Are you looking for a simple and effective way to authorize credit card use? Writing a credit card use authorization letter doesn't have to be complicated; it's all about clarity and professionalism. This document not only protects you as the cardholder but also ensures that your transaction is secure and properly documented. Let's dive in and explore the essential elements of a well-crafted letter that keeps everything above board!

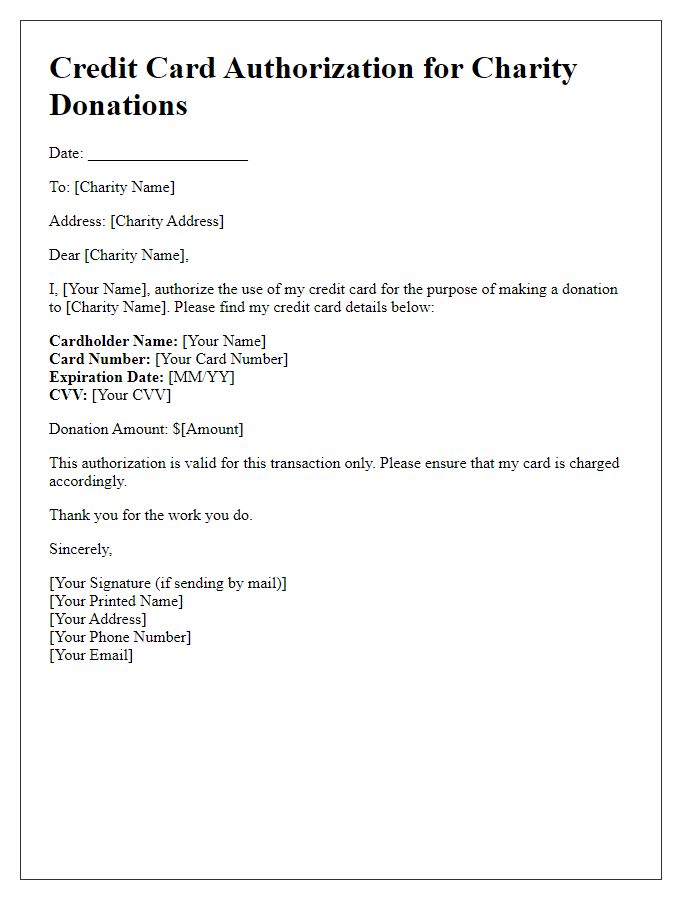

Cardholder's Full Name

Credit card fraud can severely impact financial stability. A legitimate cardholder's full name is essential for processing transactions securely. Authorizing transactions involves sharing personal identifying information, including the card number, expiration date, and security code. For example, transactions over $200 may require additional verification to prevent unauthorized use. It's crucial for cardholders to regularly monitor their statements for suspicious activity as financial institutions often advise checking account activity weekly. Additionally, using two-factor authentication can provide an extra layer of security, ensuring that only the authorized user has access to the cardholder's financial information.

Authorized User's Details

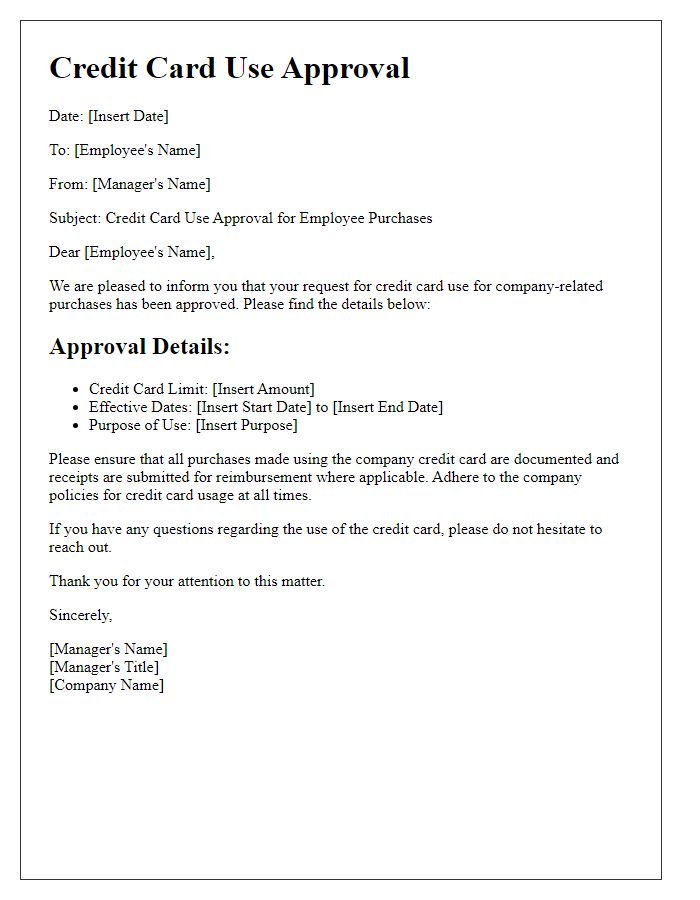

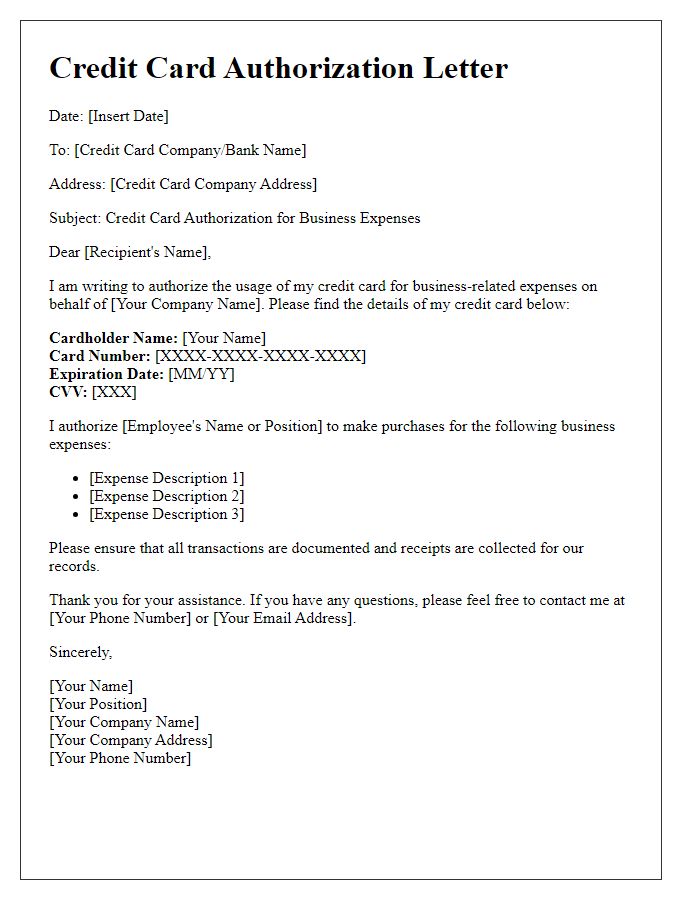

Unauthorized credit card usage can lead to serious financial consequences for cardholders, especially with personal details being misused online or in physical stores. Certain banks offer features like instant alerts to notify users of unauthorized transactions, which can be linked to the cardholder's phone number or email address. In 2023, cyber fraud incidents increased by 30% compared to the previous year, highlighting the need for vigilance in monitoring account activity. Furthermore, many credit card companies allow for the designation of authorized users, which can help manage spending for family members while maintaining control over the primary account. Institutions often implement specific requirements for authorized users, including age restrictions (usually 18 years or older) and the necessity of providing personal identification documentation such as a government-issued ID.

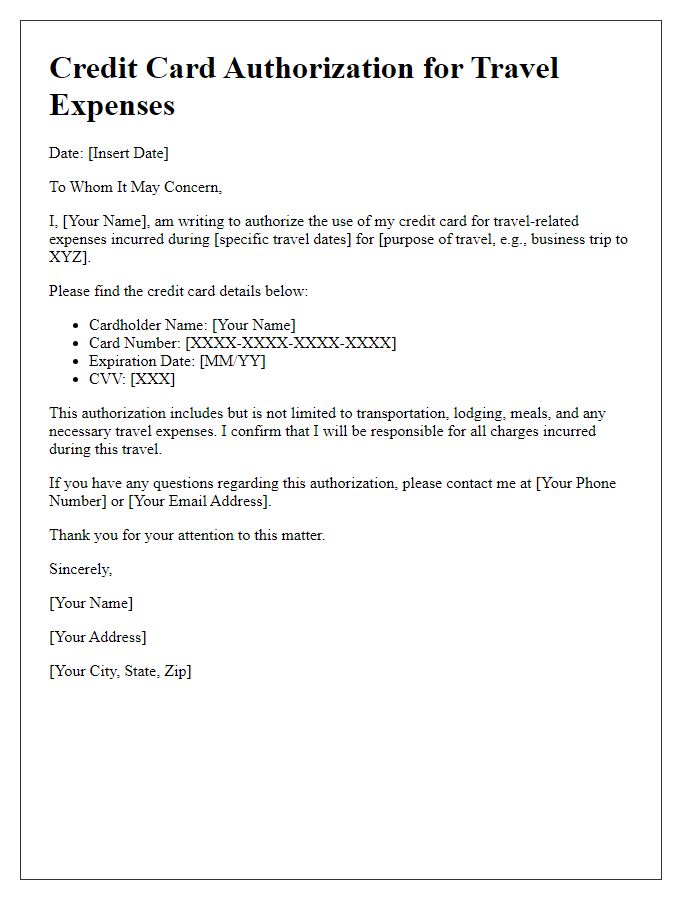

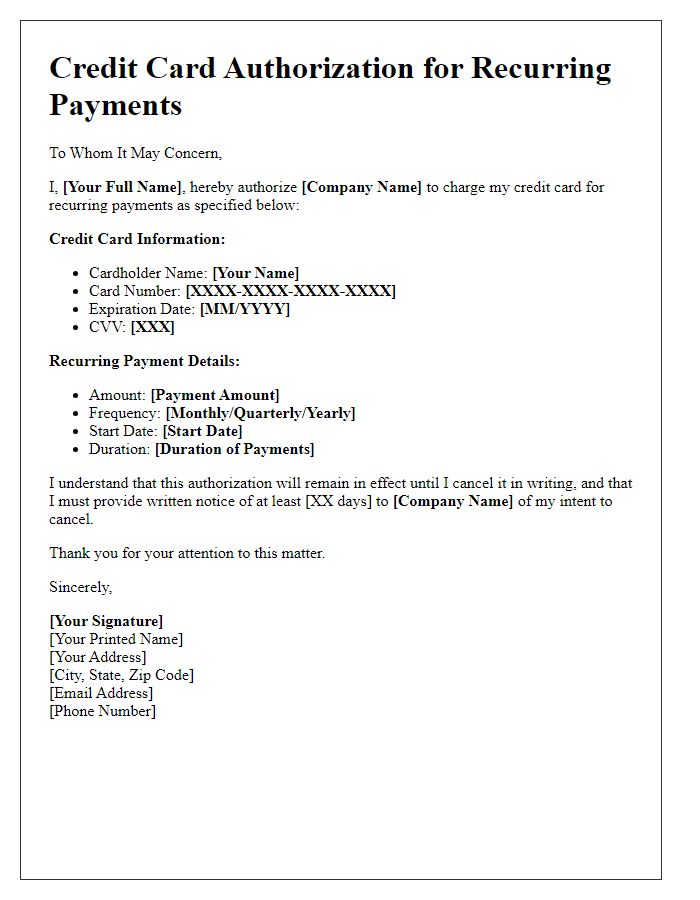

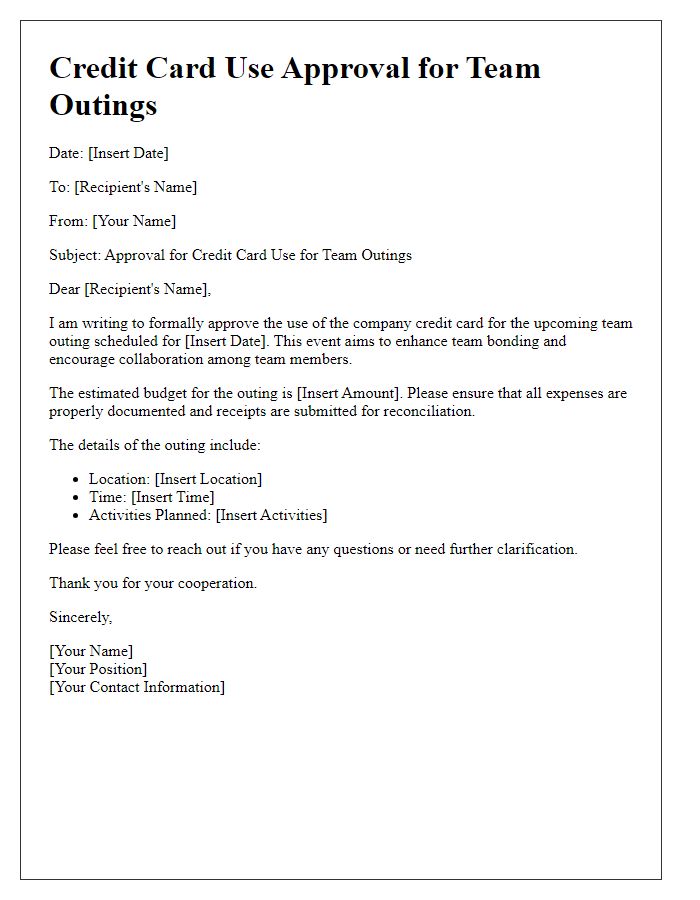

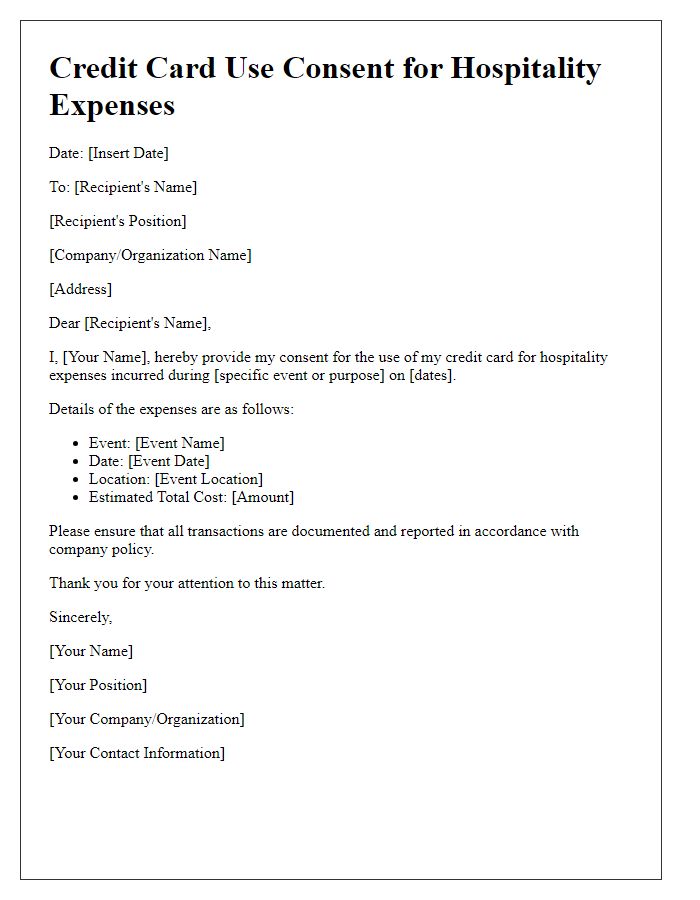

Specific Usage or Limitations

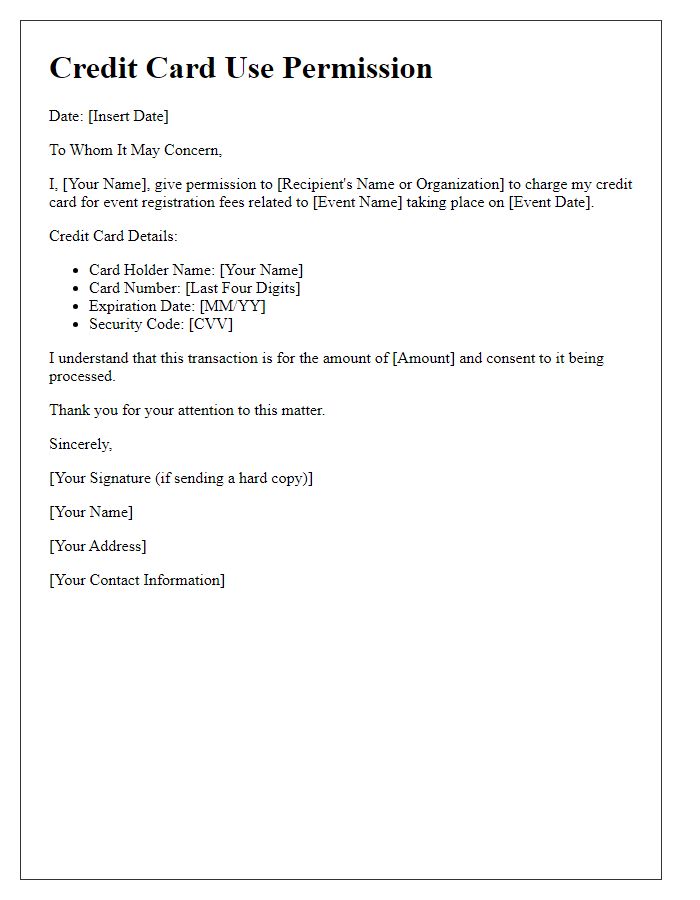

Credit card usage authorization for specific transactions provides security and ensures appropriate spending limits. When authorizing a credit card, important details include the cardholder's name, card number, and expiration date. Specific usage may pertain to particular merchants or transaction types, such as travel-related expenses or online purchases. Limitations can include specified dollar amounts, like a $500 maximum per transaction, or designated time frames, such as a two-week period from October 1 to October 15, 2023. This protects against unauthorized transactions while allowing necessary expenditures. Additional notes could involve requiring identification or specifying approval procedures for transactions exceeding set thresholds.

Duration of Authorization

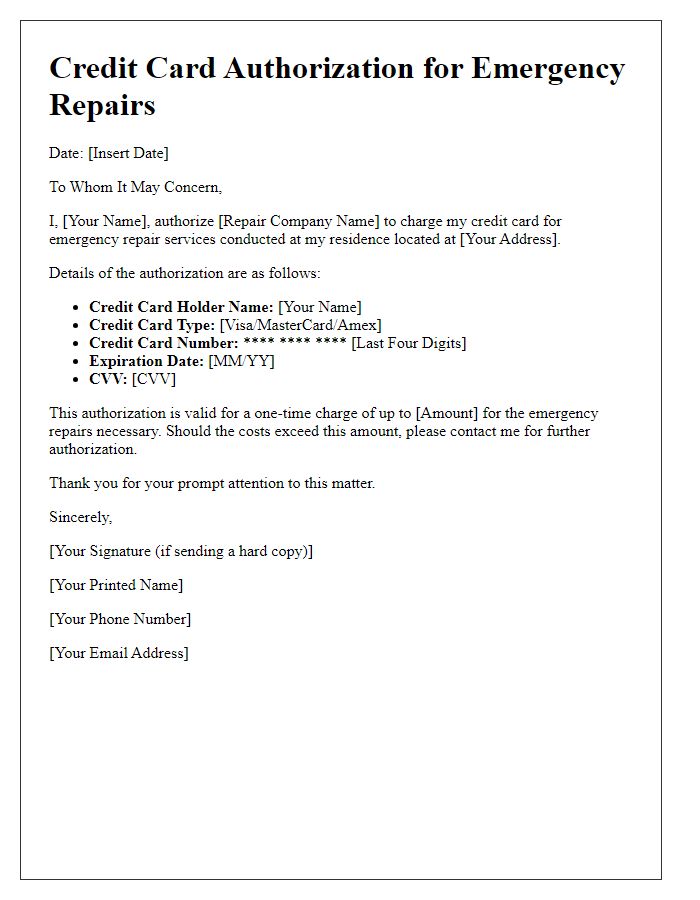

Credit card use authorization documents are critical for preventing unauthorized transactions and ensuring financial security. The duration of authorization typically specifies a fixed time frame, ranging usually from one month to one year, during which individuals or entities can utilize the credit card for specified purposes. Key entities include the cardholder (individual authorized to use the card), the issuing bank (responsible for offering the credit card), and the merchant (retailer or service provider accepting the card). Specific dates are often outlined, including start and end dates, ensuring clarity and accountability. Depending on the terms, this duration may be adjustable upon request or renewal, depending on the lender's policies. Additionally, there might be stipulations regarding maximum amounts charged or types of transactions permissible within that authorization period, providing further control over card usage.

Contact Information for Verification

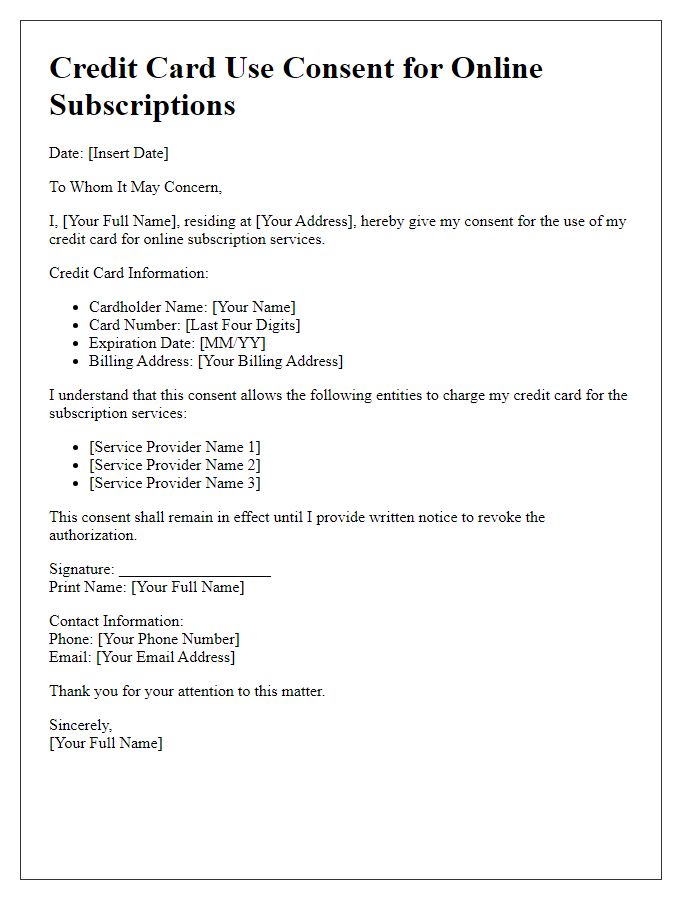

A credit card use authorization form is a crucial document for transaction security, particularly for online purchases or services that require payment in advance. This form generally includes essential details such as the cardholder's name, billing address, credit card number, expiration date, and CVV code, along with the contact information for verification purposes, including a phone number and email address. Businesses must verify this information to prevent fraudulent activities and ensure that the individual authorizing the transaction is indeed the legitimate cardholder. The proper handling of sensitive data such as credit card information adheres to guidelines set forth by organizations like the Payment Card Industry Data Security Standard (PCI DSS).

Comments