Are you considering taking your business to the next level with private equity investment? Crafting the perfect proposal can make all the difference in capturing the attention of potential investors. In this article, we'll explore key elements to include in your letter, ensuring it resonates with your audience while effectively conveying your vision. Join us as we delve deeper into the intricacies of creating a compelling private equity proposal!

Executive Summary

Private equity investments, particularly in high-growth sectors like technology and healthcare, provide opportunities for substantial returns. Research indicates that private equity firms, on average, have outperformed public markets by approximately 3% annually over the past decade. Targeted sectors include innovative startups in artificial intelligence (AI) and biotechnology, with potential valuations in the billions. Geographic focus may include thriving markets like Silicon Valley and Boston, known for their entrepreneurial ecosystems. Fundraising goals typically range from $50 million to $500 million, enabling strategic acquisitions and partnerships. Performance metrics, including Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC), will be closely monitored to ensure alignment with investor expectations. This proposal aims to secure investors for leveraging growth opportunities while providing risk-adjusted returns.

Investment Thesis

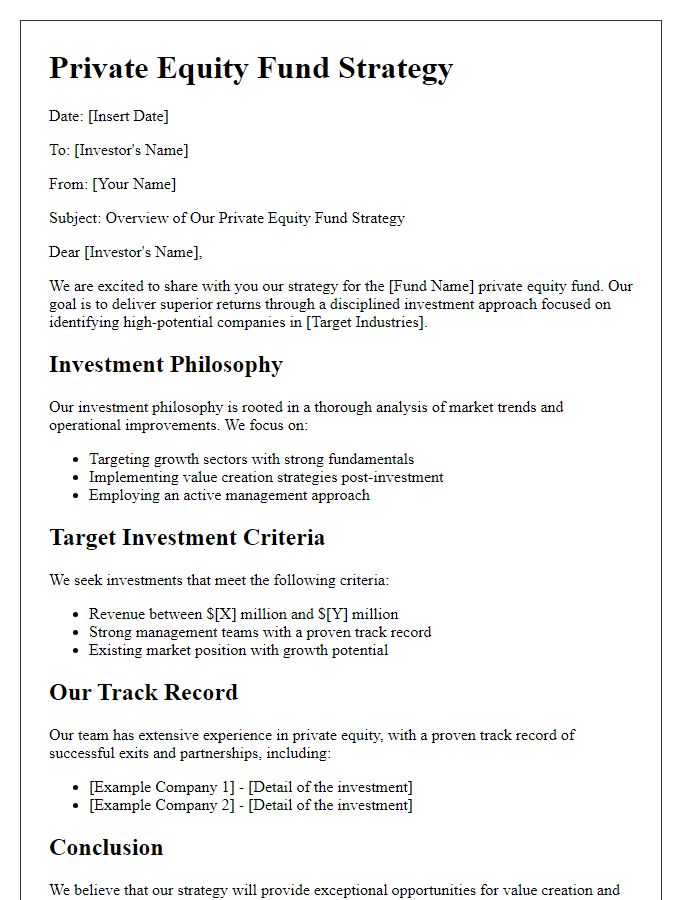

The investment thesis for private equity (PE) focuses on identifying undervalued companies in high-growth sectors, such as technology and healthcare, which have strong fundamental performance yet remain overlooked by traditional investors. Within the U.S. market, the tech industry's consistent growth rate (estimated at 5-7% annually) provides ample investment opportunity, particularly in sectors like artificial intelligence and cybersecurity. The healthcare sector, projected to grow 7% annually through 2028, presents compelling options especially in biotech firms involved in revolutionary drug developments. Target companies typically exhibit robust management teams, scalable business models, and potential for operational improvements, which aligns with PE firms' strategic focus on maximizing returns (often aiming for a 20% internal rate of return) over a 3-5 year holding period. By employing leveraged buyouts (LBOs) techniques, the PE firm can enhance capital efficiency and drive significant value creation, thus positioning itself favorably for eventual exit strategies through strategic sales or public offerings.

Market Analysis

The private equity landscape presents a compelling opportunity for investment, particularly in emerging sectors such as renewable energy and technology. The global renewable energy market is projected to expand from USD 1.5 trillion in 2021 to nearly USD 2.5 trillion by 2026, driven by governmental policies and growing consumer demand for sustainable solutions. In technology, sectors like artificial intelligence show significant promise, with a market valuation expected to exceed USD 390 billion by 2025. Notable geographical hotspots for these investments include North America, where states like California lead in innovation and sustainability initiatives, and Europe, particularly Germany and the United Kingdom, recognized for their robust regulatory frameworks supporting green investments. Analysis of industry trends reveals that private equity firms have successfully capitalized on multi-billion dollar market shifts, targeting companies adept at digital transformation and environmentally-conscious practices. This presents a ripe opportunity for strategic acquisitions, aiming to catalyze growth and maximize returns in a rapidly evolving economic landscape.

Risk and Mitigation Strategies

In private equity investments, comprehensive risk assessments are crucial for informed decision-making. Market risk, characterized by economic fluctuations, especially in sectors like technology or healthcare, can significantly impact returns. For instance, a recession can lead to reduced consumer spending, affecting portfolio companies' profitability. Financial risk, including high debt levels, necessitates strategies like maintaining a conservative capital structure and conducting regular stress tests on financial scenarios. Regulatory risk requires constant vigilance, particularly in industries such as pharmaceuticals, where compliance with entities like the FDA can determine operational viability. Operational risk can stem from management inefficiencies or supply chain disruptions; implementing robust management frameworks and diversifying suppliers can mitigate these issues. Lastly, reputation risk, a concern for firms heavily invested in consumer-facing markets, emphasizes the necessity of maintaining strong public relations and ethical business practices to enhance stakeholder trust.

Financial Projections

Financial projections serve as a crucial element in evaluating the potential profitability and sustainability of private equity investments. These projections often encompass detailed forecasts over a period, typically five to seven years, showcasing revenue growth, cost structure, and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margins. Key assumptions include market share expansion within targeted industries, anticipated economic conditions (such as inflation rates or GDP growth), and scalability of operations. Incorporating various financial metrics--such as return on investment (ROI), internal rate of return (IRR), and net present value (NPV)--provides investors with a quantifiable analysis of expected performance. Furthermore, scenario analysis (best case, base case, worst case) enhances the understanding of risks and their potential impact on cash flow projections, enabling informed decision-making for stakeholders involved in the private equity landscape.

Comments