In today's dynamic business landscape, the potential for growth often lies in collaboration. As we explore the exciting possibilities of a merger, we believe that combining our strengths could create a powerhouse that drives innovation and expands our market reach. This partnership isn't just about numbers; it's about harnessing our shared vision to unlock new opportunities for success together. Intrigued by what this merger could mean for both our companies? Read on to discover the benefits and synergies we can achieve together!

Introduction and Purpose

A merger between two established companies can create significant synergies and open up new markets. The primary aim of this proposal is to outline the benefits of forming a joint enterprise, particularly in enhancing operational efficiency and expanding the customer base. By combining resources and expertise, both entities can leverage their strengths in competitive industries, improve financial stability, and accelerate innovation. The merger seeks to create a formidable presence in key areas, fostering long-term growth while delivering increased value to stakeholders. A well-structured partnership can lead to enhanced market share, diversified portfolios, and shared strategic goals, ultimately resulting in a stronger, more resilient organization.

Strategic Benefits

A merger between two companies can create substantial strategic benefits, including enhanced market share that allows for increased competitiveness within the industry. Operational efficiencies often result from combined resources, such as streamlined supply chains and shared technological advancements. The collaboration may open new geographic markets, leveraging the strengths of each company to penetrate areas previously inaccessible. Furthermore, a diversified product portfolio emerges, allowing for risk mitigation and appeal to a broader customer base. Financial synergies can lead to cost savings, enabling reinvestment into innovation and growth initiatives, strengthening the overall positioning in the marketplace.

Financial Overview

A financial overview is crucial for assessing the viability of a business merger, detailing potential synergies and economic benefits. The combined revenue projections might exceed $5 million annually, drawing from key markets such as North America and Europe. Utilizing balance sheets, assets may include $2 million in cash reserves and $10 million in inventory across both entities. Liabilities, estimated at $8 million, will need careful management to ensure optimal debt-to-equity ratios. Evaluating operational costs could highlight savings of around 15% post-merger, primarily through shared services like marketing and distribution. Investors may anticipate a return on investment (ROI) of approximately 20% over the first three years, contingent on achieving projected growth rates. Comprehensive forecasts will enable stakeholders to make informed decisions about resource allocation and strategic direction, fostering long-term successful integration.

Operational Synergies

Operational synergies in a business merger can lead to enhanced efficiency and cost savings for both entities involved. Streamlining processes across departments, such as supply chain management and human resources, can reduce redundancies and create a more agile operational framework. For example, integrating technology systems can simplify data sharing and improve decision-making capabilities. Shared services may also result in lower overhead costs, while pooling resources can foster innovation, speeding up product development cycles. Furthermore, aligning corporate cultures and training programs can enhance employee engagement and retention post-merger, ultimately driving long-term growth and profitability.

Legal and Compliance Alignment

A merger proposal between two business partners necessitates a thorough examination of legal and compliance alignment to ensure adherence to regulatory frameworks (e.g., SEC guidelines in the United States or GDPR in the European Union). Due diligence must be conducted, focusing on the compatibility of corporate structures and existing contracts, such as vendor agreements and employment contracts, to identify potential liabilities or conflicts. Key components include evaluating intellectual property rights, such as patents and trademarks, to assess the protection of innovations and proprietary technologies. Compliance with industry regulations, specific to sectors like finance or healthcare, is critical in preventing legal complications post-merger. Engaging legal experts specializing in merger and acquisition laws can provide insights on necessary filings with regulatory bodies, such as antitrust notifications, which may impact the timeline and feasibility of the merger.

Letter Template For Business Partner Merger Proposal Samples

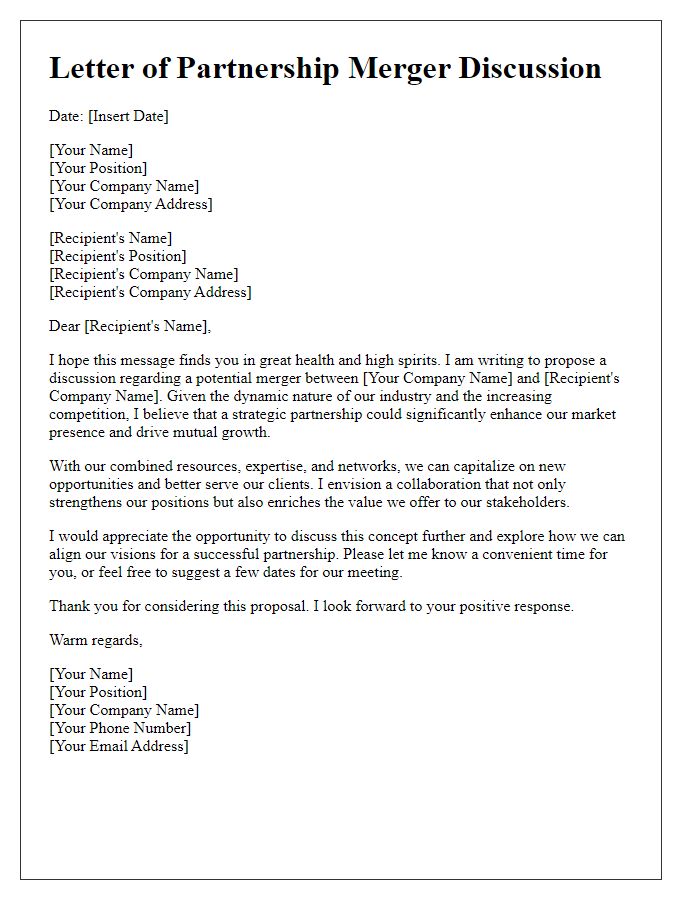

Letter template of partnership merger discussion for enhanced market presence.

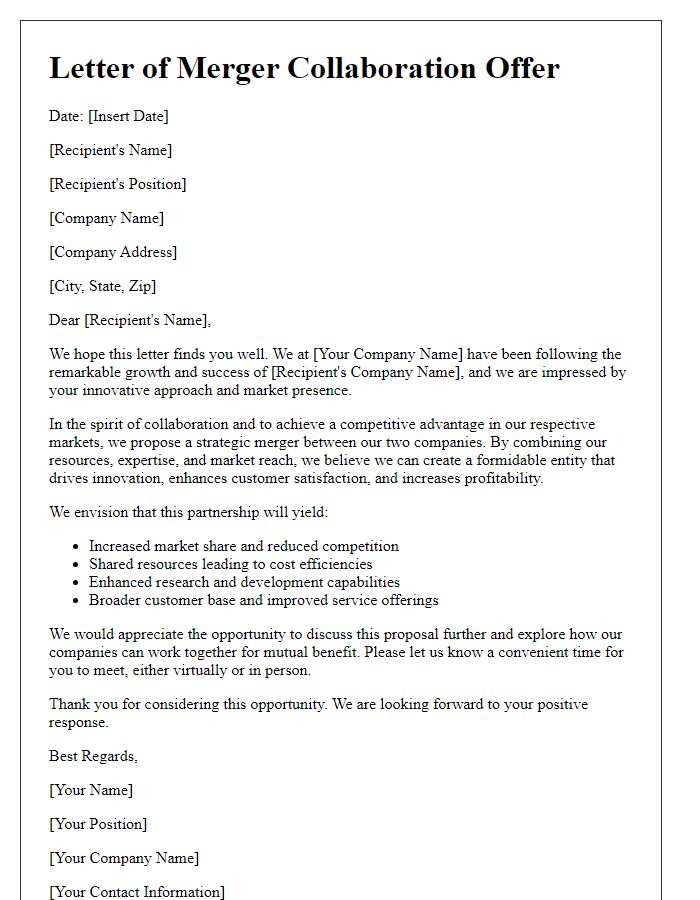

Letter template of merger collaboration offer for competitive advantage.

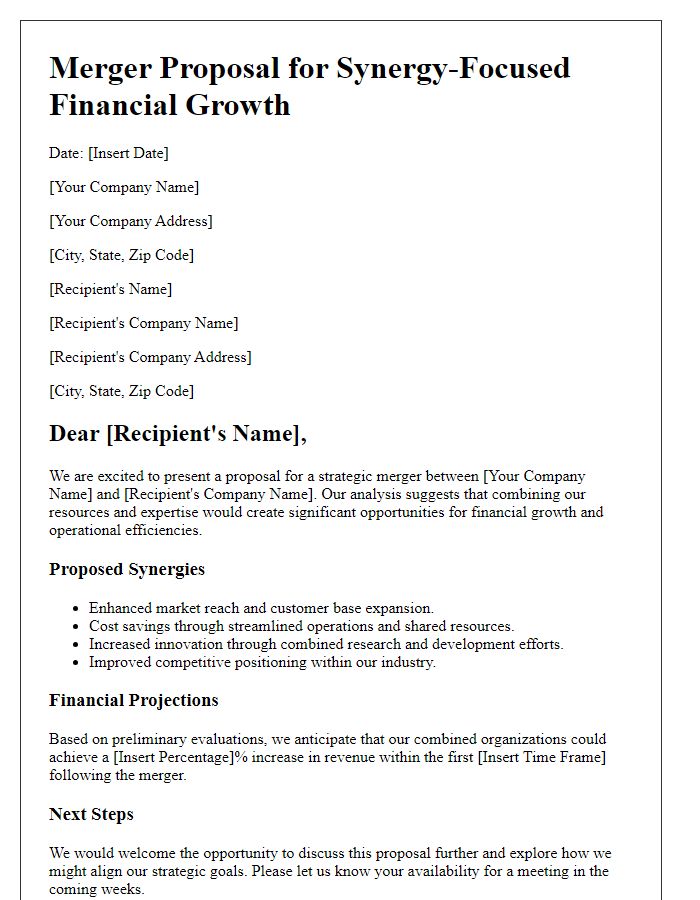

Letter template of synergy-focused merger proposal for financial growth.

Comments