Hey there! If you're gearing up to confirm your tax return submission, you've come to the right place. This article will guide you through a simple and effective letter template that ensures your submission is acknowledged, providing peace of mind as tax season wraps up. Ready to dive into the details and make your tax return experience smoother? Let's get started!

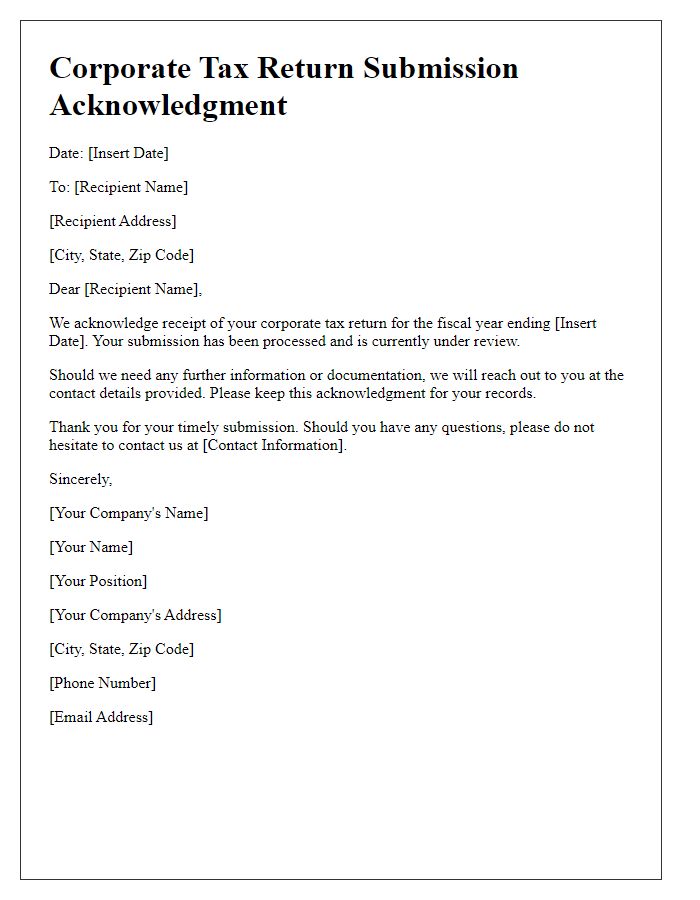

Sender's Information

The confirmation of tax return submission, an essential financial document, serves as formal acknowledgment for filed tax returns. The sender's information should include the sender's full name, title (such as Certified Public Accountant), and eligibility for tax return preparation, along with the postal address reflecting both city and state, such as 123 Tax Lane, Miami, FL 33101, and a valid email address to facilitate communication. The sender could also include a phone number for follow-up inquiries, providing an efficient channel for immediate assistance. Additionally, including the tax identification number (e.g., Social Security Number or Employer Identification Number) can lend credibility to the submission process, ensuring that the recipient can verify authenticity through the tax authorities if needed.

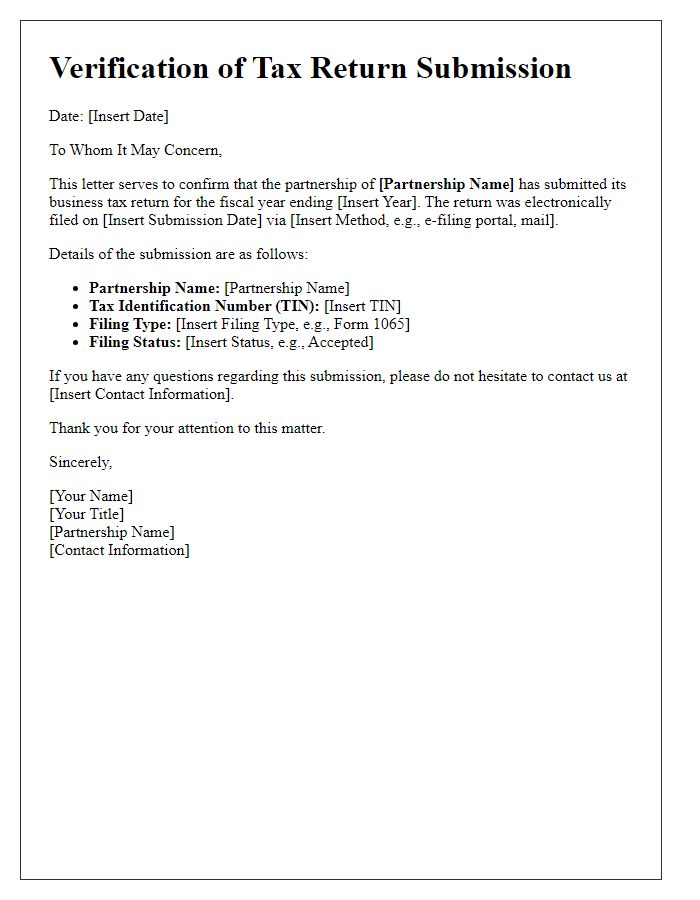

Recipient's Details

The process of confirming tax return submission involves essential details including the taxpayer's name (John Doe), address (123 Main Street, Springfield, IL 62701), Social Security number (123-45-6789), and the tax year (2022). The submission typically occurs through electronic platforms like the IRS e-file system or via postal mail to the designated Internal Revenue Service (IRS) address. Confirmation generally includes a unique tracking number (such as CP11) to verify the status of the tax return submission. Important deadlines, like the April 15th filing date for individual taxpayers, must be adhered to avoid penalties. Documentation might also comprise support items, including W-2 forms (Wage and Tax Statement) and 1099 forms (for self-employment income) to validate reported income.

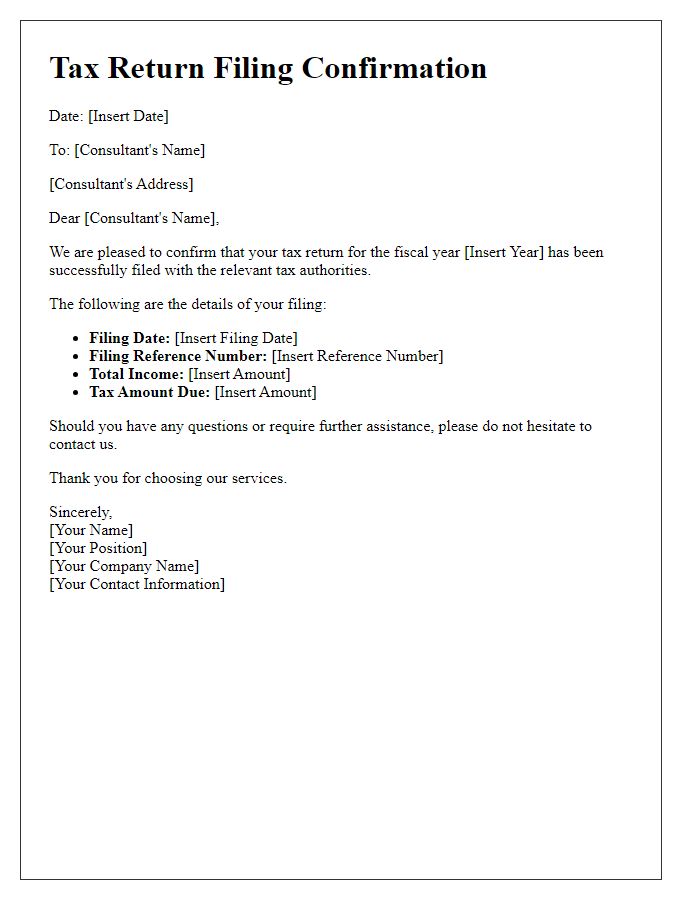

Confirmation Statement

A confirmation statement serves as official acknowledgment for the successful submission of tax returns, providing important details such as submission date, tax year (for instance, 2022), and the unique transaction reference number assigned by the tax authority (like the IRS in the United States). This document also includes the taxpayer's full name, address, and identification number, ensuring proper identification in official records. Additionally, it may feature instructions for tracking the status of the submission, deadlines for potential responses, and guidelines for future correspondence with the tax authority, promoting efficient communication and compliance with tax regulations.

Submission Date

Tax return submissions play a crucial role in the annual financial obligations of individuals and businesses, ensuring compliance with federal regulations in countries like the United States. For example, the Internal Revenue Service (IRS) mandates that personal tax returns must be submitted by April 15 each year, a date that marks the end of the tax season. Failure to meet this deadline can result in penalties amounting to 5% of the unpaid taxes for each month the return is late. Additionally, individuals can confirm their submission date electronically through the IRS website, which provides a confirmation number that serves as proof of timely filing. Maintaining accurate records of submission dates enhances financial management and preparation for potential audits in the future.

Contact Information

Contact information is essential for ensuring clear communication regarding tax returns. Taxpayers must provide their full name, including first name, middle initial, and last name, along with their residential address (including street address, city, state, and zip code). Additionally, including a valid phone number (preferably a mobile number for quicker response) and an email address (to facilitate electronic communication) is crucial. For businesses, the Employer Identification Number (EIN) should also be included. This detailed contact information helps tax authorities, such as the Internal Revenue Service (IRS) in the United States, to verify submissions, address any discrepancies, and provide updates about the tax return process. Providing accurate contact details ensures a smoother interaction with tax officials.

Letter Template For Confirming Tax Return Submission Samples

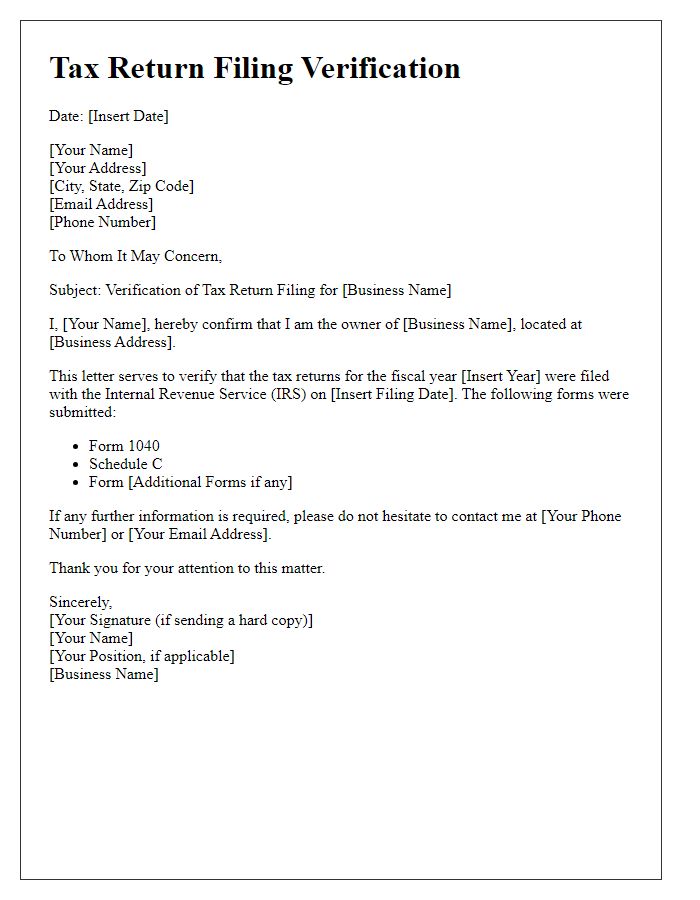

Letter template of tax return filing verification for small business owners

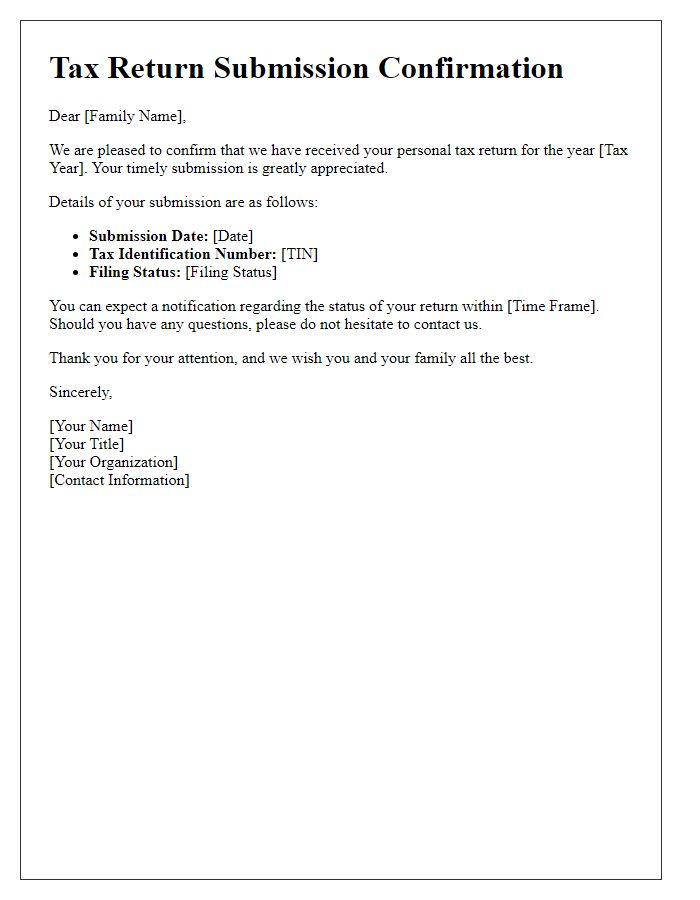

Letter template of personal tax return submission confirmation for families

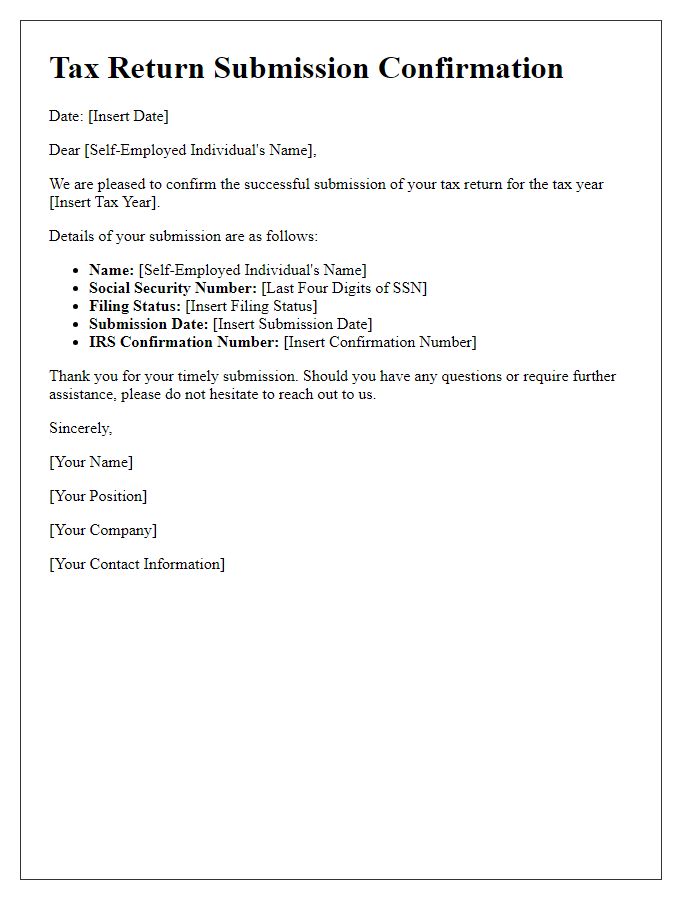

Letter template of tax return submission confirmation for self-employed individuals

Letter template of tax submission receipt confirmation for international taxpayers

Letter template of annual tax return submission acknowledgment for rental property owners

Comments