Writing a letter to convey a business asset sale offer can seem daunting, but it's easier than it sounds! This type of correspondence is all about clarity and professionalism, ensuring that both parties understand the proposal at hand. Whether you're selling equipment, inventory, or real estate, a well-structured letter can facilitate a smooth transaction. Ready to learn the essential components of crafting the perfect asset sale offer letter? Let's dive in!

Clear Identification of Parties Involved

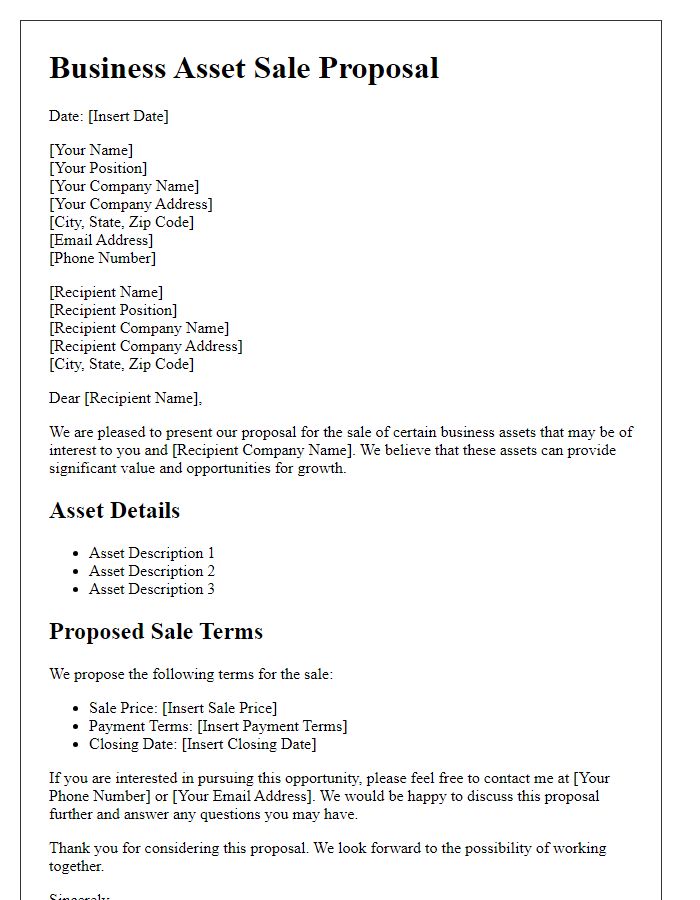

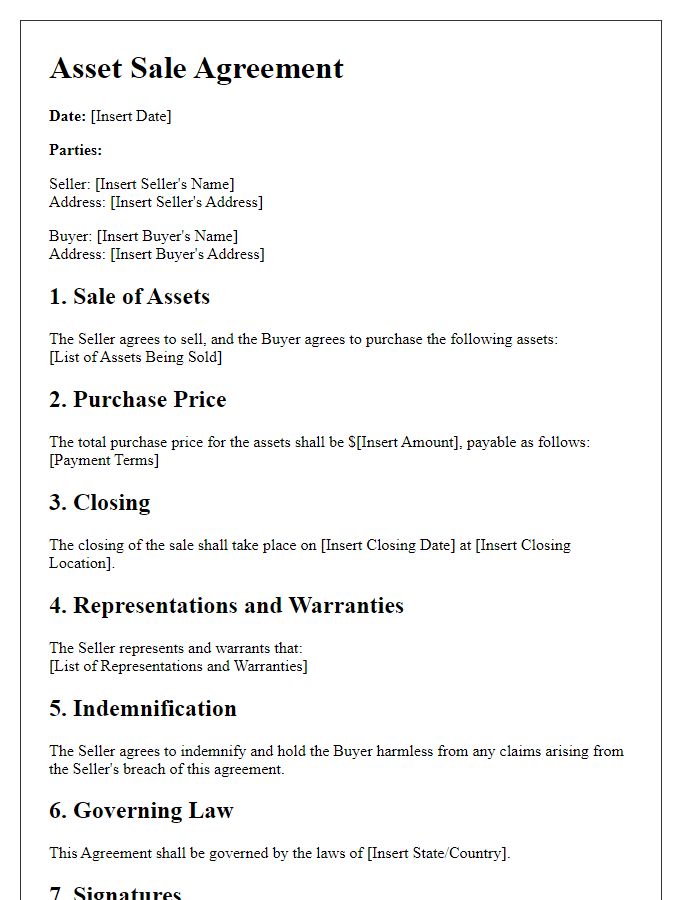

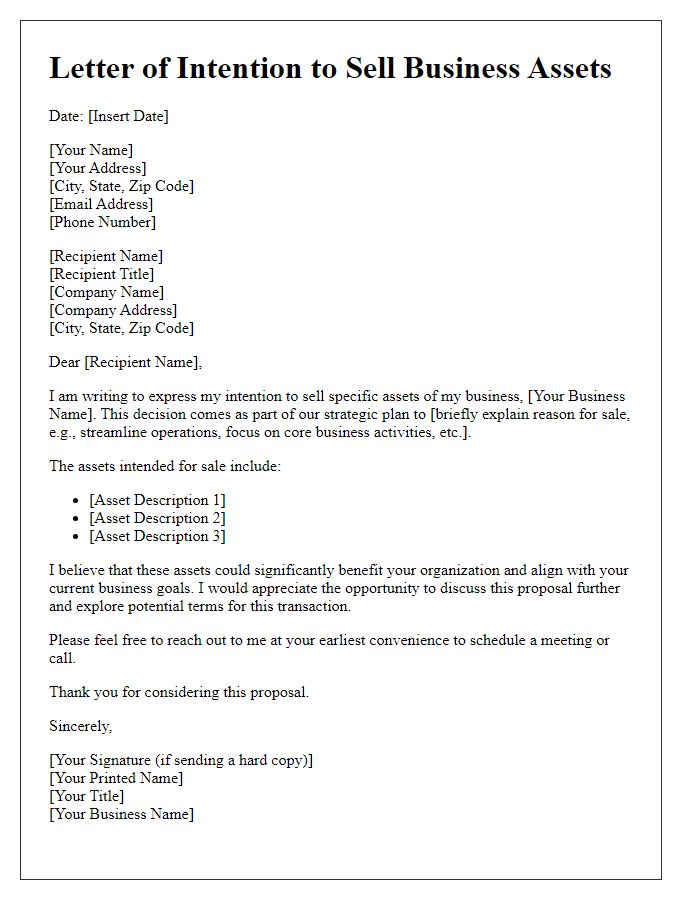

In a business asset sale offer, it is crucial to clearly identify the parties involved to minimize any potential misunderstandings or legal issues during the transaction. The Seller, typically the current owner or representative of the business entity, must be identified with full legal name, business registration details, and contact information. The Buyer, the interested party acquiring the assets, should be similarly identified, including their legal name, business registration, and relevant contact details. Proper identification ensures both parties are recognized legally, establishes accountability, and streamlines negotiation processes. Clarity in this section can also include any affiliated individuals or entities representing each party, ensuring comprehensive identification and support of the transaction.

Detailed Description of Assets

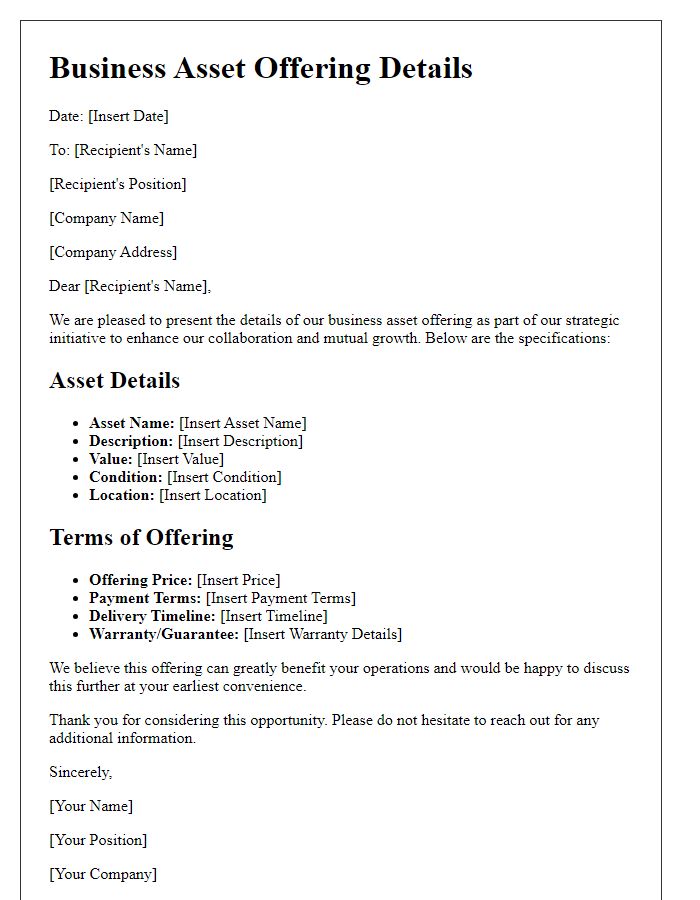

A comprehensive asset sale offer may include various business assets such as inventory, machinery, equipment, intellectual property, and real estate. Inventory, which can range from retail products valued at $50,000 to $200,000, requires accurate valuation for potential buyers. Machinery encompasses heavy-duty equipment like forklifts or industrial printers, often worth tens of thousands of dollars, with potential depreciation impacting their market value. Equipment may include computers and office furniture, collectively valued at approximately $30,000. Intellectual property involves patents or trademarks, which can significantly enhance the sale price based on their market potential. Real estate assets, if applicable, may comprise commercial properties located in prime areas, with market values often exceeding $500,000. Each of these components contributes to the overall valuation and attractiveness of the business for prospective buyers.

Price and Payment Terms

A business asset sale offer should include specific details regarding the price and payment terms. The overall purchase price, typically represented as a total sum in U.S. dollars, should be clearly stated. Payment terms may involve an initial deposit, often a percentage of the total purchase price, followed by installments or a lump-sum payment at closing. Payment methods, such as wire transfer, certified check, or escrow, should also be detailed. Additionally, any contingencies related to financing, inspections, or closing timelines should be outlined to ensure clarity and mutual agreement between the seller and buyer parties involved in the transaction.

Conditions of Sale

When selling business assets, key conditions of sale must be clearly defined. The terms often include the purchase price, payment method, and due date. A detailed description of the assets is essential, encompassing quantities, conditions, and locations, ensuring transparency for both parties. Specific requirements regarding the transfer of ownership, including legal paperwork and timelines, should be outlined. Warranty disclaimers and liabilities are critical, protecting the seller from future claims. Additionally, confidentiality agreements may be necessary to safeguard sensitive business information. Finally, establishing a dispute resolution process is crucial, often involving mediation or arbitration as methods for resolving conflicts.

Confidentiality and Non-Disclosure Terms

A business asset sale offer involves various elements, among them confidentiality and non-disclosure terms. In transactions involving sensitive information, such as financial statements, client lists, and operational strategies, it is crucial to establish confidentiality protocols to protect proprietary data. The involved parties must agree to a Non-Disclosure Agreement (NDA), clearly outlining the types of information deemed confidential, typically including trade secrets and operational insights, along with stipulations on the duration of confidentiality, often set at three to five years post-discussion. Additionally, consequences for breaches of confidentiality, such as financial penalties, help enforce compliance. By ensuring strict adherence to these terms, both buyer and seller can navigate the sale process smoothly while safeguarding their interests and intellectual property.

Comments