Are you juggling multiple financial obligations and finding it hard to keep up with payments? You're not alone, and sometimes a bit of flexibility can make all the difference. In this article, we'll explore how to craft a compelling letter requesting a payment plan that suits your needs. So, let's dive in and discover the steps to get you back on track!

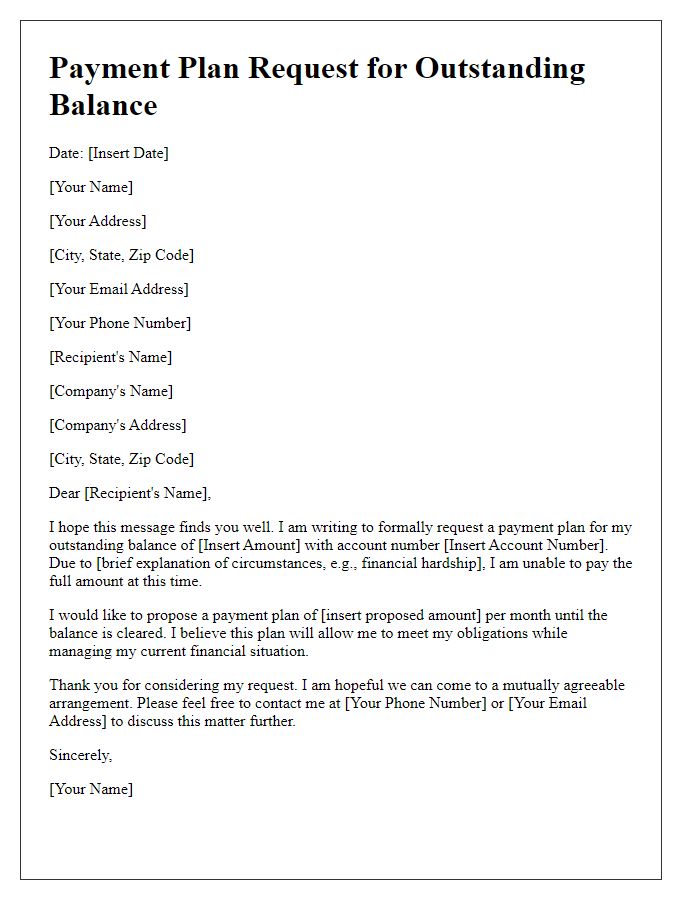

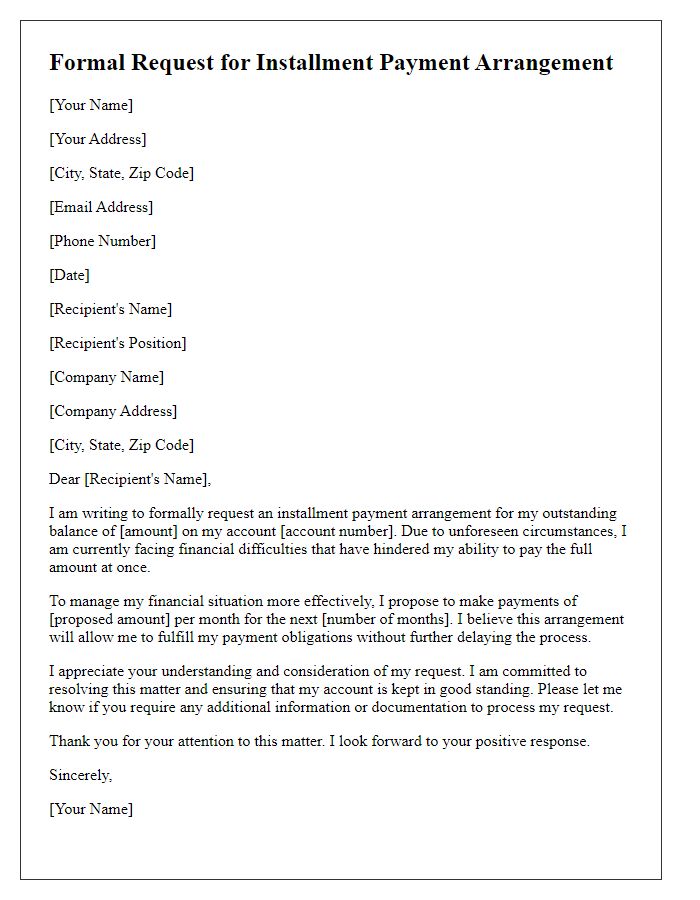

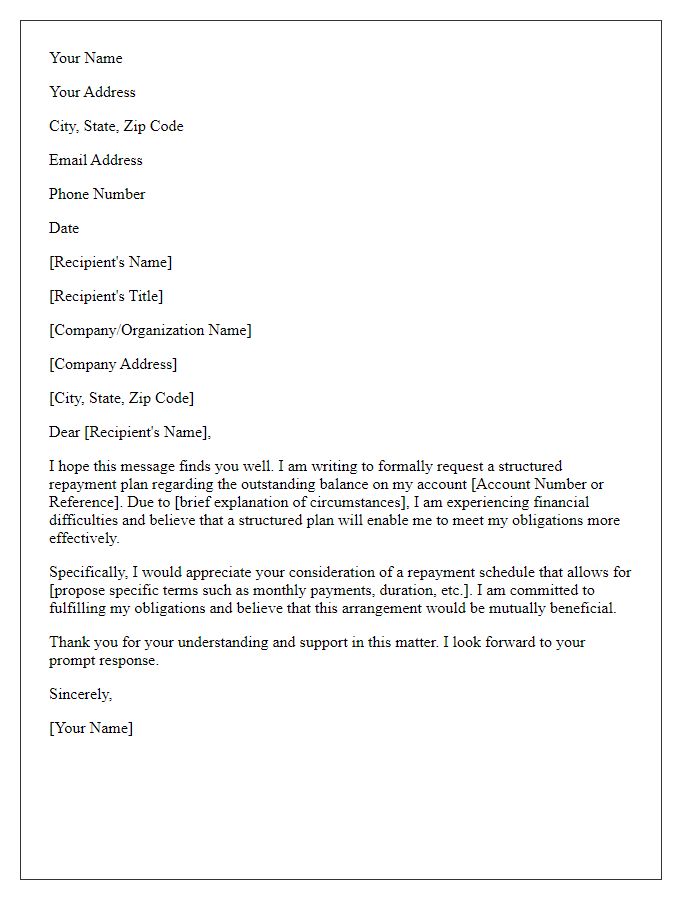

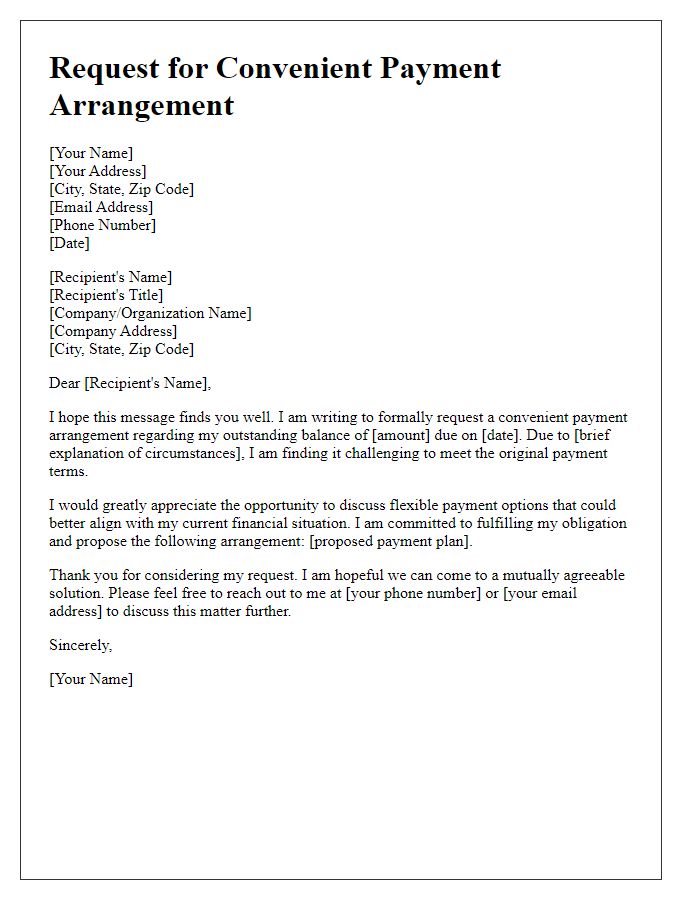

Personal and account information.

Requesting a payment plan can involve various personal and account information details. Individuals seeking to establish a payment arrangement typically provide personal identification, such as their full name, address, and contact number. Additionally, account information must include the account number, outstanding balance, and any relevant reference numbers related to the payment. Details about financial circumstances, including monthly income and expenses, may also be included to justify the request. Furthermore, the desired payment terms, such as the proposed monthly payment amount and duration of the plan, should be clearly outlined. Institutions may require this information to assess the individual's request and formulate a suitable payment structure.

Reason for payment plan request.

Many individuals face financial difficulties due to unexpected expenses, such as medical bills or job loss. A payment plan can provide a structured way to manage debts over time while maintaining financial stability. Entities such as creditors often offer payment plans to accommodate varying circumstances. Upon formal request, relevant documents, including income statements and budget outlines, may be necessary to support the request. This approach not only aids in preserving credit scores but also fosters better communication with creditors, establishing a path towards financial recovery.

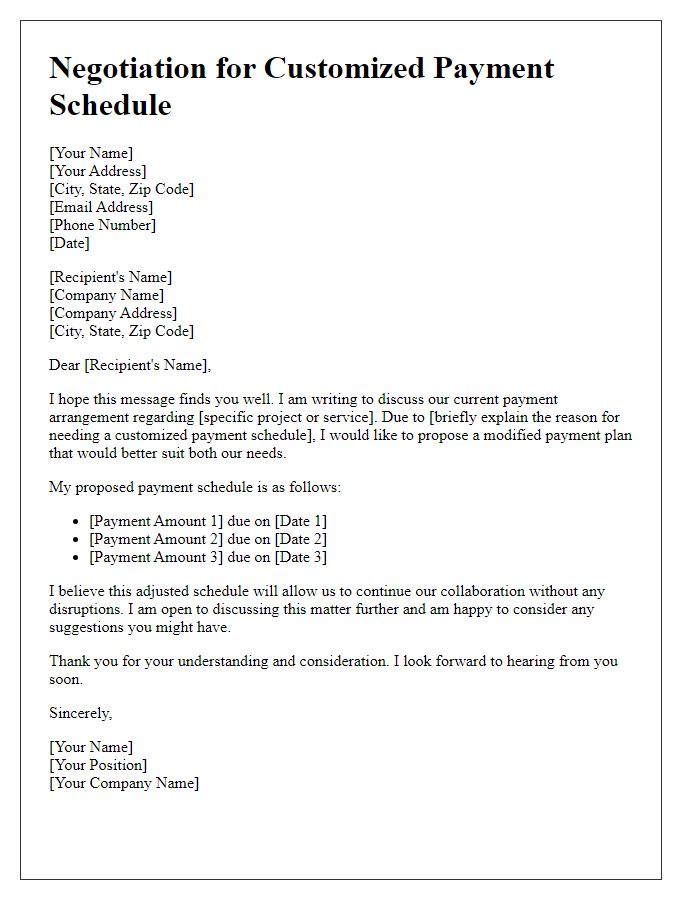

Proposed payment plan structure.

A proposed payment plan structure involves detailed breakdowns of financial arrangements between parties. For instance, the total amount owed, such as $5,000, can be divided over a specified timeline, typically six months. Each installment may subsequently be set at approximately $833.33 per month. Specific due dates, like the first of each month, can ensure timely payments. Additional terms might include conditions for missed payments, such as a grace period of 10 days before a late fee of $50 is assessed. Clear communication channels, such as a designated email or phone number for payment inquiries, can facilitate smooth transactions and address any concerns. The agreed payment method (bank transfer, credit card) should also be explicitly outlined to avoid any confusion.

Assurance of commitment and follow-up details.

Crafting an effective request for a payment plan requires clarity and professionalism. The intention is to communicate the desire to fulfill financial obligations while seeking flexibility. Payment plans often relate to various financial commitments, such as loans, utility bills, or tuition fees, and may involve specific terms and conditions that ensure mutual understanding. Indicating a willingness to adhere to an agreed schedule is paramount, as it reassures the lender or service provider of your commitment. Proposing a timeline for follow-up discussions ensures that both parties remain aligned and fosters open communication, which is vital for a successful payment arrangement.

Contact information for further communication.

Individuals seeking a payment plan often need to establish clear pathways for further communication. Contact information plays a vital role in this process, including essential details such as full name, email address, and phone number. A professional designation, such as a business title or role, could add credibility to the request. Furthermore, specifying a preferred method of contact, such as phone calls during business hours or email correspondence, enhances clarity. Including a physical address can also prove beneficial, especially for legal or official correspondence, ensuring that all parties maintain an open line of communication.

Comments