In today's ever-evolving business landscape, maintaining compliance is more crucial than ever, especially when partnering with others in your industry. As you navigate the complexities of regulatory requirements and partnership obligations, having a solid compliance documentation process in place is essential for safeguarding your interests and building trust. This article will walk you through the key elements of crafting a letter template that effectively communicates your compliance expectations to your business partners. So, let's dive in and explore how you can streamline this process for success!

Clear Identification of Parties

In any business partner compliance documentation, the clear identification of parties is crucial for establishing a formal agreement. This section typically includes the full legal names of the entities involved, such as Company A, registered in Delaware, and Company B, based in California, along with their respective addresses. Additional details like Tax Identification Numbers (TIN), which uniquely identify the businesses for tax purposes, and the names of authorized representatives, including their titles and contact information, can enhance clarity. Identifying these parties accurately ensures that all obligations, rights, and responsibilities are explicitly outlined, reducing the risk of misunderstandings in future dealings. This section serves as the foundation for legally binding agreement terms and conditions between the parties involved.

Compliance Standards and Requirements

Compliance standards and requirements play a critical role in maintaining business integrity and legal adherence in partnerships. Effective compliance documentation outlines the necessary guidelines that partners must follow to ensure alignment with regulatory expectations, such as the Sarbanes-Oxley Act for financial accountability or GDPR for data protection in the European Union. Comprehensive documentation includes relevant policies, procedures, and training materials, tailored to industry-specific regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) for healthcare partners or the Federal Acquisition Regulation (FAR) for government-related contracts. By emphasizing the importance of regular audits and assessments, compliance documentation promotes transparency, risk management, and a mutual commitment to ethical practices throughout the partnership lifecycle.

Confidentiality Obligations

Confidentiality obligations serve as crucial elements in business partner agreements, ensuring that sensitive information shared between entities--including proprietary data, trade secrets, and strategic plans--remains protected from unauthorized disclosure. These obligations dictate the legal responsibilities of both parties in upholding confidentiality, typically spanning across a specified duration, such as five years post-disclosure, to prevent any potential misuse of information. Essential components include the definition of "confidential information," procedures for handling such information, and measures for safeguarding data, like encryption and access control protocols. Non-compliance may result in legal consequences, including monetary damages or injunctive relief, underscoring the importance of adherence to these confidentiality terms in fostering trust and collaboration between business partners.

Terms and Conditions of Agreement

The Terms and Conditions of Agreement serve as a vital document outlining the responsibilities and expectations between business partners engaged in a collaborative project. This comprehensive agreement typically includes sections addressing scope of work, deadlines, payment terms, confidentiality clauses, and dispute resolution mechanisms. Specific legal provisions may reference governing laws applicable in the relevant jurisdiction, such as the State of Delaware. In addition, it should detail any compliance requirements mandated by governing bodies, highlighting the importance of adhering to industry regulations like the Sarbanes-Oxley Act for financial reporting. Clearly defined terms benefit both parties by establishing a framework that promotes accountability, thereby enhancing mutual trust and ensuring a successful partnership.

Signature and Contact Information

Compliance documentation for business partnerships requires accurate and formal signature and contact information. Signature blocks generally include the signatory's full name, title, and date of signing, ensuring legal accountability. Contact information should encompass the physical address, phone number, and email address, providing accessible communication channels. Properly formatted documentation guarantees that all parties maintain transparency and adhere to compliance standards, crucial for fostering trust and ensuring alignment with regulations across diverse industries.

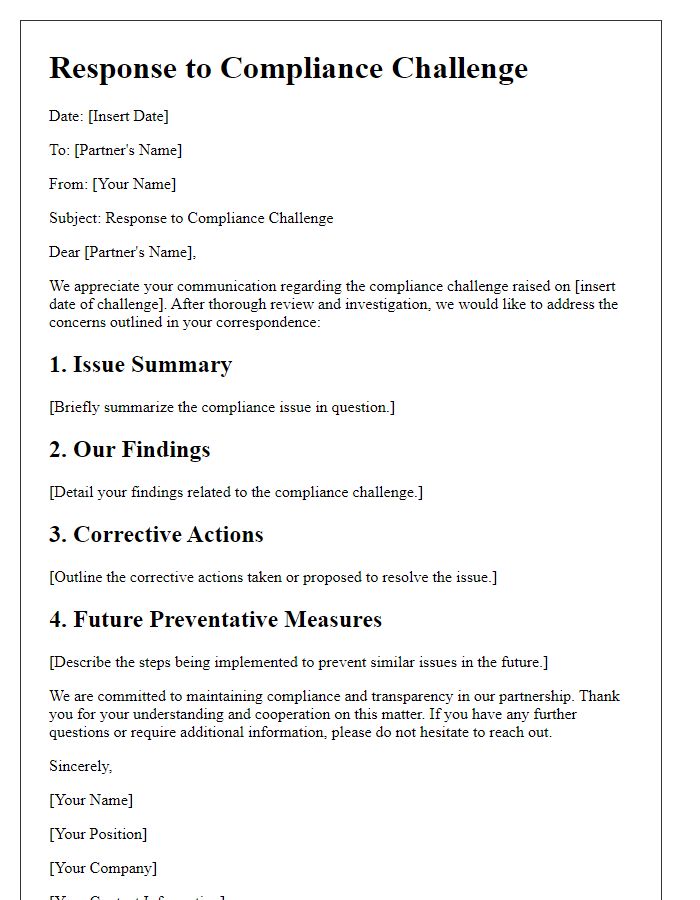

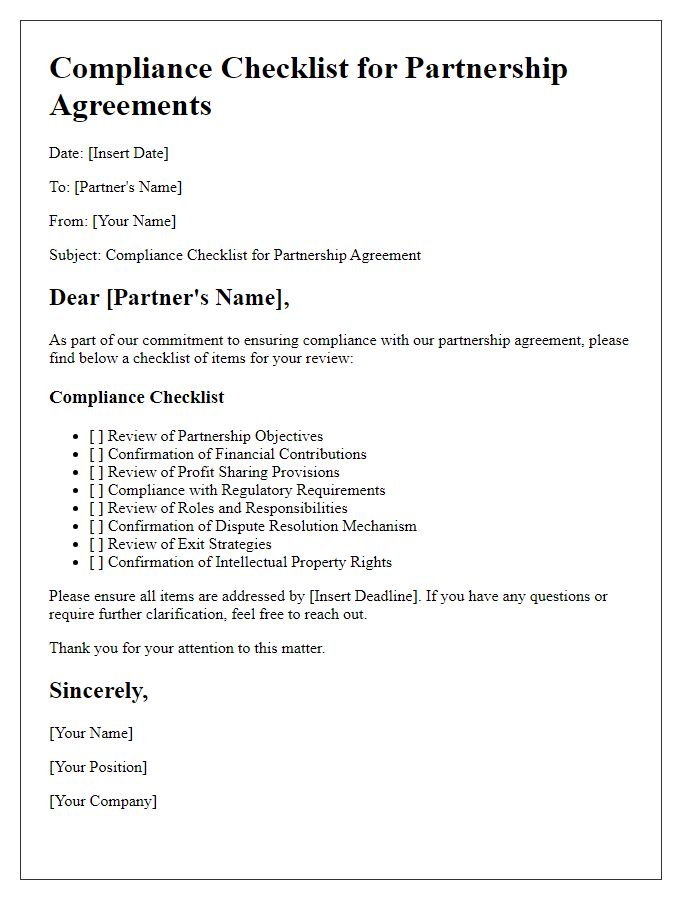

Letter Template For Business Partner Compliance Documentation Samples

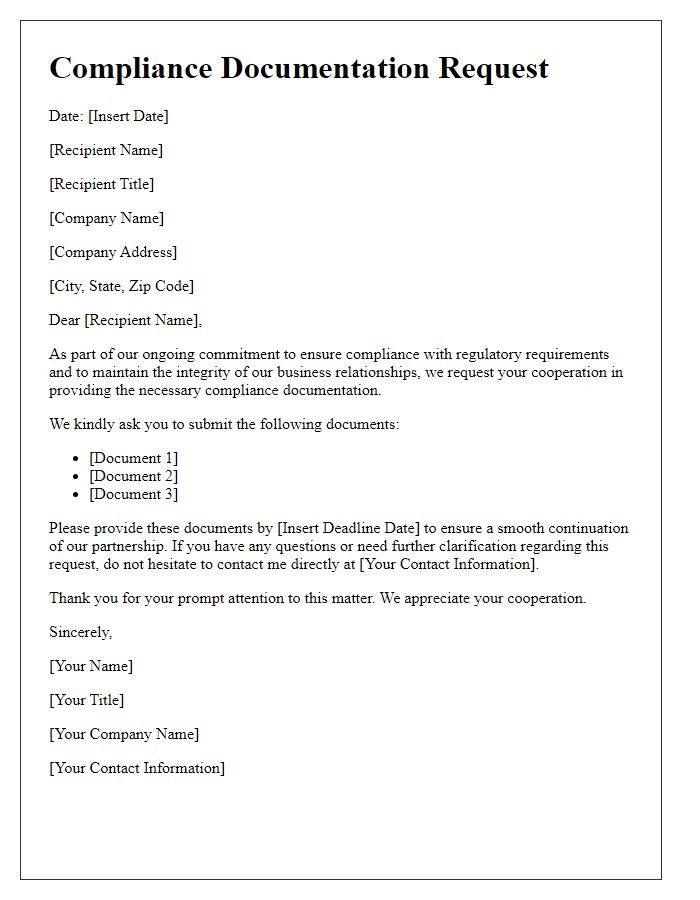

Letter template of compliance documentation request for business partners.

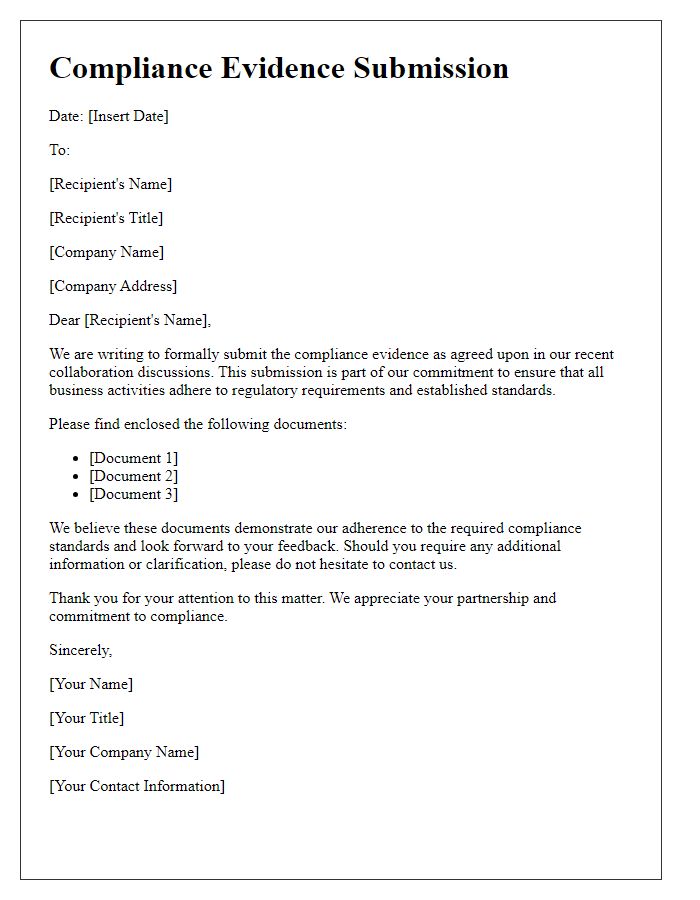

Letter template of compliance evidence submission for business collaborators.

Comments