Are you looking to solidify an investment agreement with a compelling confirmation letter? Crafting the perfect letter can ensure both clarity and professionalism, setting the stage for a successful partnership. By outlining key details like investment amount, terms, and mutual obligations, you can foster trust and transparency. So, let's dive into the essential elements of an investment confirmation letter and help you create a powerful document that solidifies your commitment!

Clear Identification of Parties

A well-defined investment agreement necessitates the clear identification of parties involved, including the names and legal entities of all investors and recipients. For instance, in an investment agreement between a venture capital firm, Venture Partners LLC, based in San Francisco, and a startup, InnovateTech Inc., located in Austin, the document should explicitly state "Venture Partners LLC, a limited liability company organized under the laws of California, hereinafter referred to as 'Investor,' and InnovateTech Inc., a corporation organized under the laws of Texas, hereinafter referred to as 'Company.'" This clarity ensures that all parties are legally recognized and accountable under the terms of the agreement. Additionally, including pertinent details such as registered addresses and contact information serves to facilitate reliable communication throughout the partnership.

Detailed Agreement Terms

An investment agreement confirms the terms and conditions negotiated between parties regarding financial contributions, ownership shares, and profit distributions. Key elements of the agreement include investment amounts (e.g., $250,000), ownership percentages (e.g., 25% stake), and profit-sharing ratios (e.g., 50% of net profits). Important clauses often address funding timelines (e.g., initial payment due within 30 days of signing), roles and responsibilities (e.g., active involvement in management), and exit strategies (e.g., terms for selling shares after three years). Legal compliance with local regulations (e.g., U.S. Securities and Exchange Commission guidelines) ensures the agreement's validity. Signatures from all involved parties finalize the binding contract, outlining future obligations and protecting each investor's interests.

Investment Amount and Structure

Investment agreements often include specific details on the amount and structure of the investment. An investment amount refers to the total capital provided by an investor, typically expressed in currency (e.g., USD, EUR). The investment structure outlines how this capital is allocated, including equity stake, debt instruments, or convertible notes. Precise terms of the agreement also specify the rights and obligations of each party, projected timelines for return on investment, and exit strategies. Proper documentation ensures clarity and legal protection for both parties involved.

Return on Investment (ROI) Details

The Return on Investment (ROI) calculation is a critical aspect of the investment agreement, outlining the financial performance expected from the investment within a specified timeframe. Estimated ROI percentages often depend on various factors including market conditions, investment duration, and the nature of the asset involved. For instance, equity investments in the technology sector, particularly in companies located in Silicon Valley, have historically yielded annual returns ranging from 15% to 25%. Key performance indicators such as profit growth, revenue increase, and asset appreciation will play an essential role in assessing the returns generated from the investment. Additionally, regular reporting on financial performance scheduled quarterly will enable stakeholders to monitor progress and make informed decisions regarding future investments.

Termination and Amendment Clauses

An investment agreement encompasses critical termination and amendment clauses that ensure clarity for all parties involved. Termination clauses specify conditions under which the agreement can be legally ended, such as breach of contract, insolvency, or mutual consent. Amendment clauses outline the procedures required for modifying the agreement, often necessitating written consent from all stakeholders involved. These elements protect the interests of investors, ensuring that changes or cessation of the investment relationship are managed in an orderly manner. Properly drafted clauses consider regulatory compliance and reflect negotiated terms, thus minimizing future disputes over the agreement's execution.

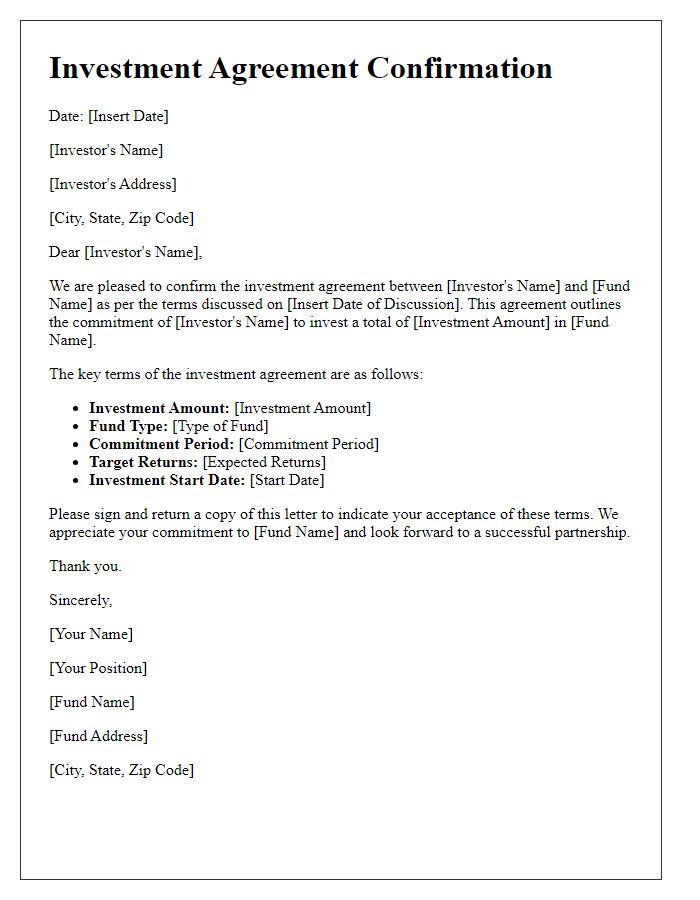

Letter Template For Confirming Investment Agreement Samples

Letter template of investment agreement confirmation for individual investors

Letter template of investment agreement confirmation for corporate stakeholders

Letter template of investment agreement confirmation for venture capitalists

Letter template of investment agreement confirmation for real estate investments

Letter template of investment agreement confirmation for equity crowdfunding

Letter template of investment agreement confirmation for angel investors

Letter template of investment agreement confirmation for startup investments

Comments