Are you looking to streamline your insurance processes with ease? Authorizing your insurance broker can significantly simplify how you manage your policies and claims. It allows experts to act on your behalf, ensuring you get the best coverage tailored to your needs. Curious about how to create a letter for this authorization? Read on to discover a simple template that makes the process a breeze!

Client Information

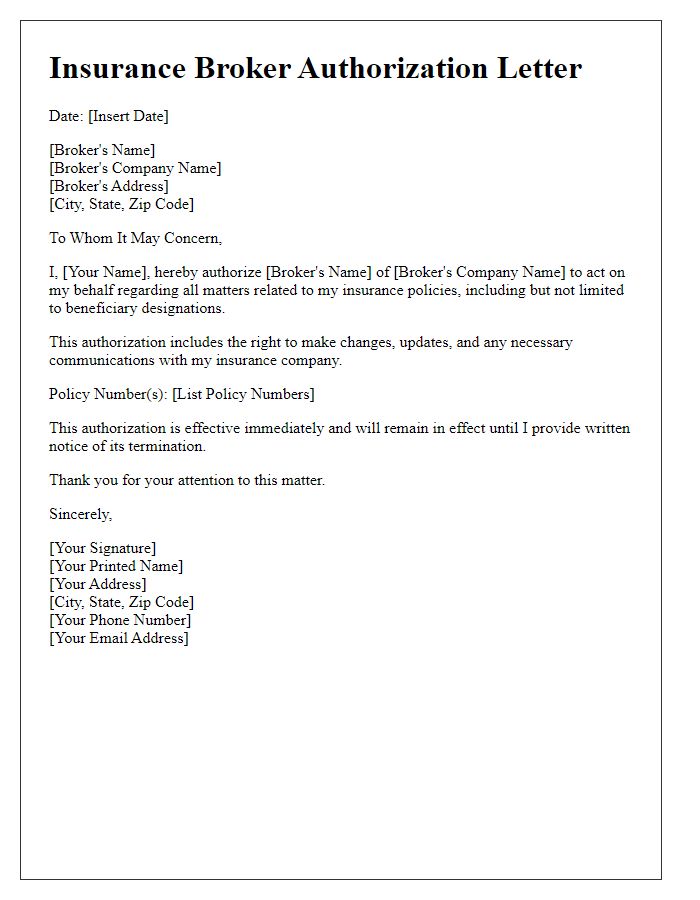

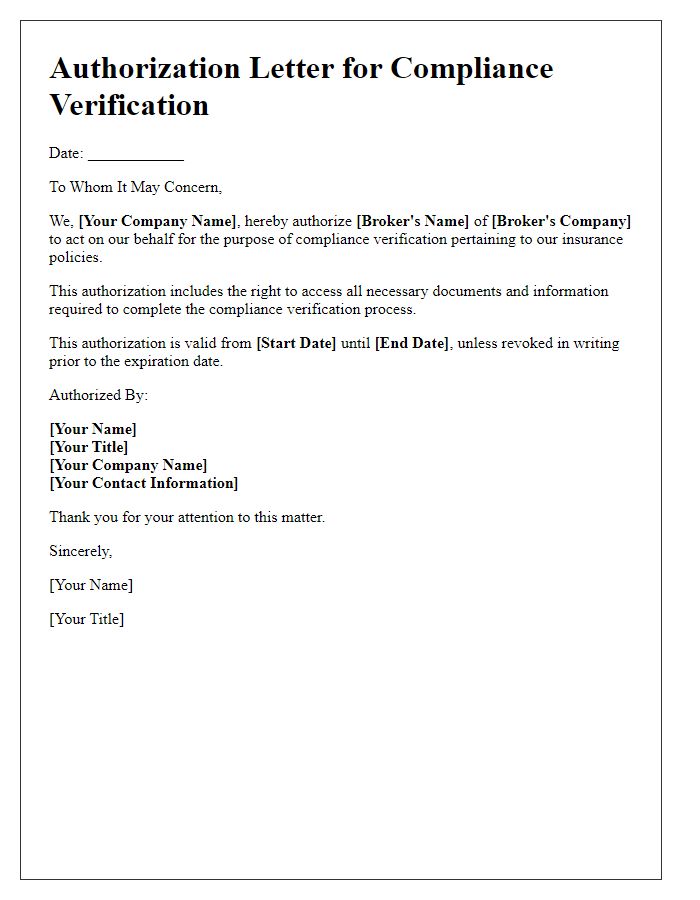

A comprehensive insurance broker authorization empowers designated agents to manage client policies effectively, ensuring seamless communication between clients and insurance providers. Essential client information typically includes full name, date of birth, policy numbers, contact details, and addresses which are critical for accurate record-keeping. Additionally, details of the specific insurance company and types of coverage, such as auto, home, and health insurance, facilitate the broker's understanding of the client's needs. The authorization should specify the scope of the broker's authority, including the ability to access sensitive information, make policy changes, and handle claims on behalf of the client, thereby enhancing overall service delivery.

Broker Details

Insurance brokers play a crucial role in facilitating communication between clients and insurance providers, ensuring that individuals and businesses secure the appropriate coverage. For effective operations, brokers such as those from AON or Marsh must be properly authorized to communicate on behalf of their clients. Detailed authorization letters typically include key components such as the client's identification, policy numbers, and the specific services for which the broker is authorized. Timely authorization is critical, particularly during events such as claims processing, where brokers need to act swiftly to represent their clients' interests. Proper documentation streamlines the workflow and mitigates possible delays, ensuring that client queries regarding coverage, renewals, and claims are addressed efficiently.

Purpose of Authorization

Authorization for an insurance broker empowers the agent to act on behalf of the individual. This legal agreement allows the broker to access sensitive financial information, submit applications, and negotiate terms with insurance companies. The authorization specifies the scope, such as obtaining quotes for health, auto, or home insurance, and provides the broker with the ability to communicate directly with the insurance provider. Notably, this also includes the rights to review policy details and make necessary adjustments or claims on behalf of the individual. The objective of this authorization is to streamline the insurance procurement process, ensuring informed decision-making based on tailored advice and comprehensive market analysis.

Duration of Authorization

The duration of authorization for the insurance broker, typically ranging from one to three years, is a critical aspect of the agreement. This timeframe dictates the broker's permission to act on behalf of the client for policy management, claims processing, and renewals. Specifications regarding the start date, which is often aligned with the signing of the authorization letter, must be clearly defined to avoid ambiguity. Additionally, conditions for renewing or terminating the authorization should be included, providing a clear protocol for both parties in the event of changes in the client's circumstances or satisfaction with the broker's services. Accurate record keeping, including specific documentation required during the authorization period, is essential for compliance and effective communication between the broker and the client.

Client Signature and Date

Insurance broker authorization allows designated agents to manage policies on behalf of the client. This process often requires a signed document that includes the client's name, specific policies involved, and detailed instructions for the broker's authority. Such documents facilitate smooth communication during claims processing, policy renewals, or adjustments. The client's signature serves as verification, while the date signifies the commencement of the authorization period, typically aligning with industry standards to ensure compliance and legal validity. Protection of personal information is critical, emphasizing confidentiality protocols in the handling of such sensitive data.

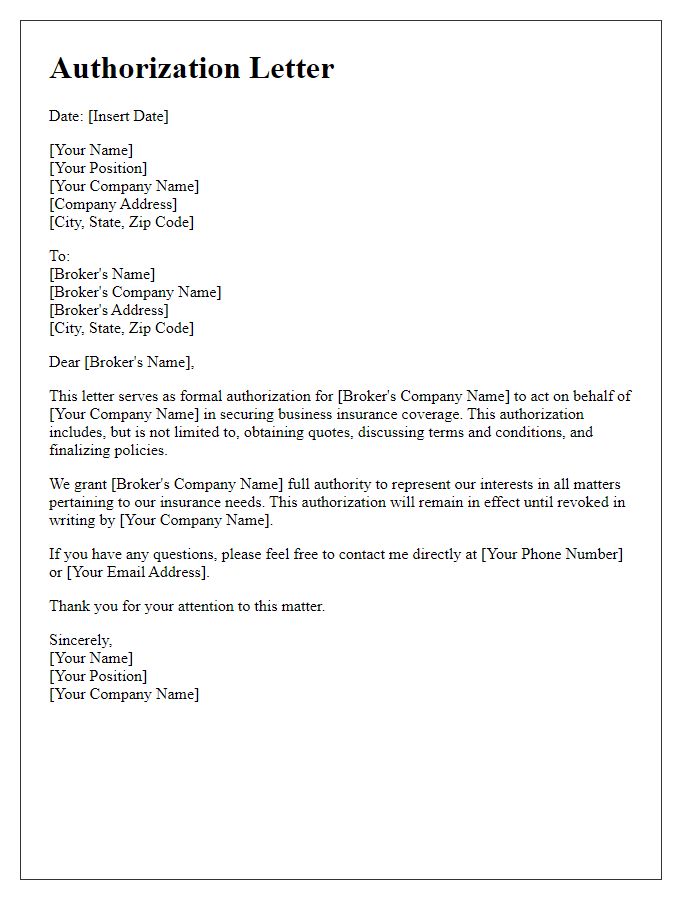

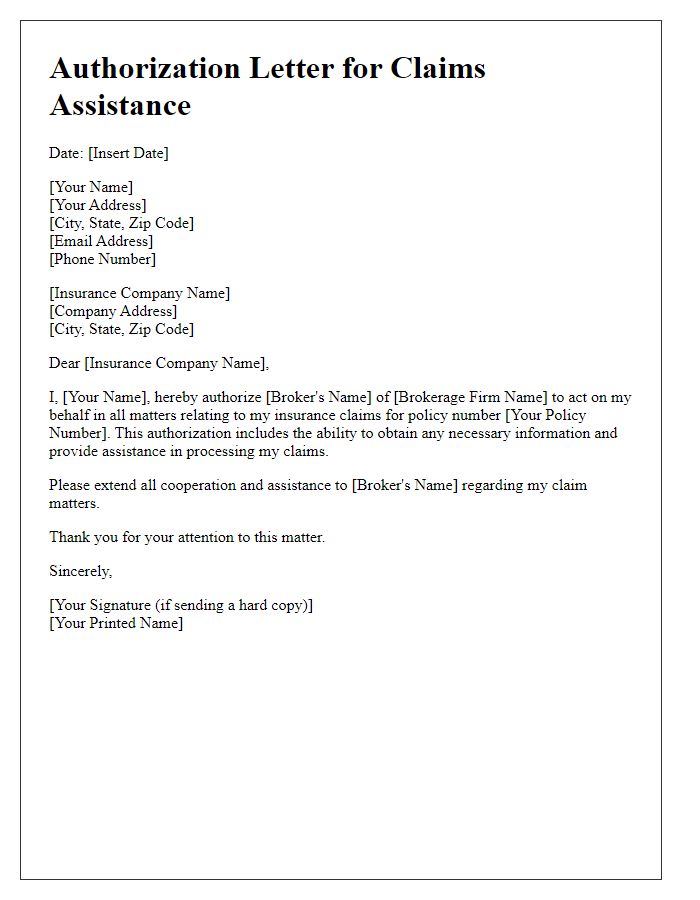

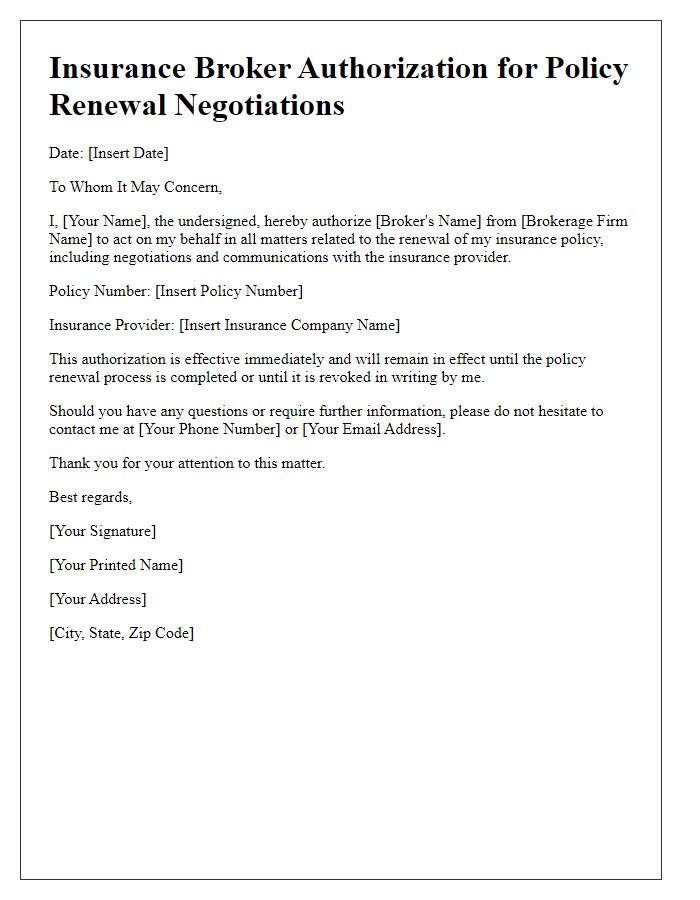

Letter Template For Insurance Broker Authorization Samples

Letter template of insurance broker authorization for personal policy management.

Letter template of insurance broker authorization for business coverage representation.

Letter template of insurance broker authorization for claims assistance.

Letter template of insurance broker authorization for policy renewal negotiations.

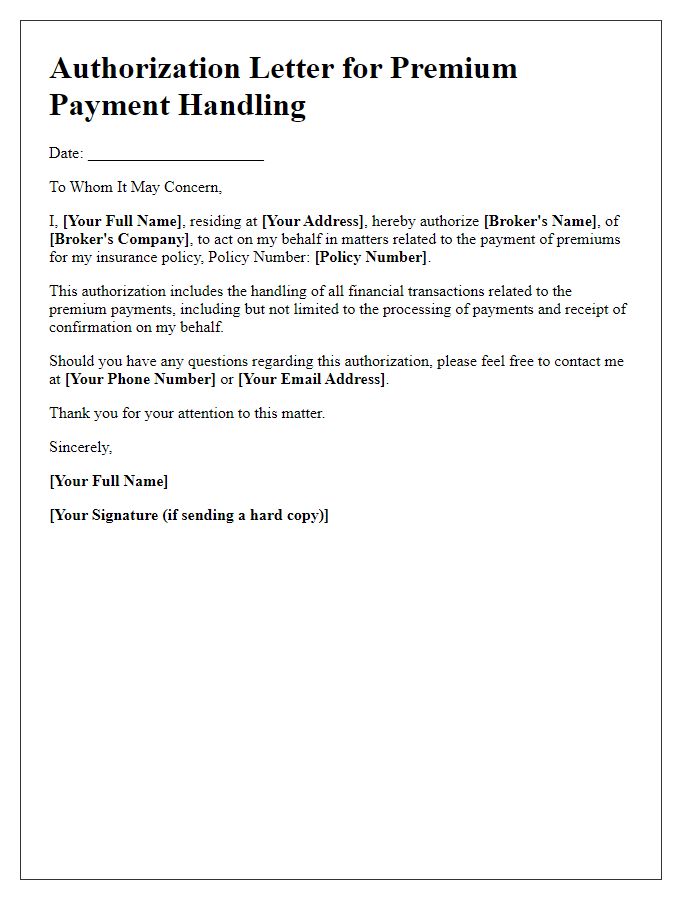

Letter template of insurance broker authorization for premium payment handling.

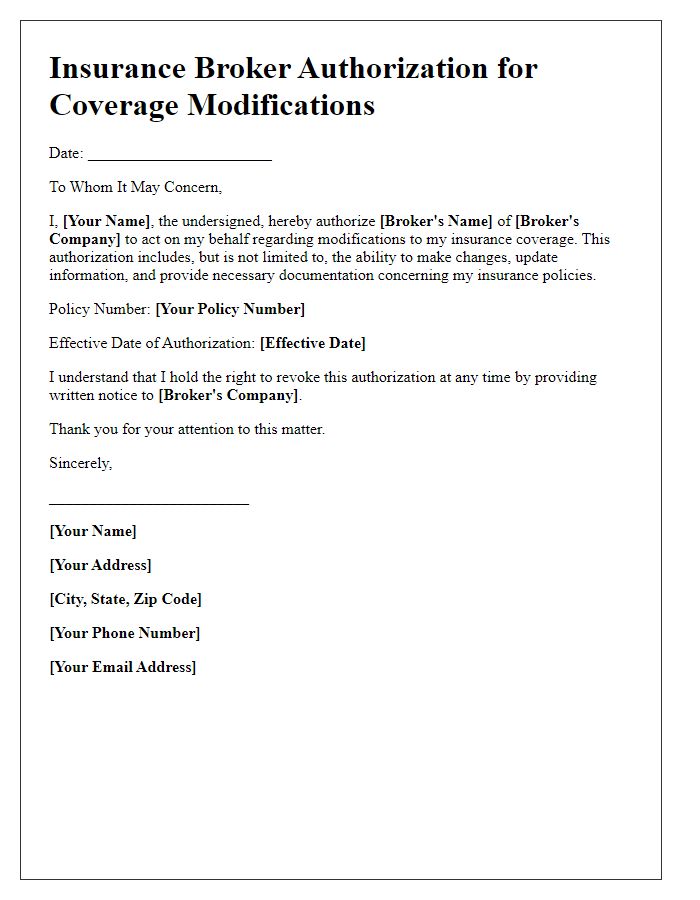

Letter template of insurance broker authorization for coverage modifications.

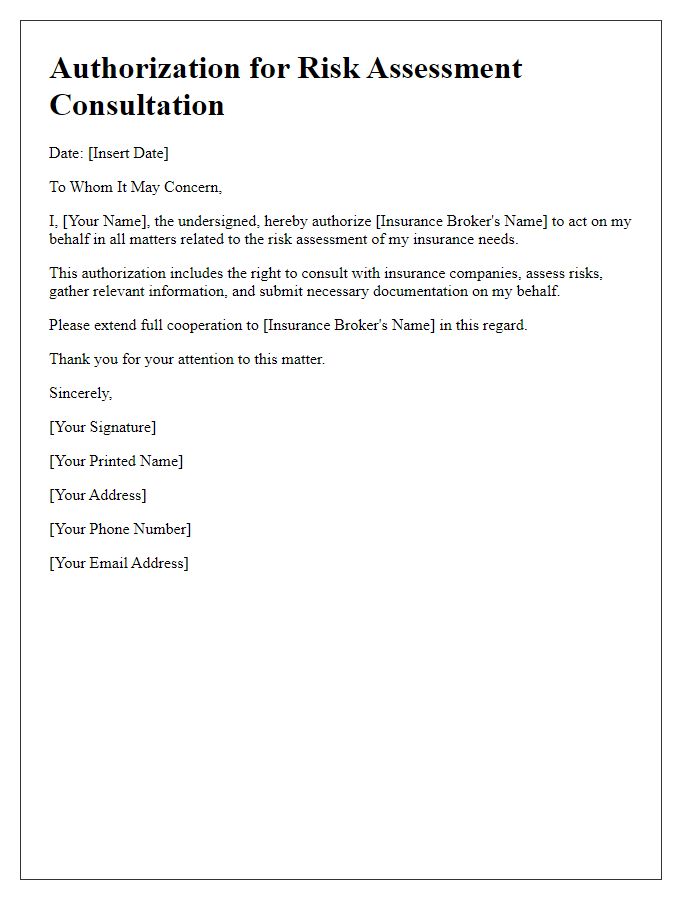

Letter template of insurance broker authorization for risk assessment consultations.

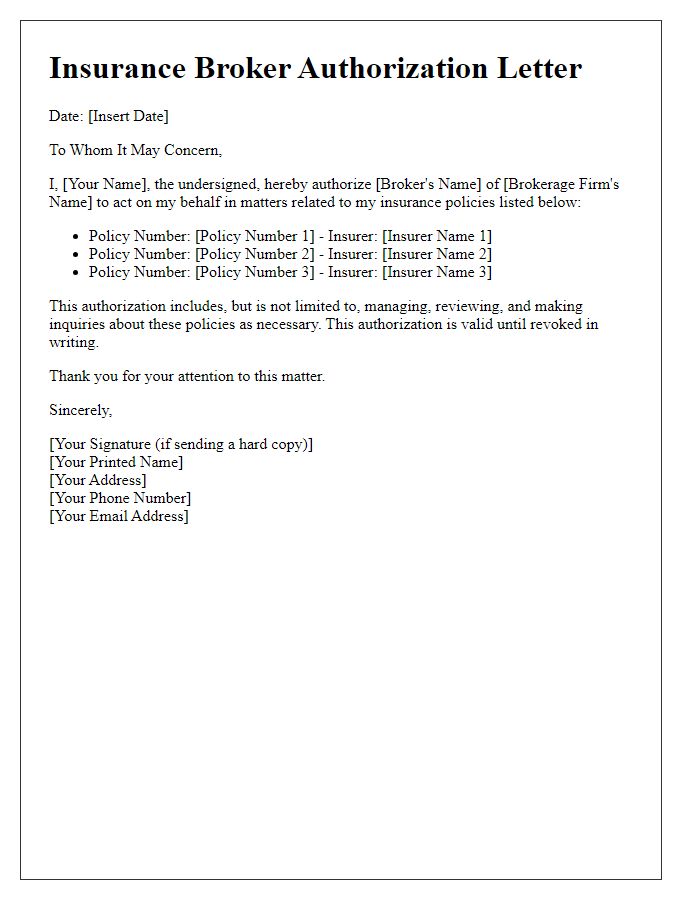

Letter template of insurance broker authorization for multiple policy oversight.

Letter template of insurance broker authorization for beneficiary designations.

Comments