Have you ever glanced at your bank statement only to spot an unfamiliar charge? It can be frustrating and alarming, especially when you're certain you didn't make that purchase. In this article, we'll guide you through the steps of writing a complaint letter for unauthorized charges to ensure you assert your rights effectively. So, let's dive in and empower you to take action against those unwelcome expenses!

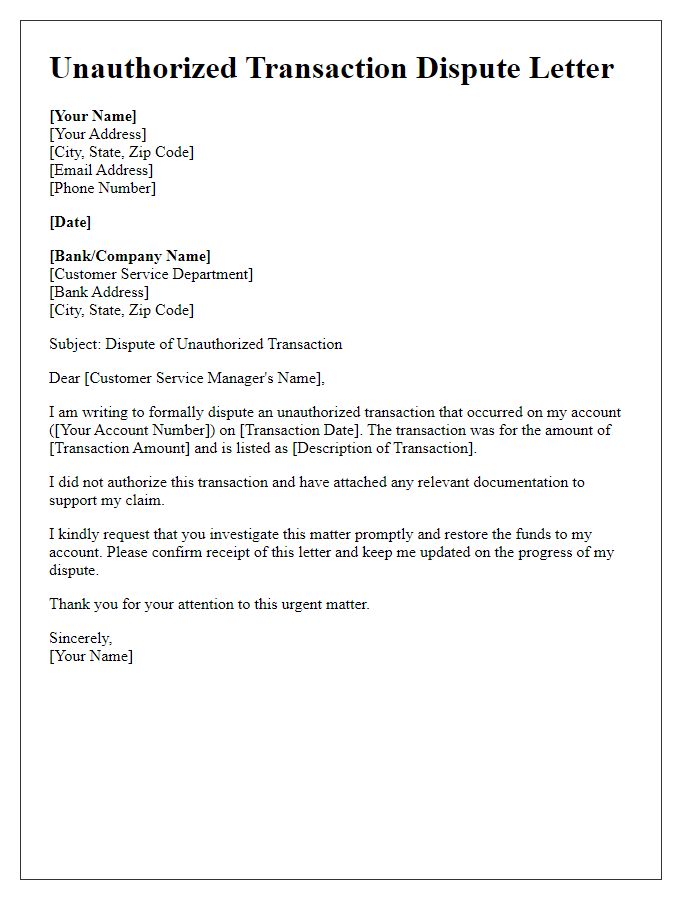

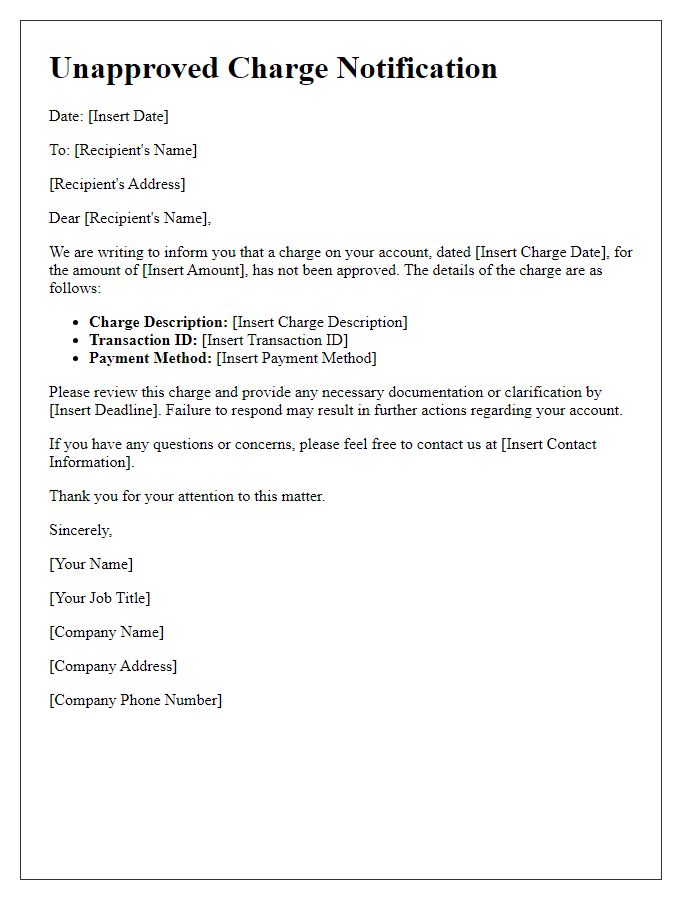

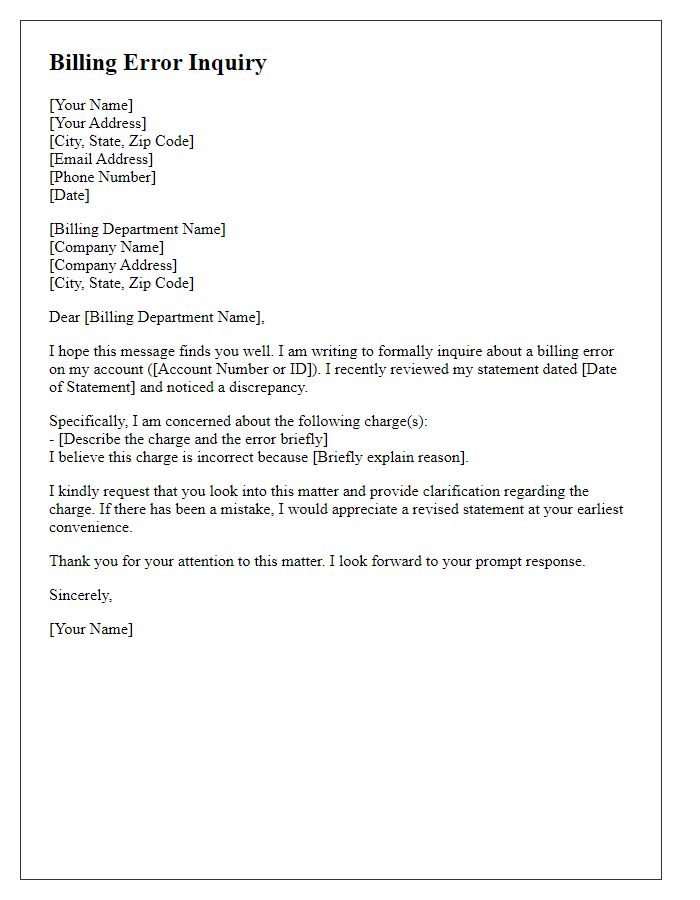

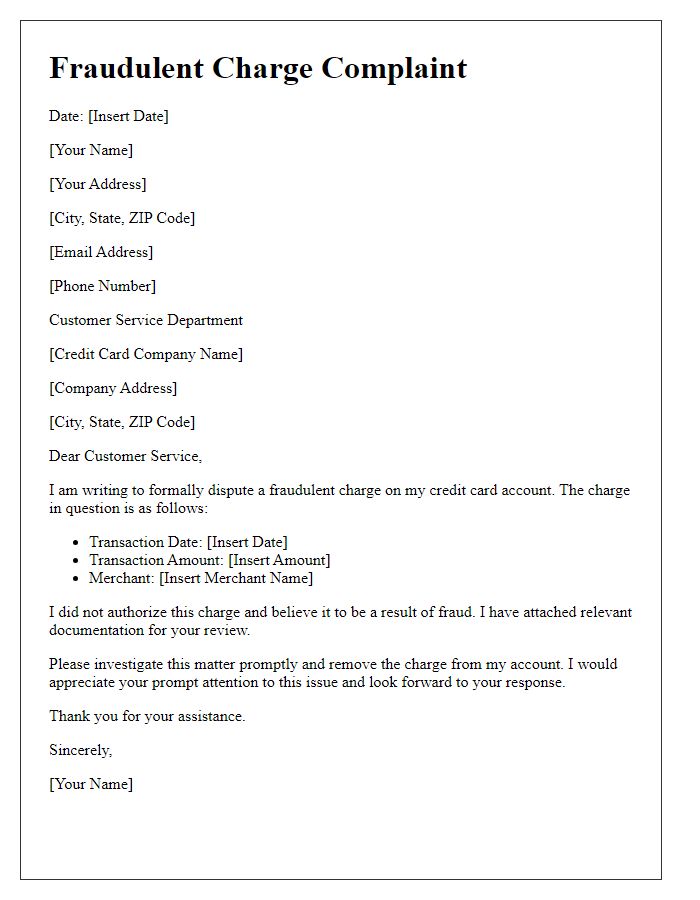

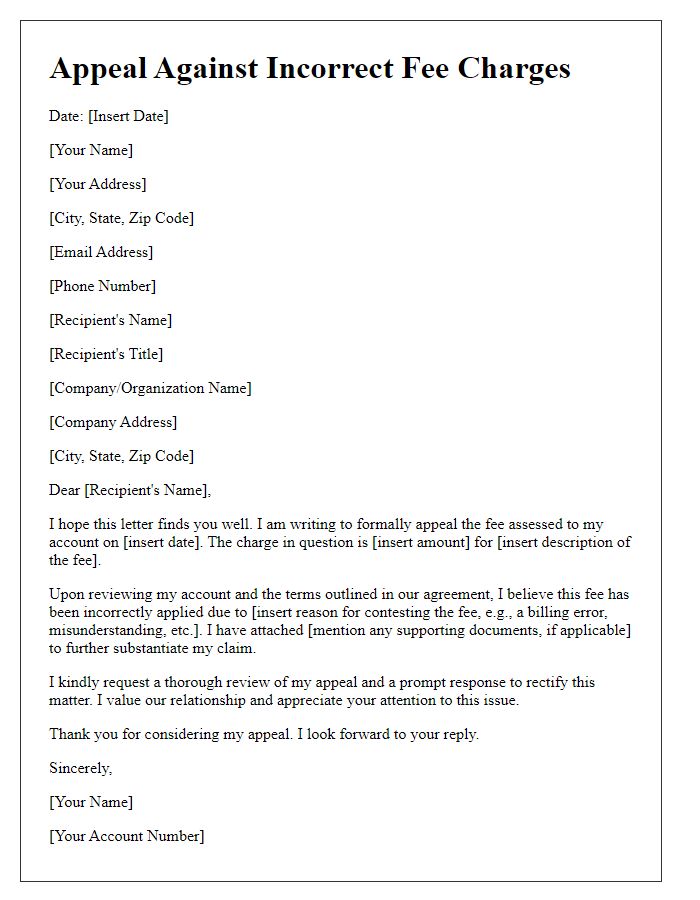

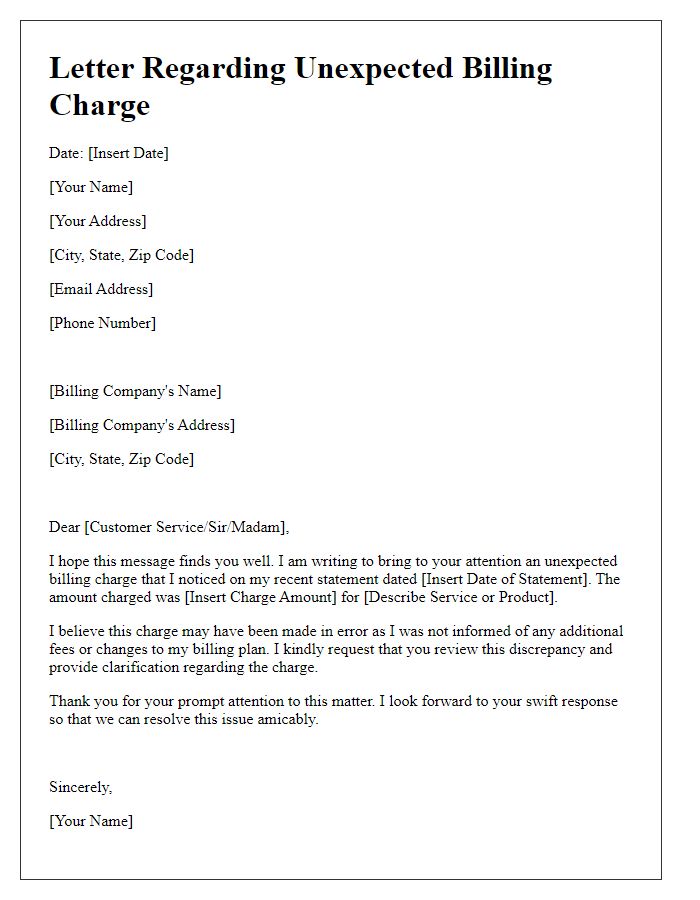

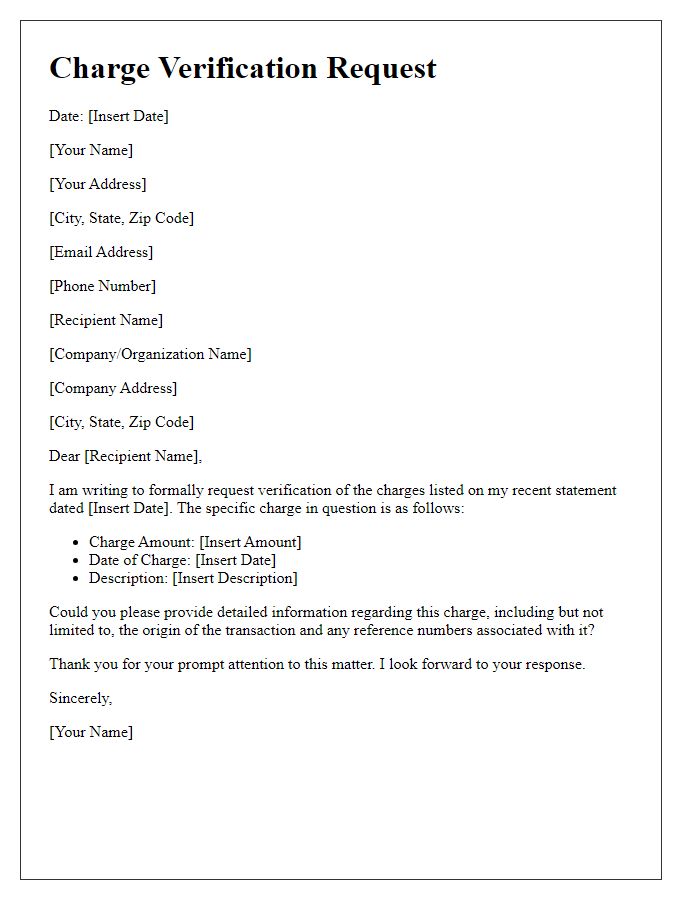

Recipient details and contact information

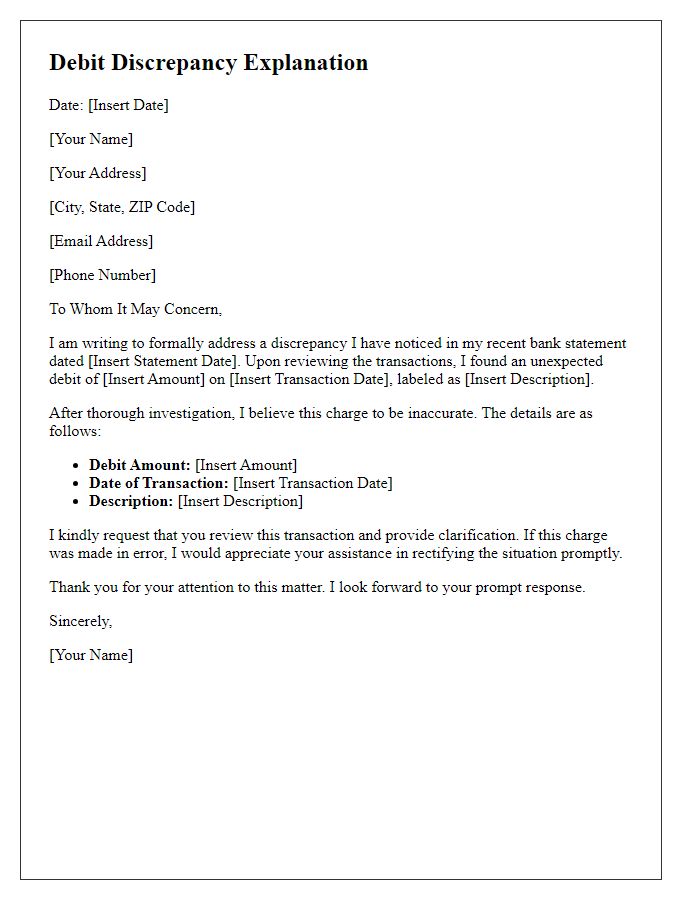

Unauthorized charges on credit card statements can lead to consumer distress and financial inconvenience. Unauthorized charges often manifest as unfamiliar transactions that appear on monthly bank statements, typically from unknown vendors or amounts. Cardholders should promptly contact the financial institution, providing information such as transaction dates, amounts, and merchant names (e.g., "XYZ Online Store" with a charge of $150 on November 15, 2023). Maintaining detailed records enhances the dispute process, allowing financial institutions to investigate thoroughly and potentially restore lost funds. Consumers may be advised to monitor their accounts regularly and set up transaction alerts to prevent further unauthorized charges in the future.

Detailed description of unauthorized charge

Unauthorized charges on credit card statements can create significant financial concern and require prompt action. A charge that appears without prior knowledge may be linked to subscription services (i.e., $9.99 monthly charges from software providers) or transactional errors, reflecting an estimated $14.9 billion lost annually by consumers due to fraudulent activity. The date of the unauthorized charge, often the most critical factor, can reveal trends in the timing of these incidents, such as breaches typically occurring around major shopping holidays like Black Friday. Consumers are encouraged to immediately contact their financial institution (or the issuing bank located in various regions, e.g., Visa, MasterCard) to dispute these charges, potentially leading to investigation and resolution. The process typically involves filling out a dispute form, which may result in as much as $1,000 reimbursement while the investigation unfolds, providing relief during a distressing time.

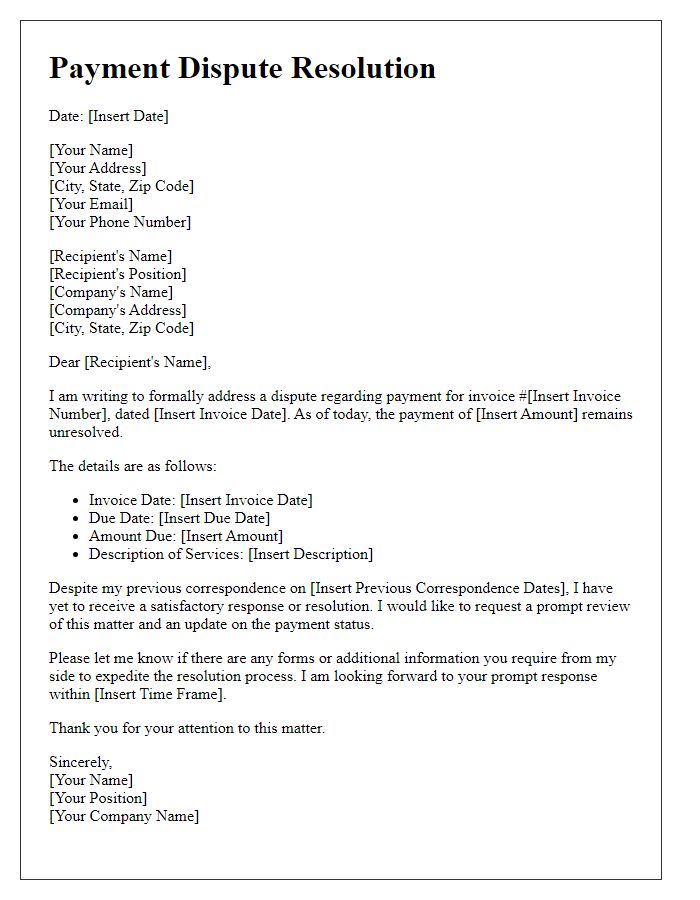

Request for investigation and resolution

Unauthorized charges from financial institutions can create significant distress for consumers. A recent example involves a credit card statement reflecting a $150 charge labeled "Online Subscription Service" without prior authorization from the account holder. This inconsistency in transaction records prompts a formal complaint addressed to the financial institution, requiring an investigation into the charge. A thorough examination may reveal potential fraud or clerical errors related to the transaction. Consumers expect timely resolutions to unauthorized transactions, which may include refunds or account adjustments. Regulatory bodies, such as the Consumer Financial Protection Bureau, advocate for consumer rights and may be involved if issues remain unresolved, emphasizing the importance of financial accountability and transparency.

Supporting evidence and documentation

Unauthorized charges can lead to significant financial distress for consumers, often resulting in lengthy disputes with banking institutions. Essential supporting evidence for a complaint includes bank statements showcasing the disputed transactions, login history from online banking platforms reflecting unauthorized access, and any correspondence with the merchant, such as receipts or order confirmations that do not match the charge. Documentation like screenshots of unauthorized transactions and records from customer service calls can provide further context. Relevant financial institutions, such as credit card issuers or banks, usually require specific information, including account details associated with the charges and personal identification, to ensure swift resolution of the claim. Consumers should compile this documentation meticulously to substantiate their claims effectively.

Contact information for follow-up communication

Unauthorized charges can lead to significant financial stress for consumers. In 2022, over 25 million Americans reported fraudulent transactions on their bank statements. These charges may stem from data breaches, compromised credit cards, or phishing scams. It is crucial to report such incidents immediately to financial institutions, such as regional banks or international credit card companies, for resolution. Contact information should include names, phone numbers, and email addresses of customer service representatives or fraud departments, ensuring prompt follow-up communication. Additionally, provide alternative communication methods such as online chat support or secure messaging through mobile banking apps for convenience.

Comments