Are you looking to streamline your financial transactions with a third-party payment authorization letter? This important document allows someone else to make payments on your behalf, ensuring your bills are handled quickly and efficiently. In this article, we'll walk you through the essential elements to include in your letter, providing you with a clear template for your needs. So, grab a cup of coffee and read on to get all the details you need to create your own payment authorization letter!

Contact Information of Authorizing Party

The process of third-party payment authorization is crucial in various financial transactions, particularly in businesses and e-commerce. Essential details include the authorizing party's name, such as Jane Doe, and her contact information including a phone number (555-123-4567) and email address (janedoe@example.com). Address (123 Main Street, Springfield, IL 62701) serves to verify identity further. Documentation may also request the account details of the payee, which could involve bank information, credit card numbers, or transaction references for clarity and tracking. Clear identification of all parties ensures compliance with legal standards and minimizes fraud risks.

Details of Third-Party Payee

A third-party payment authorization form considers essential elements such as the payee's name, contact information, and bank account details to ensure compliance with legal financial protocols. The payee's name (for example, John Smith) must be clearly stated alongside a valid address (such as 123 Main Street, Springfield), making it easy to verify identity. Detailed bank account information, including the routing number (for instance, 123456789) and account number (like 9876543210), is crucial for direct transfers. Additionally, the form typically requires the payee's signature for authentication, affirming their agreement to the payment terms and authorization. This process safeguards financial transactions between individuals or entities by establishing clear communication and accountability.

Specific Payment Details (amount, purpose)

A third-party payment authorization allows designated individuals or organizations to make transactions on behalf of another, often requiring specific details to ensure transparency and compliance. Payment information such as the exact amount, for example, $500, may be specified for services rendered, like professional consultation. Additionally, identifying the purpose of the payment is crucial, such as paying a vendor for supplies, ensuring clarity in financial records. Providing the recipient's account details, including bank name and account number, is also necessary for seamless processing, while a timestamp--dated for efficiency--verifies the legitimacy of the authorization.

Authorization Statement

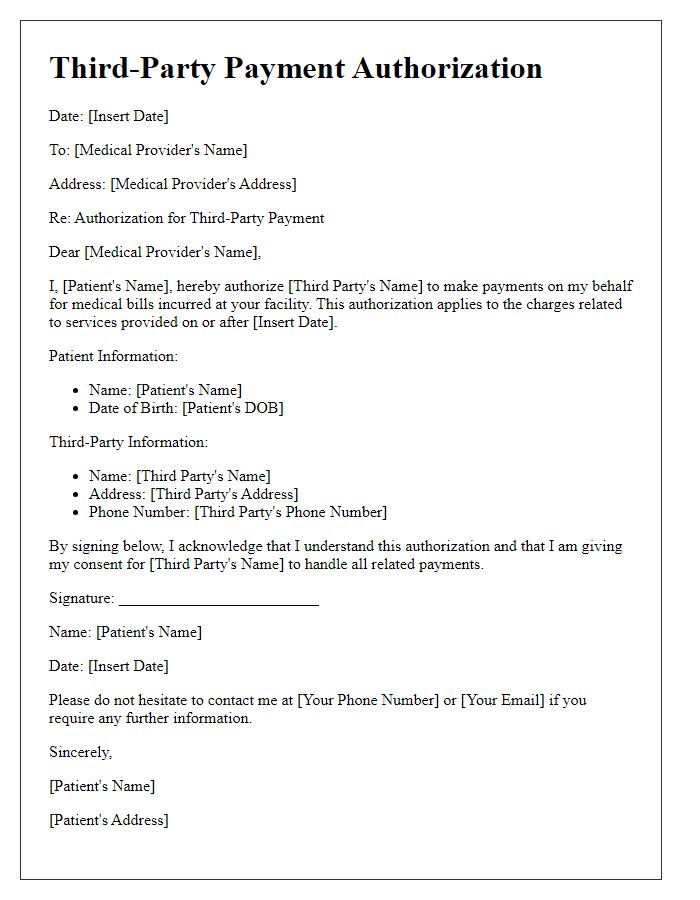

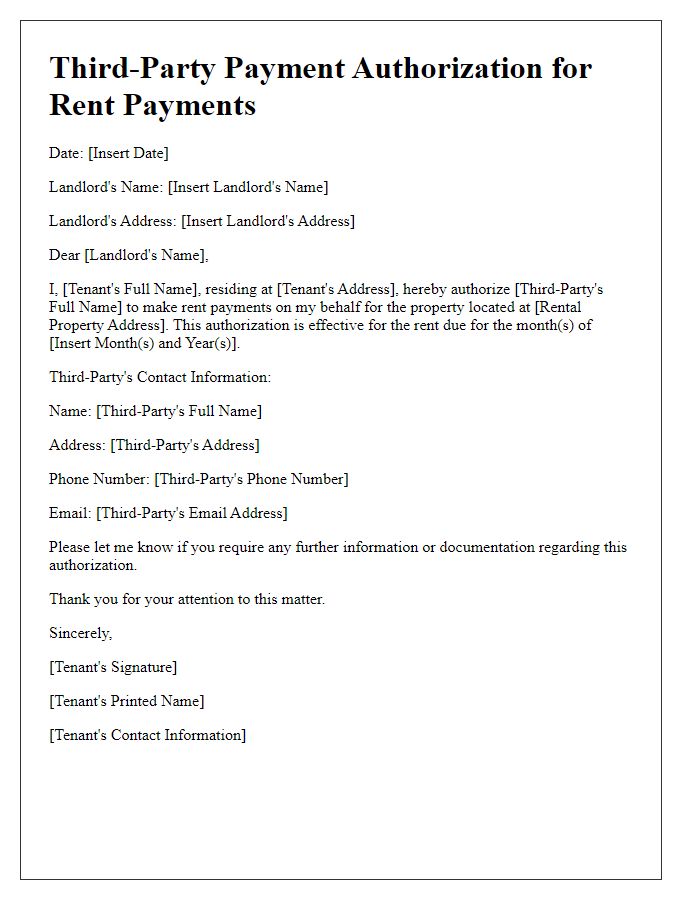

A third-party payment authorization allows individuals or entities to grant permission for another party to handle their financial transactions. For instance, a property management company managing rental payments may require tenants to authorize a third party, such as a financial institution, to withdraw monthly rent directly from their bank accounts. This type of authorization typically includes specific details such as the customer's name, bank account number, type of transaction, frequency, and effective dates. The statement ensures compliance with regulations and prevents unauthorized transactions, creating a secure environment for both the payer and the payee. Properly executed third-party authorizations facilitate seamless transactions, enhance financial accountability, and provide peace of mind for all parties involved.

Signature and Date

Third-party payment authorization enables individuals or organizations to allow another party to make payments on their behalf. This is a crucial process in various financial transactions, ensuring trust and legality. Signature stands as a critical element in authorizing such payments, representing consent from the account holder. Typically dated with an official date such as October 23, 2023, this documentation may include specific terms outlining the extent of the authority granted. Both the signature and date serve as verification against fraud, confirming that the account holder willingly permits the transaction. It is essential to ensure clarity in the authorization details, including amounts, frequency, and recipient entities to avoid any misunderstandings.

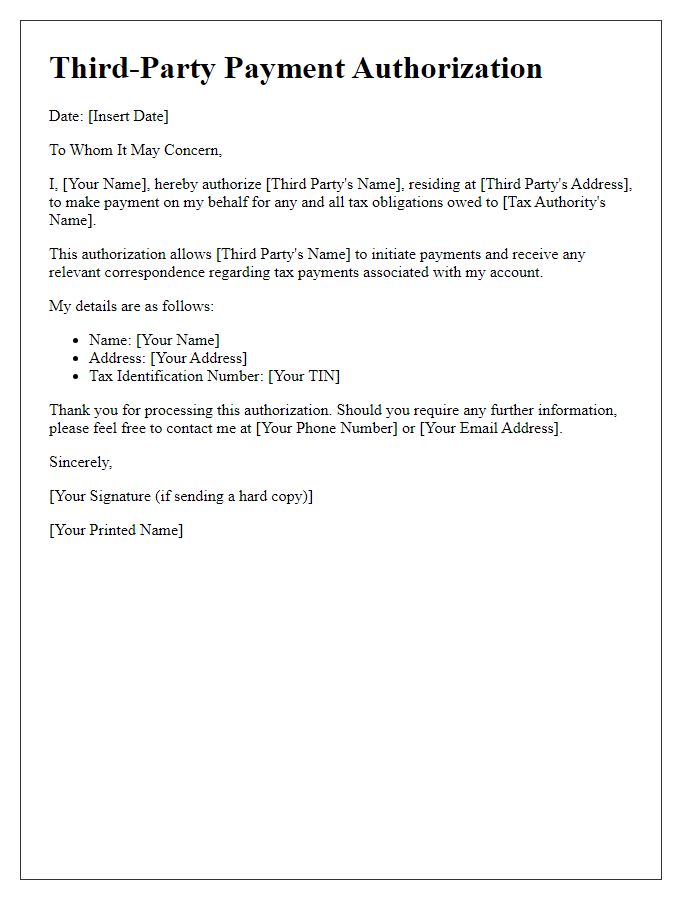

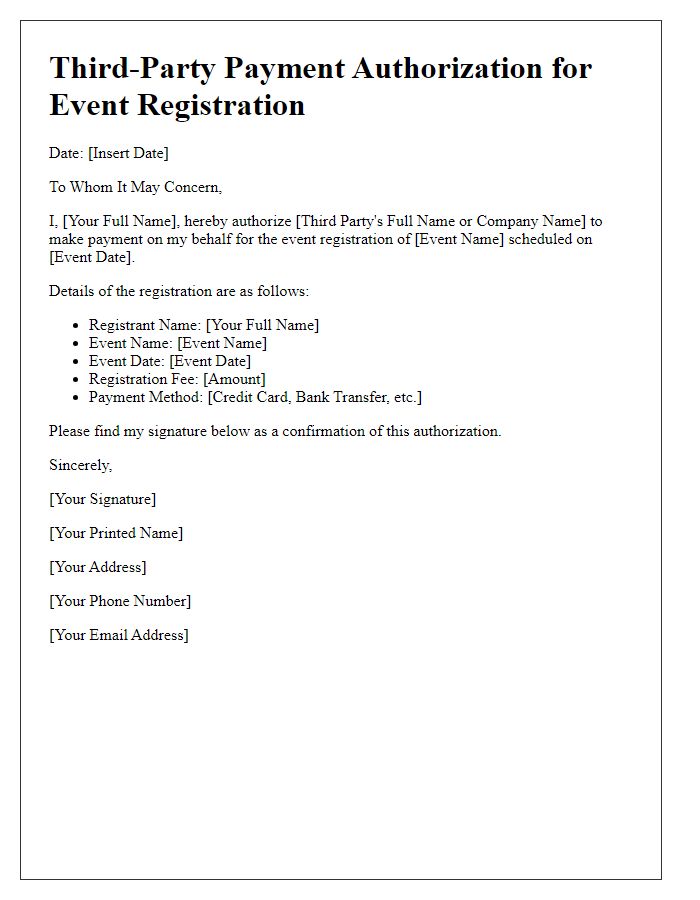

Letter Template For Third-Party Payment Authorization Samples

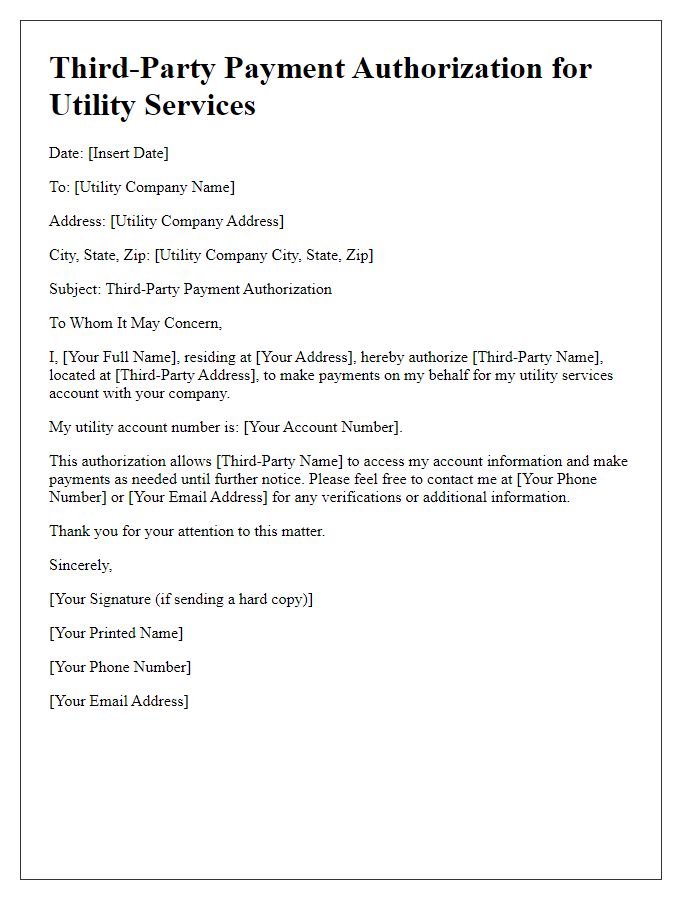

Letter template of Third-Party Payment Authorization for Utility Services

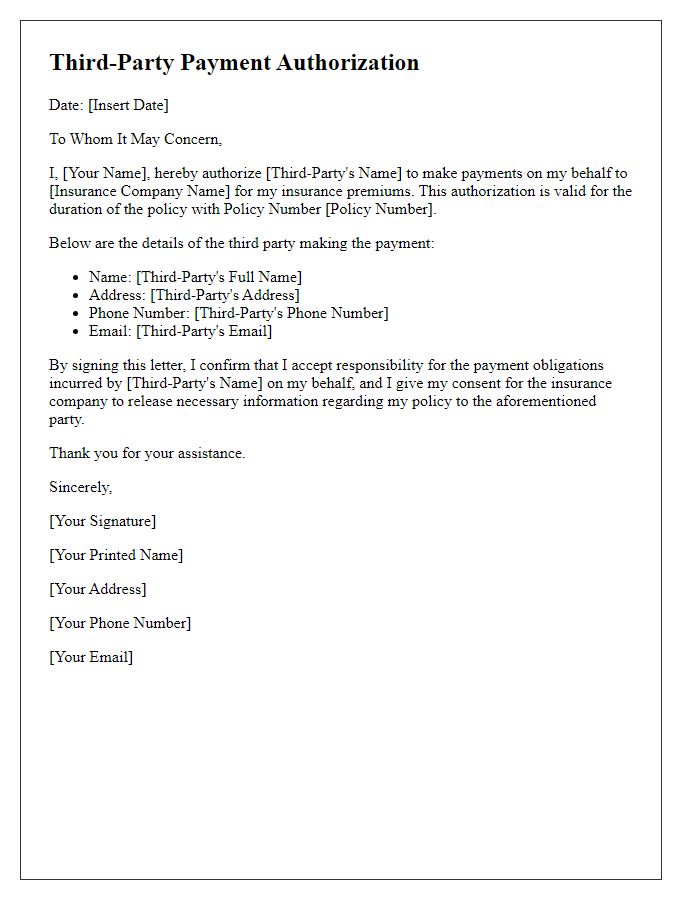

Letter template of Third-Party Payment Authorization for Insurance Premiums

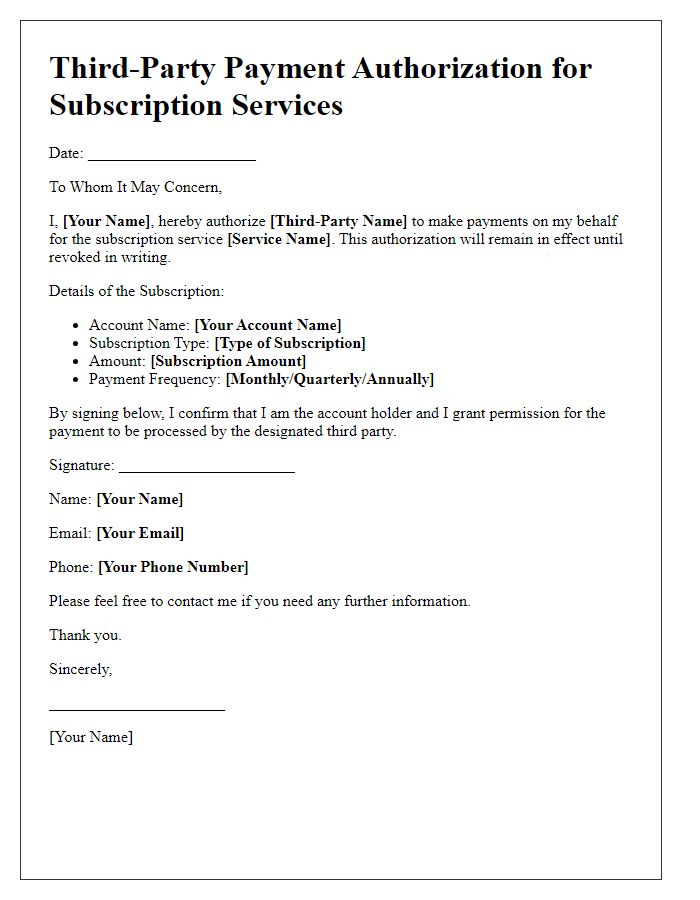

Letter template of Third-Party Payment Authorization for Subscription Services

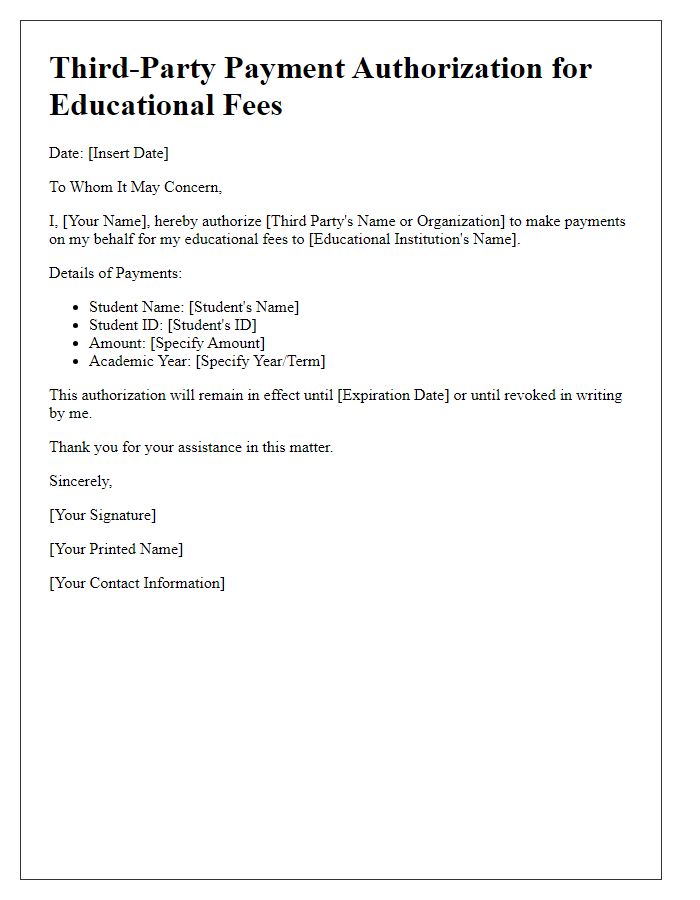

Letter template of Third-Party Payment Authorization for Educational Fees

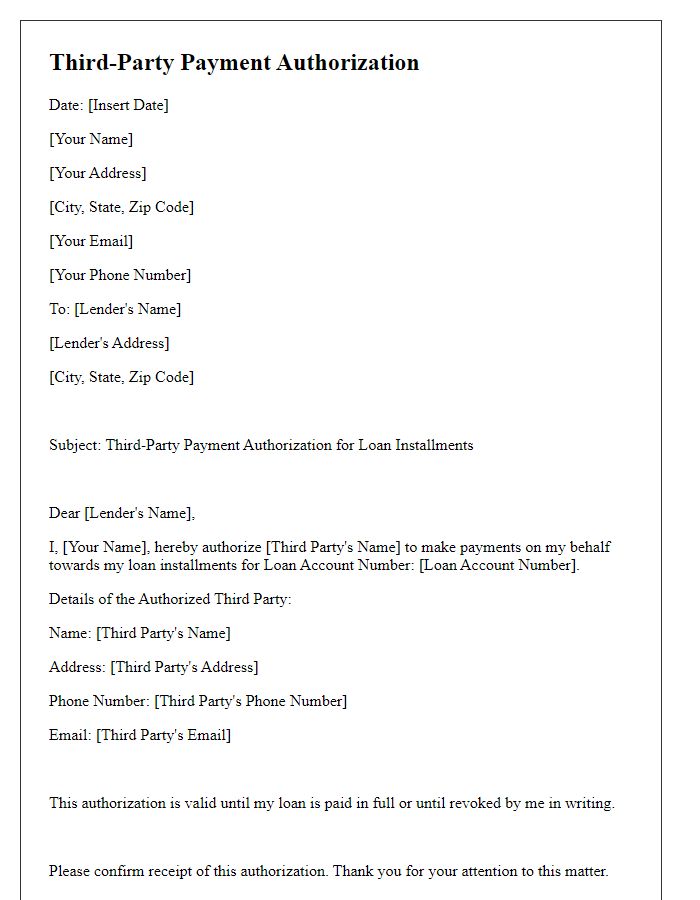

Letter template of Third-Party Payment Authorization for Loan Installments

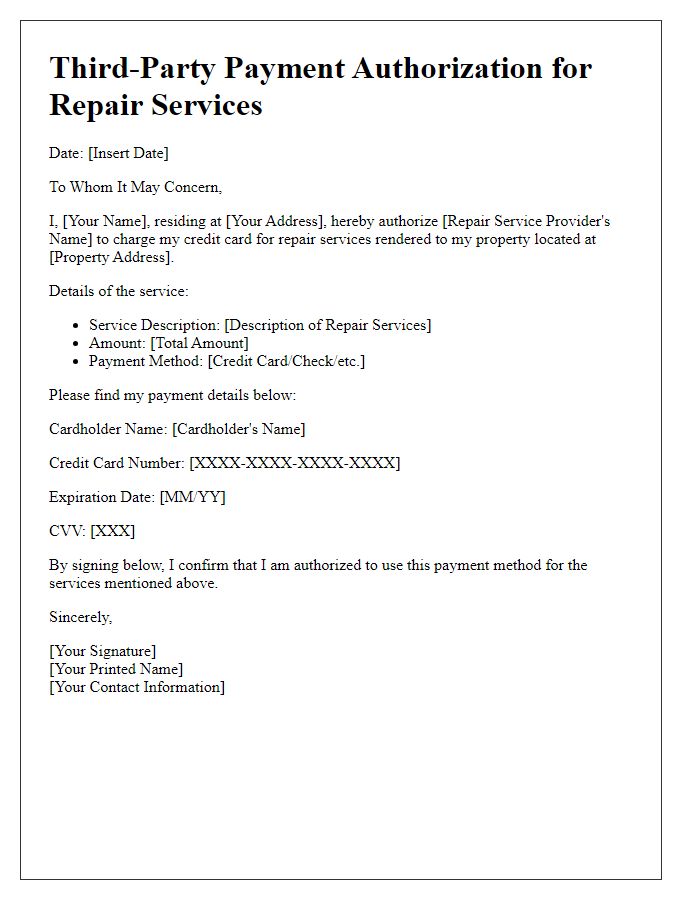

Letter template of Third-Party Payment Authorization for Repair Services

Comments