Are you navigating the complexities of business tax compliance? Understanding the various requirements and staying updated can often feel overwhelming. That's why having a clear letter template for confirming tax compliance is essential for your business's financial health and peace of mind. Join us as we delve deeper into crafting the perfect letter for your tax compliance confirmation and discover tips to streamline your process!

Accurate business identification details

Accurate business identification details are crucial for tax compliance confirmations. Registration numbers, such as Employer Identification Number (EIN), ensure proper identification by tax authorities like the Internal Revenue Service (IRS) in the United States. Business addresses, including physical and mailing locations, aid in correspondence and official documentation. Legal entity types, such as Limited Liability Company (LLC) or Corporation, influence tax obligations and reporting requirements. State-specific identifiers, such as Sales Tax Permit numbers, are necessary for compliance with local tax regulations in states like California or Texas. Maintaining updated records of business ownership details, including the names of partners or shareholders, is essential for clarity in tax matters.

Clear declaration of tax compliance status

A clear declaration of tax compliance status is crucial for businesses, especially for those operating in densely regulated environments like New York City. Compliance with local tax laws, including sales tax, income tax, and payroll tax, is mandatory. The IRS stipulates that businesses must file annual returns, with deadlines typically by March 15 for S corporations and April 15 for others. Failure to comply can result in penalties up to 25% of the amount owed, or even stricter enforcement actions. Businesses are advised to maintain tax records for at least three years to support compliance efforts, particularly during audits which can occur randomly or due to discrepancies. The need for timely filing and accurate reporting cannot be understated, as they are key components in maintaining a good standing with state and federal tax authorities.

Detailed tax period and payment records

Business tax compliance confirmation entails accurate documentation of tax periods and payment records. For instance, the federal tax return for 2022, due on April 15, reflects a total income of $1,000,000 for the fiscal year ending December 31, 2022. The payment history, including quarterly estimated payments, outlines the amounts remitted: $25,000 in April, $30,000 in June, $25,000 in September, and a final $20,000 in January 2023 for the preceding tax year. Verification of compliance requires referencing tax identification numbers, such as the Employer Identification Number (EIN), along with relevant state tax forms which may vary by jurisdiction, ensuring the business meets local tax regulations and deadlines. Incomplete or inaccurate records could result in penalties or audits by the Internal Revenue Service (IRS) or state tax authorities.

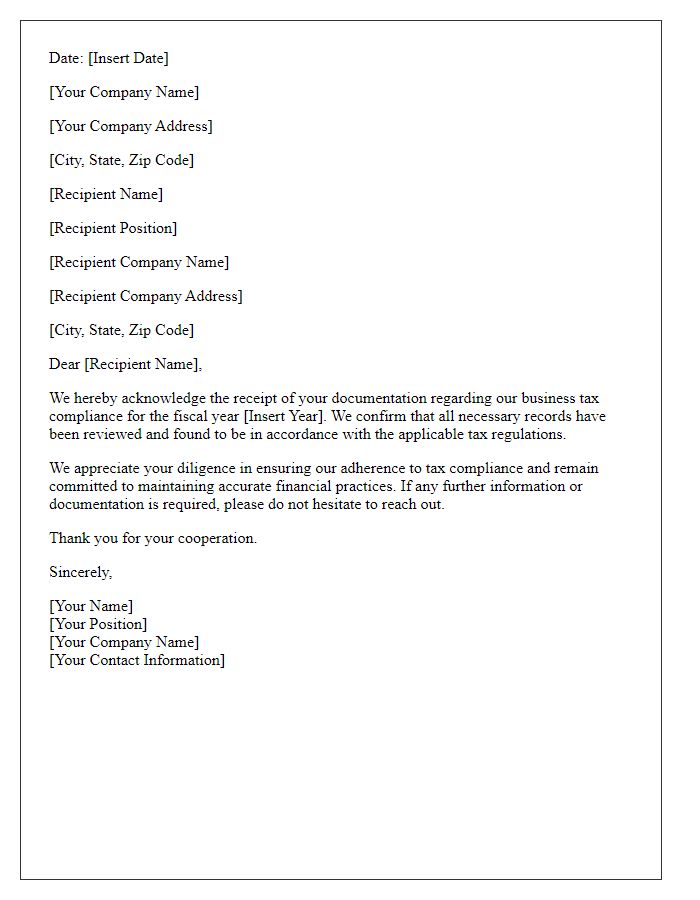

Contact information for further inquiries

Business tax compliance confirmation ensures adherence to local and federal tax regulations. Many businesses, registered in the United States, specifically adhere to the Internal Revenue Service (IRS) guidelines. Accurate documentation, including Form 941 (Employer's Quarterly Federal Tax Return) and Form 1040 (Individual Income Tax Return), is essential for compliance. Audits may arise from discrepancies, leading to penalties or interest charges. For further inquiries regarding tax compliance, businesses should contact the local IRS office or a certified public accountant (CPA). Ensure that all contact details are accurate, including phone number, email address, and physical address, to facilitate prompt communication and resolution of any compliance issues.

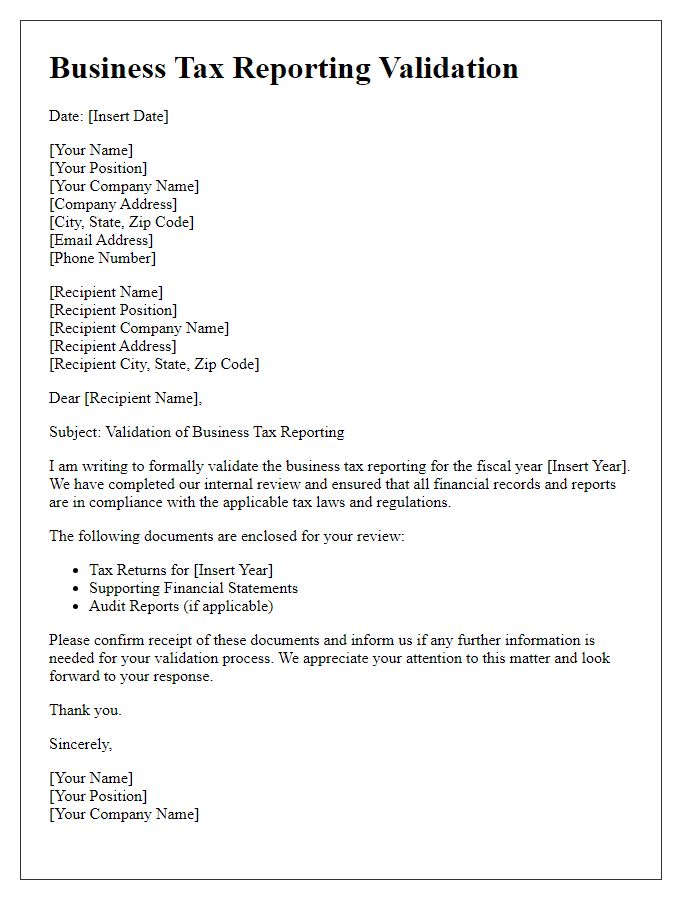

Professional tone and formatting

Business tax compliance confirmation is crucial in maintaining good standing with tax authorities. Timely submissions of corporate tax returns, such as estimated tax payments required quarterly under IRS regulations (typically due on the 15th of April, June, September, and January), demonstrate diligence. Accurate reporting of taxable income, deductions, and credits contributes to compliance, ensuring the avoidance of penalties. Additionally, maintaining detailed financial records, including receipts and invoices, supports the verification process in case of audits. Collaboration with certified tax professionals facilitates adherence to complex tax laws, which can significantly vary based on industry nuances and jurisdictional requirements.

Comments