Hey there! If you're looking to better understand your investment portfolio and the benefits it brings, you're in the right place. Our comprehensive letter template walks you through the key elements of your portfolio report, highlighting essential details you'll want to communicate to your beneficiaries. So, grab a cup of coffee and let's dive into how to craft the perfect report that keeps everyone informed and engaged!

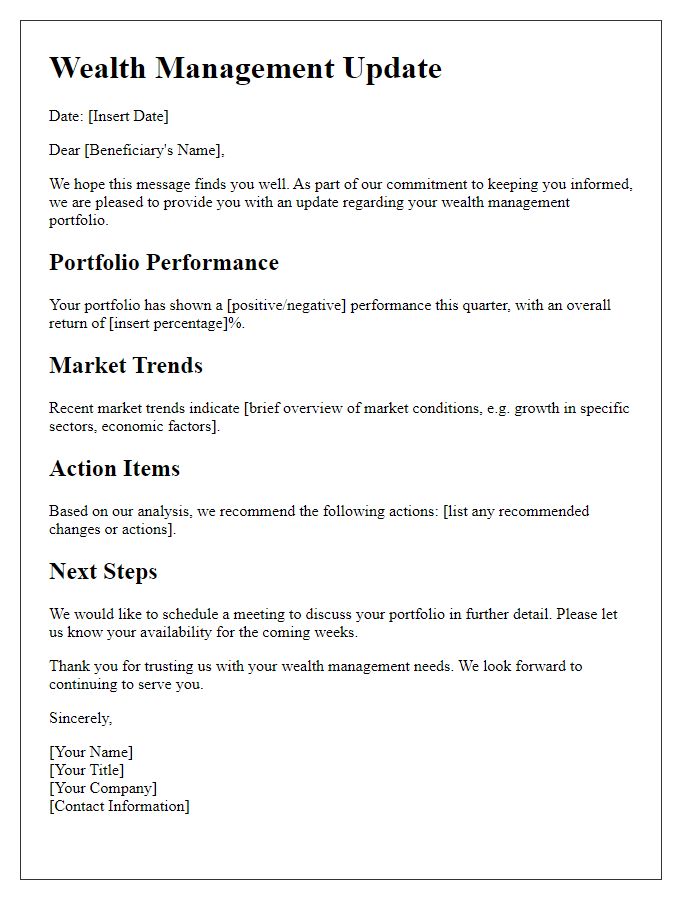

Personalized Greeting and Client Information

Personalized greetings create a welcoming atmosphere in investment portfolio reports, enhancing client engagement. Client information includes essential details such as the client's full name, account number, and investment objectives, providing a clear reference point for all relevant data. Information may also encompass the date of the report, current market conditions, and recent investment performance metrics, allowing clients to understand their portfolio's health and growth trends. Additionally, incorporating personalized notes about significant life events, such as anniversaries or milestones, can foster a deeper client-advisor relationship, making the report feel tailored and considerate.

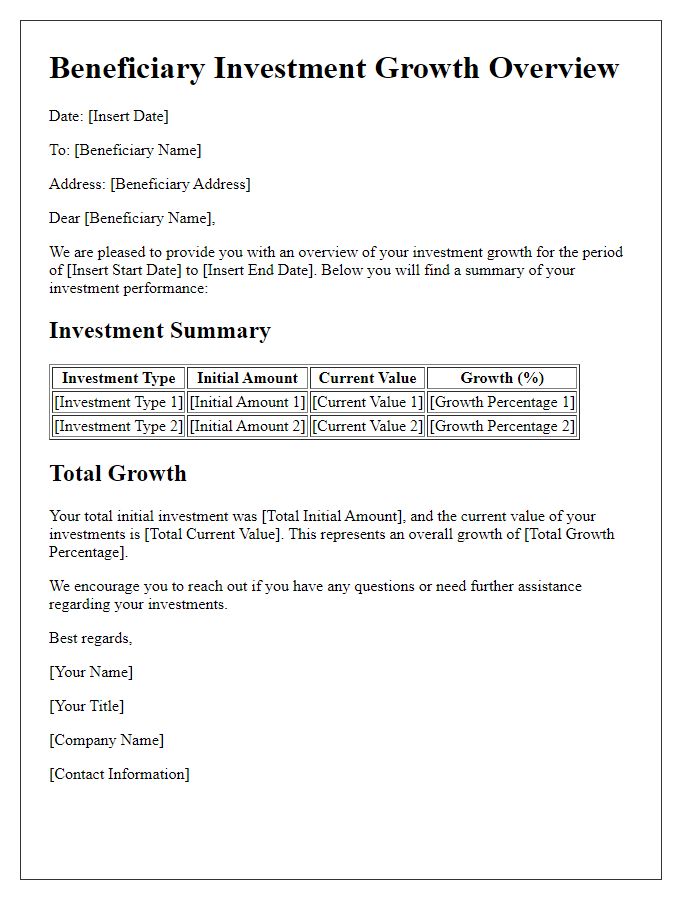

Portfolio Performance Summary and Analysis

The portfolio performance summary highlights the investment results for the month, reflecting key metrics such as total return percentages, asset allocation breakdown, and top-performing securities. The average annual return for the last five years stands at an impressive 8.5%, indicating steady growth in diverse market conditions. Notable investments include technology stocks, which have seen a quarterly gain of 12%, and sustainable energy assets, contributing significantly to the overall portfolio value. Research by investment analysts suggests maintaining exposure to these sectors can yield favorable outcomes amidst changing economic landscapes. The report includes a risk assessment section, detailing volatility measures and historical performance against benchmarks like the S&P 500, ensuring beneficiaries are informed about potential market fluctuations affecting their investments.

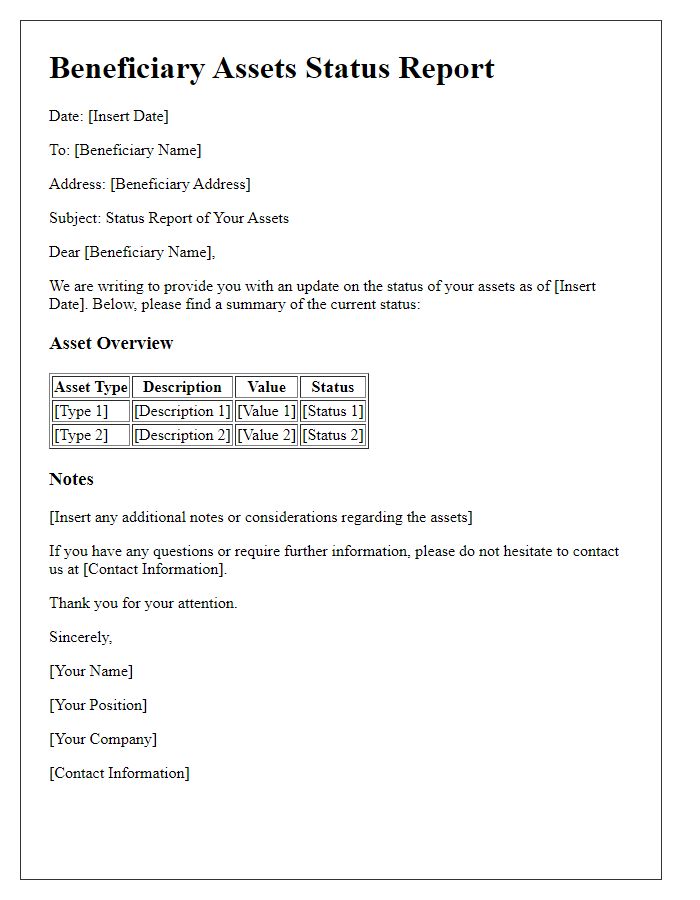

Asset Allocation and Diversification Strategies

The investment portfolio report outlines essential asset allocation and diversification strategies tailored for maximizing financial returns while minimizing risks. Asset allocation involves the systematic distribution of investments across various asset classes, such as equities, fixed-income securities, real estate, and cash equivalents, to optimize performance according to market conditions. Diversification strategies include investing in a mix of sectors (technology, healthcare, consumer goods), geographic regions (North America, Europe, Asia), and investment types (growth stocks, income-generating assets) to buffer against market volatility. Regular rebalancing is critical to maintain the desired asset mix, ensuring alignment with financial goals and risk tolerance. This approach not only enhances potential returns but also protects the portfolio against downturns in specific markets or sectors, fostering long-term growth and stability.

Risk Assessment and Market Conditions Overview

The risk assessment of investment portfolios involves analyzing various factors such as market volatility, economic indicators, and asset allocation. Current market conditions are characterized by fluctuations influenced by global events, interest rates adjustments by central banks like the Federal Reserve, and geopolitical tensions. For example, the S&P 500 index has shown a year-to-date increase of approximately 15%, reflecting investor sentiment and economic recovery post-pandemic. Conversely, sectors such as technology face higher scrutiny due to inflation concerns and supply chain disruptions. The assessment includes evaluating potential risks such as credit risk, liquidity risk, and market risk, which can affect the portfolio's overall performance. Furthermore, diversification strategies are crucial for mitigating risks and enhancing returns, particularly in unsteady markets, as demonstrated by recent trends in commodities like oil and gold.

Recommendations and Future Investment Opportunities

The investment portfolio report highlights the performance metrics for the fiscal year 2023, emphasizing key asset classes such as equities, fixed income, and alternative investments. The portfolio returned an impressive 12% annual growth, outperforming the benchmark S&P 500 index, which achieved a 10% increase during the same period. Sector analysis indicates that technology and healthcare stocks contributed significantly to gains, with notable performers including Microsoft and Johnson & Johnson. Key recommendations for the upcoming year include increasing exposure to renewable energy stocks, which have shown robust growth and legislative support, particularly in the renewable energy sector, driven by recent policy changes in the United States and EU. Additionally, diversifying into global markets, particularly in emerging economies like India and Brazil, presents future investment opportunities. The current economic climate amidst rising interest rates necessitates a strategic approach to asset allocation, balancing risk with potential returns.

Letter Template For Beneficiary Investment Portfolio Report Samples

Letter template of quarterly investment portfolio update for beneficiaries

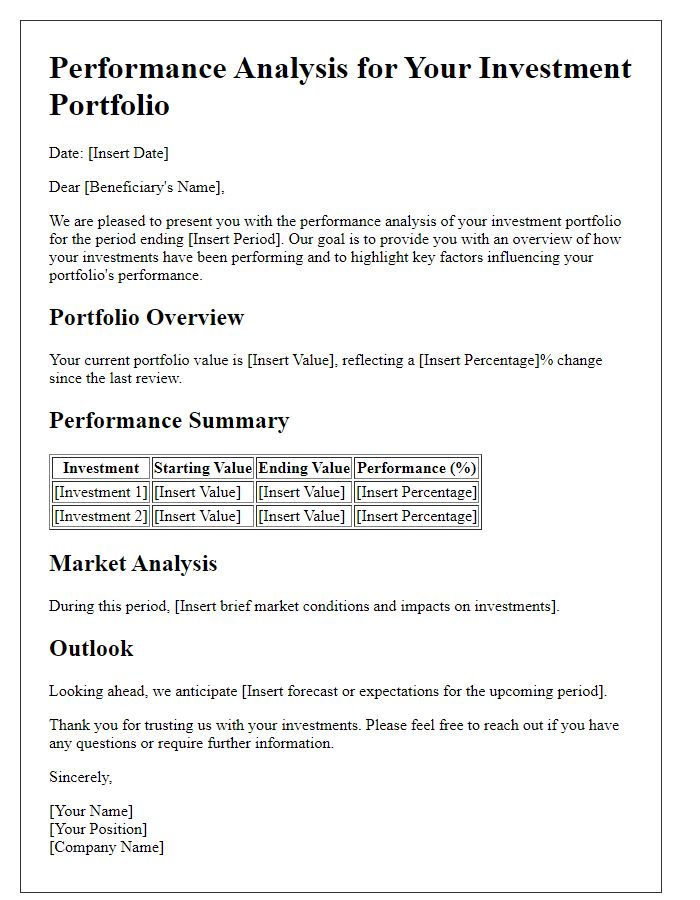

Letter template of performance analysis for beneficiary investment portfolios

Comments