Are you looking to secure a loan but feeling overwhelmed by the application process? Don't worry, we've got you covered with a simple letter template that can streamline your authorization request. This handy guide will walk you through the essential components to ensure your letter is both professional and effective. So, dive in to discover how to craft your loan application authorization with ease!

Personal Information

Loan applications require a comprehensive set of personal information to assess eligibility and risk. Borrowers must provide essential details such as full name, date of birth, and Social Security number to verify identity. Additionally, contact information including phone number and email address is crucial for communication. Residential address, including city and zip code, helps lenders evaluate geographic risk factors. Employment details, such as employer name, income level (monthly or annually), and job title, are necessary for understanding financial stability. Furthermore, financial institutions often request credit history data, such as outstanding debts and credit scores, to gauge repayment capacity. Each of these elements plays a vital role in the loan approval process, influencing the terms and interest rates offered to individuals.

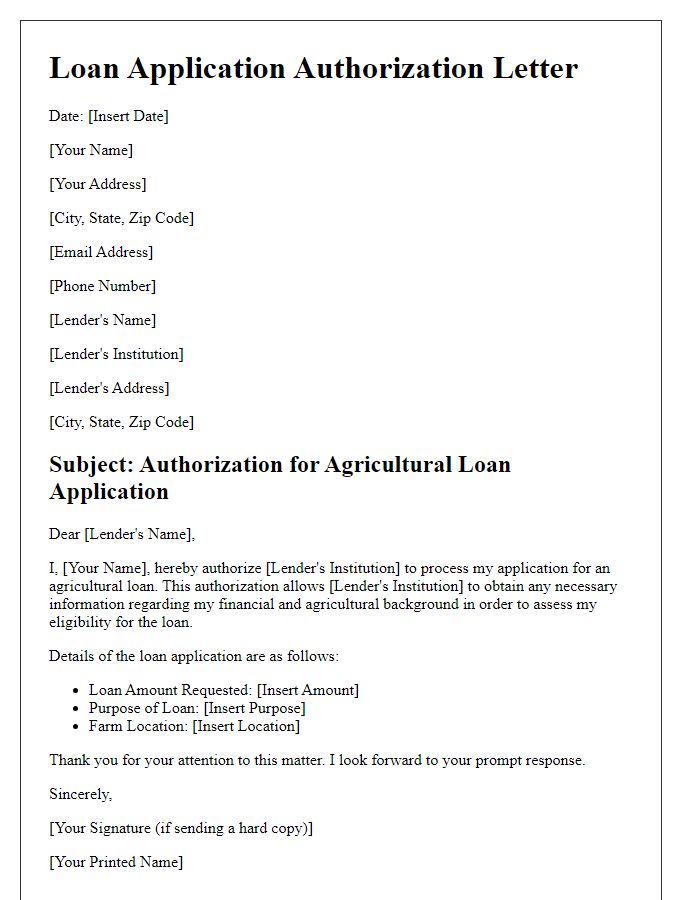

Loan Details

Loan applications require specific authorization details to ensure the processing of the request. Essential elements include the applicant's personal identification information, such as full name, social security number, and address, alongside the loan amount requested, the proposed payment terms, and the purpose of the loan. Additional requirements often encompass the applicant's employment details, monthly income statistics, and current debts that may affect approval. Providing a signed authorization allows lenders to access credit history, enabling them to evaluate the financial standing and creditworthiness. Documentation may involve bank statements, tax forms, and any necessary collateral verification, ensuring a comprehensive view of the applicant's financial health. Factors influencing loan approval may include credit scores, which generally range from 300 to 850, and existing financial obligations.

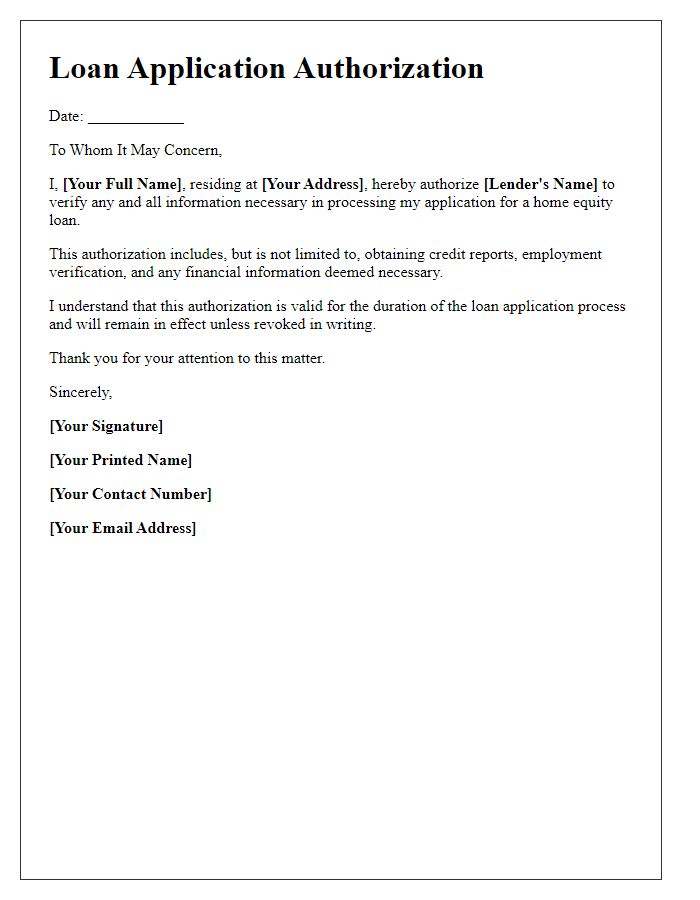

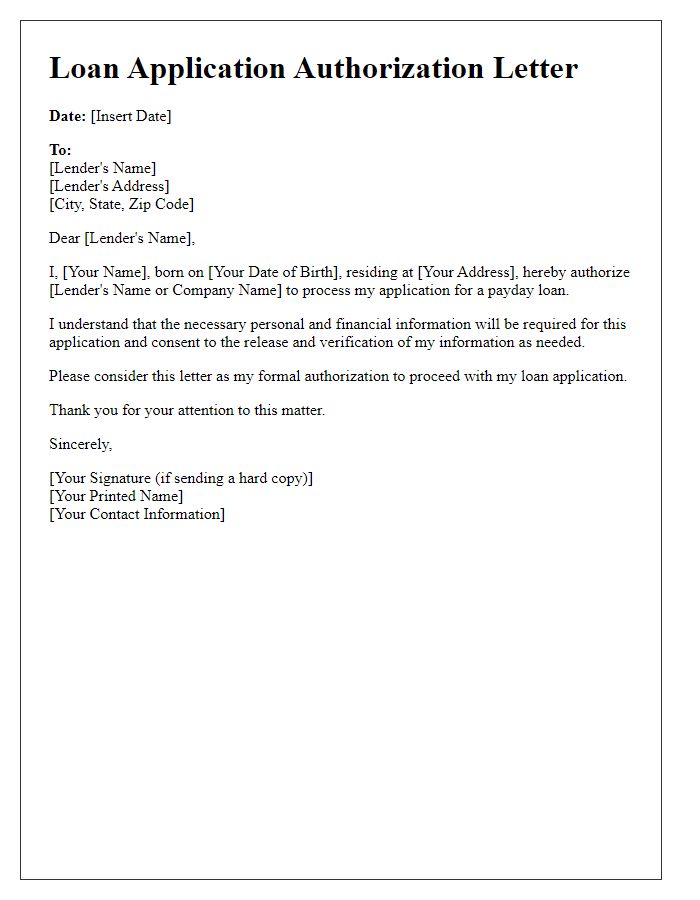

Authorization Statement

A loan application authorization statement is a critical document that enables a lender to access and verify a borrower's financial information. This statement typically includes key personal details like full name, Social Security number, and address to confirm the identity of the borrower. Financial institutions often require such authorization for applications involving mortgages, personal loans, or auto financing, as it grants permission to review credit history, employment records, and income validation. Validity often extends to a specific period, ensuring that authorization is up-to-date during the application process, which can greatly affect loan approval rates. Properly drafted authorization saves time in the approval process, ensuring lenders have the necessary information to assess risk accurately.

Contact Information

A loan application authorization document typically includes essential details such as the applicant's contact information. Key entries include full name, residential address, phone number, email address, and potentially Social Security Number for identification purposes. Accurate entry of this data is crucial for financial institutions to verify the applicant's identity and creditworthiness. Furthermore, having a clear line of communication, such as a mobile number, ensures timely updates regarding the loan application status. A well-structured contact section expedites processing time, allowing institutions to contact applicants quickly for additional documentation or clarification.

Signature Block

Loan applications often require a signature block to authorize the lending institution to process personal and financial information. The signature block typically includes crucial elements such as the applicant's full name, address, and date of birth, alongside a designated space for the applicant's signature and the date of signing. Furthermore, the terms of authorization may clarify the extent of the lender's rights to share information with credit bureaus or employment verification agencies. Proper formatting, adhering to legal guidelines, ensures that the authorization is valid and recognized by financial institutions, facilitating a smooth loan application process.

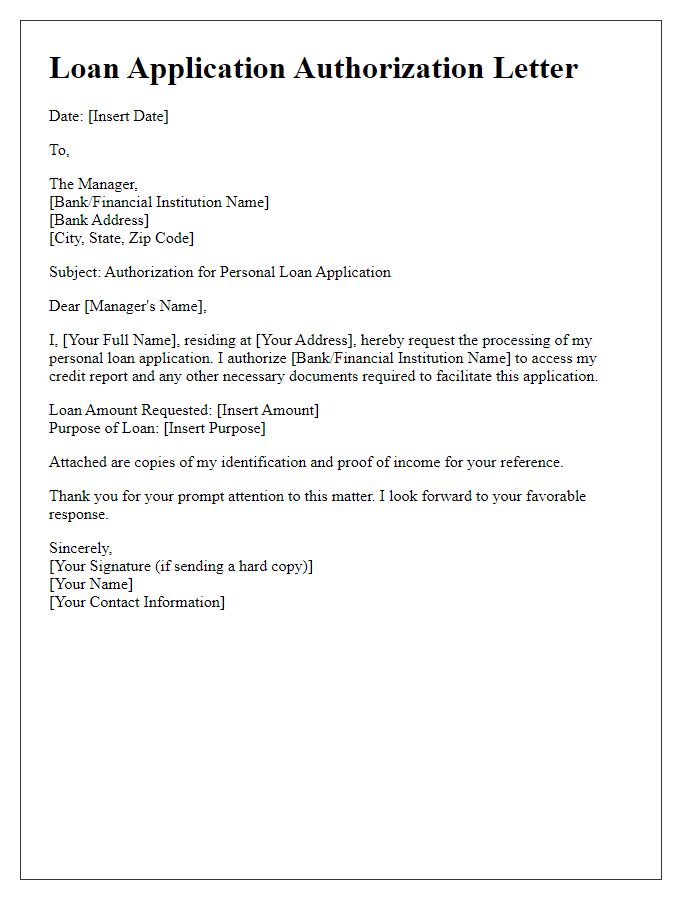

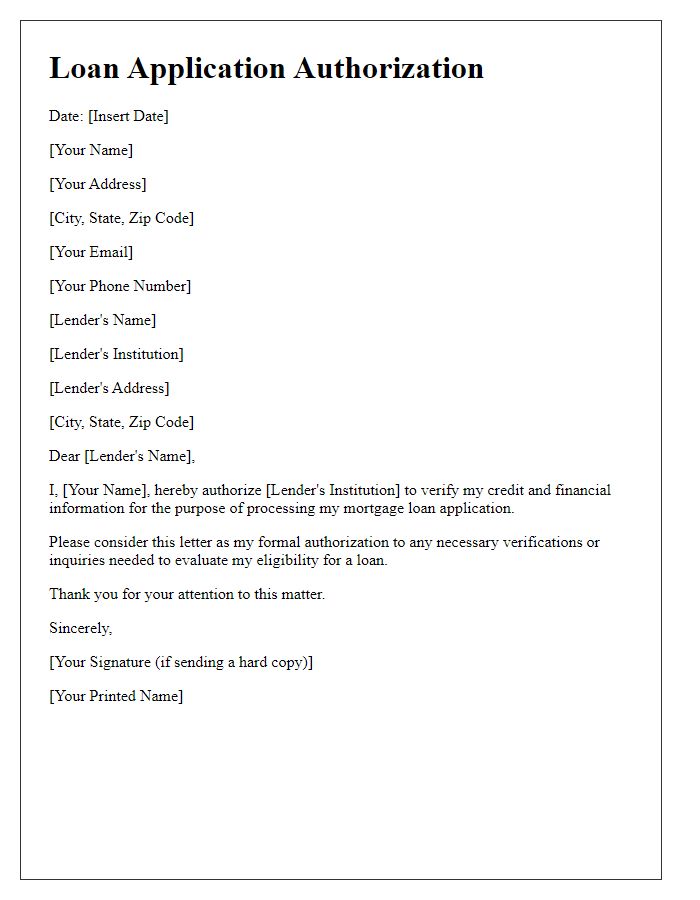

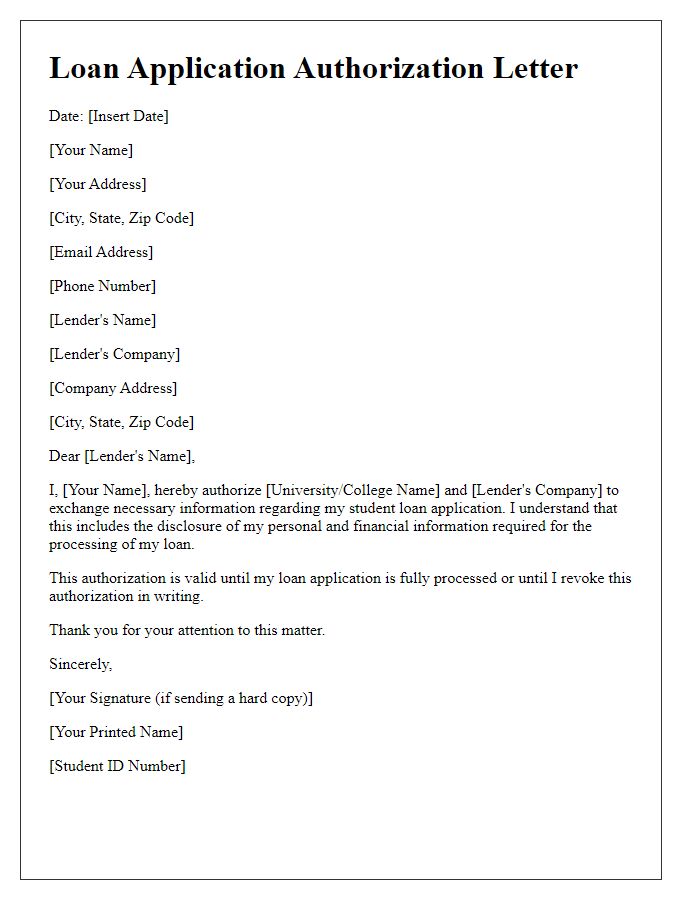

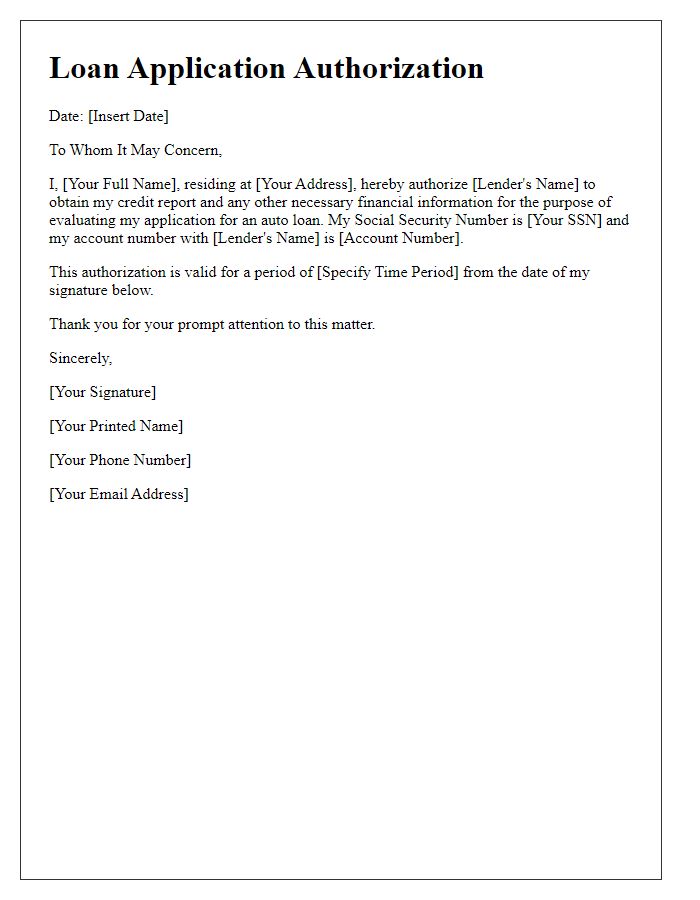

Letter Template For Loan Application Authorization Samples

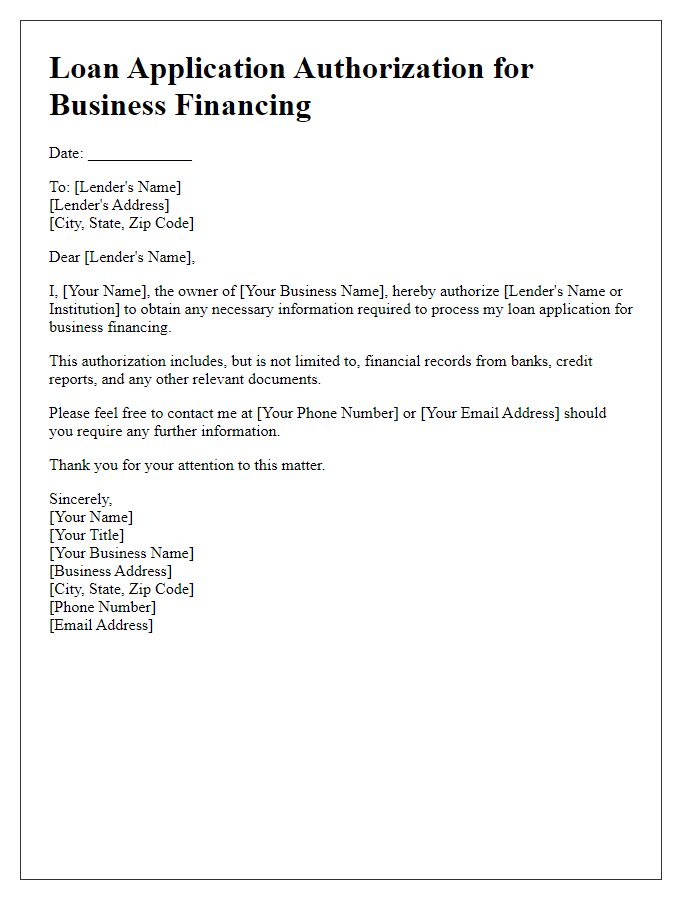

Letter template of loan application authorization for business financing

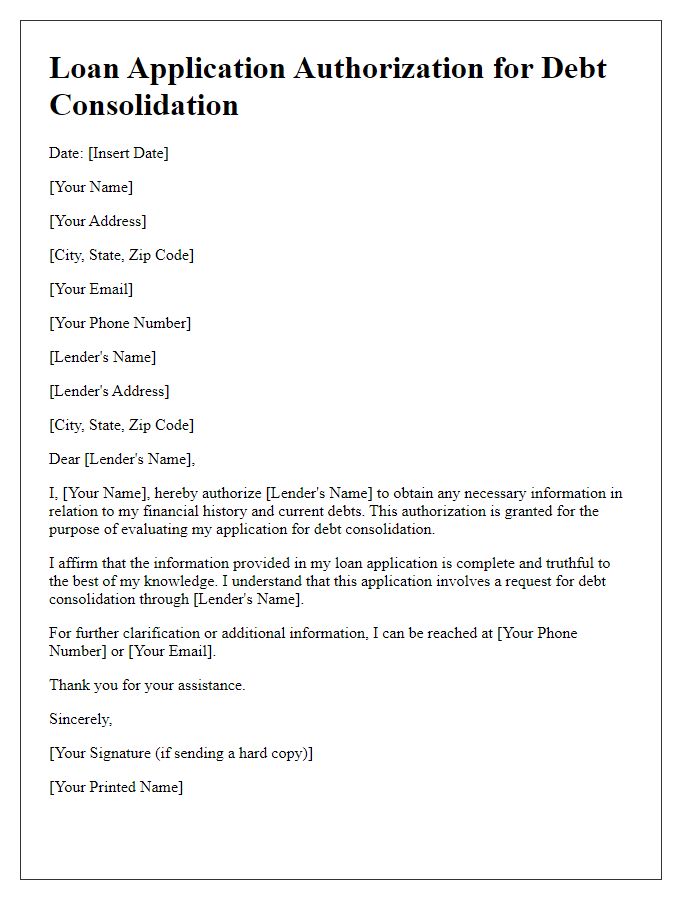

Letter template of loan application authorization for debt consolidation

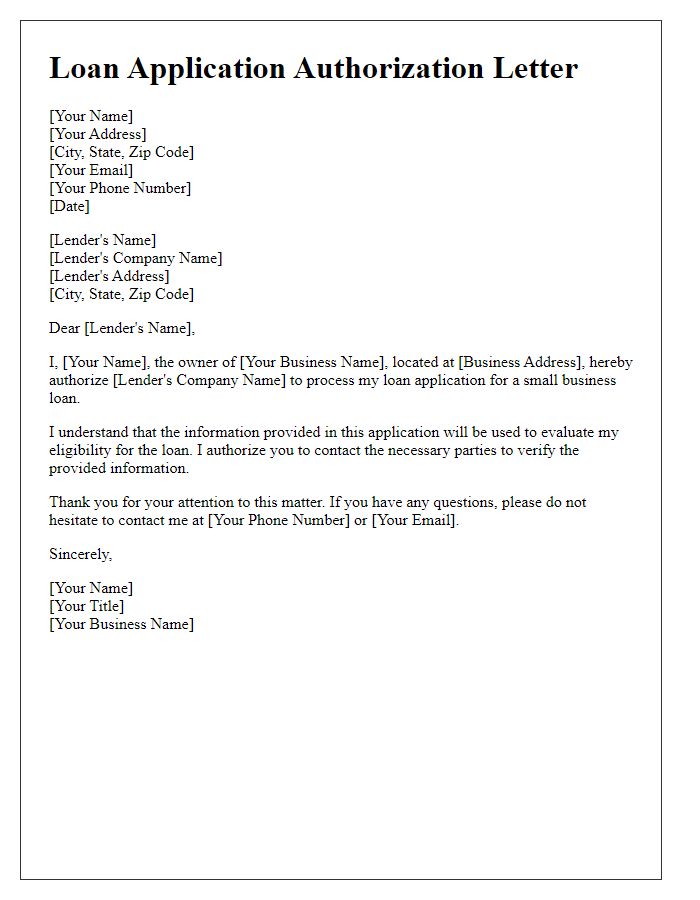

Letter template of loan application authorization for small business loans

Comments