Are you concerned about the recent data breach that has affected your personal information? You're not alone; many individuals are seeking clarity and support in these troubling times. A well-crafted complaint letter can be a powerful tool to express your concerns and push for accountability. Join us as we explore the essential elements of an effective data breach complaint letterâread more to empower yourself in protecting your rights!

Clear Identification of the Breach

The recent data breach incident at Target Corporation, which occurred in December 2013, exposed the personal information of approximately 40 million credit and debit card accounts and the contact information of 70 million customers. This breach was the result of malware installed on point-of-sale systems, allowing unauthorized access to sensitive financial data. The breach raised significant concerns about the security of customer information and the effectiveness of protective measures in place to prevent such incidents. As a result, Target faced multiple lawsuits and regulatory scrutiny, underscoring the need for businesses to enhance cybersecurity practices to safeguard customer data against future breaches.

Detailed Description of Incident

A data breach incident occurred on March 15, 2023, affecting approximately 250,000 customers of the financial institution SecureBank, located in San Francisco, California. Cybercriminals exploited a vulnerability in the bank's online portal, accessing sensitive customer information--including names, social security numbers, account numbers, and transaction histories--over a 48-hour window. The breach was discovered on March 17, 2023, after unusual activity was detected by the bank's cybersecurity team. Investigation revealed that unauthorized access came from an IP address linked to a known hacking group operating from Eastern Europe. SecureBank notified affected customers by mail, offering identity theft protection services for one year. The incident raised concerns regarding the adequacy of data protection measures and compliance with regulations such as the California Consumer Privacy Act (CCPA).

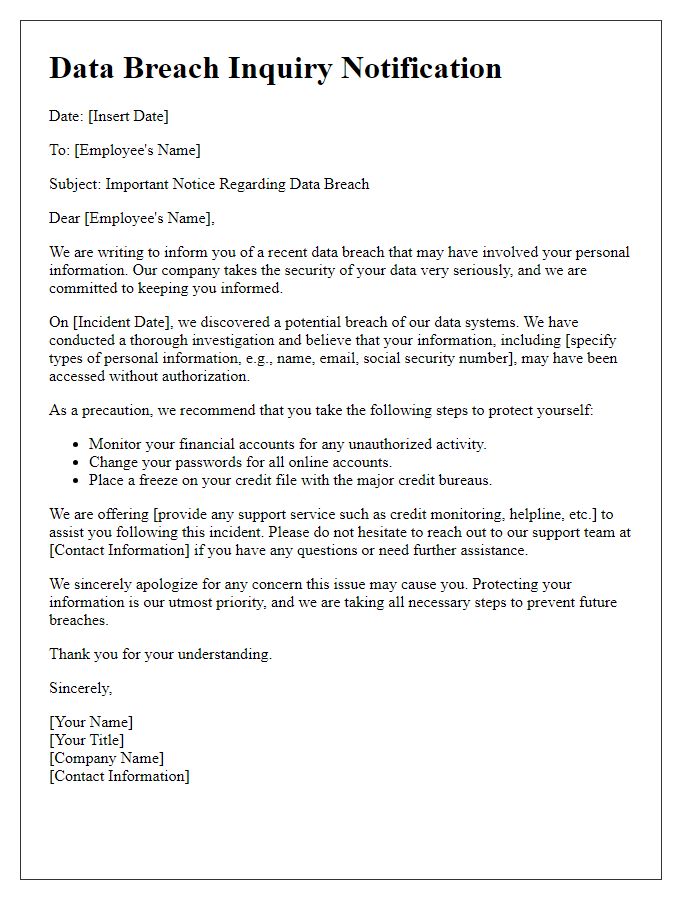

Impact on Affected Parties

A data breach can significantly impact affected parties, such as individuals and organizations. Personal information, including Social Security numbers, credit card details, and medical records, may be compromised, leading to risks of identity theft, financial loss, and emotional distress. Businesses, such as retail chains and financial institutions, can experience reputational damage, loss of customer trust, and potential fines from regulatory bodies, such as the Federal Trade Commission (FTC). Affected parties may incur expenses related to credit monitoring services, legal fees, and remediation efforts. Moreover, the emotional toll on individuals, including anxiety and fear about privacy, can have long-lasting psychological effects. Organizations may also face operational disruptions while managing the aftermath of a breach, impacting their ability to serve customers effectively.

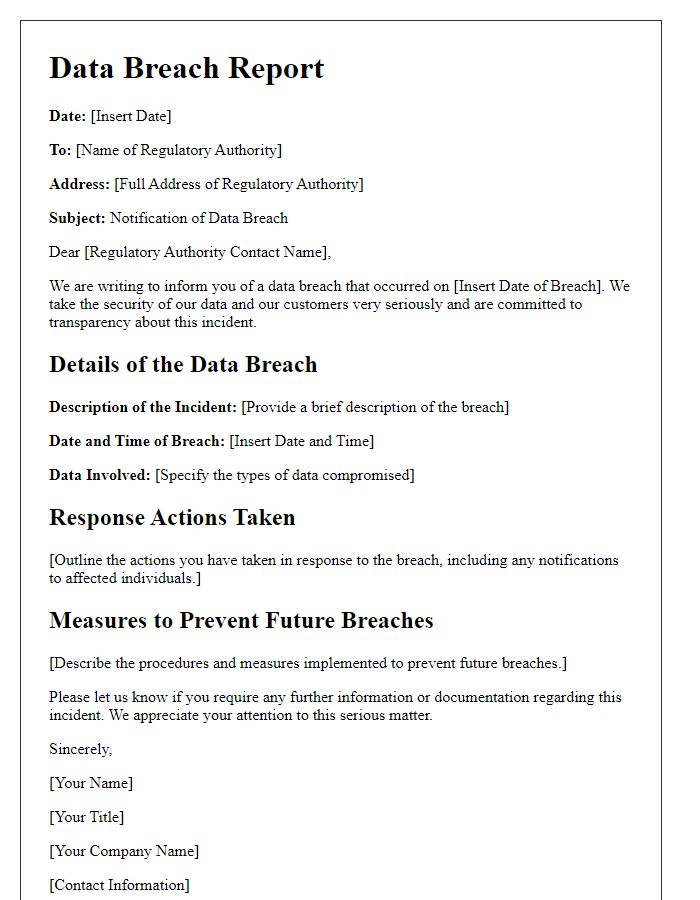

Legal Obligations and Regulations

A data breach incident, especially affecting personal information, can invoke serious legal obligations and regulations, such as the General Data Protection Regulation (GDPR). Under Article 33, organizations have a strict deadline of 72 hours to report breaches to the relevant supervisory authority following their discovery. Additionally, affected individuals must be informed without undue delay if the breach poses high risks to their rights and freedoms. Notable entities, such as the California Consumer Privacy Act (CCPA), mandate businesses to implement robust data protection measures and notify consumers promptly about breaches. Compliance is essential not only to avoid substantial fines--potentially reaching millions of dollars--but also to maintain consumer trust and safeguard personal data, particularly in industries like healthcare or finance that handle sensitive information.

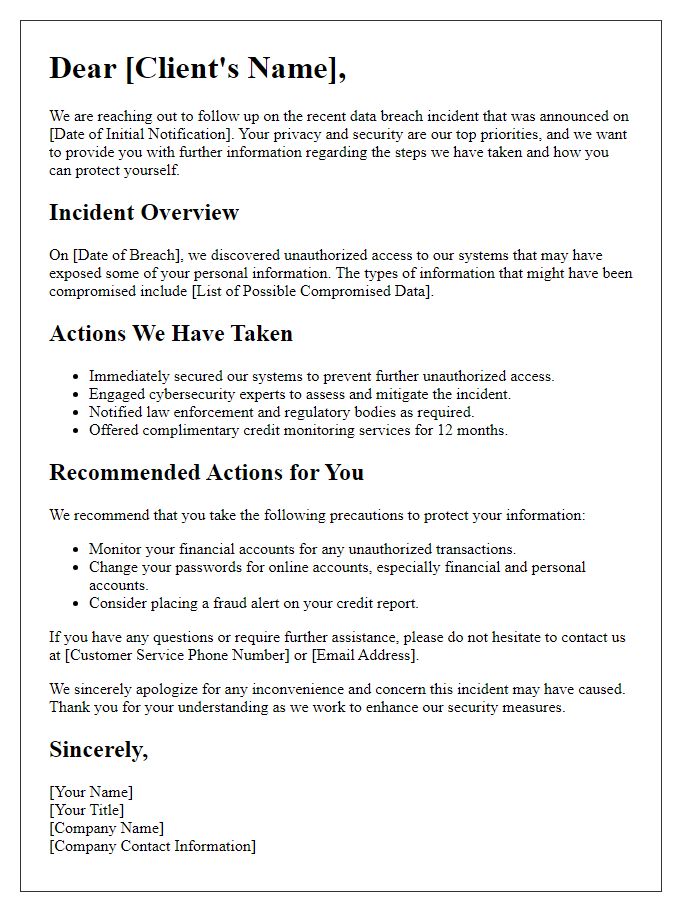

Requested Actions and Resolutions

In response to the recent data breach incident that compromised sensitive information, including personal identification numbers and financial records from entities such as [Organization Name], immediate actions must be taken to restore security and rebuild trust. A thorough investigation, conducted by cybersecurity experts, should identify the breach's origin, which reportedly occurred on [Date] and affected approximately [Number] individuals, including customers and employees. Transparent communication detailing the breach's implications, including risks of identity theft and fraud, is essential. Implementation of enhanced data encryption methods and regular security audits must follow. Additionally, offering affected parties identity theft protection services, with coverage options extending up to [Number] years, can mitigate further risks. An open channel for inquiries and support must be established, ensuring victims receive timely assistance in navigating the aftermath of this breach.

Comments