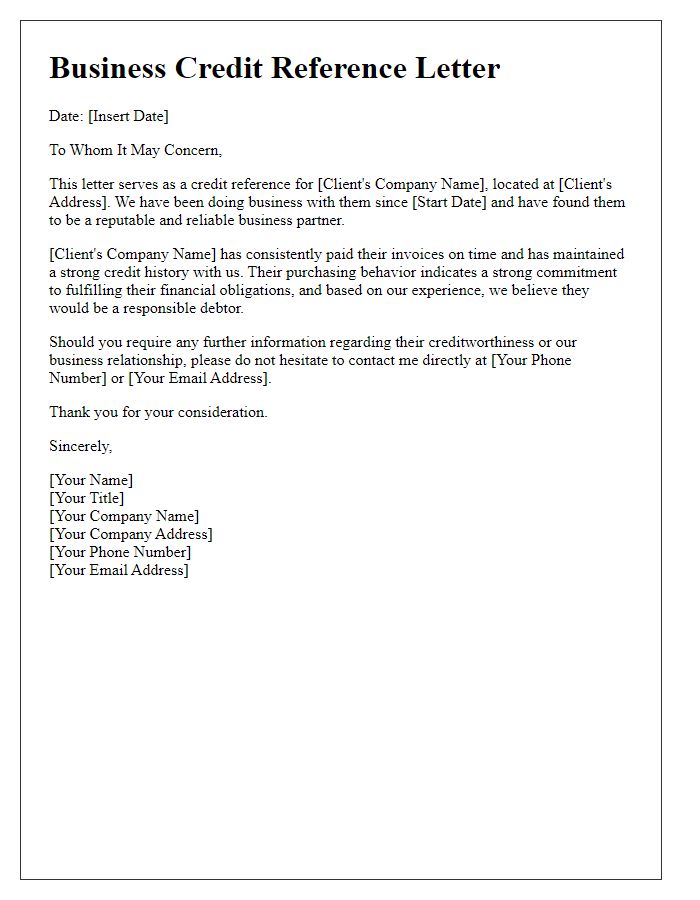

Are you looking to provide a business credit reference but unsure where to start? Crafting the perfect letter can open doors for your colleague or client, showcasing their reliability and financial responsibility in a professional manner. With a few key elements in mind, you can create a powerful credit reference letter that highlights the strengths of the business in question. So, let's dive deeper into how you can effectively write this letter and make a positive impact!

Company Name and Contact Information

Providing a business credit reference is essential for establishing trust and credibility in financial transactions. Business credit references often include the name of the company, such as Acme Tech Solutions, initial contact details (phone number, email address), and specific information about the nature of the business relationship. Key aspects to highlight could be the ongoing partnership duration, credit terms (e.g., payment periods of 30, 60, or 90 days), and the payment history, which could reflect on-time payments and overall creditworthiness. Additionally, noting the annual revenue range and industry category (e.g., technology, manufacturing) of the company can enhance the context, making it easier for the prospective lender to gauge the reliability of the business seeking credit.

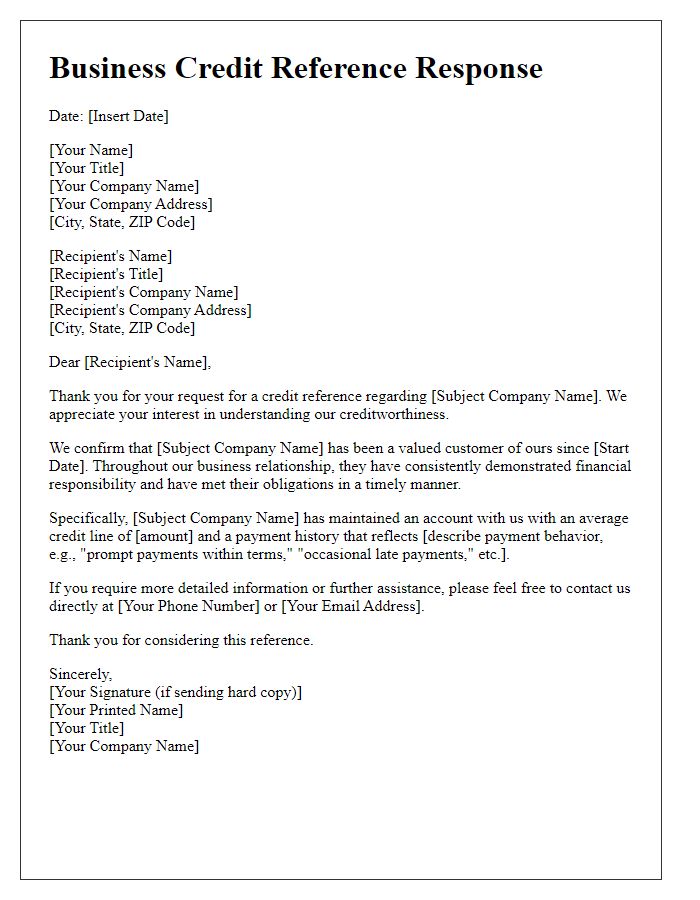

Requesting Party Details

A business credit reference report contains valuable information crucial for assessing potential business partnerships. The requesting party, which could be a financial institution or a company looking to establish credit terms, must provide vital details such as the full legal name of the business, the registered address including the city and state, Federal Tax Identification Number, and primary contact information including phone and email. Further, the length of the business relationship and the type of trade relationship (e.g., vendor, supplier) can give deeper insight into credit history reliability. Additionally, the requesting party might specify any relevant transaction history or payment terms that could enhance the context of the credit inquiry.

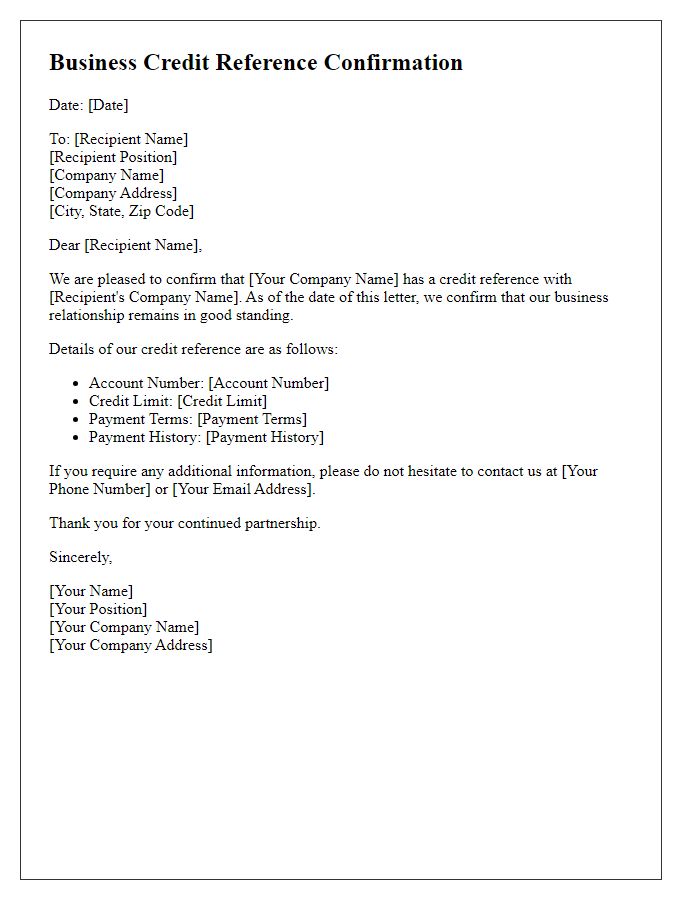

Account History and Payment Performance

A business credit reference reflects an entity's account history and payment performance in relation to credit agreements with financial institutions. This reference typically includes critical details such as outstanding credit limits, payment terms (often net 30 or net 60 days), and the historically recorded payment behavior (punctual payments, late payments, or defaults). For instance, a company with a substantial credit line of $100,000 and a commendable history of timely payments over a three-year period bolsters its reputation, demonstrating financial stability and trustworthiness. Conversely, frequent late payments or any instances of non-payment can tarnish a business's credit profile, impacting future credit applications. A comprehensive review often includes specific accounts relating to suppliers, loans, and contracts, potentially influencing partnership opportunities and financing options in a competitive marketplace.

Credit Terms and Limits

Business credit references play a crucial role in establishing financial trust and credibility between companies. A comprehensive credit reference typically includes details such as credit terms (the agreed-upon period for settling invoices) and limits (the maximum amount of credit offered to a client). For instance, a company may extend credit terms of 30 days to its clients, allowing them to pay their invoices within that time frame without incurring late fees. Additionally, a credit limit could be set at $50,000, which indicates the maximum credit extended to a business. Companies often evaluate factors such as payment history, outstanding debts, and financial stability to determine these terms and limits, ensuring a mutually beneficial relationship.

Contact Information for Further Inquiries

A business credit reference is a crucial document that outlines the creditworthiness and financial reliability of an organization. This reference is typically provided by a bank or a financial institution that has been involved with the organization, highlighting their payment history, credit limits, and overall financial behavior. Included in the credit reference are specific contact details such as the business name, contact person's full name, position, phone number, and email address. These details facilitate further inquiries from potential creditors or partners interested in assessing the organization's credit risk. Accurate and reliable information is essential, ensuring transparency and fostering trust in the business community.

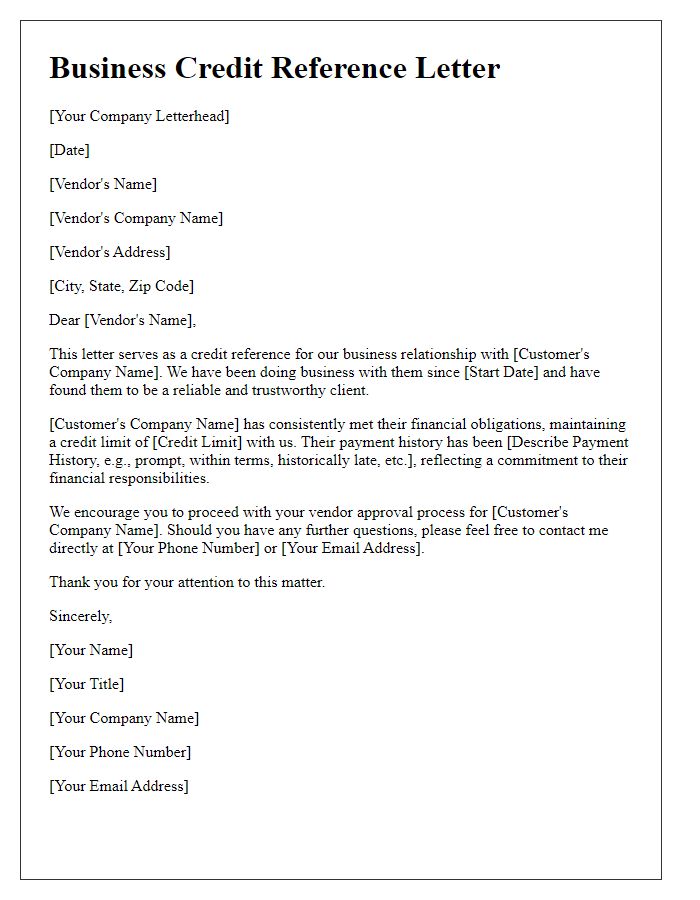

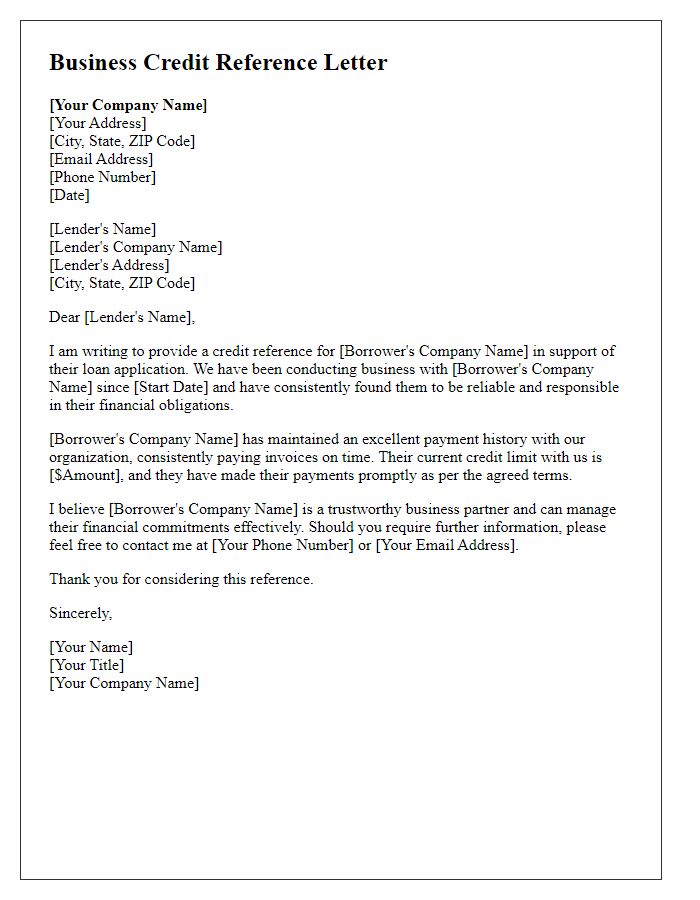

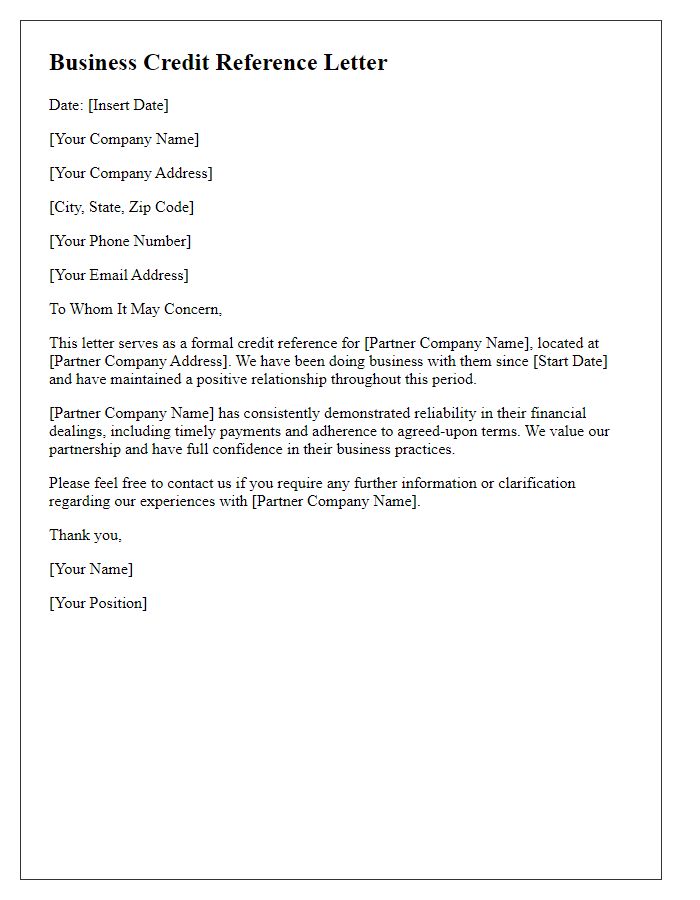

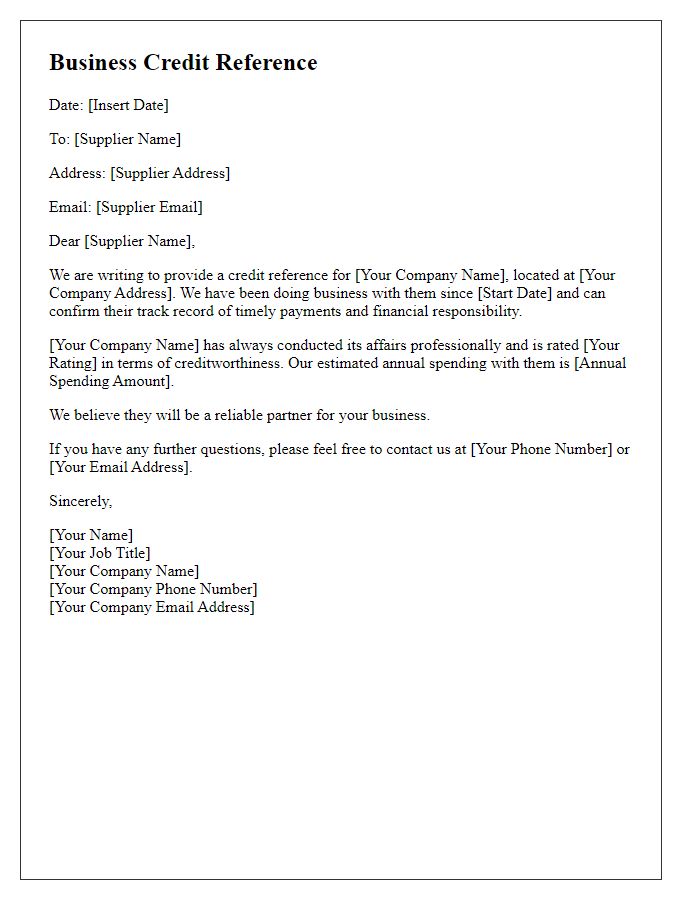

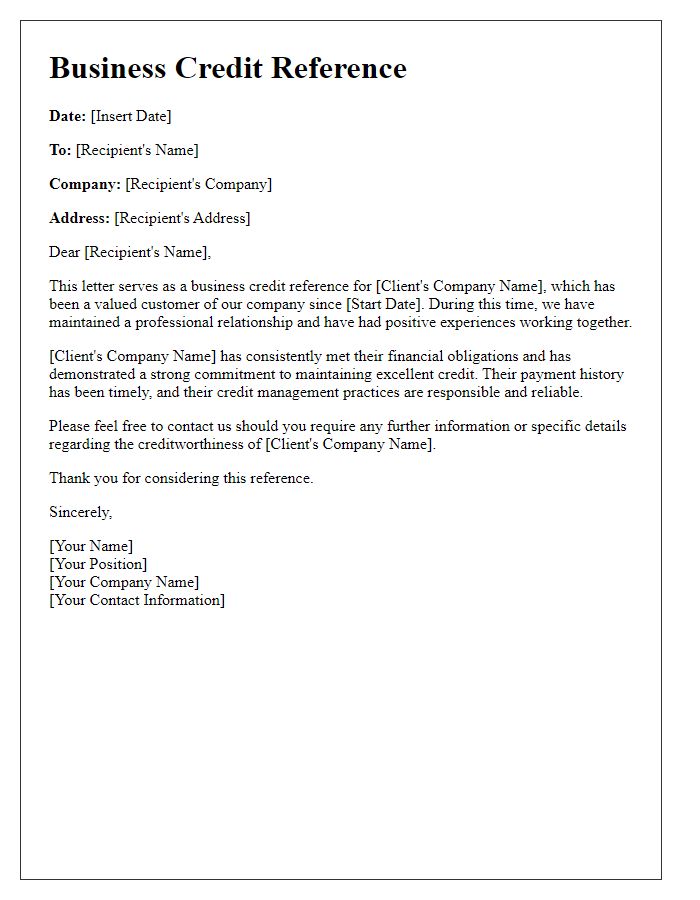

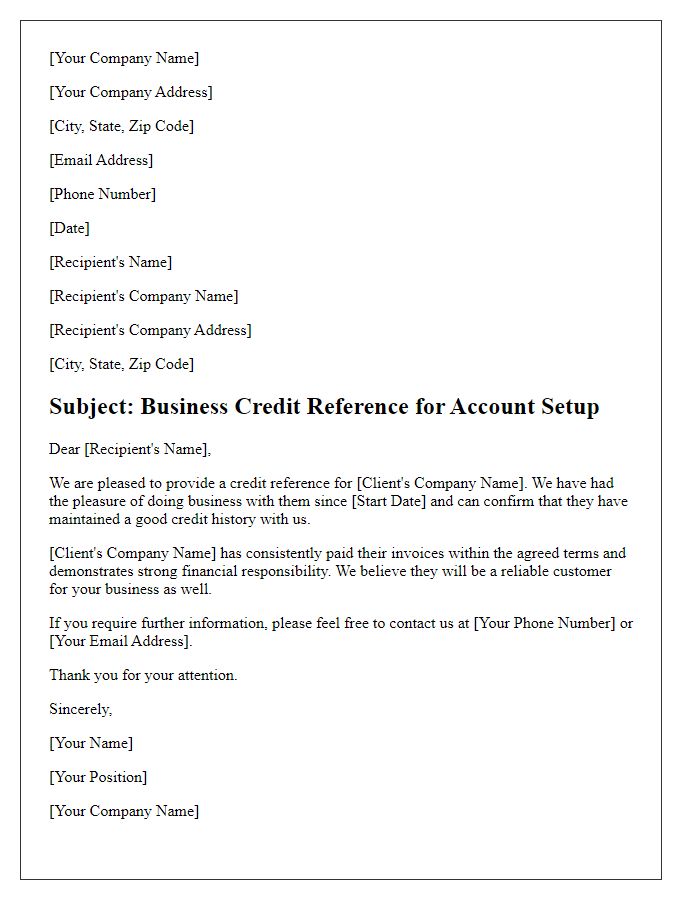

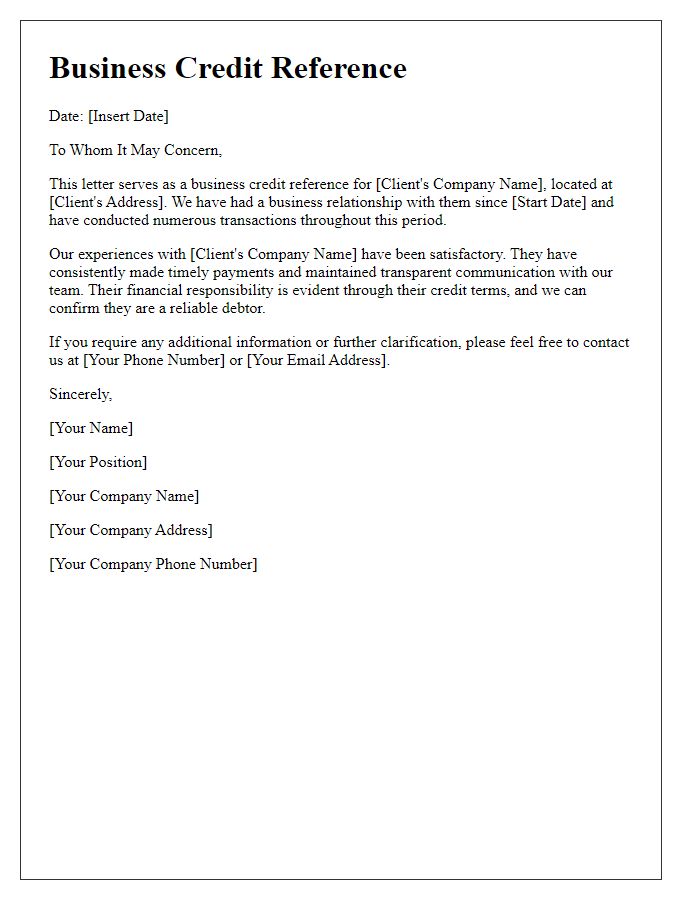

Letter Template For Providing Business Credit Reference Samples

Letter template of business credit reference for trade credit application

Comments