Are you facing challenges with your current payment terms? Adjusting payment terms can often bring much-needed relief and flexibility to both parties involved in a transaction. Whether you need to extend payment deadlines or modify installment plans, it's important to communicate clearly and effectively. Dive into this article for tips on how to draft a letter for payment terms adjustments that fosters understanding and cooperation!

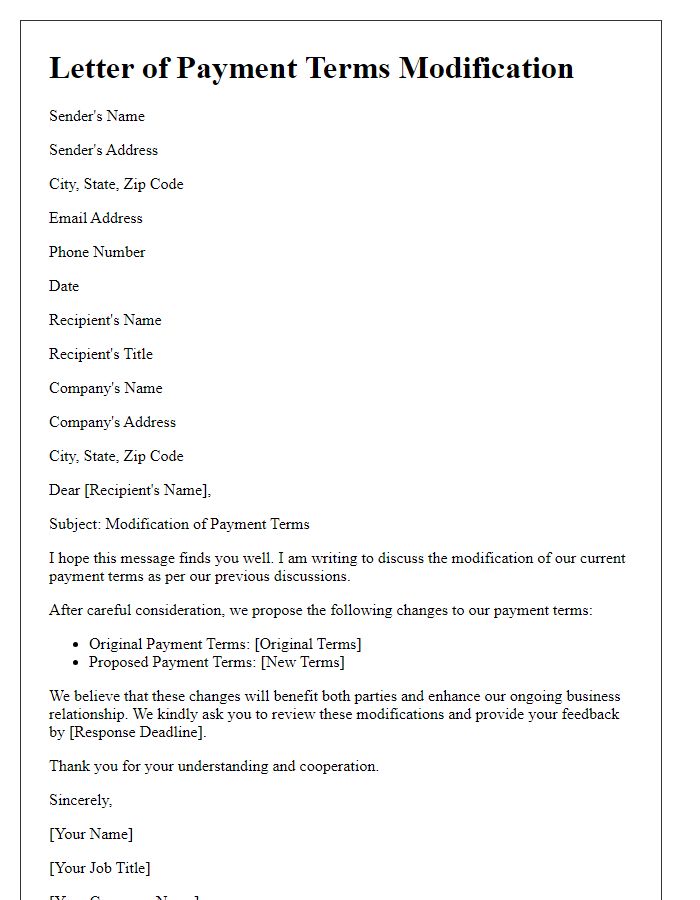

Clear Subject Line

Payment terms adjustment requests require clear communication and detail-oriented language, particularly to delineate the specific terms being adjusted. Highlight important factors, like the previous payment timeline (net 30 days) and proposed changes (extension to net 45 days). Specify affected parties, including the payment recipient (XYZ Supplies, a vendor based in New York) and the adjusting entity (your company, ABC Enterprises). Additionally, include the effective date for the new terms, reinforcing the importance of and justification for this change, such as cash flow considerations or project timelines. Providing a summary of the contractual context, while ensuring professionalism and clarity, is paramount in facilitating a mutual understanding.

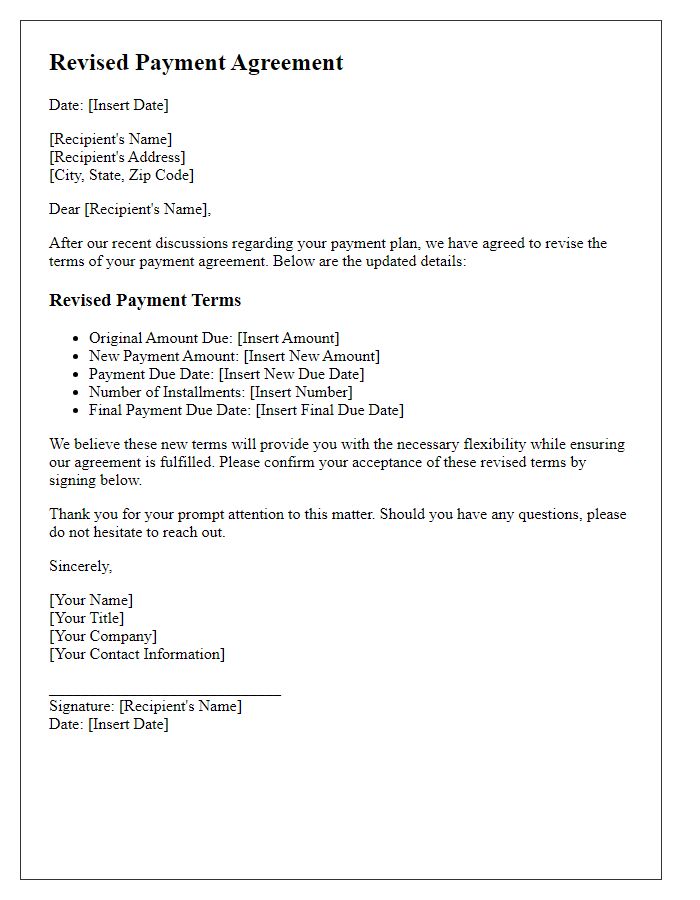

Professional Language

A payment terms adjustment can greatly impact business operations and cash flow management. Clearly defined terms, such as net 30 days or net 60 days, establish the timeframe for payment obligations. For instance, large corporations often negotiate extended terms, influencing smaller vendors relying on prompt payments for operational expenses. Adjustments can stem from various factors, including economic shifts, industry standards, or changes in supplier relationships. Documenting these adjustments in formal communication, highlighting specific changes in percentages or due dates, ensures clarity and maintains professional relationships. Understanding and outlining the implications of these terms is essential for maintaining financial stability and fostering trust among trading partners.

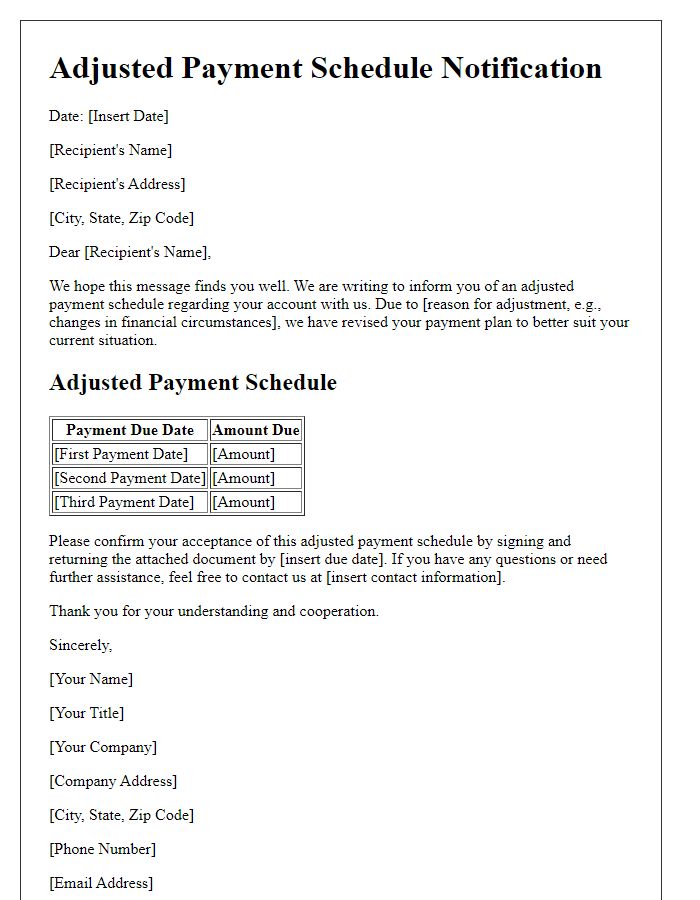

Specific Adjustment Request

Adjusting payment terms is essential for businesses aiming to enhance cash flow management. Clear and concise communication about this request can strengthen supplier relationships and foster collaboration. Specific adjustments might include extending payment deadlines (e.g., moving from net 30 to net 60 days) or altering installment plans for larger invoices. Providing context is crucial; for example, a sudden increase in operational costs stemming from logistics issues in Q3 2023 can justify the request. Additionally, outlining potential benefits for both parties, such as improved sales forecasts or anticipated revenue growth, may encourage agreement on revised terms that are mutually beneficial.

Reason for Adjustment

Payment terms adjustment may occur due to various factors impacting financial agreements between entities. For instance, a business experiencing cash flow challenges might negotiate extended payment terms to improve liquidity, allowing more time to settle outstanding invoices. Specific industry standards, such as the typical net 30 days for small enterprises versus net 60 or 90 days for larger corporations, can also necessitate adjustments. Additionally, significant economic events like inflation rates, interest rate hikes by central banks, or changes in vendor relationships may prompt a reevaluation of payment terms to maintain operational stability. Such adjustments aim to foster a mutually beneficial relationship while ensuring that obligations remain manageable for both parties involved.

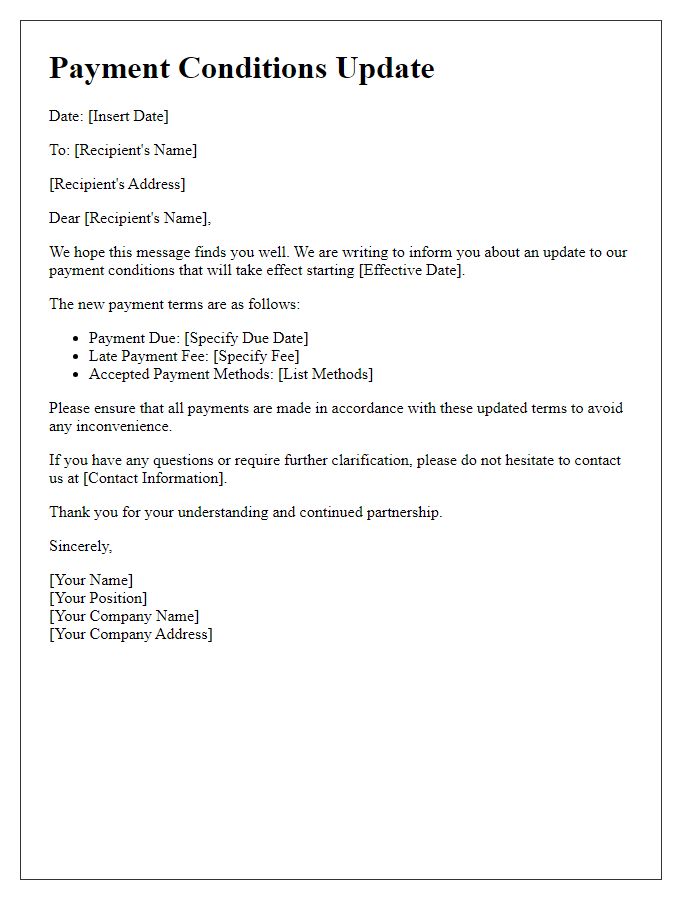

Contact Information

Adjusting payment terms can be crucial for maintaining healthy cash flow in business transactions. Clear communication of updated terms is essential to ensure mutual understanding. Key elements include payment due dates (typically net 30 or net 60 days), late fees (often ranging from 1.5% to 2% per month), and accepted payment methods (such as bank transfers, credit cards, or checks). Clarity in specifying any adjustments, for instance, extending payment terms during economic hardship or to accommodate large projects, establishes trust. Furthermore, providing contact information, including telephone numbers (like a direct line to the finance department) and email addresses, facilitates prompt communication for any inquiries related to the new payment terms.

Comments