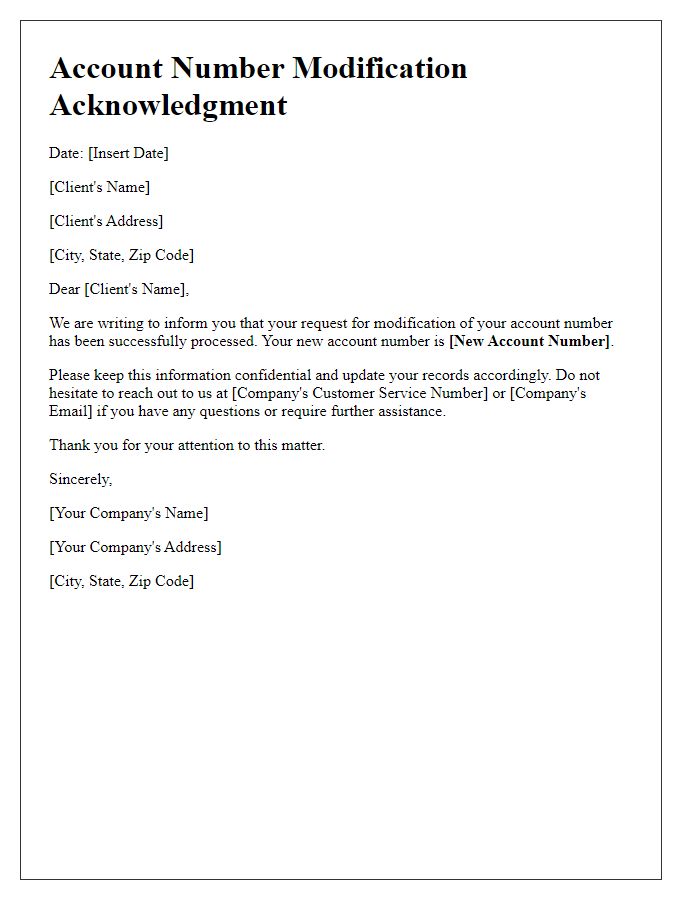

Letter template of account number modification acknowledgment for clients.

Letter template of account number transition notice for service providers.

Letter template of confirmation for account number alteration for clients.

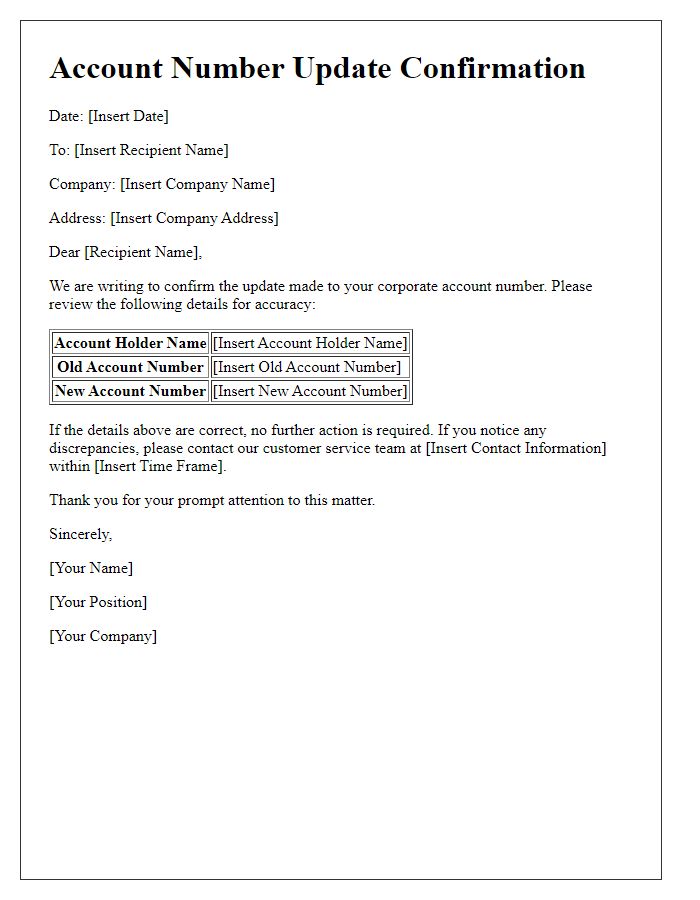

Letter template of account number update validation for corporate accounts.

Letter template of notification for change in account number for account holders.

Letter template of confirmation of bank account number change for customers.

Comments