Hey there! If you're looking to confirm your insurance policy, you've come to the right place. It's crucial to ensure that all the details are accurate and up-to-date, giving you peace of mind and security for what matters most. This handy template will guide you through the essential points to include, making the process a breezeâlet's dive in and explore!

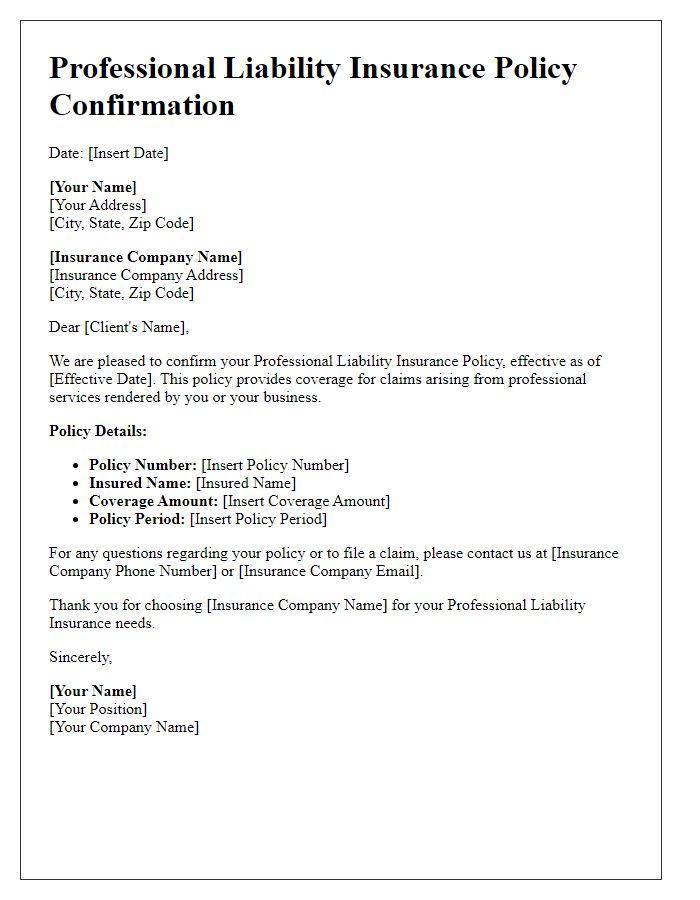

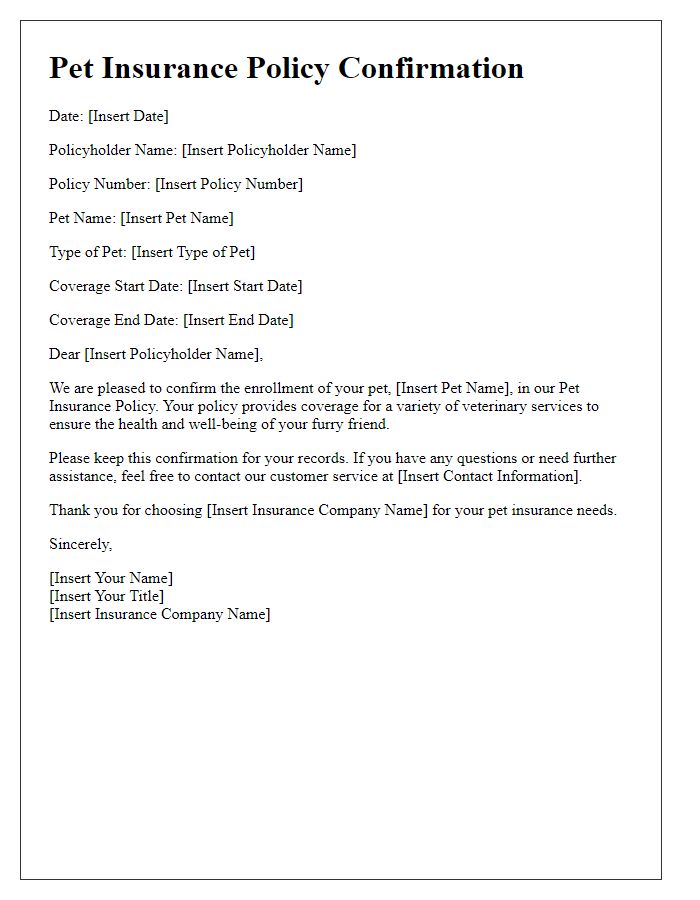

Policyholder's Full Name and Contact Information

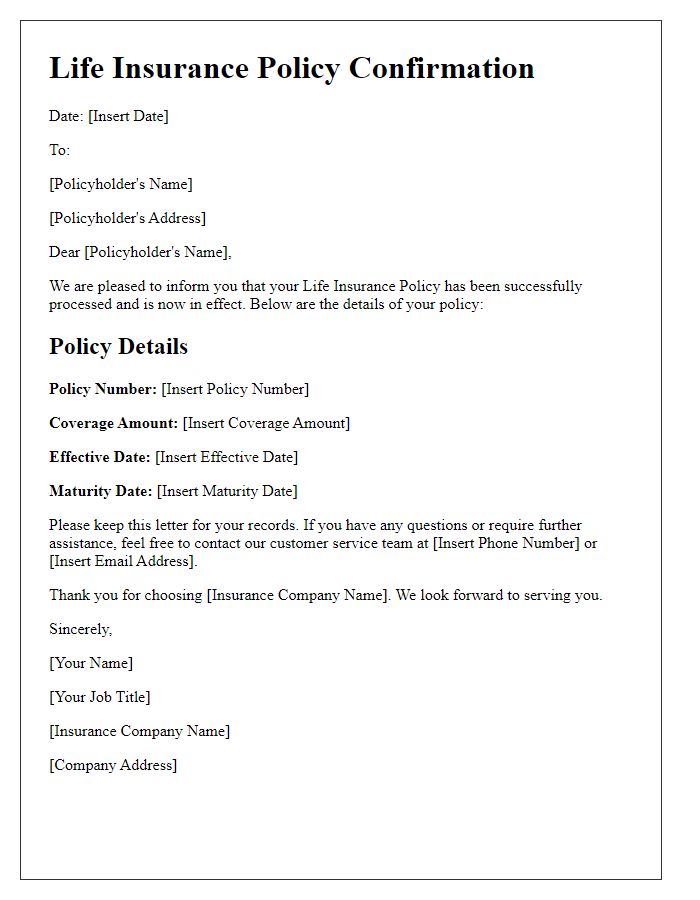

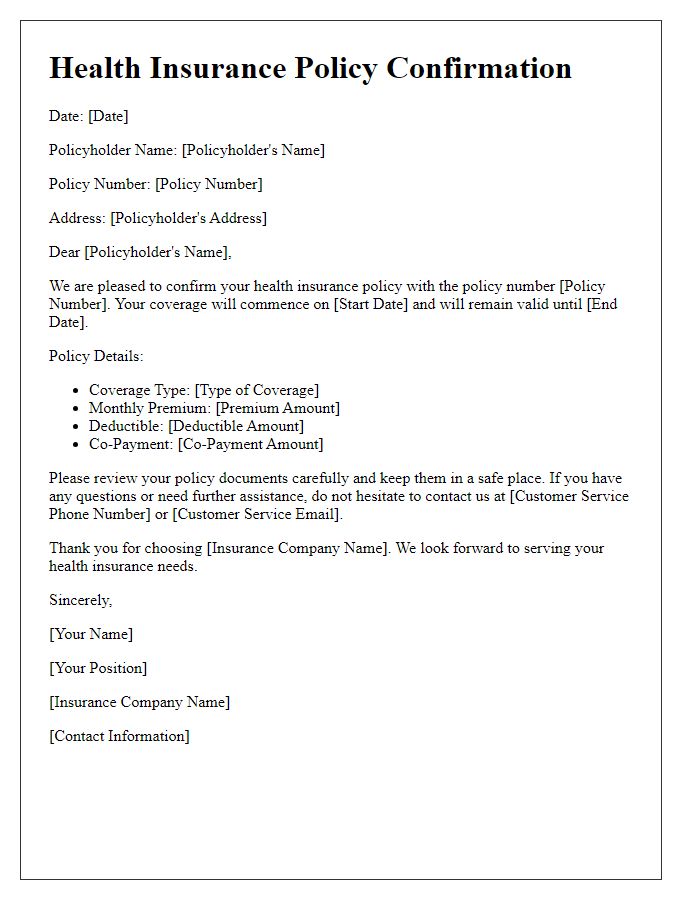

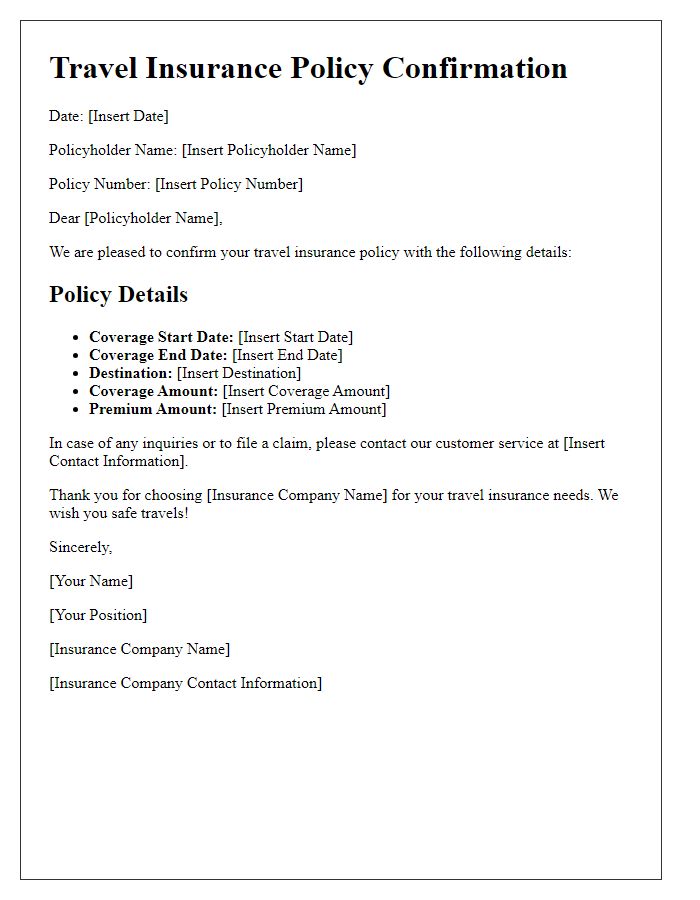

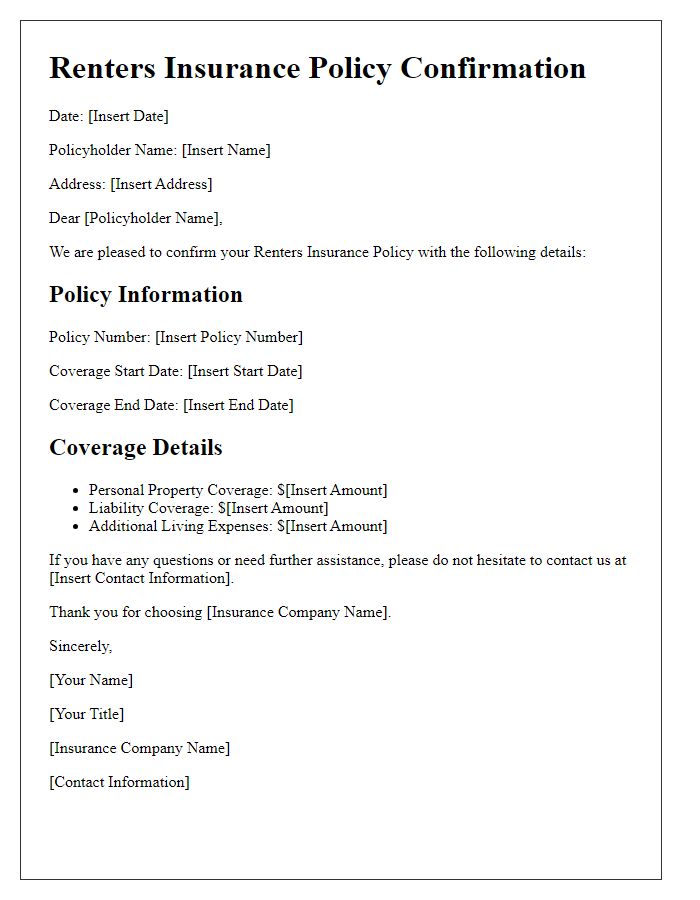

The confirmation of an insurance policy typically includes essential details such as the policyholder's full name, representing the individual or entity covered, and their contact information, which facilitates communication between the policyholder and the insurance provider. This policy confirmation outlines specific coverage details, including the effective date, types of coverage (such as auto, home, or life insurance), premium amounts, and any deductibles or limits associated with the policy. Additionally, the confirmation provides the policy number, a unique identifier crucial for managing claims and inquiries. Proper documentation ensures both parties understand their rights and responsibilities, enhancing transparency and trust in the insurance relationship.

Insurance Company Name and Contact Details

Insurance companies provide essential protection for assets and liabilities. The policy, often numbered for specific identification, outlines the coverage details including limits and exclusions. Coverage types can vary significantly; for example, auto insurance protects vehicles against accidents and theft, while homeowners insurance safeguards residences against various hazards. Policyholders typically receive documents via email or postal service, detailing the terms and conditions of the coverage. Proper confirmation from the insurance company ensures validity and understanding of the agreement, which is crucial during claims processes. Regular reviews of policy details, especially upon significant life events like purchasing a home or getting married, ensure that coverage remains adequate and relevant.

Effective Date of Policy Confirmation

The confirmation of an insurance policy's effective date is crucial for ensuring coverage begins as intended. For instance, a health insurance policy effective from January 1, 2024, guarantees access to medical services without interruptions. Similarly, a homeowner's insurance policy effective from February 15, 2024, protects the dwelling against unexpected damages like fire or theft. Providing clear details in written communications enhances understanding and ensures all parties are aware of their rights and responsibilities regarding coverage. Thus, maintaining accurate records of these effective dates can significantly impact any future claims or disputes that may arise.

Policy Number and Coverage Details

The insurance policy confirmation document contains essential information regarding the specific agreement between the insurance provider and the policyholder. Policy Number (unique identifier for tracking and management) ensures easy reference. Coverage Details include types of protection offered, such as liability or property coverage, with monetary limits specified for various scenarios. Additional clauses may outline exclusions (situations not covered by the policy) and conditions (requirements to maintain valid coverage). This documentation is vital for understanding the extent of protection and the responsibilities of both parties involved.

Premium Payment Terms and Conditions

Insurance policies require careful attention to premium payment terms and conditions to ensure coverage remains active. Policies typically outline specific due dates, such as the first of each month or annual renewals. Payment methods may include options like direct bank transfers, online payments, or mailed checks. Grace periods, often ranging from 10 to 30 days, allow for late payments without immediate penalties but risks lapse in coverage after this period. Penalties for delayed payments can include late fees or increased premium rates upon renewal. Policyholders must understand that failing to comply with these terms can result in policy cancellation, leaving them uninsured against potential claims or losses.

Comments