Are you navigating the sometimes tricky waters of handling financial documents? Reaching out to request updated financial records can seem daunting, but it doesn't have to be! In this article, we'll explore a straightforward letter template that makes this task easier and more efficient. Let's dive right in and uncover the essential elements you need to include in your request!

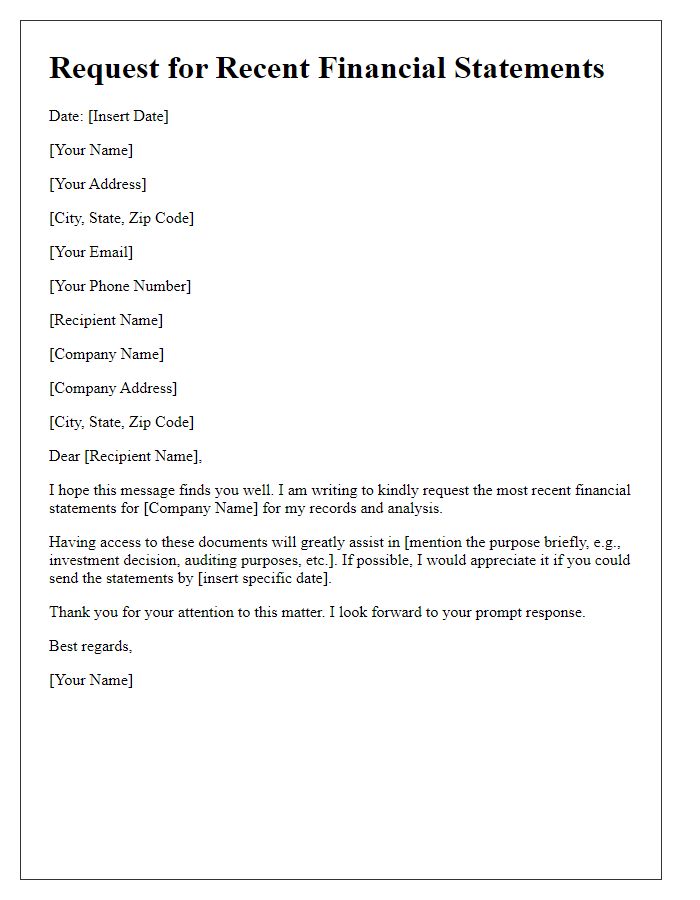

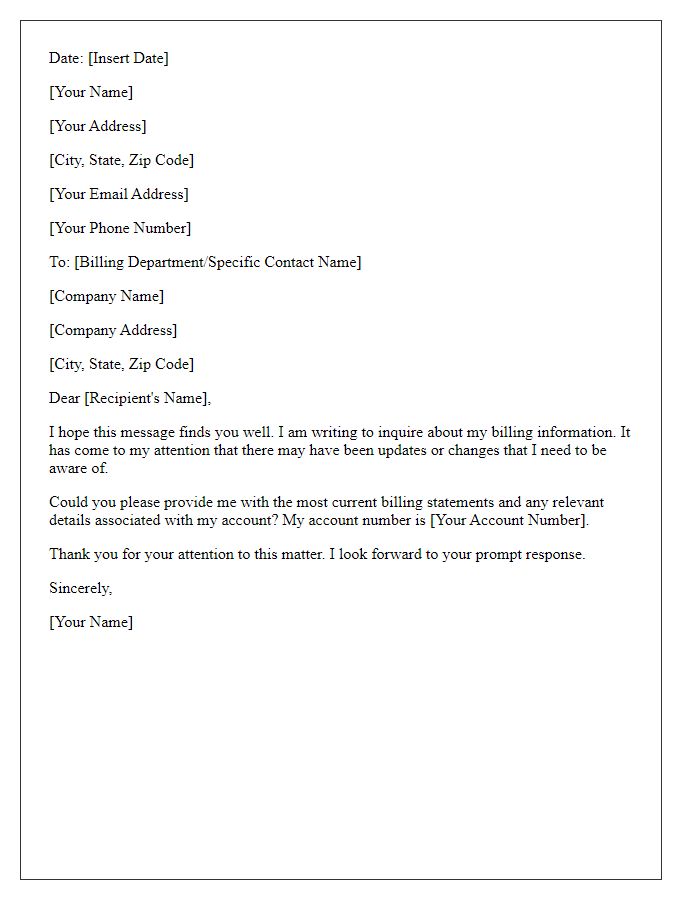

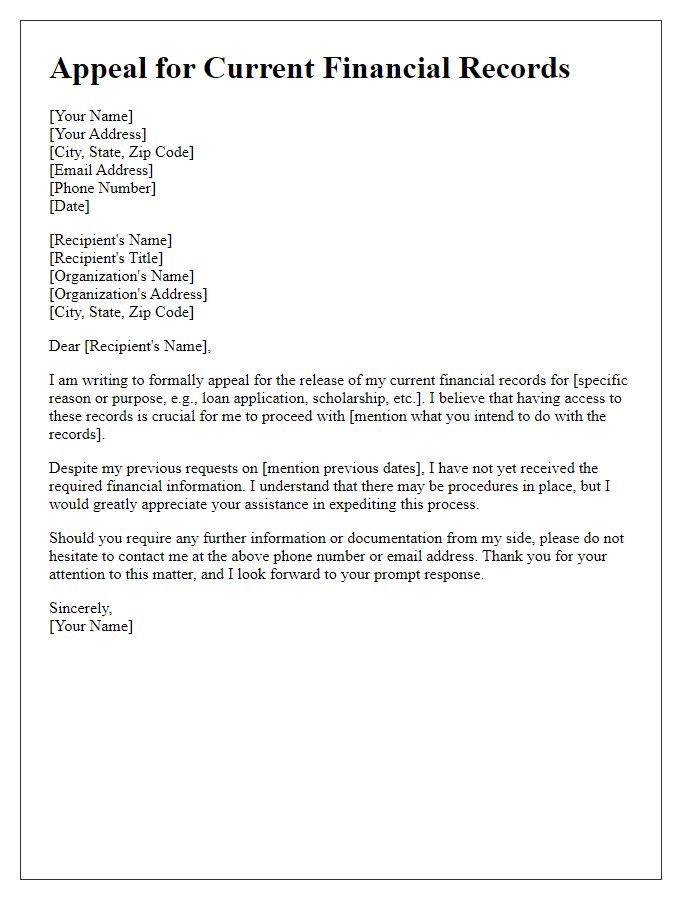

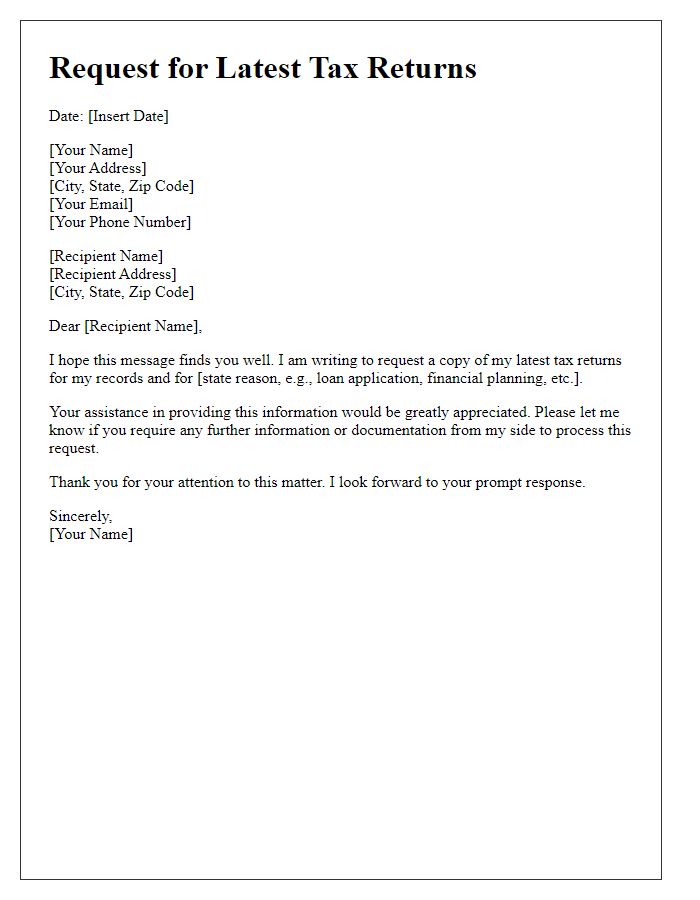

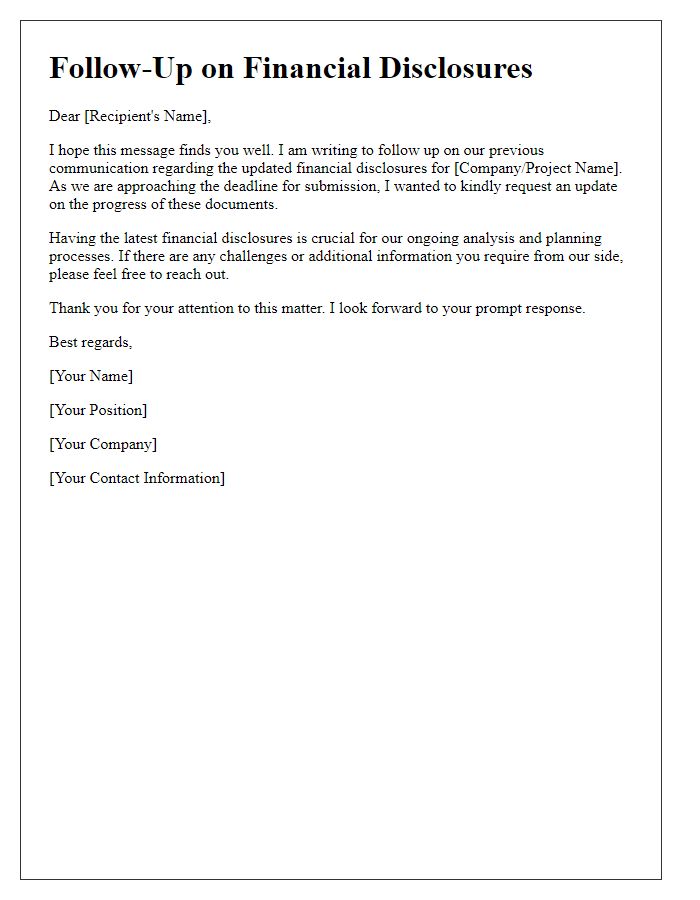

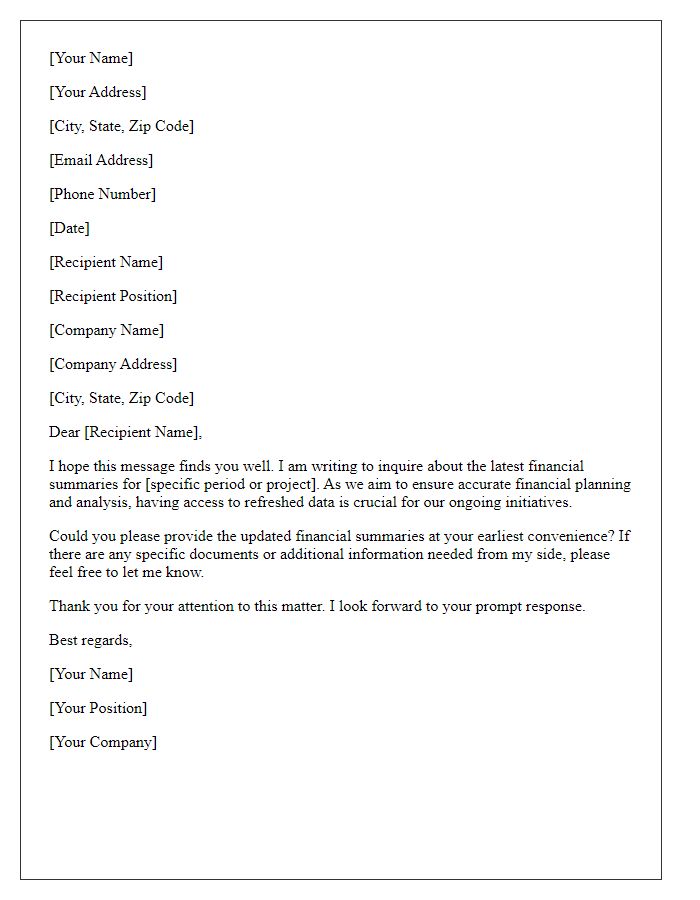

Contact Information

Requesting updated financial documents is essential for maintaining accurate records in business transactions. Specific documents may include income statements, balance sheets, and cash flow statements. Timely updates are crucial, particularly if the business operates in a dynamic industry such as technology or finance (where quarterly updates are common). Providing clear contact information, including email addresses and phone numbers, streamlines communication, fostering prompt responses. Additionally, noting the importance of compliance with regulatory standards (e.g., GAAP or IFRS) ensures all necessary documentation is prepared according to legal requirements.

Subject Line

Subject Line: Request for Updated Financial Documents for Review

Purpose Statement

Requesting updated financial documents is essential for maintaining accurate records and ensuring compliance with regulatory standards. Financial documents, including income statements, balance sheets, and cash flow statements, provide a comprehensive overview of an entity's fiscal health. Regular updates, typically quarterly or annually, allow for timely analysis and strategic decision-making. Access to the most current financial documents facilitates transparency, enabling stakeholders to assess performance metrics effectively. Obtaining these documents from relevant departments or financial institutions ensures adherence to deadlines and supports ongoing financial planning and auditing processes.

Document List Needed

Requesting updated financial documents is essential for accurate financial analysis. Items required include the latest bank statements from all accounts, updated income tax returns for the last two fiscal years, profit and loss statements for the current year, balance sheets, and cash flow statements. Additionally, any recent investment account statements (from mutual funds, stocks, etc.) and receipts or documents reflecting outstanding debts or liabilities are crucial. These documents assist in developing a comprehensive view of financial status, facilitating informed decisions.

Deadline for Submission

Updated financial documents are essential for maintaining accurate records in any financial operation. In businesses, financial documents like balance sheets, income statements, and cash flow statements provide a comprehensive view of the company's fiscal health. A deadline for submission, often set at the end of the fiscal year (December 31), ensures timely compliance with regulations and facilitates effective financial analysis. Businesses must adhere to specific timelines to avoid penalties. For example, failing to provide these documents within a 30-day period can result in fines or legal issues. Requesting these updates ensures all parties involved have access to the latest, most accurate information, fostering transparency and informed decision-making.

Comments