Are you looking to invest in commercial real estate but unsure where to start? Crafting a persuasive proposal can be the key to securing that lucrative property deal. In this article, we'll guide you through the essential elements of a successful letter template designed specifically for commercial real estate proposals. So, let's dive in and explore how to make your proposal stand out from the competition!

Clear Property Description

The proposed commercial real estate property located at 123 Main Street, Springfield, encompasses a prime 25,000 square foot building. This strategically positioned facility features an open floor plan ideal for retail or office use, complemented by high ceilings (12 feet) and large windows that offer ample natural light. The property sits on a 1-acre lot, providing generous parking space for over 100 vehicles, a significant advantage in this busy urban area. Zoning regulations permit diverse business activities, enhancing its investment potential. Nearby amenities include Springfield Mall and Central Park, attracting foot traffic and potential clientele. The site also benefits from high visibility due to its location on a major thoroughfare, serving over 30,000 vehicles daily. Recent renovations, including a new HVAC system, modernized restrooms, and upgraded electrical wiring, ensure the property meets contemporary standards and appeals to a wide range of businesses.

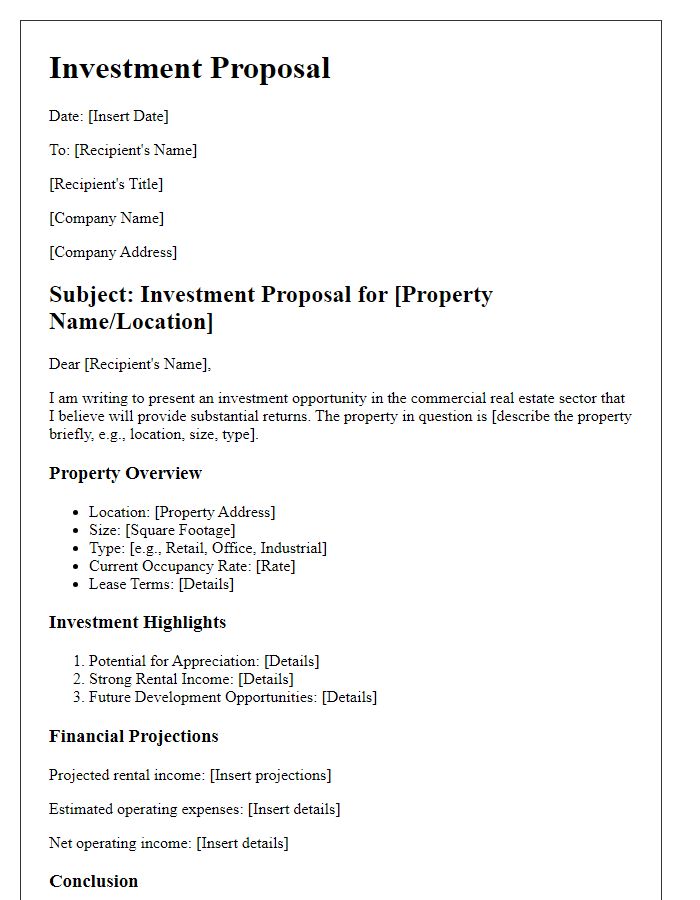

Detailed Financial Terms

The financial terms of the commercial real estate proposal outline essential considerations, such as property acquisition costs, financing options, and projected returns on investment. Total investment amounts are crucial; for instance, a commercial property priced at $2 million may require a 20% down payment, translating to $400,000. Lease agreements typically span five to ten years, dictating monthly rental income, often ranging from $15 to $30 per square foot, depending on location and amenities in cities like New York or Los Angeles. Additionally, operating expenses, including maintenance, property management, and insurance, can comprise approximately 30% of rental income, affecting net operating income calculations. Market comparisons and comparable sales data are vital for assessing potential appreciation or depreciation over time, emphasizing trends in specific areas, such as the growing tech presence in San Francisco's commercial sector. Tax implications, including property tax rates and potential deductions, further influence overall financial viability, making these elements essential for informed decision-making in commercial real estate investments.

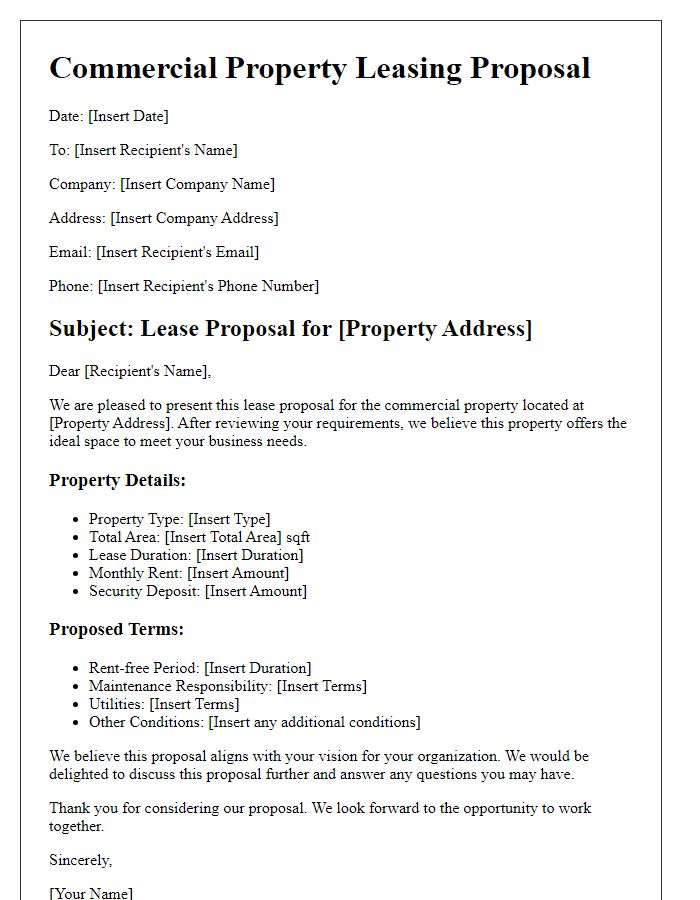

Tenant Requirements and Options

In the competitive landscape of commercial real estate, understanding tenant requirements is crucial for successful leasing strategies. Specific needs often include space configurations such as open floor plans for collaborative environments, or private offices to enhance confidentiality for businesses in sectors like finance or legal services. Location factors, such as proximity to public transportation hubs and major highways like Interstate 95, significantly influence tenant decisions, especially for companies with a mobile workforce. Additionally, square footage requirements often range from 1,500 to 10,000 square feet depending on the business size and operational needs, while amenities such as high-speed internet, ample parking facilities, and green spaces are becoming increasingly important. Flexibility in lease terms, including options for renewal or expansion, can provide incentives for prospective tenants, allowing businesses to adapt to changing market conditions. Tailoring property features to meet these diverse requirements ensures a valuable alignment between landlords and tenants, fostering long-term occupancy and satisfaction.

Comprehensive Market Analysis

A comprehensive market analysis provides critical insights for investing in commercial real estate properties, particularly within urban areas like Manhattan, New York City, showcasing high-demand sectors such as retail, office space, and industrial properties. Key metrics include average rental rates (often exceeding $80 per square foot in prime locations) and vacancy rates, which typically hover around 10% for office spaces, indicating a competitive market. Economic indicators, such as job growth (approximately 2% annually in the financial sector), and population trends reveal an increasing migration toward metropolitan hubs, driving demand for commercial spaces. Additionally, understanding zoning laws in specific neighborhoods, like Brooklyn's rezoned sections for mixed-use development, can unveil lucrative opportunities. External factors, such as interest rates projected to rise by 0.25% in the coming year, can also impact investment strategies, requiring careful consideration for financial modeling and risk assessment.

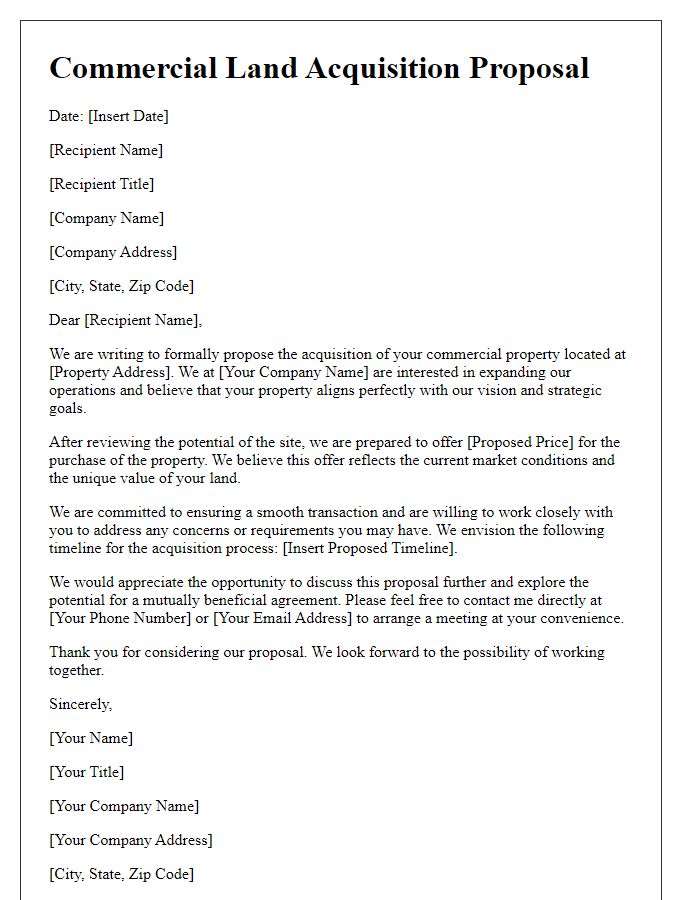

Strategic Investment Opportunities

The commercial real estate market offers strategic investment opportunities in various key segments, such as office spaces (class A, B, C classifications), industrial properties (warehouses, distribution centers), and retail locations (shopping centers, urban storefronts). Noteworthy city centers like New York City with a dense population exceeding 8 million and a strong corporate presence serve as prime locations for high-yield investments. Emerging markets such as Austin, Texas, known for rapid growth and a tech-savvy population, present lucrative prospects for development. Investment strategies may include leveraging tax incentives, understanding zoning regulations, and conducting thorough market analysis to identify undervalued properties. High occupancy rates in these strategic zones can contribute to substantial rental income and long-term capital appreciation, making them desirable for institutional investors and individual stakeholders alike.

Comments