Are you ready to take control of your future and ensure your loved ones are protected? Estate planning can seem overwhelming, but it's an important step in safeguarding your assets and aligning your wishes with legal directives. By drafting a comprehensive estate planning authorization, you're not only securing peace of mind for yourself but also clarity for those you care about. If you're curious about how to get started, read on to discover a simple template and tips for effective estate planning!

Legal Identification and Contact Information

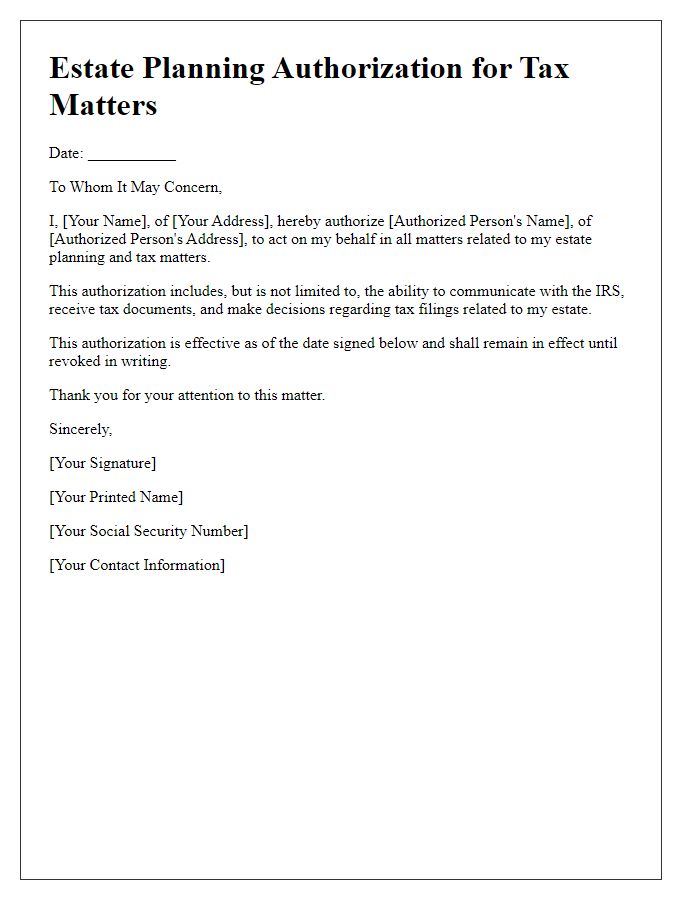

Estate planning documents must include essential legal identification and contact information for verification purposes. Important identifiers include full legal name (first, middle, last), date of birth (month, day, year), and residential address (street, city, state, zip code). Additionally, including social security numbers (SSN) may be necessary to ensure the unique identification of individuals involved. Contact information should specify primary phone number (area code and number) and email address (format must adhere to standard conventions). This information safeguards against potential disputes and facilitates the execution of wills, trusts, or powers of attorney in accordance with local regulations and legal standards.

Detailed Scope of Authorization

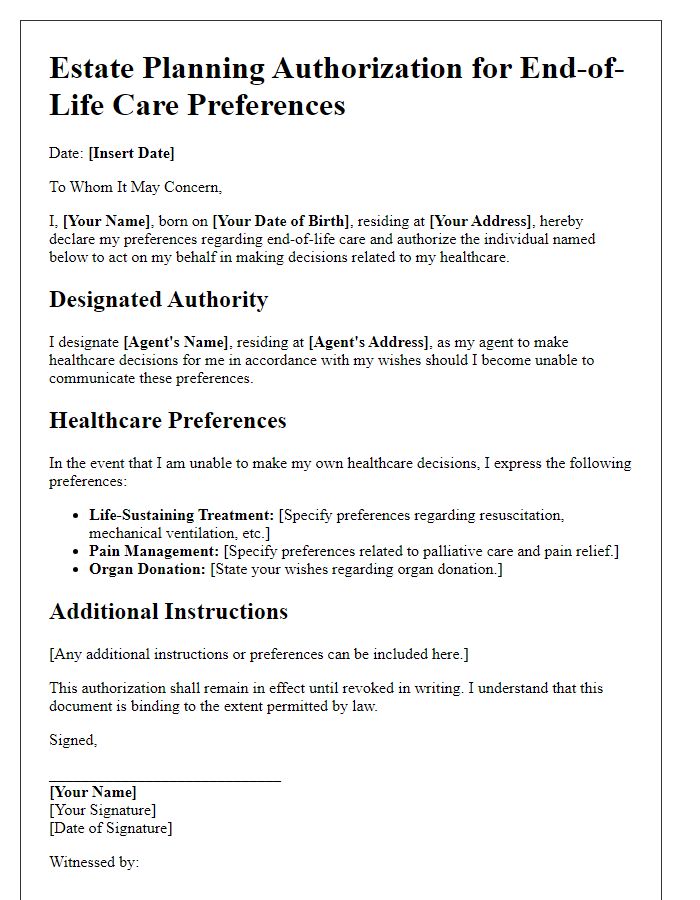

Estate planning authorization provides individuals with the legal framework to designate representatives for managing their affairs posthumously or during incapacitation. Key elements to consider include the appointment of executors (individuals responsible for carrying out the terms of the will), powers of attorney (agents authorized to make decisions regarding financial and healthcare matters), and living wills (documents outlining medical preferences). Additionally, specific instructions for asset distribution, such as real estate properties in particular jurisdictions (e.g., New York, California) and financial accounts held in various institutions (e.g., Bank of America, Fidelity Investments), should be clearly defined. The authorization must also adhere to applicable state laws regarding testamentary capacity and formalities (witnessing, notarization), ensuring the validity of the estate plan. Clear communication with all designated parties regarding their roles can prevent conflicts and ensure the smooth execution of the individual's wishes.

Duration and Revocation Terms

Estate planning authorization documents specify the duration and revocation terms for powers granted to agents or representatives in managing an individual's affairs. The authorization typically lasts until the individual (principal) revokes it in writing or passes away. Revocation can occur at any time, ensuring the principal retains control over their estate. Written notice must be delivered to agents to formally terminate authority, protecting the principal's interests. Important details include identification of the principal, names of appointed agents, specific powers granted, and a date indicating when the authorization takes effect. Additionally, it may outline any conditions under which the authorization may automatically terminate, such as the principal's incapacitation.

Notarization and Witness Requirements

Estate planning documents require careful consideration of notarization and witness requirements to ensure legal validity. Each state has specific regulations governing the execution of documents such as wills and trusts, with some states necessitating signatures from at least two witnesses while others may require notary public acknowledgment. For example, in California, a will must be signed by at least two witnesses who are present at the same time, while a trust may only need a notary to verify the identity of the signatory. Ensuring compliance with these legal requirements is crucial, as failure to adhere to them can result in the invalidation of the estate plan, potentially leading to disputes among heirs or complications in the probate process. Proper documentation and understanding of local laws, such as the Uniform Probate Code adopted by several states, are essential in creating a legally binding estate plan.

Confidentiality and Privacy Provisions

Estate planning documents often include confidentiality and privacy provisions to protect sensitive information related to assets, beneficiaries, and personal wishes. Strict measures are required to maintain confidentiality during the estate planning process, covering documents such as wills, trusts, and powers of attorney. Privacy provisions should include restricted access to personal data, safeguarding financial records, and ensuring that only authorized individuals can access estate-related information. Specific legal language may indicate that any unauthorized disclosure can lead to penalties, reinforcing the importance of maintaining privacy throughout the estate administration process. Additionally, digital documents should be encrypted, and physical copies stored securely, highlighting the estate planner's commitment to confidentiality.

Letter Template For Estate Planning Authorization Samples

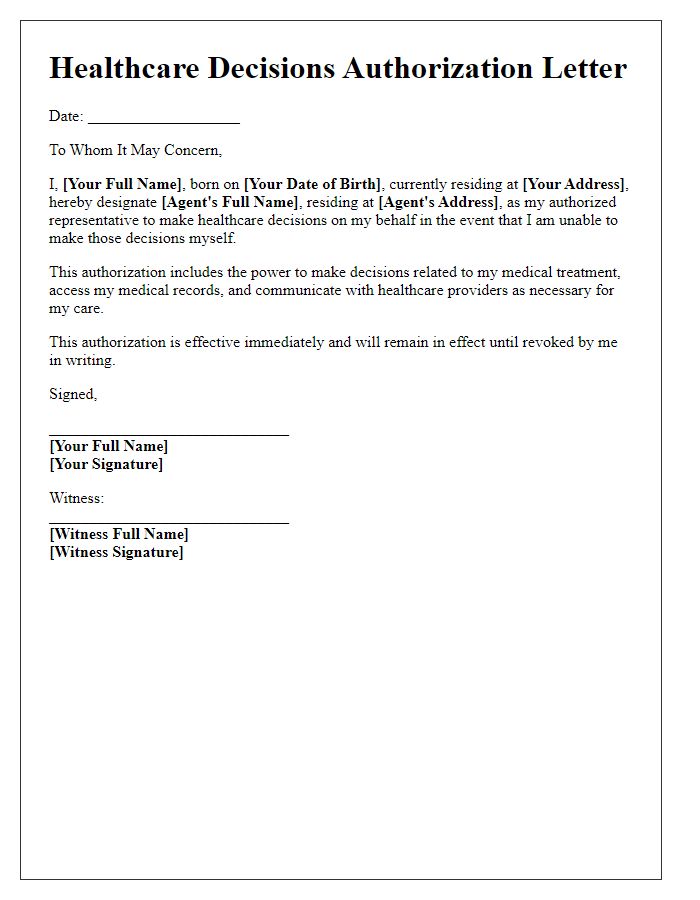

Letter template of estate planning authorization for healthcare decisions.

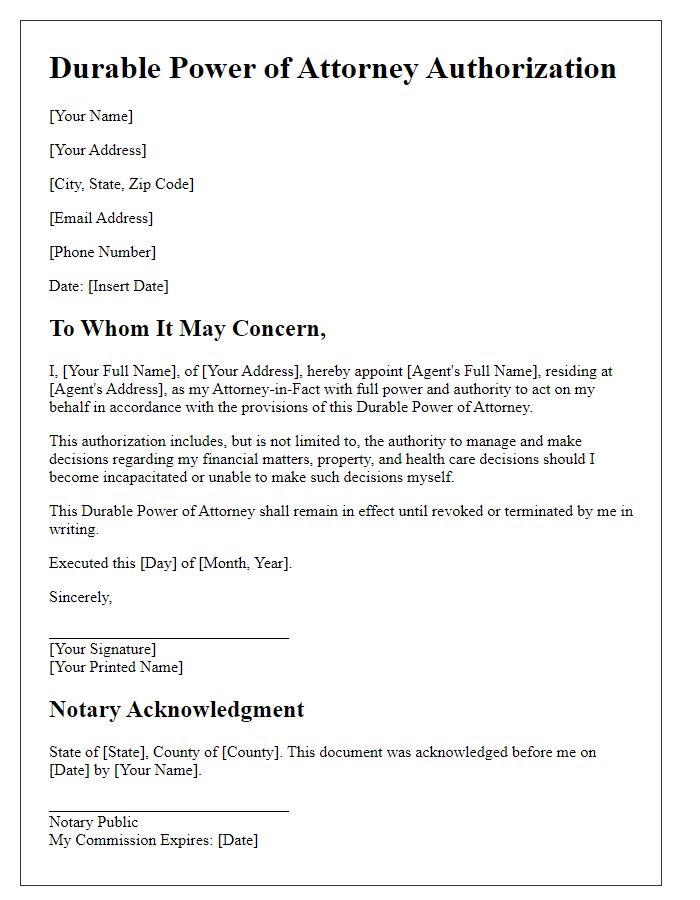

Letter template of estate planning authorization for durable power of attorney.

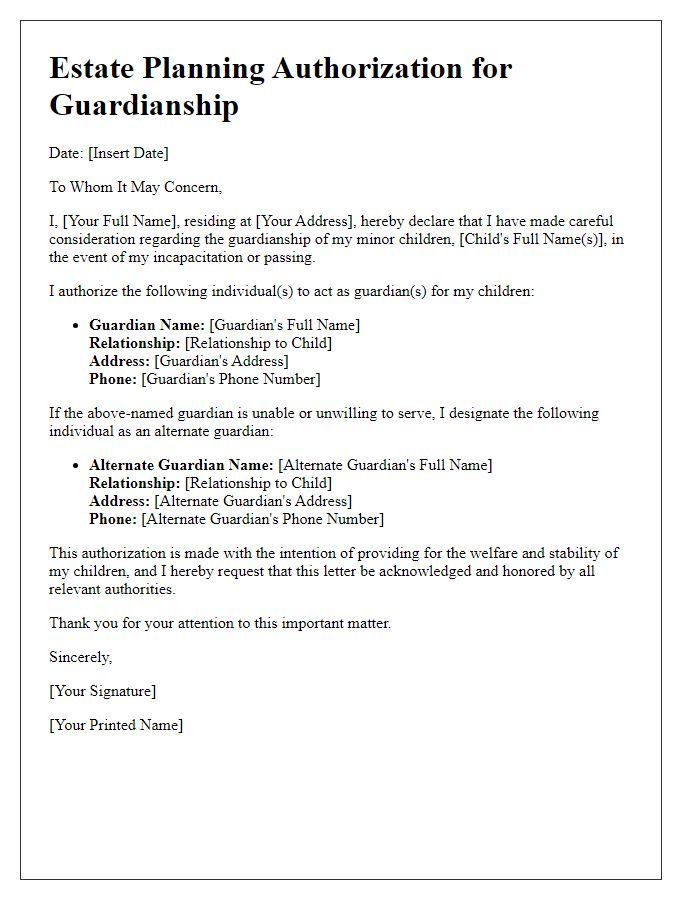

Letter template of estate planning authorization for guardianship arrangements.

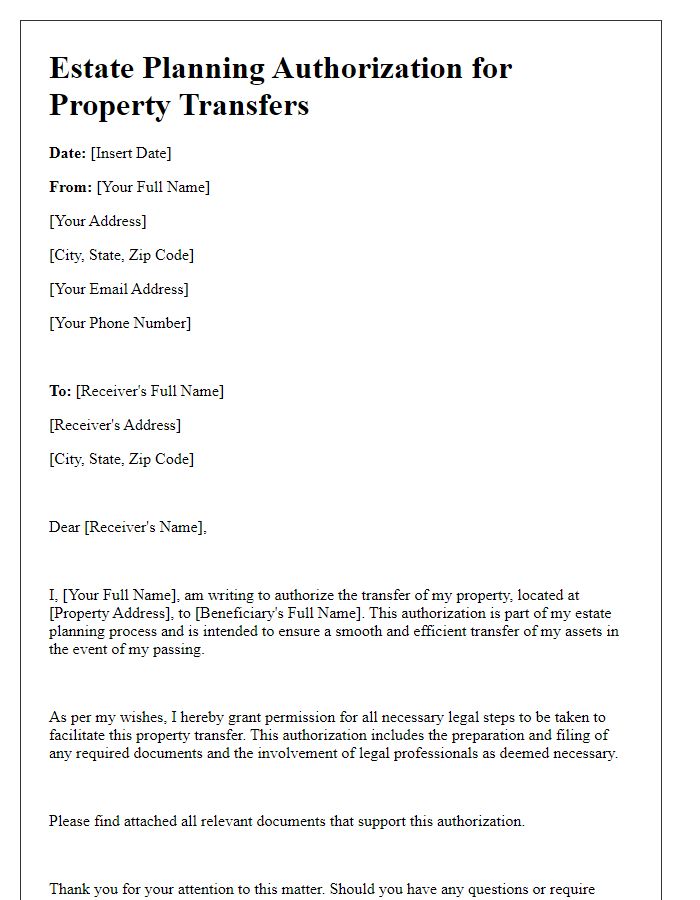

Letter template of estate planning authorization for property transfers.

Letter template of estate planning authorization for charitable donations.

Comments