Are you looking for a concise way to grant a financial adviser the authority to manage your accounts? Understanding the necessary components of a financial adviser authorization letter is crucial for ensuring clear communication and safeguarding your interests. In this article, we'll break down the essential elements you need to include, making the process seamless and straightforward. Ready to dive in? Keep reading to learn how to craft the perfect authorization letter!

Client's full name and contact information.

A financial adviser authorization letter serves as a formal document granting permission to a financial adviser to act on behalf of the client concerning their financial matters. The client's full name (e.g., John Smith) should be clearly stated at the top of the document, along with relevant contact information, including the street address (e.g., 123 Main St, Springfield), phone number (e.g., (555) 123-4567), and email address (e.g., john.smith@email.com). This information ensures that the adviser can easily reach the client for discussions regarding accounts, investments, or other financial services. It establishes a clear line of communication and responsibility, facilitating the adviser's role in managing the client's financial portfolio effectively.

Financial adviser's full name and credentials.

Financial adviser John Smith, a Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA), has the authority to manage investment portfolios for clients. With over 15 years of experience in wealth management, Smith has guided numerous clients in achieving financial independence. His client base, ranging from young professionals to retirees, trusts his expertise in developing tailored financial strategies. Smith is known for his comprehensive understanding of market trends, tax implications, and retirement planning practices. Moreover, his credentials from recognized institutions underscore his commitment to ethical standards and ongoing education in the financial advisory field.

Specific financial matters and permissions granted.

A financial adviser authorization grants specific permissions for managing an individual's financial affairs. The document must detail the financial matters under consideration, such as investment management, retirement planning, or tax advisory services. Including a clear outline of the permissions granted to the financial adviser ensures clarity, indicating the authority to access bank account information, execute trades, or communicate with financial institutions. Additionally, it should specify the time frame of the authorization, which may include ongoing or specific dates, and the scope of transactions allowed, ensuring compliance with legal regulations and protecting the individual's assets.

Duration of authorization and termination conditions.

The financial adviser authorization typically lasts for one year, allowing clients to grant permissions for financial transactions, investment decisions, and access to personal data. Termination conditions include written notice required 30 days prior to cancellation, account closure leading to automatic termination, or incapacity of the client, which necessitates immediate revocation of authorization. In specific situations, such as fraudulent activities or breach of contractual obligations, termination may occur instantly. It is essential to maintain clear communication to ensure mutual understanding of these terms between clients and financial advisers.

Legal disclaimers and client signature section.

The financial adviser authorization document must include explicit legal disclaimers to protect both parties involved. These disclaimers clarify that the adviser operates within the bounds of applicable financial regulations and that the client understands potential risks associated with financial investments. The client signature section requires clear identification of the client's full name, date of signing, and a statement confirming their consent for the adviser to manage their financial matters. It is essential for the document to specify the adviser's full name, professional credentials, and contact information, ensuring transparency and professionalism throughout the financial advisory relationship. This structured format fosters trust and accountability, crucial elements in financial planning.

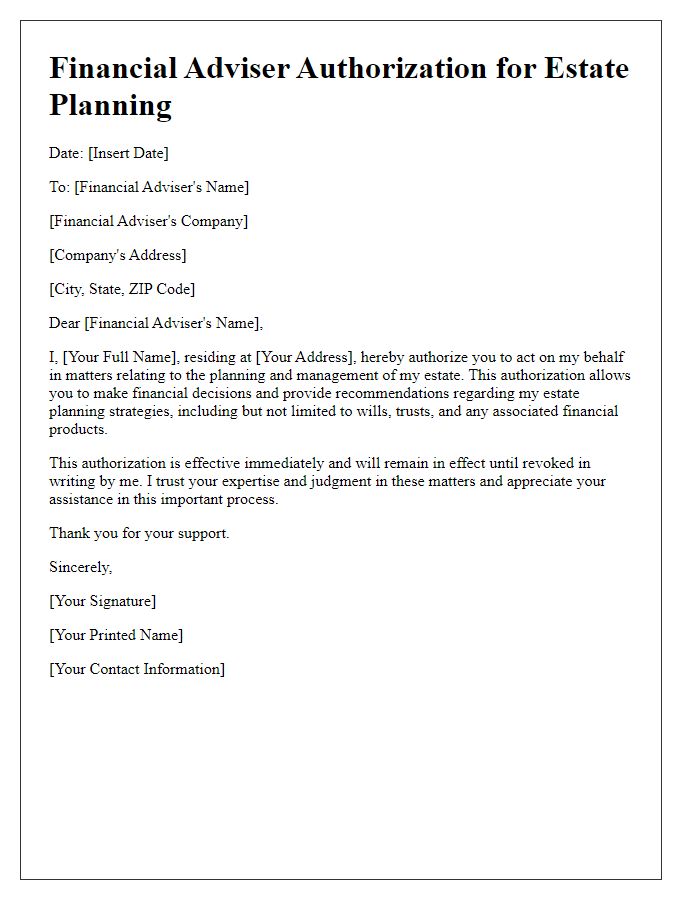

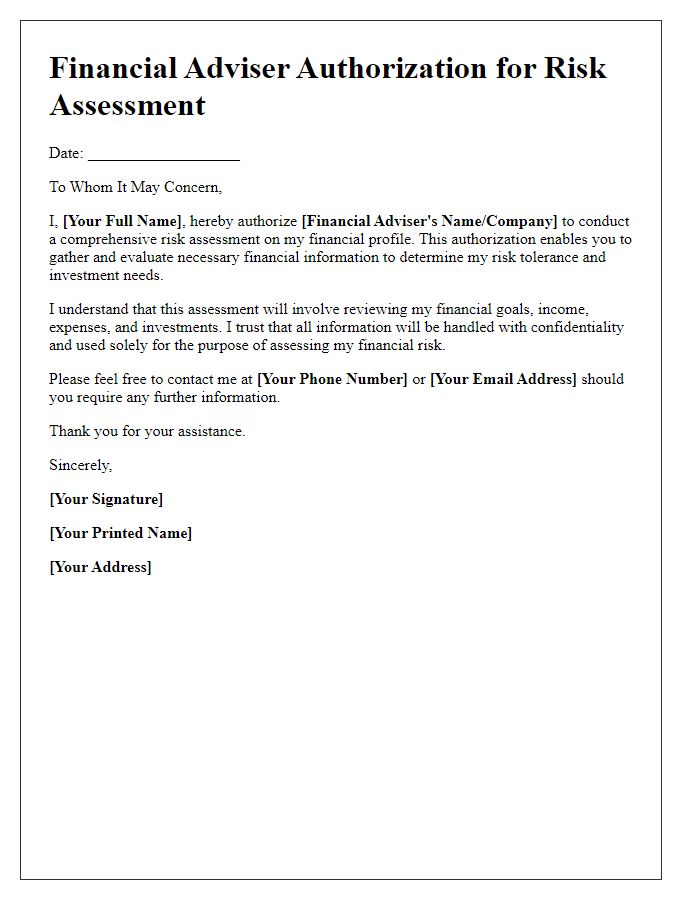

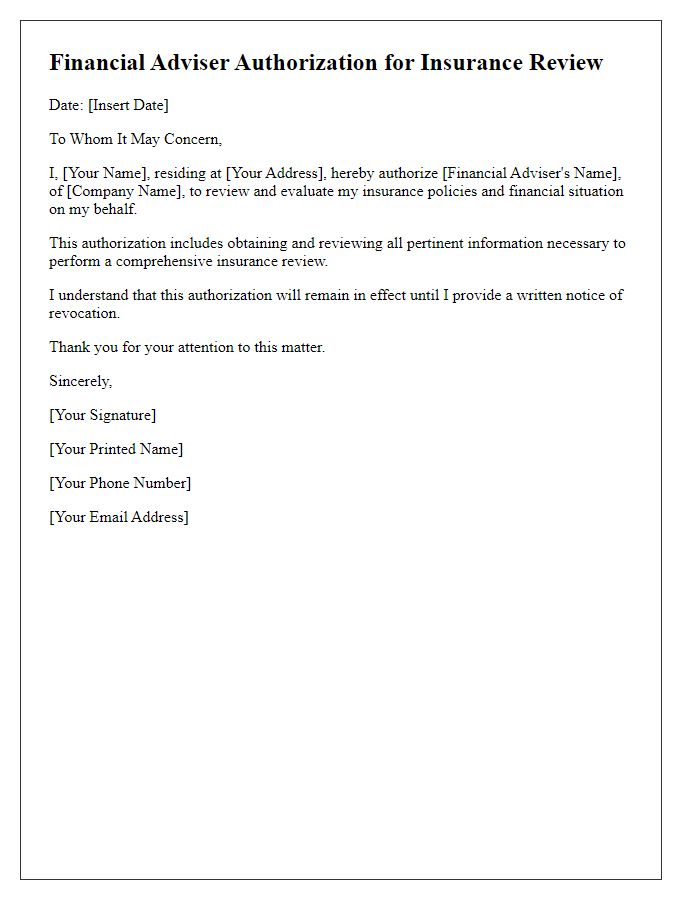

Letter Template For Financial Adviser Authorization Samples

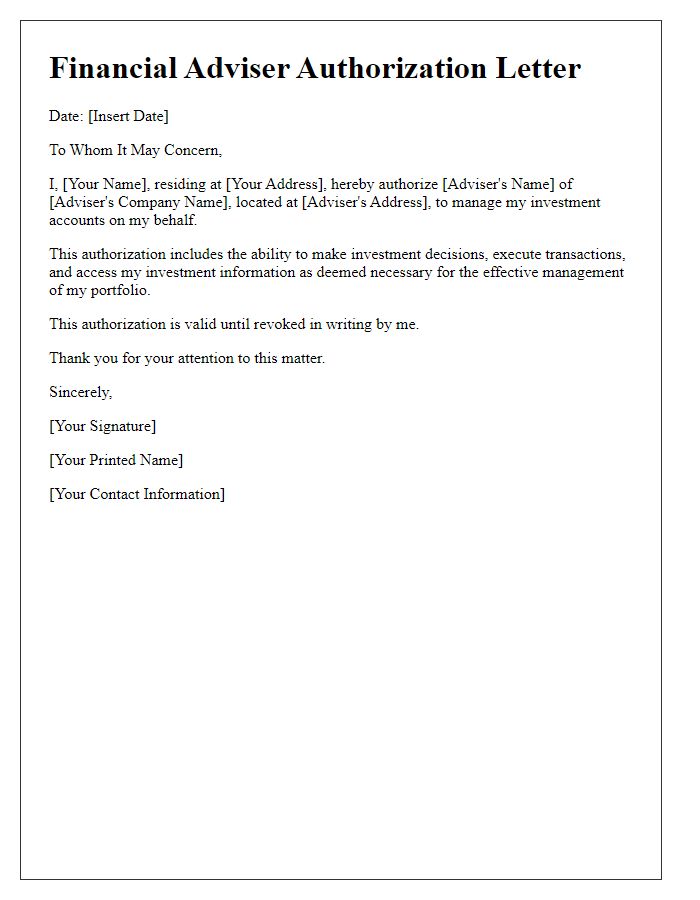

Letter template of financial adviser authorization for investment management.

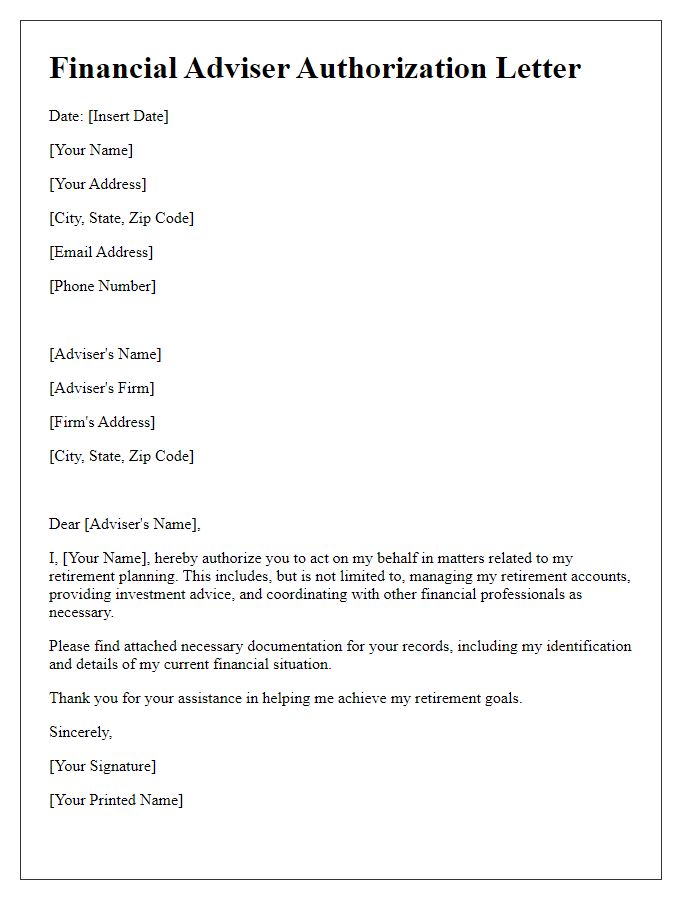

Letter template of financial adviser authorization for retirement planning.

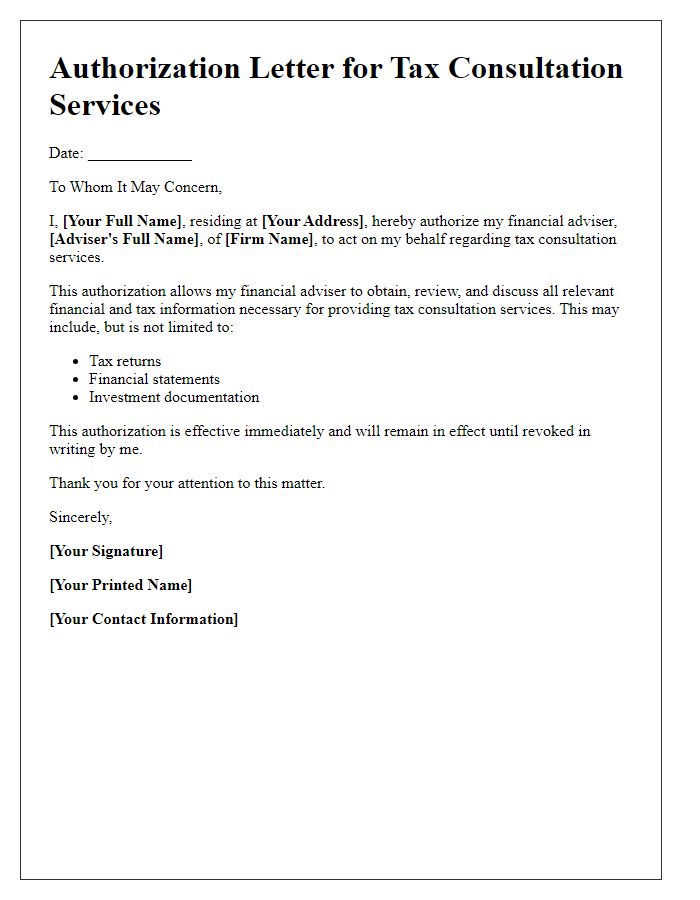

Letter template of financial adviser authorization for tax consultation services.

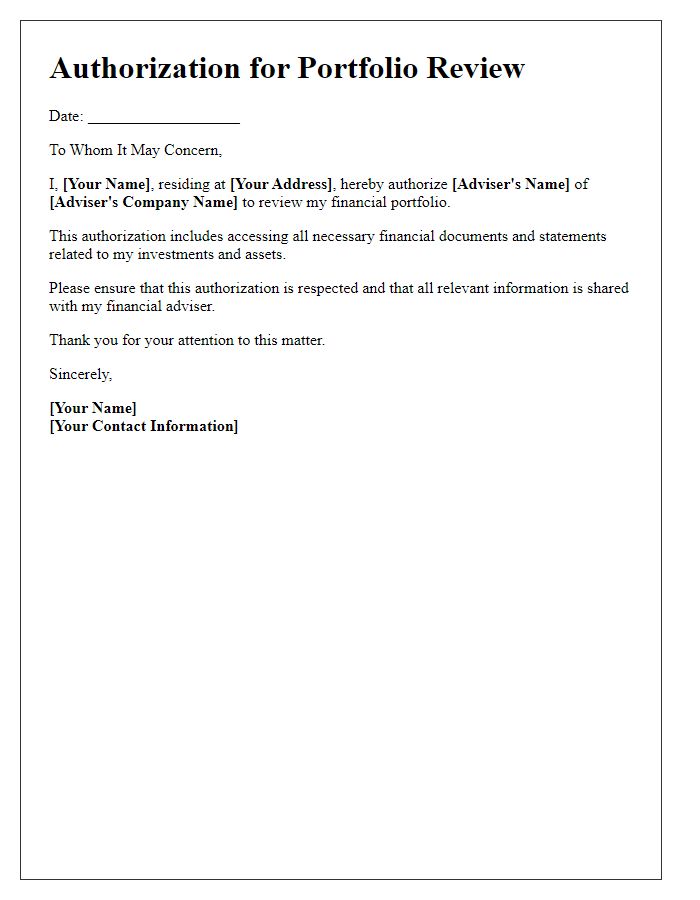

Letter template of financial adviser authorization for portfolio review.

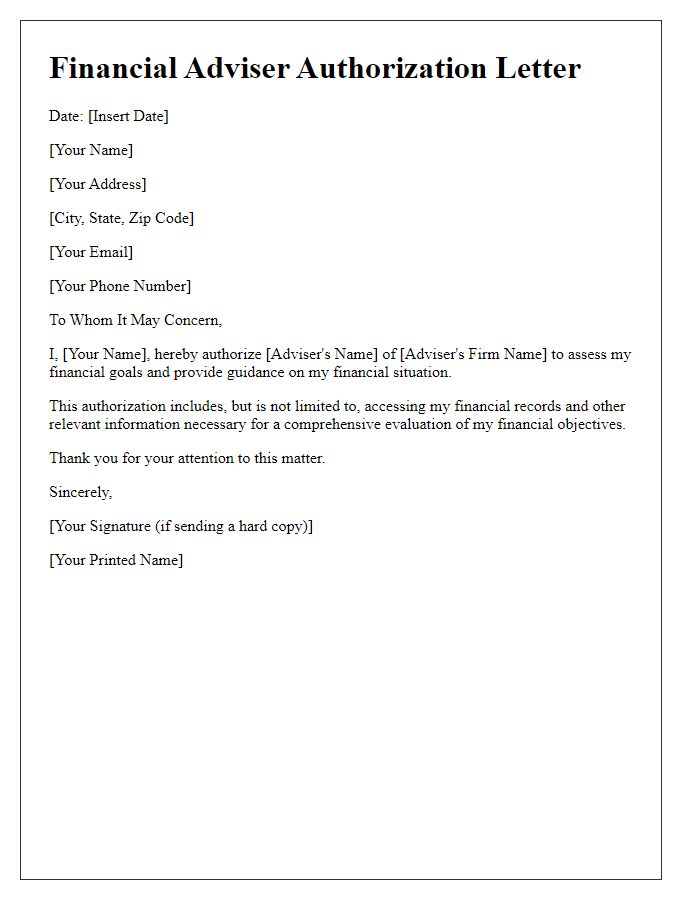

Letter template of financial adviser authorization for financial goal assessment.

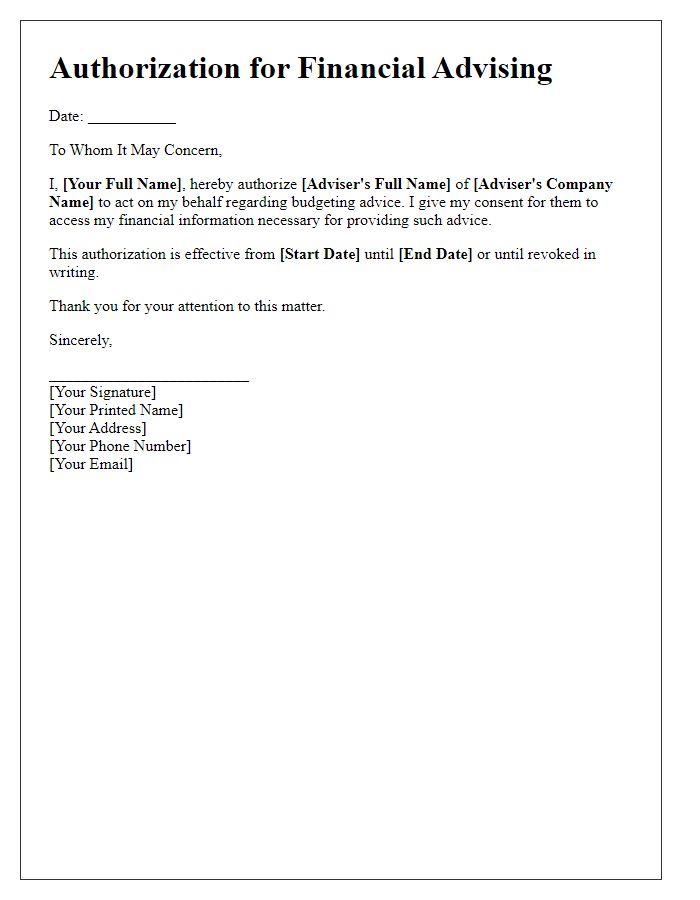

Letter template of financial adviser authorization for budgeting advice.

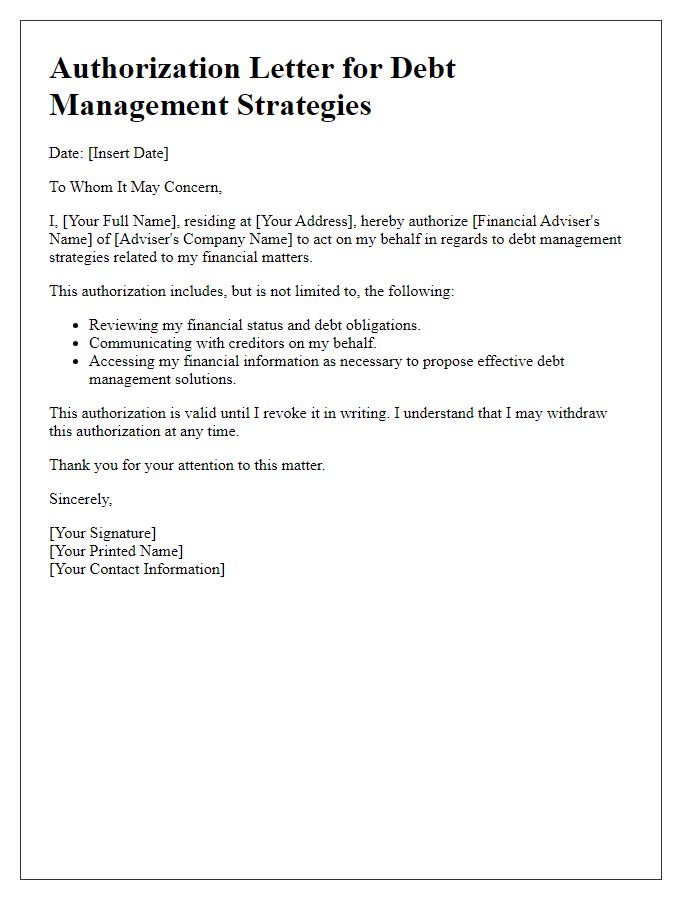

Letter template of financial adviser authorization for debt management strategies.

Comments